Matterport: Uninspiring Name, Stellar Business Opportunity

Matterport, Inc. (MTTR) describes itself as a "spatial data company" with a laser-sharp focus on digitizing and indexing the "built world." Google and others map the exterior spaces of the physical world. Matterport is scanning and mapping the *interior* spaces. Using AI, they can take photos and videos and turn them into complete and accurate distances-calibrated digital views like an exposed dollhouse or any other format a client requests.

Basically, Matterport creates digital "twins" of physical buildings and their interior spaces. They do this using a combination of 3D cameras, LiDAR, 360-degree cameras, and, just added in 2020, apps for the latest iterations of Apple (AAPL) iPhones. (Many Apple owners may just be discovering this feature!)

This is AI driven visualization technology that scans, or lets subscribers and clients scan, existing space and then reproduces it in digital form on Matterport's own proprietary cloud for use by those with the appropriate legal rights to the product.

The output created is a virtual reality picture of a residence or commercial property for sale / a building being designed or under construction / a hotel's convention facilities, rooms and suites / the inner workings of electrical and plumbing infrastructure, and more.

Isn't this being done already via video tours of, say, residential real estate? Not the same. When MTTR says their product is a visual twin, they mean exactly that: a video tour does not provide precise measurements nor does it look into the walls and crawl spaces of a residence or commercial property. MTTR's patented software creates that as a matter of course.

You can readily see why insurance companies would find this service every bit as valuable as an honest seller or an interested buyer for any built product. Each industry mentioned above will find cost-savings via using Matterport's digital twin, and each insurance company will benefit from knowing exactly what is in place and what isn't. There would be no need to inspect an insured's statement that they have upgraded their HVAC system; a new digital image will clearly show the appropriate shape and design.

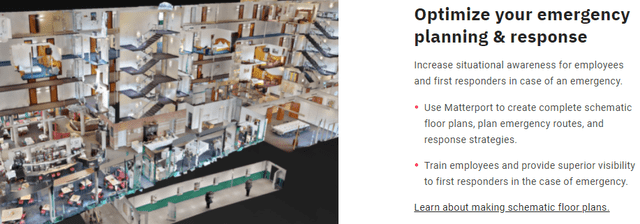

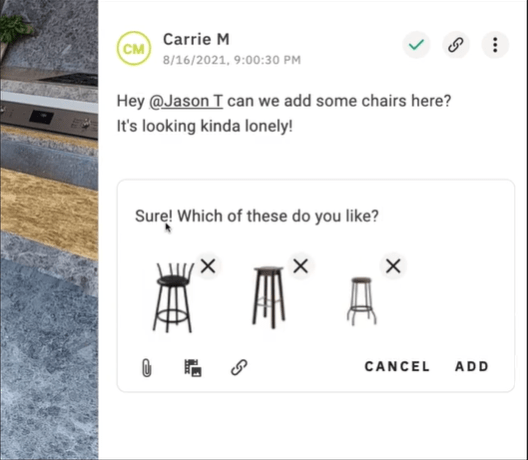

Here are a couple examples from the Matterport website.

A buyer or lessee, not on site, of a to-be-opened retail property, asks the designer, also not on site, to fill a vacant space with seating. Voila.

(Source: https://matterport.com/)

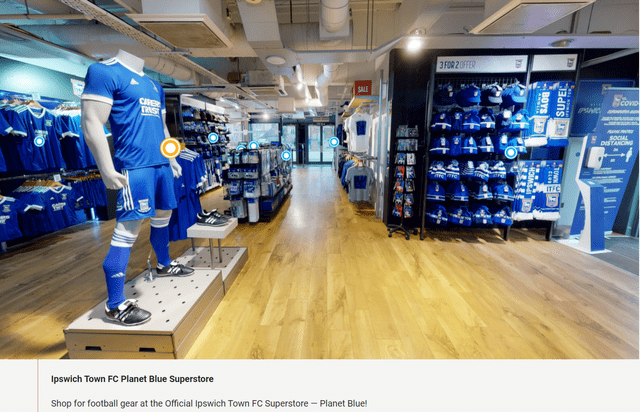

An existing retail store in Ipswich, UK, cognizant of Covid restrictions, wants the public to feel as if they are actually walking through the store. It also wants to point out sale items and provide the opportunity to purchase. This 2-dimensional photo doesn't do this justice; go to 3D Tour Gallery at the MTTR website to take the visual tour.

(Source: https://matterport.com/)

Take a tour that allows you to almost touch every inch of your new zillion-dollar superyacht being finished out -- from the privacy of your hedge fund office. Try not to notice the former clients protesting outside.

