MicroMarvel - Capital Products LP: Shipping Is Risky Right Now

MicroMarvel is a series of articles highlighting undercovered stock with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

Image Source: Pexels

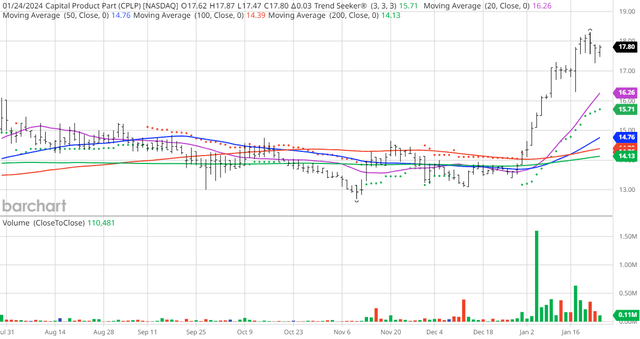

Today's MicroMarvel is the Greek shipping company Capital Products LP (CPLP). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 1/2 the stock gained 24.04%.

CPLP Price vs Daily Moving Averages (Barchart)

Capital Product Partners L.P., a shipping company, provides marine transportation services in Greece. The company's vessels provide a range of cargoes, including liquefied natural gas, containerized goods, and dry bulk cargo under short-term voyage charters, and medium to long-term time charters. It also owns vessels, including Neo-Panamax container vessels, Panamax container vessels, cape-size bulk carrier, and LNG carriers. In addition, the company produces and distributes oil and natural gas, including biofuels, motor oil, lubricants, petrol, crudes, liquefied natural gas, marine fuels, natural gas liquids, and petrochemicals. Capital GP L.L.C. serves as the general partner of the company. The company was incorporated in 2007 and is headquartered in Piraeus, Greece.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 35.11+ Weighted Alpha

- 26.78% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 29.83% in the last month

- Relative Strength Index 79.04%

- Technical support level at $17.56

- Recently traded at $17.80 with 50 day moving average of $14.76

Fundamental Factors:

- Market Cap $980 million

- P/E 6.60

- Dividend yield 3.38%

- Wall Street projects Revenue will grow 19.80% this year and another 17.20% next year

- Earnings are estimated to increase at an annual rate of 15.66% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 4 strong buy, 2 buy and 1 hold recommendation last month

- Analysts price targets are $19 to $21 with a consensus of $20 which is a 12% gain

- The individual investors following the stock on Motley Fool voted 161 to 7 for the stock to beat the market with the most experienced investors voting 11 to 3 for the same result

- Value Line gives the stock its below average rating of 4

- CFRAs MarketScope has a sell rating

More By This Author:

Chart Of The Day: Is Workday In Recovery

MicroMarvel - IperionX - Promises, Promises And More Promises

Chart Of The Day: Nutanix - Cloud Software

Disclosure: I/We have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

The ...

more