Lululemon (LULU) Q1 Earnings & Revenues Beat On Improved Traffic

Lululemon athletica inc. LULU reported robust first-quarter fiscal 2021 results, with the top and bottom lines surpassing the Zacks Consensus Estimate as well as improving year over year. Strength across all segments contributed to growth, led by continued e-commerce expansion and rebound in in-store sales. Also, the company noted that all key metrics reflected marked improvements compared with the first quarter of fiscal 2019, which represents the pre-pandemic level.

Management notes that the strong business momentum has continued into the second quarter. Further, its financial position keeps it on track to deliver on its Power of Three growth strategy. Consequently, this Zacks Rank #3 (Hold) company provided expectations for the second quarter and raised its view for fiscal 2021.

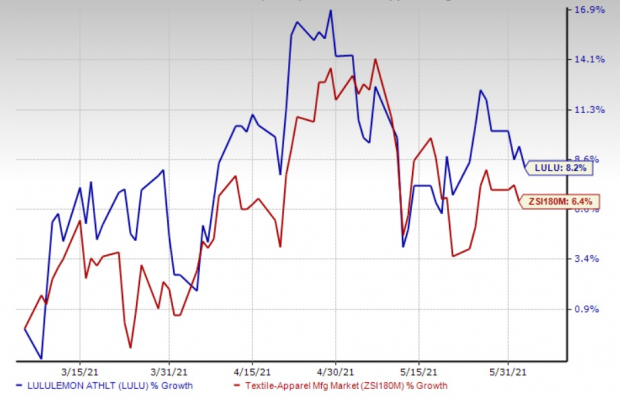

We note that shares of the company have gained 8.2% in the past three months compared with the industry’s 6.4% growth.

Image Source: Zacks Investment Research

Q1 Numbers

Lululemon’s adjusted earnings of $1.16 per share in the fiscal first quarter beat the Zacks Consensus Estimate of 91 cents and increased substantially from earnings of 23 cents in the year-ago quarter.

The Vancouver, Canada-based company’s quarterly revenues advanced 88% year over year to $1,226.5 million and surpassed the Zacks Consensus Estimate of $1,117 million. On a constant-dollar basis, revenues increased 83%. Top-line growth was driven by strength across all categories, channels and geographies. A rebound in brick-and-mortar stores, driven by improved footfall as consumers moved out to stores for their shopping needs, aided sales growth. Also, continued expansion in the e-commerce channel was a key driver.

Compared with the first quarter of fiscal 2019, earnings per share were up 56.8% from 74 cents, while net revenues improved 57%. On a two-year compounded annual growth rate basis, revenues rose 25%.

Lululemon athletica inc. Price, Consensus and EPS Surprise

lululemon athletica inc. price-consensus-eps-surprise-chart | lululemon athletica inc. Quote

In the reported quarter, revenues at company-operated stores advanced 106% to $536.6 million. Direct-to-consumer sales rose 55% to 545.1 million and were up 50% in constant currency. Direct-to-consumer revenues represented 44.4% of the company’s total revenues compared with 54% in first-quarter fiscal 2020. Additionally, management pointed out that in-store productivity improved 88% from the comparable fiscal 2019 levels.

In the digital channel, revenues increased 61%, on a two-year CAGR basis, benefiting from strength in traffic and conversions. The company has been witnessing robust traffic trends, driven by both new and existing guests, while conversion continues to gain from positive customer responses for its enhancements on the e-commerce sites and mobile app.

Moreover, it witnessed growth of 82% in North America and 125% in international markets.

Margins

Gross profit advanced 109% year over year to $700.3 million in first-quarter fiscal 2021. Meanwhile, gross margin expanded 580 basis points (bps) year over year to 57.1%. On a two-year basis, gross margin increased 320 bps on a 220-bps leverage in occupancy, product team costs and depreciation, a 80-bps increase in product margin, and 20 bps of favorable foreign exchange. The increase in product margin was mainly driven by lower markdown than 2019, offset by higher airfreight expenses due to the COVID-19 outbreak.

SG&A expenses of $496.6 million increased 65.8% year over year and 69.5% on a two-year basis. SG&A expenses, as a percentage of sales, declined 550 bps year over year and increased 310 bps on a two-year basis to 40.5%. SG&A expense leverage on a year-over-year basis is mainly related to a higher top line than the COVID-impacted first-quarter fiscal 2020. The deleverage from the 2019 levels was mainly due to the consolidation of MIRROR’s results this year along with higher depreciation expenses, owing to accelerated investments to support the e-commerce business and COVID-related operating channel costs.

