Medigus Is Facing Multiple Opportunities But Is Not Without Risk

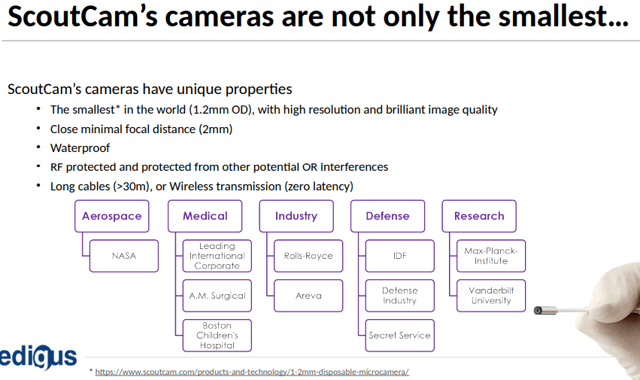

Medigus (MDGS) is an Israeli tech company that has developed the ScoutCam, a micro camera that claims to be the smallest in the world, just 1mm in diameter including illumination.

We like little companies that have a leading technology with multiple applications in markets with good growth opportunities, but the company has other opportunities than just on the SoutCam, it has multiple business lines, only the first are based on its micro camera technology:

- ScoutCam (micro camera's and systems, 50.1% stake)

- The Muse System (non-invasive treatment for GERD)

- Polyrizon (anti-viral and allergy gels)

- Algomizer Group and Linkury (internet marketing technology)

- L-1 Systems (Covid-19 related products)

- Elbit (LifeCan ventilators)

- Matomy (ad tech, 24.99% stake)

We'll get to these below in more detail. Basically the company is a sort of mini-conglomerate, with stakes in quite a few diverse businesses. For a company with a $11M market capitalization that could pay-off if one of these opportunities (let alone several) starts to flourish, but we're not there yet.

While present revenues are insignificant still, most of the company's market capitalization is cash, so the company has sufficient cash to see this out a couple of years, in which things could start to move.

ScoutCam

The ScoutCam has many applications, from the May 2020 IR presentation:

Medigus is majority (50.1%) owner of ScoutCam, which is trading under its own ticker symbol: SCTC. The mini cameras are not usually sold as final products but are part of a custom designed product for customers in which ScoutCam earns a non-Recurrent engineering fee.

It also has the capability for complete turn-key projects where ScoutCam is responsible for the design and production phases of the customer's product.

According to the 20-F the company has two major customers that generate most of the present and projected revenue (20-F):

One of them is a large international bio-med company. ScoutCam Inc. develops a visualization component for this customer’s invasive surgical device. The other customer is a US based company that develops and markets minimally invasive, surgical devices for skeletal and soft-tissue procedures. The company specializes in orthopedic surgeries of the extremities.

Since we wrote our first article, there are lots of developments:

- On June 6, 2019, ScoutCam had a $1.1M order backlog.

- On July 12, 2019, ScoutCam received an $1.6M order for 1400 integrated visualization devices from A.M. Surgical.

- On July 18, 2019, ScoutCam completed the sale of micro camera systems to the nuclear energy sector and is in talks with several other players in this sector.

- On July 19, 2019, ScoutCam sold micro cameras to two leading defense organizations and is in talks with several other defense companies.

- On April 28, 2020, ScoutCam received a $500K order from a Fortune 500 medical company.

- On May 19, 2020, ScoutCam received a $2M investment from Founder and Chairman of Arkin Holdings Moshe Arkin

- On May 22, 2020, ScoutCam announced a breakthrough with the successful integration of its wireless micro ScoutCam into medical endoscope devices introducing the healthcare industry’s first operating room-ready wireless endoscope (by a privately held orthopedic company).{C}

- On June 12, 2020, ScoutCam received a new patent for its endoscope irrigation technology in Canada.

What also happened is that ScoutCam was acquired by Intellisense, in exchange for:

- 60% of the shares of Intellisense.

- Intellisense securing $3.3M of external investment which produces a company post-money valuation of $13.3M for ScoutCam.

- If ScoutCam sells more than $33M in the three years since the closing of this operation, Medigus gets another 10% of the shares of Intellisense.

- The merger was closed on January 2, 2020.

Since June 24, the company has a 50.1% stake in ScoutCam after the $2M investment from Moshe Arkin and the conversion of outstanding credit.

