Market Briefing For Monday, March 19

Dismissing 'liquidity' as a concern is so commonplace, that analysts celebrate the Senate trampling some banking reform rules that followed our projected 'Epic Debacle' (financial crisis) beginning a decade ago. It is likely inappropriate (or naive) to remove stress tests and more, though of course temporarily that buttressed bank share performance (other of course than Wells Fargo where the FBI is looking into deeper, as on top of other egregious behaviors, clients were allegedly pushed to certain investments that managers knew were not suitable risk assumptions).

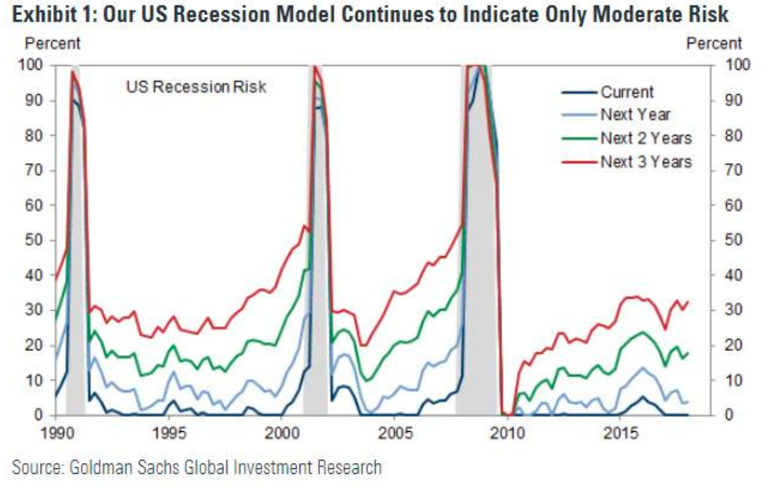

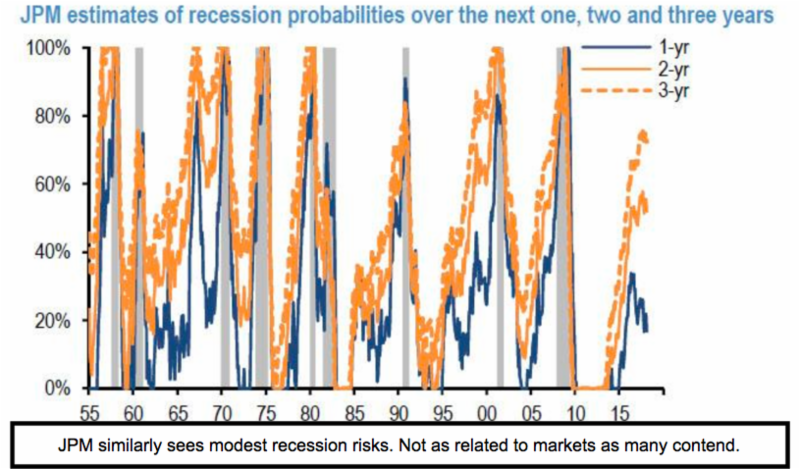

However, for now we should not dismiss risk concerns, even as analysts (not pundits that are mostly focused on fear or greed rather than reality) generally maintain fully-invested postures for clienteles. Periodically I've mentioned that if the new tax and most rules reforms are not reversed by any future Congress (that's why making lower tax structures relatively permanent matters), we could see a protracted economic long-cycle for years, regardless of current slowing or even an interim recession.

That is very important for growth; essential for price stability (inflation is not as desirable as even some Fed-heads seem to think, however there is little doubt we'll get more especially if the trade tariffs really expand or bite); and in order to perpetuate the revitalization of the U.S. We've got a bit of that achieved already and the bullish super-long-term possibility (I know it departs from the typical negativity of just demographic studies or the like) on the economy, is part of why I speak of bear markets within a context of the long cycle, or at least severe corrections; not catastrophe.

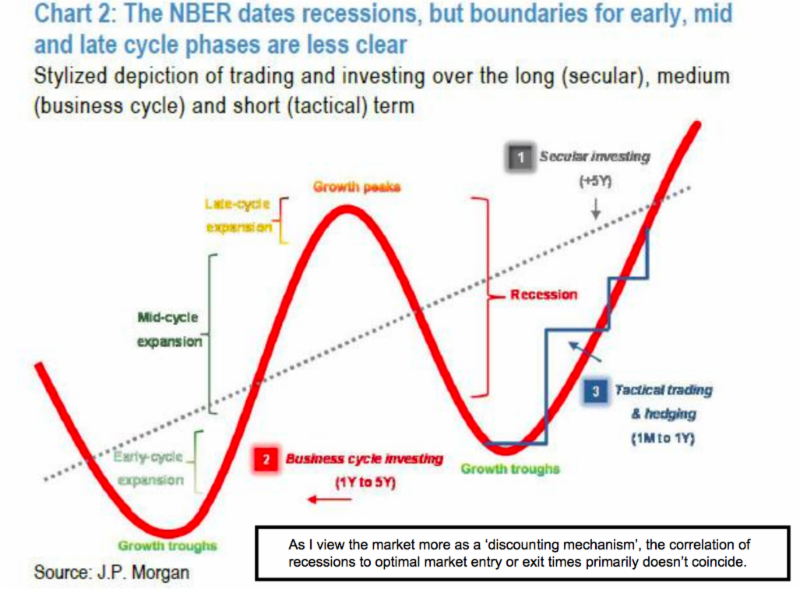

That may be faint praise for a forthcoming market decline that gains lots of traction, but it's a reality that comes from viewing markets as leading, rather than lagging, indicators, nor viewing the equity market as focused just on immediate earnings especially if the prior year(s) advance fully anticipated (discounted) those achievements.

