Lower Mortgage Rates Could Trigger A New Surge For Stocks

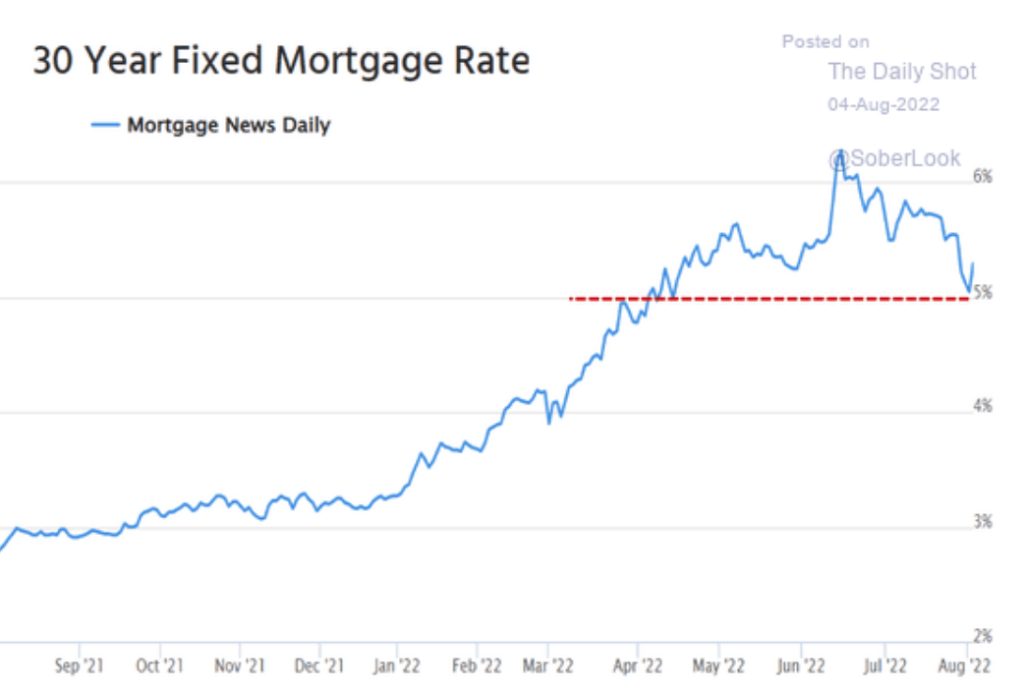

Take a look at the chart below…

From: The Daily Shot

The chart shows rate for a 30-year mortgage over the past year.

Clearly, mortgage rates have been moving higher as the Fed raises its own target rates to combat inflation. But over the last several weeks, we’ve seen a shift in that trend.

As investors price in a recession, long-term interest rates have declined. And that decline has pushed mortgage rates from well above 6% to a current level near 5%.

This pullback could have a big impact not just on the market for homes, but also in other areas of the market!

One Last Chance to Refinance

Thanks to housing inflation many homeowners now have significant equity in their homes.

Untapped home equity is a source of wealth that could be accessed by refinancing a mortgage.

But with mortgage rates moving higher for the last year, that equity has been largely trapped. Homeowners haven’t wanted to refinance or take out a second mortgage because interest rates were too high.

I know of several friends who would like to borrow against their homes but don’t want to pay higher rates.

Now that mortgage rates are pulling back, homeowners at least feel like they’re getting a better deal (since rates are below where they were a couple of months ago).

This could trigger a large wave of cash-out refinancing transactions, leaving consumers with more spending money headed into the fall.

The big question for me as an investor is “where will this money be spent?“

Travel, Leisure & Luxury Goods

Last month, American Express reported that affluent consumers have been spending aggressively on leisure and travel.

This makes sense as wealthy families aren’t nearly as challenged by high inflation. And many families have been putting off travel to their favorite destinations for years.

Keep in mind, that a strong U.S. dollar creates an incentive for international travel. Despite high inflation, American dollars now buy more value with international goods and services.

Also, note that affluent consumers with expensive homes and high credit scores are the most likely homeowners to refinance.

That’s because banks are tightening lending standards. As the probability of a U.S. recession increases, these banks only want to lend to well-qualified borrowers. And they want to make sure they have plenty of collateral — expensive real estate — to back up those loans.

Affluent homeowners are the ones most likely to be taking advantage of the pullback in interest rates. And these consumers are more likely to spend that money at high-end retail locations.

So retailers like VF Corp. (VFC) — the company behind The North Face, Timberland, and Vans — along with apparel companies like Lululemon Athletica (LULU) stand to benefit.

Bottom line, a multi-week pullback in interest rates could trigger spending in other areas of the market. So keep travel, leisure, and luxury stocks on your radar this fall!

More By This Author:

Politics Aside, Green Energy Has Room To Run

Buckle Up For Market Turbulence

What the Apple News Tells Us About Inflation