Market Up Or Market Down, These Spirited Beverage Companies Make Money

I predict that retail sales, as well as those from bars and restaurants, will accelerate after our quadrennial presidential campaign is over.

In politics, one side will win, one side will lose. But no matter the outcome, the alcoholic beverage industry wins perennially over something so transitory as "four more years" or "a new beginning".

Those of us on every side of the aisle who enjoy the occasional beer, wine, cocktail, or some more refined (refined, as in distilled) fruit of the barley will be relieved to have the double whammy of Covid-19 and presidential election over with. Whichever side we are on, if our team wins, we will drink heartily in celebration; if our team loses, we will drink to drown our sorrows. If this year results in an election where the final result is delayed, we will likely also drink to relieve the anxiety of not knowing.

This is truly a business that wins no matter who prevails when the final ballots are counted.

There are those who cannot drink by faith or genetics or those who choose not to imbibe, of course, so they may elect to not invest in the companies that provide these small ambrosial treats. As a courtesy to them, the rest of us are encouraged by both the alcoholic beverage companies and the various temperance, teetotalist, and outright prohibition movements to "Drink Responsibly".

Source: Temperance Movement in the US

I prefer a slightly different approach. I have two favorite Irish whiskies, Jameson Crested and Mitchell & Son's Green Spot. Green Spot asks us to "Taste Responsibly." Since it is the sublime flavors of our favorite beers, wines or spirits that most of us enjoy, not the effects of too much (of almost anything) that attracts us, I think "Taste Responsibly" says it best.

There are far too many breweries, distilleries, packagers, distributors, end-sellers, etc. for me to cover them all. As you read this, I am certain at least two new microbreweries and one new celebrity-branded vodka will be released.

Because there are so many variations on a theme, with scores of them as listed public companies, I am going to limit my suggestions for your due diligence to the biggest of the big. These are the listed companies that could make a significant difference in your investing portfolio. I call them the "ABCDs" of the alcoholic beverage industry.

Are People Drinking More or Less These Days?

It depends upon who you ask. Bloomberg posted an article a couple of months back that claimed people are drinking less. Since fewer restaurants, bars, and sporting venues are available to imbibe socially, drinking beer or wine with your at-home meals and 2 or 3 fingers of Highland Park or Teeling for a nightcap is just not making up the difference.

That is not my straw poll and personal observation experience, but I am willing to accept Bloomberg's numbers - for now.

However, every month that goes by, every week, every day, the brilliant researchers at the most advanced ethical drug companies are coming closer and closer to a Covid-19 vaccine. Every day medical researchers and doctors on the front lines are discovering new treatment protocols.

Today, the city of Reno, down the mountainside about 40 minutes from me just reopened the bars and beer-, wine- and liquor-selling restaurants. As this happens nationwide, I predict the pall over beer, wine, and liquor companies will lift. The time to buy for increasing earnings in the future is today, not in the future.

The second big point in the Bloomberg article is that 20-somethings (you know, the only market that counts for some companies!) are not drinking alcohol. They prefer non-alcoholic or very low alcoholic beers and other beverages. The Bloomberg article labeled this "the White Claw phenomenon." My response to this phenomenon is, "Just wait a while." Every generation starts with such beverages. Most, as they grow older, seek out the subtleties and unique flavors of distilled liquor and add it to their fermented cousins like beer or wine.

Every generation for a zillion+1 generations back has found as they mature that there is something satisfying about the flavor of distilled grains tasted responsibly. I submit there is room for both. And if previous generations are any indication, younger people will still enjoy beer but also move on to higher-quality wines and spirits. Welcome to the revolution!

Source: WellBeing Brewing via Bloomberg

Case in point from the same article: Millennials, discovering they are no longer 20-somethings drank 29 alcoholic drinks a month last year, up from 24 a month in 2013. (This according to booze-producer Constellation Brands.)

Next case in point from 2019: after hand sanitizers and toilet paper, beer, wine, and spirits were the next highest items purchased in the immediate aftermath of nationwide bar and restaurant closings. According to market research firm Nielsen, "online" alcohol sales surged a mind-boggling 243%. As restaurants and bars reopen, profits will accrue to those best-positioned to provide the product.

No-, low-, or "regular" alcohol, which are the best investable companies?

I say all three because let's face it, the innovative non-alcoholic producers at the smaller firms may carve out a forever niche, but the more likely path is they and their recipes will be bought for mega-millions by the big companies with the legal staff, the distribution network, the ability to deal more easily with regulators and the advertising and marketing budget to carry sales to the next level.

