Massive Month-End Buying Of Biggest Losers

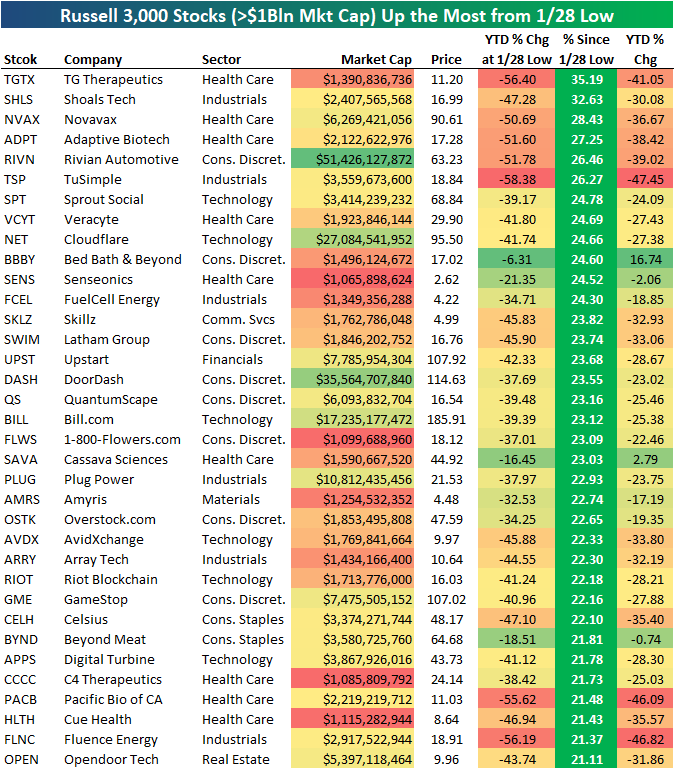

The average stock in the Russell 3,000 is now up 7% from the index’s low point last Friday (1/28) as we near the final close of January 2022. We have seen some massive rallies since Friday morning when US markets started the day in the red. Below is a look at the Russell 3,000 stocks with market caps >$1 billion that are up the most since their intraday lows last Friday. For each stock, we also show how it had performed on a year-to-date basis at its low point last Friday. What we see here is that the stocks that are up the most during this two-day month-end rally are generally the same ones that were down the most YTD heading into the rally. The six stocks that are up the most since their lows on Friday are up 26%+, but five of the six were down 50%+ YTD at their lows! A 50%+ YTD decline usually takes more than a month to play out, but not this year! And 25%+ rallies usually take more than two trading days to play out as well.

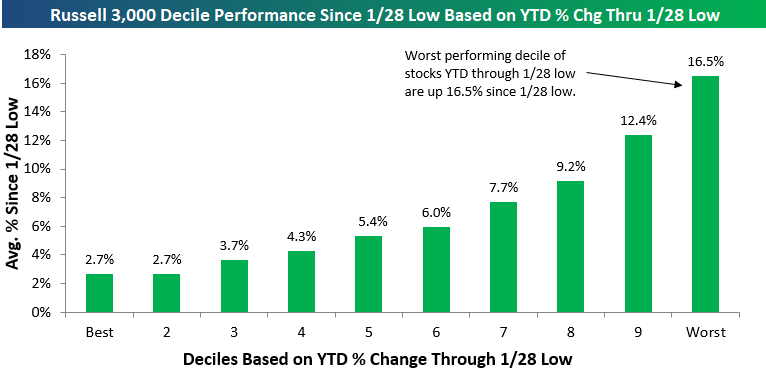

If we break the Russell 3,000 into deciles based on YTD performance through the low on Friday (1/28), we can clearly see that the stocks that were down the most YTD are the ones bouncing back the most. The 10% of stocks in the Russell 3,000 that were down the most YTD at the low on 1/28 are up an average of 16.5% since. Conversely, the 10% of stocks in the index that were doing the best YTD at their low point last Friday are only up 2.7% since then.

Below is a look at the rally off last Friday’s lows by sector. The average Health Care stock was down 25%+ YTD at last Friday’s low, but they’re now up more than 10% since then. Tech stocks were down nearly 20% YTD on average through last Friday’s lows, and they’re up 9.8% since.

We would note that the Energy sector is the only one that saw stocks up YTD through last Friday’s low, and they have tacked on a gain of 3.8% since then for a full-year average gain of 8.44%.

Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view ...

more