Market Briefing For Tuesday, December 27

A 'Trump Bump' flagpole leading into a narrow 'pennant' formation, is the correct technical description of the behavior of the last seven weeks' forecasts. It turns out this is the 'narrowest' trading-range week for the Dow Industrials in...would you believe 30 years. That's something in the wake of the persistently bullish trend we've analyzed as following the election this year.

Meanwhile you've had comparatively broader strength in the S&P than Dow and likewise the Russell 2000 and Value Line (as I've noted before) already challenged the secular series of generational highs from preceding years.

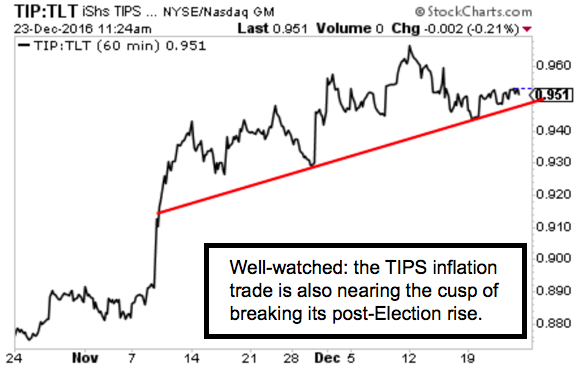

I fully understand the propensity of analysts and pundits searching for value (I don't disagree if we indeed revive basic industries adequately in the USA); while you do have hints (like Copper) suggesting we've had the best of what can be described as a 'transformational potential bet-on-the-outcome' advance.

It's a move we've endorsed; we've believe can revitalize the USA and shift a focus where it needs to be (provided it doesn't undo several valued gains in the social and human rights areas of prior years); and could take America back from the brink (always risky) of far-right or far-left politics to the center.

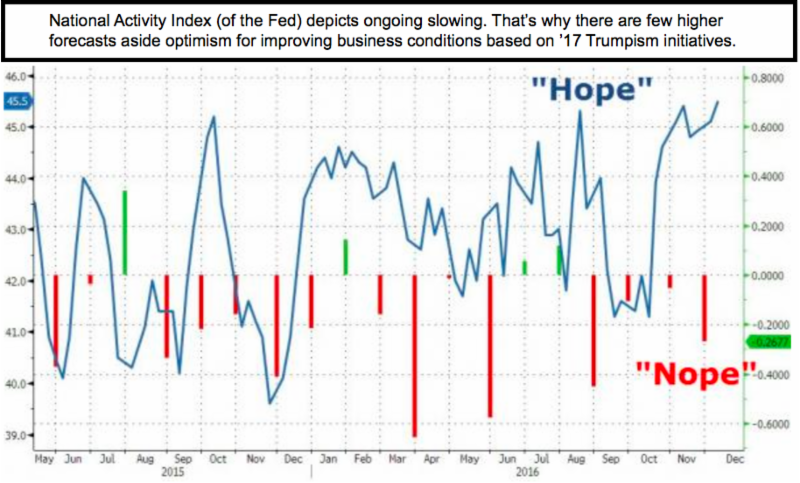

What's not visible, but perhaps factored into stocks; in a coming tax reform that is absolutely essential to justify earnings bumps that analysts will need to remotely justify high price levels, until 'actual' (not conceptual) revival.

At the same time, one nervously eyes both year-end 'reallocation' (mostly that is from equities to bonds) that lots of mutual funds and managers 'must' do (because of proportionality, beyond diversification of strong stocks that are now higher percentages of portfolios); so it too is a part of the unease.

Bottom line, the market is on fumes but stable and grinding higher; against the known pressures of an unusual reallocation coming and an unusual tax aspect this go-round, beyond just deferring long-term gains another year (of course that's the prospect of those deferred gains taxed at a lower rate too).

As to Dow 20k; it's irrelevant as the broader market's there. I'll review more next week as we get into the final days (and new trade settlement year) of an incredible 2016. More on 2017 next week; but for now:

Just paraphrasing our market perspective, which for several days has been one of less sanguine short-term optimism; while believing the longer-term as we've outlined, has potential to be extremely transformative, and beneficial to many segments of business and society in-general. But it's a process and isn't going to be sorted out on a dime, though likely will be in-time.

That suggests a misfit; the market's gift of our totally supported rally lifting a lot of forgotten basic industrial stocks (and oils) for the past 6-7 weeks, was and is based primarily on prospects that are yet to be carved in stone. That IS likely to occur; though (especially with regard to taxes), we continue with the view that they should go all at once, not plan a gradually-phased shift. If they do it gradually, the full benefit won't be seen, for business or markets.