The 4 companies I have selected to discuss are, in alphabetical order, the "ABCD" of the beer, wine, and liquor business.

My international readers might protest that I have neglected to include many fine European, Asian, South American, Asian, and, of course, Australian purveyors of beer, wine, and spirits.

However, even the well-known names like Pernod Ricard (OTCPK: PDRDF) are often more difficult to buy because they trade fewer shares and are, therefore, less liquid and have higher bid/ask spreads - even though their sales rival those above in some cases.

I realize, too, that I have neglected to include Molson Coors (TAP), Heineken (OTCQX: HEINY), Kirin, and a number of other large listed brewers, vintners, and distillers. That will have to wait for a future article. Diligent research in this field requires time, patience, and relaxed reflection upon the myriad qualities of the various products.

Three of the four ABCD giants are in the beer business:

- Anheuser-Busch InBev

- Constellation Brands

- Diageo PLC

All of them are in the wine business:

- Anheuser-Busch InBev

- Brown-Forman

- Constellation Brands

- Diageo PLC

And three are in the distilled spirits business:

- Anheuser-Busch InBev

- Constellation Brands

- Diageo PLC

Seeing the above may change your mind about what a "beer company" or a "liquor company" is. Once these firms have learned to negotiate the various laws, rules, and regulations of almost every country on the planet, created products that appeal to local taste, and figured out the best distribution networks, there is no reason to limit themselves to one product, one brand, or one type of brew, wine, or spirit.

I believe all are worthy of your due diligence, though I have my own favorites. The foundation of success in all cases will be the popularity of their products. But how they direct their cash flow into new areas, willingness to sell off less popular lines, how high their margins and resulting earnings are, and how they are perceived in the marketplace must be part of the equation as well.

Anheuser-Busch InBev

BUD, which many people think of as "an American beer company" was acquired by Belgium's Interbrew a few years back, creating, along with assets from Brazil's AmBev, by far the biggest brewery conglomerate in the world, both in terms of output as well as revenue.

Anheuser-Busch was founded in 1852 in one of America's great Heartland cities, St. Louis. Interbrew was founded nearly 500 years earlier in 1366 and is headquartered in Leuven, Belgium.

Budweiser, Corona, Stella Artois, Beck's, Leffe, Michelob, Antarctica, Bud Light, Brahma, Modelo, Victoria, and Skol are just a few of their best-selling brands and/or best-tasting brands. You have to figure that a company that has been brewing and selling popular beers for 654 years just might have a little staying power.

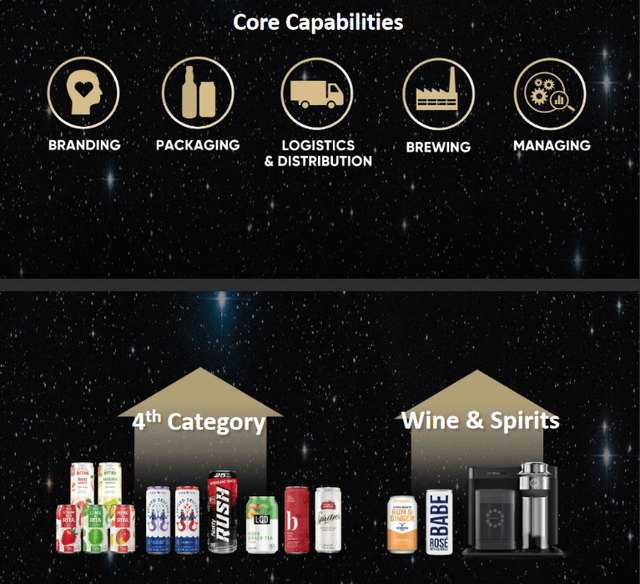

BUD has in total more than 500 brands of beer. Yet, even a company we traditionally think of as a premier beer company, is branching out, as these photos show:

Source: BUD investor presentation 2019

Among the innovations in the "4th category" are canned margarita cocktails in various flavors, hard cider, hard seltzers, energy drinks, and - I'm not sure I see the logic but somebody must - hard green tea and hard coconut water.

Source: BUD investor presentation 2019

As for canned wine, why not? We can't all drink Chateau Lafite 1869, or even Opus One, every day. Remember, the market for serious wine aficionados is not that big. The market for wine snobs who know all the right terms but can't tell a good old vines zin from their grandma's big toe is larger. But the biggest still is the biggest demographic alive today, millennials, and their younger cohorts who would rather find something more approachable. Different strokes for different enjoyers of the company's offerings.

