Market Briefing For Friday, June 15

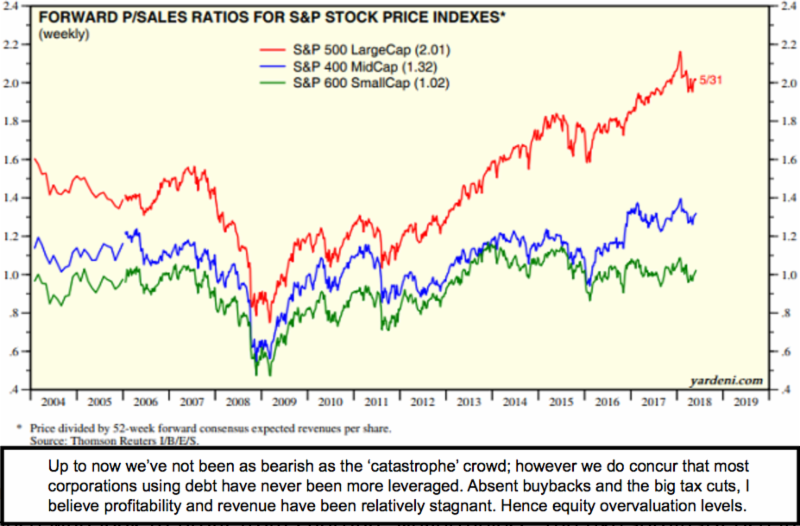

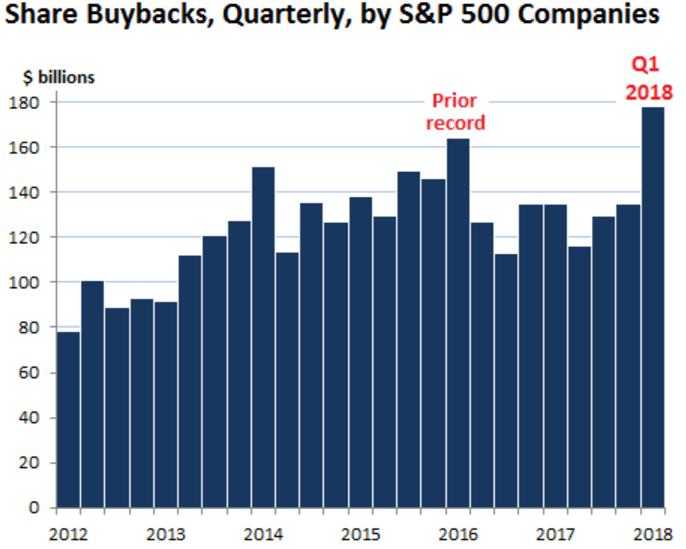

Too-good-to-be-true can work tactically for a while but generally tends to lead to at least a period of volatility. So the appearance of everything in a lined-up formation to mount another leg higher, can be the finale of what is actually a rather 'old' trend, rather than the kick-off of anything new.

The tariffs issued Friday won't alone be able to break the market but just being wary in what some view as a sweet-spot for the markets on a sort of continuing basis. For certain stocks, that were overdone on the downside or didn't really participate in this year's upward tech swing (yet), there is more possibility of gain, or at least resistance to decline if the S&P falters.

Some will say only a 'black swan' event can bring the market down and to me that's only partially the case. Mostly it's because leverage works until it doesn't, as they have enough clearance above the 50 & 100 DMA to keep this alive for the moment. But not infinitely, so a modicum of caution.

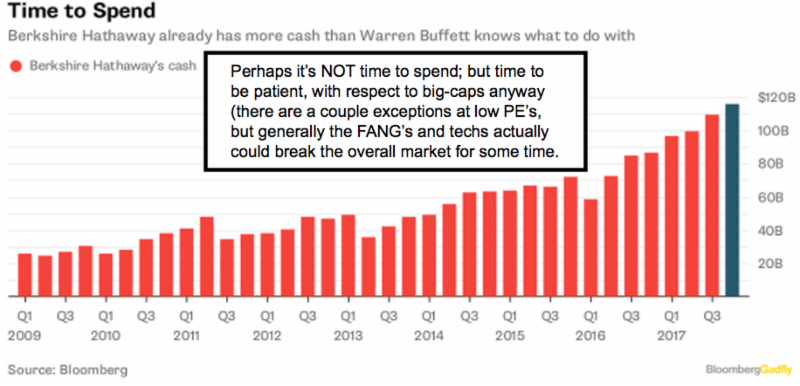

It seems, based on leverage and commitment (see last night about even Warren Buffett in a higher-than-usual cash position), that most aren't even willing to contemplate anything significant ruffling the markets' feathers. So many are worried; but few are truly prepared for a volatile summer.