The Muse System

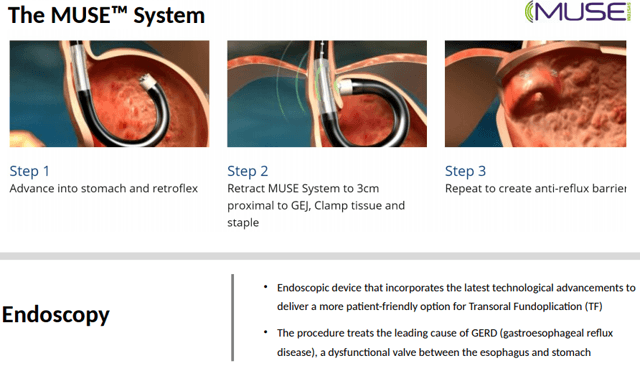

A main use of the ScoutCam is in the Muse System, an endoscopic device that is used for treating GERD (gastroesophageal reflux disease):

There are some 55M people with chronic GERD and the probability for them to get esophageal cancer is 7 times higher. The Muse offers a midway between surgery (some 350K cases a year) and PPI (proton pump inhibitors) use, which prevent acid production in the stomach.

The Muse system has more than 85 approved patents worldwide, is cleared by the EU and the FDA. Management has decided to terminate its distribution deal and concentrate on license deals. This has been fairly successful with two license deals signed already:

- $3M deal with Shanghai Golden Grand Medical Instruments for China, Hong Kong, and Macau (June 3, 2019) with the final $1.8M to be paid when a Muse System assembly line is completed in China.

- $4M MoU with L-1 Systems for Latin America (February 14, 2020).

The company might also sell the business.

Polyrizon

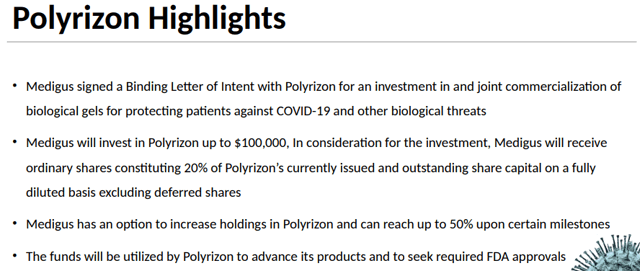

On April 24, 2020, the company signed an investment and joint marketing deal with Polyrizon, a privately held company that develops gels that protect people against biological threats.

In exchange for $100K, Medigus will receive up to 20% of Polyrizon's outstanding shares and the companies entered into a joint marketing deal (linked PR):

As part of the principal terms of the letter of intent, Medigus and Polyrizon will enter a commercial arrangement for the joint marketing and commercialization of Polyrizon products based on a revenue share model, focusing on a unique Biogel for the protection from COVID-19 virus. The commercial arrangement grants Medigus an exclusive right to market, resell and distribute Polyrizon’s products for a period of four years, commencing upon and subject to receipt of the requisite FDA approvals for the products.

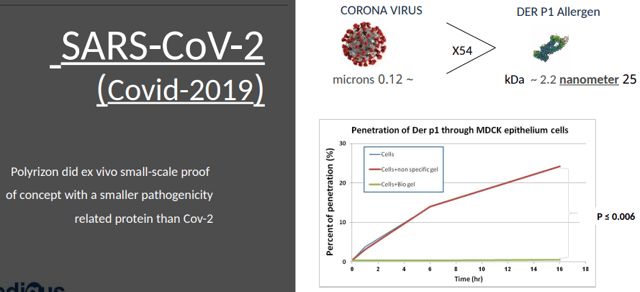

From the latest IR presentation:

The biogel that Polyrizon has developed is used as a spray and limits the ability of viruses like Covid-19 to enter cells. The company did a small proof of concept with a similar pathogen that seems to suggest there is some protection, but this isn't FDA approved yet.

The gel potentially has wider application:

The Gel Capture and Contain Pathogenic particles encountered to human mucosal membranes; it prevents these particles from reaching target cells and activating the immune response. The gel containing the mentioned particles is then removed from the body via natural processes.

Polyrizon’s versatile platform technology has the potential to be applied for protection against a variety of allergens, toxins, and other harmful substances. The Company’s initial target is the enormous allergy market, where there is a clear need and growing awareness of the advantages of allergy prevention. Other markets include the vaginal viral infection market, biodefense, dermatology and common respiratory infections.

Polyrizon filed a US patent on May 6. FDA approval might be expedited given the prioritization given to potential solutions to the pandemic.