While BUD is transforming itself from merely the biggest beer purveyor in the world, the stock market has passed it by. If they changed their name to "Internet Beverages" instead of InBev, I imagine they would immediately be swooned over. For some of us who prefer an improving balance sheet (by bringing down a heavy debt load) and a steady (if slower) outlook, BUD looks more and more like a fallen angel.

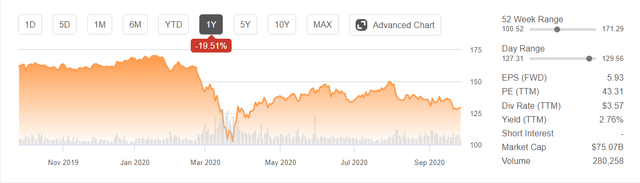

(Click on image to enlarge)

Source: Seeking Alpha

I like that Anheuser-Busch InBev conducts some 70% of its business outside the US. Competition from craft breweries in the US is minor from each brewer but becoming larger in the aggregate. The big beer companies like BUD will have more competition in the US and will either have to advertise more, price less, or buy up the competition where the size is big enough to justify a buyout.

I like that the Fed and the US Treasury will most likely do its best to subtly debase the US dollar. After all, borrowing in the trillions, you don't really want to pay interest in high-value dollars and you certainly do not want to redeem in today's (relatively) higher value dollars.

I like that Anheuser-Busch InBev has always been a high-margin company. In Q1 2020, those margins suffered from the previous 40% (EBITDA) and fell, down to around 36%. As the country and the world recover, I believe BUD will regain that level of EBITDA margins or even expand them.

I do not like the fact that Anheuser-Busch InBev took on so much debt to fund the purchase of competitor SABMiller. The combined was leveraged at about 6X EBITDA at beginning 3 years ago. This higher debt makes the company more vulnerable if, for some reason, people reduce their purchases of BUD's product line. While the debt was being steadily reduced, Covid-19 restrictions have stalled the efforts to bring the debt down.

I like the fact that, with 500 beers, BUD doesn't need to do surveys to decide who likes what in what locale. They can always adjust their output to meet local tastes. And I like that they are meeting the requests of the newest generation of responsible tasters.

I do not see great growth for BUD, but I do see a dividend at a payout ratio low enough to be sustained and slow, steady progress in reducing debt.

Brown-Forman Corp.

Brown-Forman is an institutional favorite, second only to Constellation Brands. It has also paid a dividend to shareholders for 75 consecutive years and increased its dividend for 36 years in a row, making it a Dividend Aristocrat.

Primarily thought of as a distilled spirits company, its #1 revenue generator is Jack Daniel's, the best-selling American whiskey in the world. Much as my friends along the Kentucky Bourbon Trail might sniff that this isn't even a true American bourbon, the truth is Jack Black does meet the regulatory criteria for classification as a straight bourbon.

They graciously do not call it bourbon, however, preferring instead the term Tennessee whiskey. I don't think BF.B wants to begin a war of words with neighbor Kentucky, especially since their other three whiskey brands Woodford Reserve, as well as Old Forester and Cooper's Craft are all Kentucky straight bourbons.

(One delightful piece of trivia is that America's best-selling whiskey cannot be purchaser in Lynchburg, Tennessee, home of the Jack Daniel Distillery, or anywhere else in the county. Moore County, the last time I looked, is still a dry county.)

Source: JackDaniels.com

For whiskey lovers, a travesty in the making.

Some of Brown-Forman's other brands of note are:

Source: brown-forman.com

Three different distillers of quality Scotch whisky, a crowd-favorite liqueur, Finlandia vodka, the fruit of the vine from the exceptional Russian River (Sonoma County) Sonoma-Cutrer and Korbel wineries, three different tequilas including the splendid Herradura line, Fords Gin, and Slane Irish Whiskey all make for a compelling portfolio of beer, wine, and distilled spirits.

Source: brown-forman.com

Much as I salivate at the thought of some of BF.B's great brands, I will not be buying its shares. Upon doing your own due diligence you may disagree. But the company seems to be perennially overpriced for my taste. I'd rather buy their products than their stock right now.