As the bull market staggers around, credit exhibits weakness; all monetary conditions are tightening and 'flash crashes' risk becoming the norm. One can avoid missing out on stellar returns from risk assets by being cautious.

However, most are unwilling to stray from benchmarks or get defensive as such; and that's fine; so long as they 'do like Buffett', and buttress liquidity.

Meanwhile, one of the starkest examples of dimissing risk lies in the credit markets, as investors chase yield by embracing short-duration corporates, often including some of the riskiest junk debt. A ratio of U.S. junk yields versus high-grade counterparts has reached levels recalling the warning I gave in 2007 of a coming 'Epic Debacle', and other frothy periods.

Update on my AT&T rationale

I thought a drop to anywhere around 29-31 would be an attractive entry point (and so far indeed is). The idea of course was that 'if' the deal was approved, 'arbs' (arbitrageurs playing the TWX vs. T spread) would initially sell, and then the shares might rebound a bit, which you've seen. After the 'deal' closes; a large technical overhang might exist for awhile, if TWX shareholders who don't entirely 'grasp' the transformation (which would enhance the value of tons of Time Warner contacts that do not bring CPM .. cost per thousand .. yields like existing AT&T contacts and customers do; but that would improve) it's possible some would sell holdings... hence the temporary overhang. And 'in theory' a worry that the DOJ might still intrude since some pricing arrangements with Time Warner properties must stay in place into next year. (Some are critical of CEO Stephenson for that but it actually gives time to integrate.)

Stock performance (for the combined AT&T) would subsequently improve, and even recover at least to levels logical on a fundamental basis. That's a higher level than where it is, even not considering a higher P/E multiple on a longer-term basis, if it's valued as a 'Media' not merely 'telecom' stock. If it's viewed with a 'Media' multiple, it won't be a 'widows and orphans' stock for the coupon clipper crowd; a reputation it inherited from earlier days.

So any shorts who are playing for the overhang trade lower should stay a bit nervous because they should have limited time (or price variation) for them to exit, lest they be run in when AT&T turns higher (barring calamity in the general market of course).

In essence, after the deal's close (or perhaps at the next conference call with July's Q2 earnings) I'd expect AT&T to outline the new transformation, as I have already explored ('content and distribution' being cornerstones).

As a cynical investment community begins to understand how they'll forge ahead, whether they put a higher multiple on it or not, until performance is able to show 'actual' combined results ahead; the shares should gradually be able to improve as the Street and investors (who primarily own it solely for the dividend, and perhaps option-writing to create superior returns), we expect the $40 billion of share-overhang will grasp an error in fading AT&T beyond the initial 'arb-related' drop. It could even run up a few points.

As TWX should be about 5-6% accretive for AT&T in their first year as a merged entity (and more after consolidation); suddenly eyes will open to a more attractive valuation level for AT&T. Anyway, that's my thinking and an explanation for why it wouldn't surprise me if 'T' was 40-50 in a year or so.

At press-time late Thursday the Justice Department announced that it will not seek a legal stay of the AT&T-Time Warner merger ruling, clearing the way for completion of the giant deal. It could occur as early as Friday; about a week earlier than their originally anticipated 'deal' conclusion.

There is complete 'merger panic' in media; as expected. And without trying to dissect the players (you all know how Comcast, Disney, FOX or others are either bidding, in-play or figuring it out like Verizon tries); I would like to offer a thought: a couple years from now 'fiber/digital/5G' will completely have overwhelmed cable, satellite and conventional telecom, relegating all who don't get-in-the-game 21st Century style, to low-multiple perdition.

That's why AT&T (regardless what anyone says of their CEO) transformed brilliantly and actually will be able to absorb (even if they sell holdings like in Latin America, though I doubt they'll have to) the incurred debt smoothly over time. Of course there's a hiccup or two forthcoming, a part of all merger deals. But in their case, even after a year-long fight with the government I think they're in a sweeter spot than competition; which will pay extremes to achieve combinations remotely similar to what AT&T already has done.

Bottom line

The market swings without resolution. Important to me is the inability of many pricey FANG-type stocks to move higher regardless of a decent effort to hold high-level supports so far. That suggests vulnerability in the fullness of time and part of why risk exceeds potential now.

Do know we have a one-day (this weekend only) half-price Quarterly Daily Briefing subscription offer. We never discount; however due to an off-the-cusp offer I made in Las Vegas we have that today only. You won't see it on my website; just be assured if you subscribe no later than June 16 (Saturday); you will be rebated $80 of the $159. Daily Briefing subscription. There will be no follow-up offers forthcoming. Thanks and as we do not accept advertising; we appreciate investors and traders becoming members at www.ingerletter.com/subscribe

Thanks!