And now the two companies have extended their cooperation with two deals, an investment agreement and a reseller agreement. The investment agreement is straightforward:

- $10K of investment and $94K in loan in exchange for 19.9% of the shares of Polyrizon

- The option, exercisable at its sole discretion (until April 23, 2023), of a further $1M in investment in exchange for 51% of Polyrizon's fully diluted shares, becoming a majority holder.

The reseller agreement:

- Medigus receives an exclusive global license (for four years, starting on the receipt of sufficient FDA approvals) to resell Polyrizon's products on a cost +15% basis in exchange of which Polyrizon receives a royalty payment of 10% of Medigus annualized operating profit from the sale of these products.

In short, the company now have a more intimate relationship and the wait is for FDA approval. This could be big, but there is not a lot to go by at the moment.

Participations and other deals

The company also has some participations:

- Matomy Media Group

- Algomizer/Linkury

- Elbit

- L-1 Systems

With respect to the Matomy Media Group, from a February 13, 2020 PR:

the Company purchased 2,284,865 ordinary shares of Matomy, representing 2.32% of the issued and outstanding share capital of Matomy for a total consideration of approximately US$ 153,034 (reflecting a price per share of NIS 0.23 (the “PPS”)). The Company continues its negotiations to purchase up to additional 22.67% of the issued and outstanding share capital of Matomy based on the same PPS.

But on February 18, the company bought another 22.32M shares of Matomy, raising its stake to 24.99% (per 20-F).

On September 3, 2019, the company executed a participation in Algomizer and its 100% owned subsidiary Linkury, both ad-tech companies, for $5M (NIS 5.4M in Algomizer at a price of NIS 4.15, an additional $1M through an equity change and NIS 9M in Linkury).

The company also had a MoU with Linkury for the establishment of a commercial technological platform for the manufacturing, marketing and distribution of cannabidiol (CBD) based products, but that has been terminated.

On April 27 this year, the company signed an agreement with L-1 Systems for the joint commercialization of various Covid-19 related products and solutions (PR):

Pursuant to the terms of the agreement, in consideration for jointly marketing the products with L1 Systems and providing working capital financing, Medigus shall be entitled to proceeds from sales based on a profit share model based on the scope of financing provided by Medigus, 50% of the profits in the case Medigus introduces the products, and in all other cases, of 5% of the profits.

That PR also mentioned a pilot arrangement with a prospective customer testing the product which may lead to a larger order, and indeed this is what happened as soon after, the companies received its first commercial order for COVID-19 serological test kits (PR):

The purchase order was received from a Mexican company which engages in the distribution of medical equipment to various medical centers in Mexico. Prior to placing the order, the Mexican company performed an examination of the testing kits, and following the examination, placed an order for 10,000 testing kits with a total order value of tens of thousands of dollars.

This did wonders for the share price, shooting up although that effect has waned:

But there is some fine print to the agreement:

Medigus shall be entitled to proceeds from sales based on a profit share model based on the scope of financing provided by Medigus, 50% of the profits in the case Medigus introduces the products, and in all other cases, of 5% of the profits.

L-1 Systems is also the company with which the company has a MoU for selling the rights to the Muse System in Latin America.

After gels and testing kits, the company got its hands on a third Covid-19 related product acquiring the exclusive distribution rights on May 15 this year for LifeCan from Elbit Systems Land. LifeCan is a ventilator system developed by LifeCan Medical. From the PR:

Medigus will be responsible for obtaining and maintaining licenses and approvals required by the Mexican regulations, including health administration authorities. In order to start the regulatory process, Medigus acquired two LifeCan systems that will assist the company in obtaining the required permits for the marketing and selling of the ventilators.

Finances

The finances are still not pretty with revenues declining 37% to $273K last year and an IFRS loss of $14.1M, with the non-IFRS loss at $3.96M, that did half from the $6.59M in 2018. These revenues all came from ScoutCam.

Things are not quite as bad as these figures suggest, the company still had $7M in cash and equivalents at the end of 2019 (down from $10.6M the year before) and the cash bleed is actually improving:

Data by YCharts

And this year, closing May 22, the company has sold 3.33M ADSs in a public offering at $1.50 (technically, they sold pre-funded warrants at $1.499) raising roughly $5M (minus the cost of this operation).

Data by YCharts

The company also has warrants outstanding (as of April 15, 2020), from the 20-F:

- Unregistered warrants to purchase an aggregate of 990 ADSs at an exercise price per ADS of $57.50. These warrants expire on September 8, 2021.

