Market Briefing For Wednesday, Apr. 28

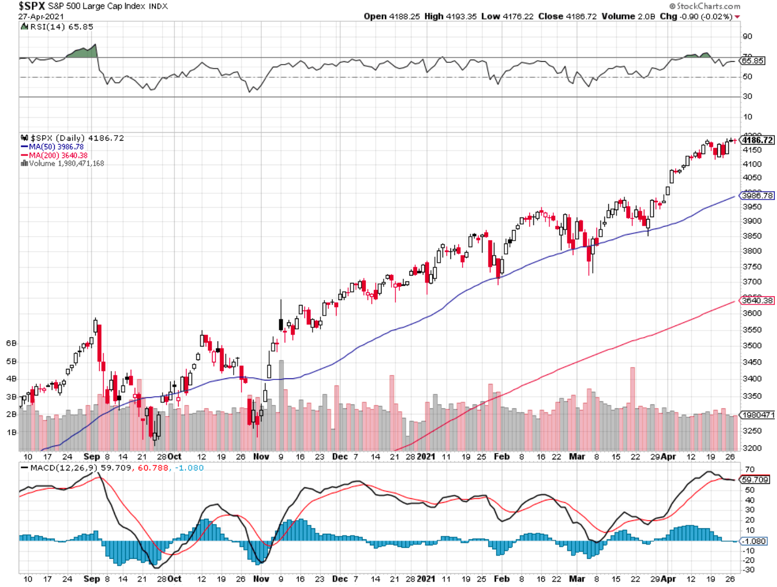

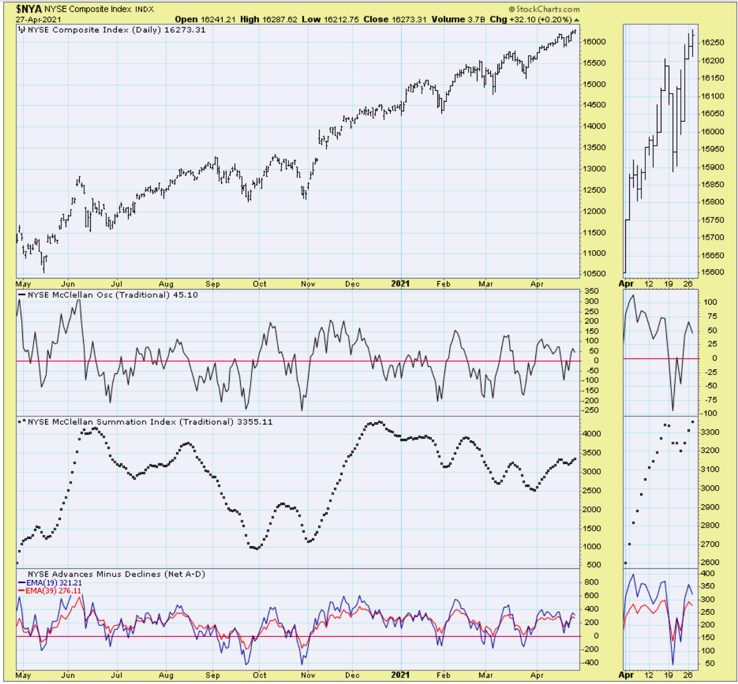

Tactical behavior requires no change whatsoever. Just recognize that signs of an impending 'big-cap' correction are rising, with less erosion probably in a slew of small-cap stocks that have already consolidated or been dormant.

Tonight won't be one of my longer reports when I'm feeling better (a member deduced that), but a shorter one despite feeling alright (considering). Reason: there's nothing happening that hasn't been in-line with expectations.

That includes the heart of the FANG-type earnings reports, and most were up there in terms of results, with several encountering good news profit-taking. In such cases the key short-term is not the knee-jerk selling, but how significant the ensuing support for such stocks is. That we'll see in a day or two.

As you know most today made numbers. Google was superb (recently we've observed higher prices likely) (GOOGL), Apple is pending but should be fine (AAPL), then there is Microsoft (super results and profit-taking) (MSFT), while AMD is talking about 50% higher revenues for the year (and it's acting just as good as suspected likely) (AMD). Amgen actually missed on earnings, exceeded on revenue, and slid a bit. If any of these stocks was most impressive, it was our AMD (cost 17 or so and picked-up as a future buy when I met their developers in Berlin in 2018) (AMGN).

That IFA 'tech show' apparently will be 'live' again this year, though I doubt I'll be in shape to risk a trip abroad (which will be permitted most likely by then). Oh we did get Texas Instruments a little disappointing, is dipping but will recover. It's already nearly doubled during our coverage time over the past year plus. Nevertheless not concerned about TXN unless the market tanks (TXN).

By the way I reiterate disapproval (by me) of Prolia, Amgen's widely promoted solution for osteoporosis. I reiterate as in stock chatter while hospitalized (you didn't think doctors mostly talk about medical issues... just teasing), there was some acknowledgement of what I contended a long time ago: it causes more fractures in post-menopausal women, because new and old cells appear more dense in a scan, and yet fragility is actually increased. Just my view.

Finally, as I detailed in the 2nd video a bit, Sorrento Therapeutics got FDA go-ahead for Phase 2 of a new cancer drug. It's already in advanced South Korean trial, and SRNE shares acted well. That was 'not' the announcement we've of course looked for, but it is reflective of the string of products in various phases of development. Not all will succeed, but enough should as will be noticeable (SRNE).

Noticeable by whom? By the medical community, by society (in the case of an efficient COVID rapid test should it be authorized by the FDA), by other phama companies (who are clearly eyeing Sorrento and perhaps pondering 'forward relationships' .. and I'll leave that comment there), plus institutional buyers (of course some of the major funds have been accumulating amidst controversy.

By the way, a 'pill' to treat COVID discussed in the news from Pfizer (PFE), barely at all explaining the mechanism of action, is 'not' a monoclonal antibody such as Sorrento, Lilly and even Merck are pursuing. It's a 'protease inhibitor', which tries blocking a portion of the virus from attaching to healthy cells. It's based roughly on early HIV treatments, which were modestly effective. Clinical trials will reveal whether protease inhibitors have better success against COVID.

In sum - the market was balanced in both directions today, and that's typical ahead of a Fed 'announcement'. As usual the inferences in comments will be determinant of tomorrow's response to the Fed Statement and 'call'. Be aware that markets often go the opposite of the knee-jerk initial reaction to any Fed move, in this case perhaps fairly bland since they'll not do anything (that may not stop traders from trying to make hay by sparking some shuffling).