Adjusted income from operations rose 479% year over year to $201.5 million in the fiscal first quarter. Adjusted operating margin of 16.4% expanded 1,110 bps year over year and contracted 10 bps on a two-year basis.

Store Updates

In the fiscal first quarter, the company opened three stores and closed one. As of May 2, 2021, it operated 523 stores. As the economies open after the easing of COVID-led restrictions, it currently has 93% of its stores open across the globe.

In fiscal 2021, the company expects to open 45-55 net new company-operated stores compared with 40-50 openings stated earlier. This includes 35-40 stores in the international markets.

Financials

Lululemon exited the fiscal first quarter with total liquidity of $1.6 billion, which indicates a strong financial position. This included $1,179.7 million of cash and cash equivalents, and 400 million available under its revolving credit facility. Further, its stockholders' equity was $2,639.9 million as of May 2, 2021. Inventories were up 17% year over year to $732.9 million.

In first-quarter fiscal 2021, the company generated an operating cash flow of $214.1 million. It incurred a capital expenditure of $64 million in the fiscal first quarter compared with $52 million reported in first-quarter fiscal 2020. The capital spending is mainly related to investments in digital channel and analytics capabilities, supply chain, technology to support business growth, and store capital for new locations, relocations and renovations.

For fiscal 2021, the company anticipates incurring a capital expenditure of $365-$375 million versus $335-$345 million mentioned earlier.

Outlook

For second-quarter fiscal 2021, it expects net sales of $1.3-$1.33 billion, indicating a two-year CAGR growth of 21-23%. The company currently has 93% of its stores open. On a two-year CAGR basis, it expects flat in-store sales, whereas e-commerce sales are anticipated to increase 55%. However, the company anticipates e-commerce sales in the fiscal second quarter to decline modestly from the prior-year quarter, as it laps the height of COVID-related channel shifts and online warehouse sales. Nonetheless, it expects e-commerce sales to increase modestly in the fiscal third and fourth quarters.

Additionally, management expects gross margin to expand from the last year’s COVID-impacted quarter and increase 30-50 bps from second-quarter fiscal 2019. Gross margin growth relative to the fiscal 2019 comparable period can be attributed to higher e-commerce sales along with occupancy cost leverage due to the slowing down of store openings in 2020 and the level of rent reductions.

However, the company anticipates continued impacts from air freight costs, owing to port congestions and capacity constraints. It expects SG&A expenses for the fiscal second quarter to deleverage 400 bps compared with the second quarter of fiscal 2019. The deleverage mainly relates to higher depreciation due to accelerated investments to support the e-commerce business in 2020 and 2021, consolidation of MIRROR’s results this year, and COVID-led costs, including labor for stores that remained closed.

Adjusted earnings are anticipated to be $1.10-$1.15 per share, whereas it reported 74 cents in the prior-year quarter. Notably, the company reported earnings per share of 96 cents in second-quarter fiscal 2019.

For fiscal 2021, it expects net revenues of $5.83-$5.91 billion compared with $5.55-$5.65 billion stated earlier. This includes the contribution of $250-$275 million from the MIRROR buyout. The company now expects e-commerce sales growth in high-single digits relative to the outsized strength seen in 2020. E-commerce growth is likely to be partly offset by a modest decline in the fiscal second quarter. Nonetheless, it expects e-commerce sales to increase modestly in the fiscal third and fourth quarters.

The gross margin for fiscal 2021 is expected to expand 150-120 bps compared with the previously mentioned 100-150 bps expansion. The company reported modest gross margin growth in fiscal 2020. The gross margin for fiscal 2021 is anticipated to include a 50-bps negative impact of additional freight costs. The company anticipates a year-over-year SG&A deleverage of 30-50 bps for fiscal 2021 on the consolidation of MIRROR for the year and investment in MIRROR brand building.

Adjusted earnings per share are now expected to be $6.73-$6.86 compared with $6.30-$6.45 mentioned earlier. This includes a modest dilution of 3-5% related to the MIRROR acquisition.

Looking for Favorable Stocks? Check These

Crocs, Inc. CROX has an expected long-term earnings growth rate of 15%. The company sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gildan Activewear, Inc. GIL, also a Zacks Rank #1 stock, has an expected long-term earnings growth rate of 28.6%.

GIII Apparel Group, LTD. GIII has an expected long-term earnings growth rate of 11.6%. It presently carries a Zacks Rank #2 (Buy).

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more