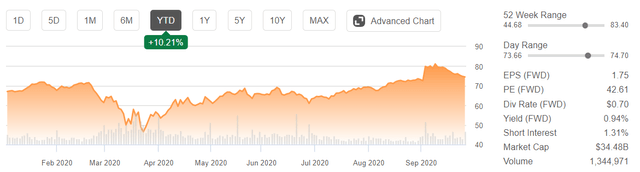

(Click on image to enlarge)

Source: Seeking Alpha

I do not like that the smallest of the Big Four in terms of revenue, BF.B is awarded a PE of 42. A bit rich I think, even though it has a positive growth outlook.

I do not like that the company's Q1 earnings report looked good but a big part of that was a slash in advertising expenditures. In this highly competitive business that can make the numbers look good for a while but harm the future numbers.

Constellation Brands

Constellation Brands is a relative newcomer to the beer, wine, and spirits business. It was founded as a wine company in 1945 in New York's Finger Lakes region. Many readers will remember the old Canandaigua Wine Co., which sold bulk wine to bottlers in the eastern US. From such tiny acorns do mighty oaks grow.

(Click on image to enlarge)

Source: Seeking Alpha

STZ today has over 100 brands in its portfolio, but you will need a great deal or time and patience to discover which they are. If you are a distributor doing business with them or a marketing partner, their website is fine. Trying to find their brands anywhere on the actual website is a challenge. They keep giving "examples" only. To save time, if you visit their site, go immediately to their most recent investor presentation. There you can find:

Source: Constellation Brands Q1 FY21 Investor Presentation

You will note in the lower right that STZ is also a cannabis company. The company paid $4 billion for a ~38% share of Canopy Growth (OTC: CGC) in October 2017 to offset declining beer revenues. Earlier this year, they declared a $71.1 million loss on its investment so far.

Regular readers know that I believe the Big Three tobacco companies will be the most likely to own the cannabis market once it becomes legal. Given the decline in the premium being paid for legal weed stocks, I imagine theirs will be the better investments.

I like that STZ says it is moving "upscale." That is called premiumization in the alcoholic (and increasingly non-alcoholic) beverage industry. The margins are better the higher-positioned a particular brand is.

I do not like Constellation Brands keeps talking about how they own the premium brands and are moving even further into those markets. This is not backed up by my research. While the company says:

Our high-end, iconic imported beer brands include Corona Extra, Corona Light, Corona Premier, Modelo Especial, Modelo Negra and Pacifico. Our high-quality premium wine and spirits brands include Robert Mondavi, Kim Crawford, Meiomi, The Prisoner, SVEDKA Vodka, Casa Noble Tequila and High West Whiskey."

I will agree that Casa Noble makes some fine sipping tequila. And I agree that the Mexican breweries turn out some premium choices like Modelo Especial and Modelo Negra.

But I do not like what seems to be either over-preening or overweening about "owning" the premium brands market. Not only the others of the ABCDs but also Pernod Ricard, Beam Suntory, Bacardi, Moët Hennessy, and Rémy Cointreau might choose to disagree.

I like that STZ is moving aggressively into the beer business since that is where most young tasters start to explore the different flavors of beer, wine, and liquor.

I do not like that so many institutions own this company. The 800-pound gorillas can move markets and individual companies up when they are the primary shareholders - but they can move a company down just as quickly with the slightest whiff of a disappointing quarter. Constellation has the highest share of institutional ownership among all four.

At present, I am underwhelmed by STZ as an investment.

D is for Diageo PLC

The "PLC" tells you this is a UK-based company. It has good bones, tracing its heritage back to the Haig family, believed to be the oldest family of Scotch whisky distillers, beginning sometime in the 1600s.

(Click on image to enlarge)

Source: Seeking Alpha

If you are seeking more premium names, intermixed, of course, with those most popular as well, you might find Diageo of interest. Premium is good not just because it adds to the parent company's reputation, but, more importantly, because the margins are higher.

Diageo owns the premium Guinness franchise. For those who prefer stouts and porters to lagers and ales, Guinness will always be at least one, if not the only, choice where dark beers are served.

Source: Diageo website

I like that.

I also like that DEO has some of the best-known and most appreciated names in Scotch whisky. Names like Lagavulin, The Singleton, Talisker, Cragganmore, Dalwhinnie, Oban, and Vat 69, among others. In vodka, add upscale Cîroc to the list and mainstream Smirnoff. For North American whiskies, Seagrams Seven, Bulleit bourbon, and George Dickel Tennessee whiskey. For rum, DEO also owns Bundaberg and Ron Zapaca, in tequila, Casamigos, and Don Julio, and in gin, add Gilbey's and Gordon's to the list. And for some dandy wines and cognacs, Dom Perignon, Veuve Clicquot, Moet & Chandon, and Hennessey.