- Unregistered warrants to purchase an aggregate of 10,469 ADSs at an exercise price per ADS of $36. These warrants expire on June 6, 2022.

- Unregistered warrants to purchase an aggregate of 998 ADSs at an exercise price per ADS of $29.48. These warrants expire on December 6, 2021.

- Warrants to purchase an aggregate of 535,730 ADSs at an exercise price per ADS of $14. These warrants expire on March 29, 2022.

- Warrants to purchase an aggregate of 37,501 ADSs at an exercise price per ADS of $17.5. These warrants expire on March 29, 2022.

- Unregistered warrants to purchase an aggregate of 101,251 ADSs at an exercise price per ADS of $9. These warrants expire on May 27, 2023.

- Unregistered warrants to purchase an aggregate of 14,177 ADSs at an exercise price per ADS of $10. These warrants expire on November 24, 2022.

- Warrants to purchase an aggregate of 3,263,325 ADSs at an exercise price per ADS of $3.50. These warrants expire on July 18, 2023.

- Unregistered warrants to purchase an aggregate of 198,637 ADSs at an exercise price per ADS of $4.375. These warrants expire on July 18, 2023.

- Unregistered warrant to purchase an aggregate of 333,334 ADSs at an exercise price per ADS of $4.00. The warrant expires on September 3, 2022.

Most of these are likely to expire worthless but the 3.26M series C warrants (trading under the ticker MDGSW) expiring in July 18 2023 have an exercise price of $3.50 and could be exercised.

ScoutCam has 32.9M shares outstanding with its latest price at $1.15 so Medigus 50.1% stake in ScoutCam is worth some $37M or so on paper. ScoutCam also has 13M warrants outstanding (per the Q1 10-Q).

Data by YCharts

The company has a market capitalization of roughly $11M, much of it in cash (the $7M at the end of 2019 plus the $5M financing minus fees and minus cash burn in H1 2020 and what they spent in 2020 deals with the likes of Elbit, L-1 Systems and Polyrizon).

There is the potential $4.5M license income from the MoU with L-1 Systems for the rights to Muse System for Latin America, and the last ($1.8M) installment from the Chinese license deal for the Muse System. There is also the $0.5M revenue from the Scout System order (although only half of that goes to Medigus), plus of course potential results from other monetization efforts.

Conclusion

What do you buy when you buy the shares here? Mainly cash, but also stakes in several interesting businesses. Most prominently their micro cameras ScoutCam in which the company has a 50.1% stake by the latest counting, and it has applications in multiple markets, of which healthcare is only one.

The Muse System uses the ScoutCams, but at present elective procedures are still facing headwinds due to the pandemic in parts of the country. It will either sell the business and concentrate on selling licenses, the company managed one license deal and MoU for another one, together these could produce $6.3M in revenues this year, should conditions be met.

Then there are the other participants selling Covid-19 related ventilators, gels, and testing kits (L-1 Systems and Elbit), as well as media and digital ad technology (Matomy and Linkury).

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

I thought this article that just came out today shows some additional potential for $MDGS / $SCTC

talkmarkets.com/.../the-electric-vehicle-space-has-shown-amazing-lockdown-resilience

Interesting but complex. What is totally unclear is the relationship between that very small camera and the medical gel materials. THOSE are TOTALLY DIFFERENT in EVERY aspect. So while the concepts make sense the partnership aspect is rather unusual, as I see it.

Yes, it's like a mini-conglomerate

I'm sure people realize how important the medical implications will be for such a tiny camera. This is pretty significant. $MDGS $SCTC

What caused $MDGS to jump so high back in May?

Interesting that #Medigus has #ScoutCam as it's own ticker. Why do you suppose that is? And which would be the better investment? $MDGS $SCTC

I love these high risk, high reward stocks like $MDGS! The potential is certainly there.

Yep, that's possible Adam, it's interesting tech which does good in medical appliances, but as with much tech, in the wrong hands it can do damage..

A 1mm sized camera?? Holy moly how is that even possible?

"Holy Moly? how is that possible?" Easy it comes from the Holy Land ;-) Seriously though, the medical implications here are unimaginable!

I'm more concerned about the big brother implications of such a small camera. There could be one on you right now and you'd never know!

There could also be a TEN mm camera watching and not being noticed. All sorts of spy cameras have been around a while for those with enough money to spend. It is the medical applications that are an inspiration.