So, since we made our point about how the market, at least temporarily, can diverge from the economy's performance, what's the concern? Debt. But not the national debt or even deficits, which are topics themselves. In this case we have already shown how dependent the stock market is on corporate 'buybacks' of their own shares.

To do that they've usually in the low-interest-rate environments, gone to the debt markets, something that might change under conditions 'either' of higher interest rates which reduce the attractiveness of borrowing for buybacks; or conversely, an actual 'recession', which slows business to a degree where funds need to be hoarded by companies, rather than put to work in buybacks, which besides making shareholders happy with the higher prices, largely function as additional 'executive compensation' as a benefit they rarely mention being a motivation for doing the buybacks.

In sum, this was an Expiration Friday, quadruple at that. Hence we did not expect or require any particular resolution to a choppy ongoing battle around the S&P 2750 inflection zone (just above it now).

Robust liquidity characterized the prior year following our enthusiasm of further upside 'if' Trump won; and the more so 'if' tax reform was passed. (And for new members, I note that I said before the election, business is wanting all this and it will be good for the market. So if you hate Trump just hold your nose and buy stocks anyway.)

That all worked great. However, this year is not that year which is why I warned the parabolic (above trend) S&P run-up in January wasn't going to be sustainable and called for a break by early February, then what I'd termed an 'automatic' rally, with churning skirmishes really since then.

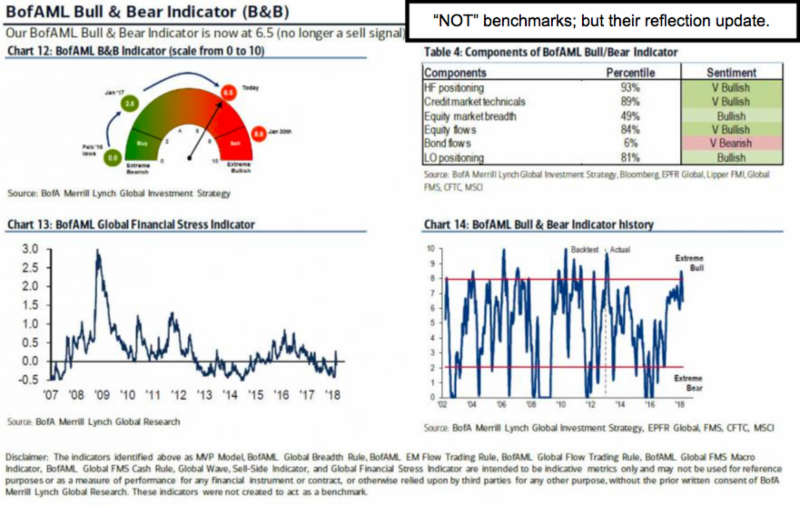

Stock market prices of course relate to supply and demand (or shocks). I believe this is a 'transition zone' for lower liquidity to increasingly appear. It can be from the simplest reason (of reduced seasonal reinvestment. I say reduced because some comes in, cleverly, by monthly withholds on a majority of workers paychecks that goes right into their funds) or can be from another reason, such as reduced foreign fund flows.

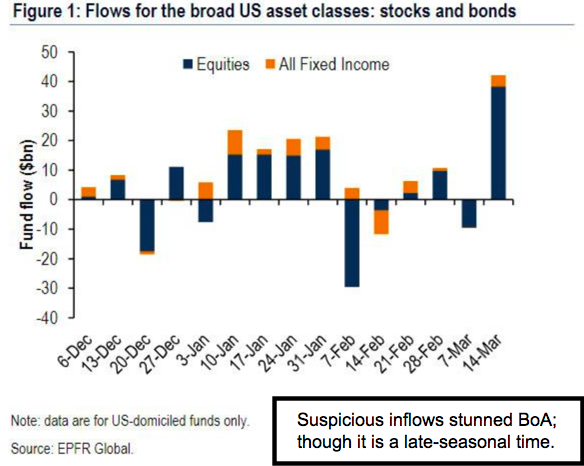

The nozzle of corporate buybacks being choked-down (not off) could be the largest such 'transition', and that's how the Bank of America surprise at the huge inflow into the market (while they've reported high wealth client withdrawals) emphasizes liquidity, and gets my attention.

To wit, if individuals are confident about the future; but simultaneously do believe stock prices are ahead of themselves then where's the funding coming from? Corporate buybacks and slowing residual seasonal flows.

Weekend (final) MarketCast

3 pm (intraday overview) MarketCast