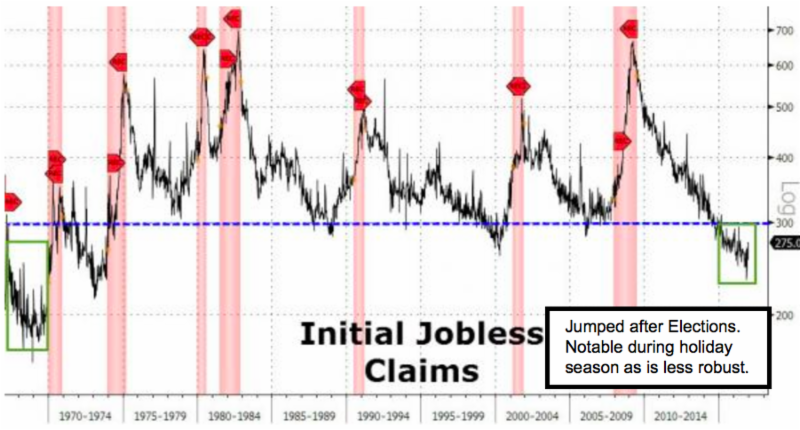

Basically we lean toward the idea of a correction 'in the wings', whether that starts (as we've suspected) almost as soon as you can sell for settlement in the new 2017 tax year (benefiting from both an extra year and the presumed lower tax rates), or whether it's choppier than that to kick-off the new year.

The anatomy of next year's market can't yet be dissected; as everything has been based on subjective reasoning of how the mood will be transformed in a dramatic fashion (like a foot lifted-off market jugulars as I described it from the start last month). That occurred; and now the ramifications (including the responses from China and others, as well as the trade and manufacturing positions being delegated to basically 'tough cookies' that will well-represent American interests), are being better understood.

That includes realization a 'protectionist' tone, 'border-tax', or even potential trade war environment becomes a possibility. That in itself can contribute to 'second-takes' on near-term market performance itself, and that's essentially been our point over the past week; on top of the reduced tax expectations. It isn't exactly casting a pall over the market; but is tempering the enthusiasm.

Daily action saw the market recover yet again; with mediocre swings that are in line with what we've been seeing. There's no change in our belief that 'risk' is brewing in the wings; mostly awaiting 2017 settlement date arrival.

Now the market doesn't have to follow any script (and usually doesn't). For instance; you might get early selling related to 'pension fund reallocation' as usually takes place in the year's final days, when they tend to 'sell winners' and 'buy losers'. That may have been part of the re-weighting I suggested as primarily the influence keeping the market moving higher for six weeks in which others fought it occasionally; but we were consistently bullish. The 'Teutonic shifts' intended to transform America into a modernized as well as efficient growth engine that it was, relates to lots more than defining when the current post-election romp settles back (beyond that seen today).

It relates to dismissing much (not all) of what was addressed during political campaigns, and recognizing that this isn't about 'elites' (opposed in election talk and then as some think injected into government; when it's seriously of course not quite the same 'elites', as Trump is focused on business leaders not political or agenda-driven presumed intellectuals). It's about what these guys and a couple gals know best: making decisions and getting stuff done.

Much will depend on how the so-called 'Day One' blueprint lays out forward thinking; and what issues receive priorities, while others are back-burnered or deferred. The broad market, helped primarily by rotation and re-weighting of sectors, including many dormant for years or decades, primarily accounts for the stamina of our forecast bullishness in the wake of the election. That's mostly 'in' the market for now; as we move to a 'proof is in the pudding' sort of mode; especially as we border on entering 2017.

Politics, not finances, dominate the headlines today. There is no special systemic market risk. Our often lengthy reports after the Election made clear our overall view and belief that this market is not necessarily 'finished' with a 'Trumphoria' move; but ideally is heading for short-term risk as we approach the month's tail end as stocks of course can then settle in the new year. It might not drop then; but after all given the prospect of lower tax rates that would likely be retroactive to Jan. 1; it makes a bit of sense to expect some sort of profit-taking at that time.

|

The election has been a catalyst to shuffle money; as markets seriously reflect dynamic new American economic prospects; or at least perception of revivals with punch, not just a bland stagflation sort of recovery. Sure, too much too fast is part of this, as swings get increasingly extended. I've called ideally for exhaustion forthcoming; regardless of the flirtation with DJ 20k at the same time NASDAQ has already (relatively) exceeded such levels. |

Disclosure: None.

Thanks for sharing. Merry Christmas