Market Briefing For October 31, 2016

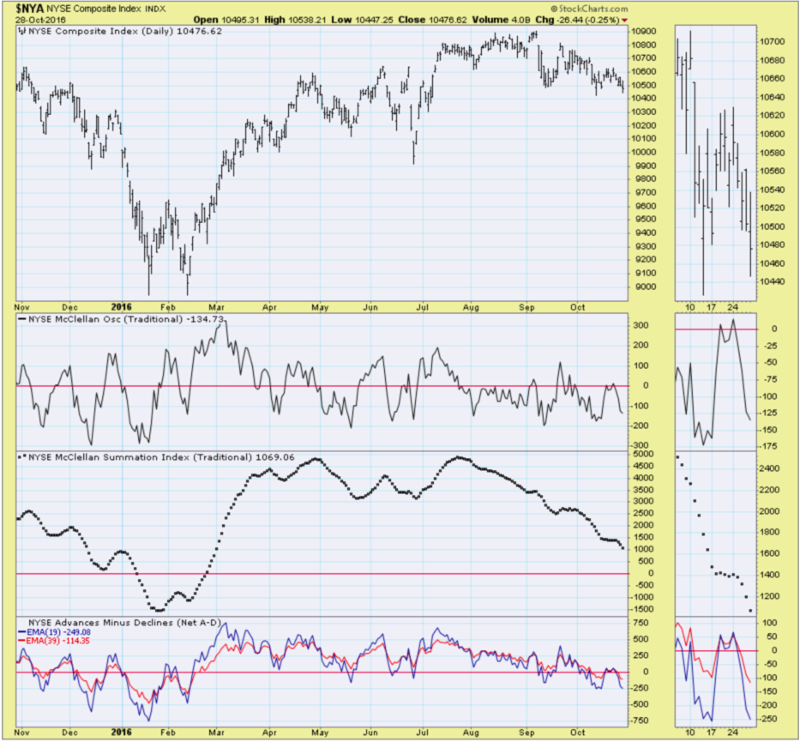

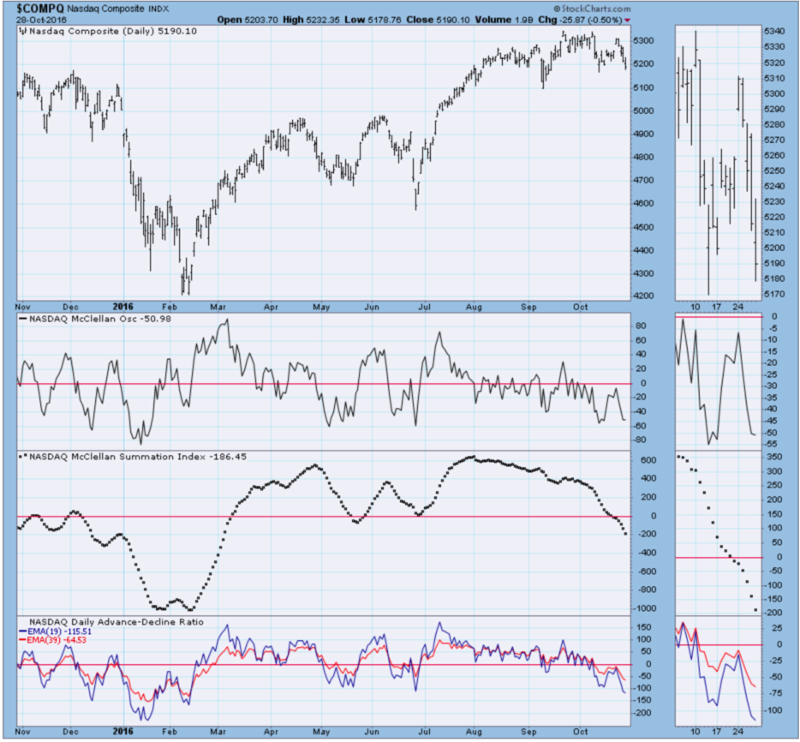

Friday's out-of-the-blue FBI revelation of (essentially reopening) what is considered to be an ongoing investigation of impropriety shook not just the S&P, but importantly, the Russell, sufficiently to venture into a crucial last-ditch technical support zone I've alluded to these past two weeks (and that's the Dec. S&P 2110-20 zone; above the lateral 2100 line you can easily visualize beneath both the September and October lows).

