The Electric Vehicle Space Has Shown Amazing Lockdown Resilience

The global economy may be in a regrettable tailspin experiencing a second round of lockdowns in many major countries, but some industries are proving surprisingly resilient totally.

Photo by Waldemar Brandt on Unsplash

While global GDP was busy plummeting by as much as a third last quarter, remarkably, electric vehicle sales have managed to hold their own through the carnage.

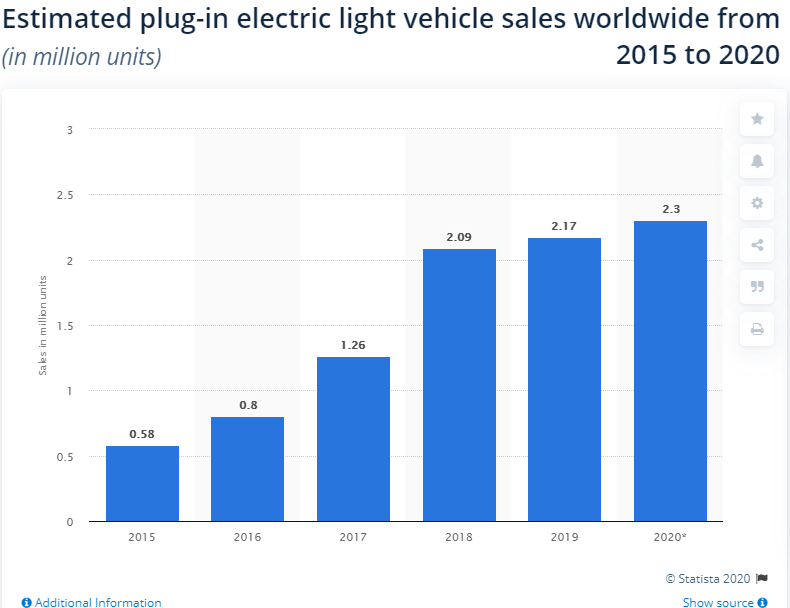

You may not have guessed it from the constant flow of negative headlines on the economy these days, but EV sales growth for 2020 has already eclipsed growth for 2019, and the data above is only current through July. We can always engage in theoretical counterfactuals, wondering what the EV industry could have been at this point had global lockdowns never occurred, but what we can see at least from the chart above is that EV has been, to say the least, extremely durable in the face of serious economic adversity.

And EV stocks have reflected this resilience recently in a big way. Tesla’s (TSLA) monster rally that began in December is lost on nobody, but even Chinese competitors such as NIO Limited (NIO) rocketed higher in 2020 without so much as a dent during the wider panic selloff as the first wave of lockdowns took effect. Interest in EV offshoot companies has also sprung on the scene. Blink Charging (BLNK) for example, the largest EV charging network in the United States, has rocketed higher since May by over ten times.

It’s mostly guesswork to try to explain timing in these cases, but fundamentally, what can be said is that investors are realizing that the EV industry has actually stood firm up to now, unlike many others that have suffered. Any successful vaccine that could put the lockdowns behind us, could then unleash a year’s worth of pent up growth in the industry that investors are just now trying to get in front of.

Luckily, there are companies that haven’t yet climbed to all-time highs for newcomers in the space to look at. Recently joining the scene is Medigus (MDGS), which just last week announced its intention to enter the EV market through a joint venture with private company EMuze for the development and commercialization of micro-mobility vehicles in urban settings for last-mile and cargo delivery. The timely announcement has drawn attention to Medigus as a new player in the field, in a niche setting within EV that isn’t getting as much focus.

Medigus isn’t strictly a speculative play on the EV sector though. The company is invested in 7 other firms across the tech and healthcare sectors as well that serve to spread out exposure for investors who want more than just the next EV play. Here are a few of the notable ones.

ScoutCam (SCTC), for example, which Medigus owns a 50.1% stake in, manufactures the world’s smallest cameras and already has contracts in place with Fortune 500 companies. Used in car engines for remote diagnostics, aerospace and defense, and surgical procedures ScoutCam’s cameras are 1mm in diameter.

Also active in COVID-19 and other disease prevention, Medigus owns a 20% stake in Polyrizon, a company trialing a biogel nasal spray designed to protect respiratory pathways against exposure to COVID-19, among other viruses and bacteria.

Medigus has also taken stakes in the Fulfillment By Amazon (AMZN) space, which accounts for about 45% of Amazon sales through the Amazon marketplace. This sub-industry has grown markedly in the pandemic era as people turn more towards online shopping. Independent Amazon stores grow quickly on Amazon Marketplace in this type of environment, which tends towards sprawling and unfocused retail outlets. Medigus’s SmartRepair Pro acquires smaller Amazon stores already showing profitability and optimizes them. Current annual sales are $3.5M with $9.8M expected by 2022, ensuring a decent revenue stream to support the growth of its other businesses.

For those who want to take a stake in an area of EV not getting much attention yet but also want a more rounded approach, Medigus may be one to look at before the world fully opens back up again and the EV industry once again meets a fully functional economy.

Disclosure: No positions in any stocks mentioned.

What is your current take on the industry?

Good read. @[Juan Carlos Zuleta](user:9576) would you agree with this?

Interesting read. Good to hear about other up and coming companies in this space. Still waiting for the other foot to drop in the EV industry. That is the issue of battery disposal. There are still no good alternatives to disposing of this waste and it is a ticking time bomb, but as there are still "relatively" few to dispose of, the bloom is still on the rose, so to speak.

Good read, looking forward to reading more by you.

Certainly the EV world will continue to do well, partly because those buying them have the resources to do that in spite of the lockdowns. It always makes sense to market to those who can pay for the purchase. The challenge for EVs will be the source of that charge power. If everybody had one the grid would be vastly overloaded.

The diversification choice was quite smart indeed.

The scout camera technology is very interesting, partly because in addition to all of the applications for small cameras, it could be the end of privacy as we presently know it. Consider a newly-built house with a dozen cameras embedded in the structure as one possible item.

@[Shareholders Unite](user:38036), you are a bit of an expert on Medigus/Scoutcam, right? Were you aware of these non-medical uses for it? This could greatly increase it's revenue potential. Complete news to me!

How does this sale growth compare to non-EV car sales? Did those increase as well? If so, buy a similar amount? With so many lockdowns in place and with so many out of work, I admit, this surprises me.

@[John Petersen](user:63015), what are your thoughts on this?

Great read, thanks.