MicroMarvel - IperionX - Promises, Promises And More Promises

MicroMarvel is a series of articles highlighting undercovered stock with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

Image Source: Pexels

- 100% technical buy signals

- 12 new highs and up 19.03% in the last month

- 77.50+ Weighted Alpha

Today's MicroMarvel is the under-followed titanium products company IperionX (IPX). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 11/7 the stock gained 9.28%.

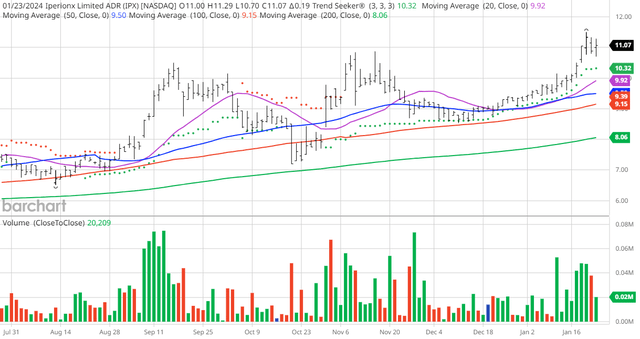

IPX Price vs Daily Moving Averages (Barchart)

IperionX Limited engages in the exploration and development of its mineral properties in the United States. It holds a 100% interest in the critical minerals Titan project, which has the resource of titanium, rare earth, and zircon rich mineral sands covering approximately 11,071 acres of surface and associated mineral rights in Tennessee, the United States. The company also produces titanium products made from scrap titanium at industrial pilot facility in Utah, United States. It operates titanium business to support various industries, including consumer electronics, aerospace, space, defense, medical, bicycles, additive manufacturing, hydrogen, and automotive. The company was formerly known as Hyperion Metals Limited and changed its name to IperionX Limited in February 2022. IperionX Limited was incorporated in 2017 and is headquartered in Charlotte, North Carolina.

Barchart's Opinion Trading systems are listed below as of the time of writing.

Barchart Technical Indicators:

- 100% technical buy signals

- 77.50+ Weighted Alpha

- 77.12% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 12 new highs and up 19.03% in the last month

- Relative Strength Index 70.09%

- Technical support level at $10.68

- Recently traded at $11.07 with a 50-day moving average of $9.50

Fundamental Factors:

- Market Cap $224 million

- Only one Wall Street analysts is following this stock but has not given Revenue or Earnings projections

- PLEASE NOTE: This company was founded in 2017 and is not expected to produce one dime of revenue until at least 2025

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Only 1 Wall Street analyst from Alliance Global Partners has strong buy recommendation in place

- His price target is $24.50 predicting a 121% price increase

- Only 192 investors are following this stock on Seeking Alpha

More By This Author:

Chart Of The Day: Nutanix - Cloud Software

MicroMarvel Neurogene Challenges Big Pharma

Chart Of The Day: Is Advanced Micro Devices Too Pricey?

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

On the ...

more