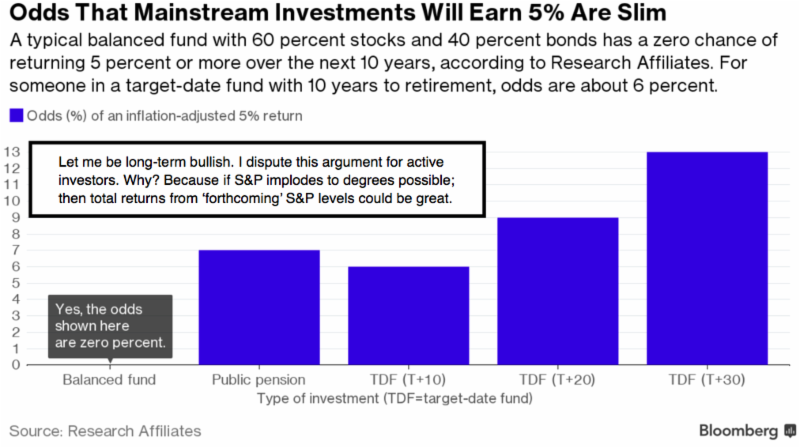

I'm trying to say just the least I can about this; as we try to keep politics out of analysis, other than when it matters. It's long been clear markets care how this election goes; perhaps for wrong presumed Wall Street reasons. The idea that a Clinton victory is welcomed since it suggests a continuation of domestic and international (read: globalist, perhaps monetarist) policies, which provide comfort to multinationals and many large institutions (or foreign sovereigns) that the boat 'won't be rocked very hard' (if at all). But I actually suspect even Hillary is more centrist on trade than President Obama; however that's not how markets see it, yet. At the moment we're dealing with perceptions about Hillary; more than how she would actually tilt in governance.

Technically, the S&P was held up by Oil stocks (now crumbling a bit as it's reported, though little noted, that Iran & Iraq may not concur on cuts in production at the formal OPEC meeting next month; after a two-day lower level one concluded Friday). I've warned all week, that though I'd predicted the recovery from the lower 40's into the 50's, that it wouldn't likely hold, because it was trading-based stories and hints already from Iraq that they should have an exemption. Now you see a series of threats to 'not' cut production levels, accusations of allocation cheating (they've done that for years), and basically that had more to do with all the market moves, while financial media focused excessively on more mundane politics, than noting the 'global bond rout' underway for days.

The December S&P, which we hold short since (about) 3 weeks ago at the 2167 level, as a guideline, with some profits taken on the first break and then suggestions to traders to use recent rallies (especially into the Expiration week preceding) to ramp-up bearish exposure (or cut back equities holdings if an investor or money manager) was in a range.

Daily Action

Catching a falling knife is what traders who are buying in my view are engaged in. Days ago pundits encouraged buying dips as on-earnings selling occurred; and in most cases shares are lower as suspected. I would not be inclined to try that; because if they think these are attractive declines; that's nuts. Just look at the 'air pockets' in a few that missed, and you have a hint of the kind of volatility awaiting.

Friday was a pretty good session; where traders momentarily deflected their shifts (musical chairs between investment sectors) and evacuated as if it was the deck chairs on the Titanic.

Among those 'deck chairs' are drug and distribution stocks; Oils, biotechs, and consumer When you see the pharmas get hit (including dramatic moves in long-dormant Bristol Myers or huge hits in McKesson, in Cardinal Healthcare or others; you know there's a political aspect to it as well. In this case I actually think our citizens are fed-up with the lack of oversight in healthcare, not just coverage issues surrounding premiums. The views (rightly or wrongly) about what the heck is going to happen in this healthcare field absolutely play-upon a short-term view of this sector, and that's as good an example as I can think of at the moment, as to why this market is in chaotic flux.

The pundits have pushed so many of these stocks; and think this is just rotational madness. Sure it is; but it's lots more... it's the rearranging of the deck chairs as if' there's some place to hide. It's a Pokemon game.

Just remember my old saying:when they come for the 'raid', they tend to take the bad girls, the good girls, the Madam; sometimes even the piano player.

Sometimes they 'raid' the wrong house; sometimes not.

We're not interested in buying pullbacks during a pending acceleration of a downturn; and this is especially at the very end of the month. It's a spooky time that makes Universal's Halloween Horror Show look more like Disney's Fantasy-land, considering the global circus antics now.

The global bond selloff provided the fundamental backdrop for our projected down-up-down Thursday. Now the plunge of Amazon (still in the mode of destroying competition by limiting their profit margins and disappointing shareholders for at least the immediate term) sets-up the potential for downside follow-through.

|

We are potentially closer (if not virtually at) 'trap door' or 'keyhole exit' status for the S&P; and much of that will depend less on Amazon or an Alphabet or an Apple, but on how Oil stocks behave, because housing is cracking again; Financials are not really attractive and there are few legs to sustain any type of strength in this market. |

Disclosure: None.

thanks for sharing

thanks for sharing