(Source: https://matterport.com/)

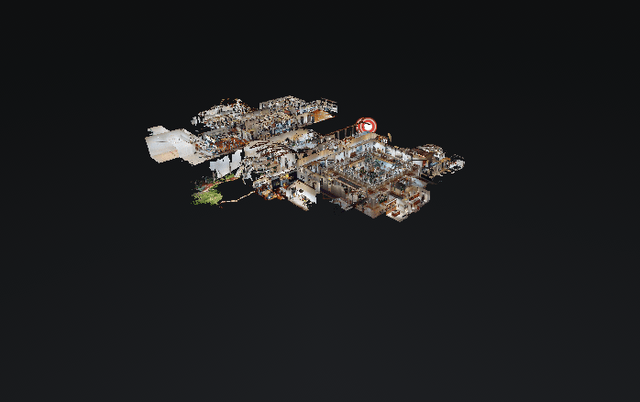

Want to visit the Spa at Sea Island? Below is what Matterport captures of this area, looking through all the walls and other spaces. This is what an architect responding to a request for changes or a renovation contractor bidding on a job, could study first. At this point, they would combine this with blueprints, plumbing schematics, etc. With Matterport's service, they may find all these one day duplicative and obsolete.

(Source: https://matterport.com/)

Here's a more human eye view of the above in 2 dimensions. Visit the 3D Tour Gallery to see into the various nooks and crannies.

(Source: https://matterport.com/)

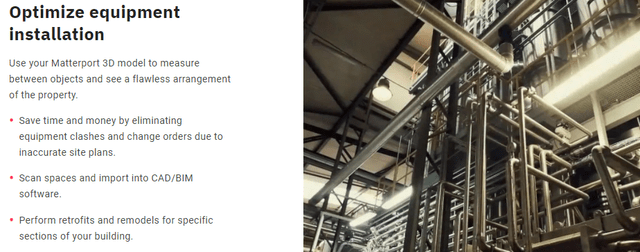

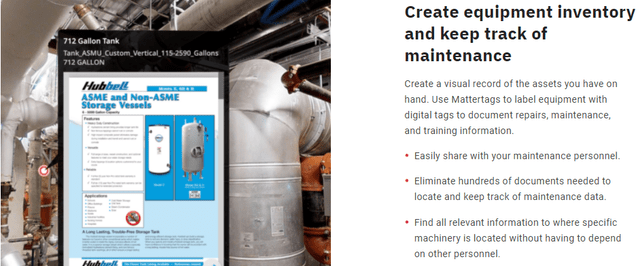

Some may see the above uses as frivolous or merely tangential to where the big money is. For those readers, I provide the following examples of the use of digital twins in just one other area, the facilities management industry. All below from https://matterport.com/.

Currently, this information is primarily kept in hundreds of different documents in scores of file cabinets, often not accessible to most employees or to first responders who need a visual sense of what they are coming into, often under the worst of conditions.

Matterport's clients include AT&T (T), Verizon (VZ), Redfin (RDFN), Cushman & Wakefield (CWK), Jones Lang LaSalle (JLL), and between a quarter-million and a half million smaller firms and individuals. I believe their client roster may well grow exponentially over the coming months and years.

Yes, I said years. Matterport has competition from firms like Palantir (PLTR), also in our Investor's Edge portfolios, as well as from other, larger companies that could decide to enter this space before Matterport has a compelling lead. That is to say, for all its benefits, MTTR is a *speculative* holding.

Revenues are minuscule by comparison to potential long-established competitors in the Information Technology sector. How minuscule?

As of 2021 Q2, released August 11, Matterport's revenue was just $29.5 million. (Up 21% year on year.)

Earnings per share? Still in the red. A loss of 62 cents.

On the other hand, and among the reasons I am purchasing shares for my own and risk-oriented clients...

- Subscription revenue increased 53% year on year.

- Annual Recurring Revenue is now at $61.1 million

- Spaces Under Management grew to 5.6 million, up *75%* compared to second quarter of 2020.

- Subscribers increased to 404,000, up *158%* compared to second quarter of 2020.

I expect MTTR shares to bounce around quite a bit over the coming weeks. I have purchased as low as $16 and change and as high as $21 -- all in the past week. This is a volatile issue. My approach is to own "some" and hope I can buy more for less. I am not reaching too far but have a reasonable position for the small portion of the portfolios I allow for speculative firms and the occasional moonshot.

Unless you are far more expert than I in this field, don't bet the ranch. And as always, never invest more than you are prepared to lose!

Disclaimer: Unless you are a client of my advisory firm, Stanford Wealth Management, I do not know your personal financial situation. Therefore, I offer my opinions above for your due diligence ...

more