Politics Aside, Green Energy Has Room To Run

Last week was an important week for green energy investors!

Senator Joe Manchin agreed to endorse a bill that has huge implications in this important area of the market.

The so-called “Inflation Reduction Act” will invest $369 billion into energy and climate-related programs. And investors are already moving in on some of the stocks that will benefit.

If this bill is passed into law, we could see much more strength for green energy stocks!

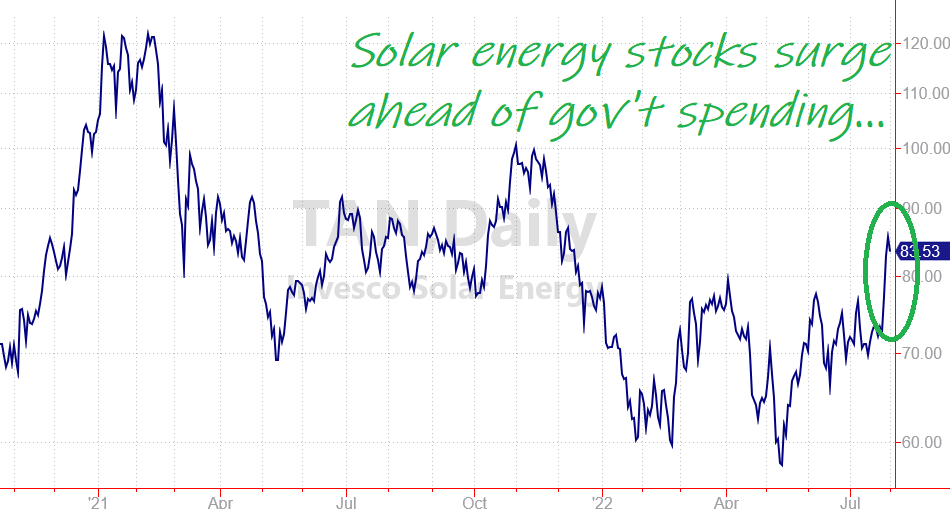

Charting the Green Energy Reaction

The Invesco Solar Energy ETF (TAN) shows us how investors reacted to the agreement between Manchin and Senate Majority Leader Chuck Schumer.

Shares moved sharply higher now that the bill has a clear path forward.

(Click on image to enlarge)

Keep in mind, solar energy stocks were already finding support. That’s because higher traditional energy sources like oil and natural gas have become incredibly expensive.

So market forces along with political pressure will drive more investment in solar energy. And that’s great news for these stocks.

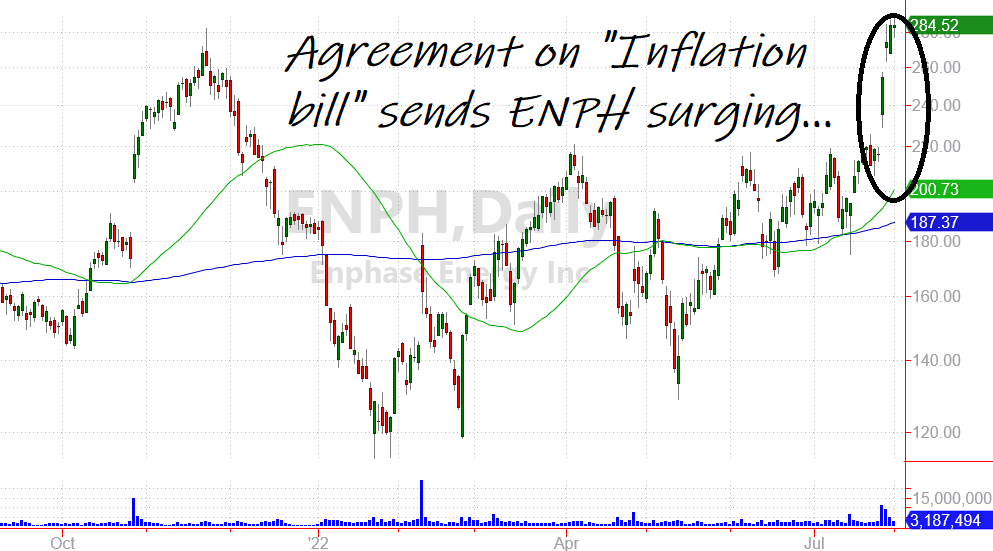

Real-Time Green Energy Plays in Progress

On July 17th, we took a position in Enphase Energy (ENPH). The company installs solar energy systems that efficiently generate and store electricity.

Following the news out of Washington, shares moved sharply higher. (And we’ve been able to lock in some attractive profits.)

(Click on image to enlarge)

And while ENPH is certainly a speculative stock, we could see shares continue to move higher as investors move capital into this area.

Similarly, we hold a position in Sunrun Inc. (RUN). This company is known for its residential solar energy installations in the United States.

Shares jumped higher as well. Investors now expect spending from Washington to create incentives for families to install solar energy systems.

(Click on image to enlarge)

Of course all investing involves risk. And not every trade will generate a profit the way these two positions have.

But the charts above show how progress on the Inflation Reduction Act has given us profits on a few positions.

You Don’t Have to Agree to Profit

This reaction for solar stocks brings up an important investment concept.

You don’t always have to agree with what’s going on to profit.

In this case, I have some serious concerns about the Inflation Reduction Act.

I’m concerned that increasing government spending could actually increase inflation.

Meanwhile, paying for the bill by reducing long-established tax concepts like depreciation could actually hurt other areas of the economy.

Some estimate hundreds of thousands of jobs could be lost as a result.

As an American, this disappoints me.

But as investors we have a responsibility to look objectively at what is actually happening in our economy. From there, we need to allocate our investments to areas that will benefit in today’s environment.

That way we can grow and protect our wealth — giving us the time and resources to focus on the things that really matter.

Hope you’re having a great start to your week!

More By This Author:

Buckle Up For Market Turbulence

What the Apple News Tells Us About Inflation

These Stocks are Holding Up in Today’s Market

Why do people still say Enphase is a speculative stock? 🤷🏻♂️

Because the stock is still trading for nearly 60 times next year's expected earnings.