Seems to me, what Constellation is striving to provide, they will be getting in line behind Diageo.

Also, more than any other of the ABCDs, Diageo owns a lot of "local" names, which might not be easily recognizable to many of us but are also immensely popular in India, China, or some other profitable region or nation.

Source: Diageo website

In India, second only to Officer's Choice, an Indian born- and distilled- whisky.

Source: Diageo website

Originally, special for Venezuelans, now all of South America, Spain, and much of Europe.

I like that Diageo's earnings per share and dividend are the highest of the four and its revenues are second only to BUD.

I like that they are #1 in many "local" markets.

Finally, I like that they cover the globe geographically and that they also are diverse from a price point perspective.

Source: Diageo website.

I like DEO.

What to Buy, What to Buy?

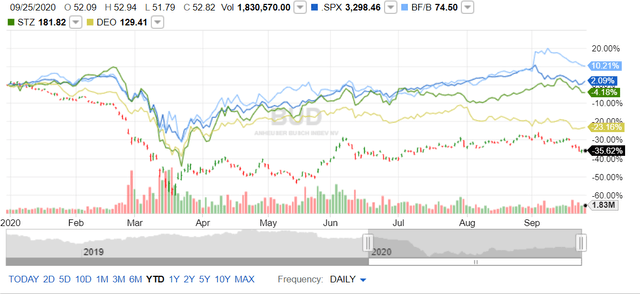

Allow me to provide two charts that will provide a bit of perspective so you can begin to do your own due diligence. The first is a year-to-date price chart for all four of the ABCD companies compared to each other:

(Click on image to enlarge)

Source: Fidelity.com

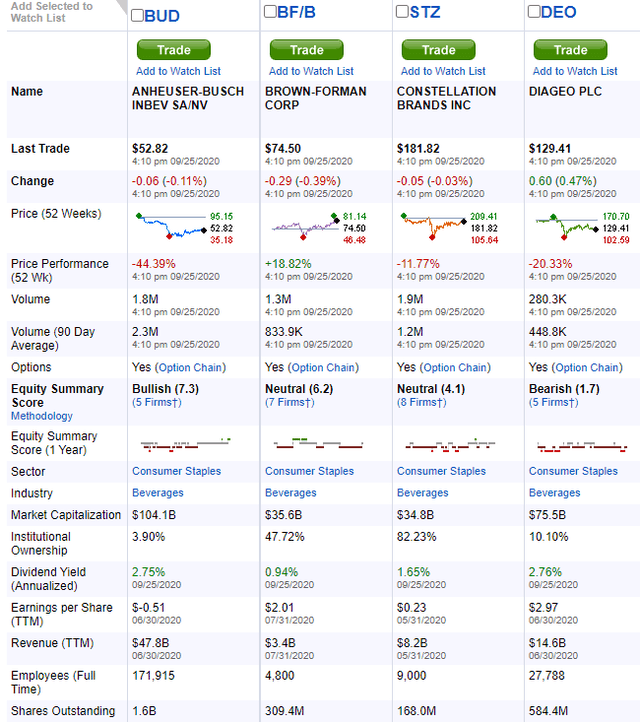

The next compares the ABCDs on a number of key metrics:

(Click on image to enlarge)

Source: Fidelity.com

You will note that BUD is down the most of the 4 over the past year. It is also the least popular among institutions and is the only one to show a loss for the trailing 12 months. On the other hand, it has the highest liquidity, the most revenue, and a history of outperformance over the long time.

Personally, I view the low institutional ownership as a plus. Once the numbers improve, they will flock back in. And we cannot overlook the fact that this company has 17 different brands that sell more than $1 billion each and every year, with plans to create even more.

An update: above, I mentioned that these giants would likely buy and radically expand the market for many of the smaller brewers, vintners, and spirits companies. As I write these words on Friday, Sept 18., BUD just received US antitrust approval to move forward with their acquisition of the US's Craft Brew Alliance (BREW).

For me, which beer, wine, and spirits to buy is rather universal, with some favorites among the four. But as for which company's shares I am most interested in, the decision is easier. For me, Anheuser-Busch InBev and Diageo are the two clear winners.

Disclosure: Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BUD, DEO over the next 72 hours.

Disclaimer: I do not know your personal financial ...

more