Looking Ahead To Retail Sector Earnings

Image Source: Pixabay

- Total Q3 earnings for the 458 S&P 500 members that have reported results through Wednesday, November 13th, are up +6.9% on +5.4% higher revenues, with 73.6% beating EPS estimates and 61.4% beating revenue estimates.

- The earnings and revenue growth pace for this group of 458 index members is broadly in line with the growth trend of recent quarters, but companies have struggled to beat consensus EPS and revenue estimates. The Q3 EPS and revenue beats percentages are tracking notably below the 20-quarter averages for this group of companies.

- Net margins in Q3 are expected to be modestly above the year-earlier level, with the Tech sector as the primary driver of keeping the year-over-year gains positive. This is the 5th consecutive quarter of expanding net margins for the S&P 500 index.

- Earnings growth is expected to accelerate after the modest growth pace in Q3, with double-digit earnings growth projected in three of the next four quarters.

Retail Sector Earnings in Focus

Home Depot (HD - Free Report) became the first major conventional retailer to come out with Q3 results, with the home improvement retailer coming out ahead of estimates, with comps benefiting from hurricanes in the U.S. Southeast. Home Depot’s better-than-expected results notwithstanding, the company’s Q3 earnings were down -1.4% from the year-earlier level on +6.6% higher revenues, as the operating environment continues to depress margins.

Home Depot’s hurricane boost offers a direct read-through for Lowe’s (LOW - Free Report) , which reports on November 19th. Lowe’s Q3 earnings are expected to be down -10.2% from the same period last year on -2.6% lower revenues.

The fortunes of Home Depot and Lowe’s are closely tied to developments in the housing market, where demand remains anemic as a result of elevated mortgage rates. While the Fed has started easing and is broadly expected to remain in the easing lane, long-term interest rates have proved to be a lot stickier relative to short-term rates that are closely tied to Fed activities.

Part of the reason for the stubborn long-term rates appears to be expectations of pro-growth policies from the incoming Trump administration. That said, the expectation is that long-term rates will eventually come down, even though the downshift at the longer end of the yield curve may be a lot less than Fed-driven easing at the lower end of the curve. All of this will be beneficial to Home Depot and Lowe’s as the major home improvement projects typically require outside financing.

Another issue for Home Depot, Lowe’s, and other retailers of big-ticket items has been the post-Covid shift in consumer spending towards leisure, hospitality, and travel type of services. There is some indication that consumers may finally be starting to ease up on that front. If true and not simply a reflection of pre-election jitters, some of those savings will move towards big-ticket items and home improvement projects. We should note also that housing equity remains in record territory and can serve as a readily available dry powder.

Discretionary items have been anemic at Walmart (WMT - Free Report) and Target (TGT - Free Report) as well, with the issue a much bigger headwind at Target given its relatively heavier indexing to that spending category. We will learn more next week when Walmart and Target report results, but the former had noted early signs of improvement in its discretionary merchandise at its last earnings call on August 15th.

The chart below shows the year-to-date performance of Walmart, Target, Home Depot, Lowe’s, and the S&P 500 index.

Image Source: Zacks Investment Research

Walmart has been a standout outperformer as it has a huge grocery business and is also enjoying gains from the digital platform. Walmart’s ability to gain market share in grocery stores by attracting higher-income households through its convenient e-commerce platform has been at play for some time now.

We have discussed the Retail sector’s earnings scorecard and how the sector’s Q3 results stack up relative to the other recent periods in section 1 of this report.

The Earnings Big Picture

Looking at Q3 as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total earnings for the S&P 500 index are now expected to be up +7.6% from the same period last year on +5.6% higher revenues.

The Q3 earnings growth pace would improve to +10.0% had it not been for the Energy sector drag (decline of -22.9% for Energy). On the other hand, quarterly earnings for the index would be up +2.8% once the Tech sector’s hefty contribution is excluded (earnings growth of +19.9% for the Tech sector).

The quarterly earnings growth pace is expected to improve from next quarter onwards. You can see this in the chart below, which shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

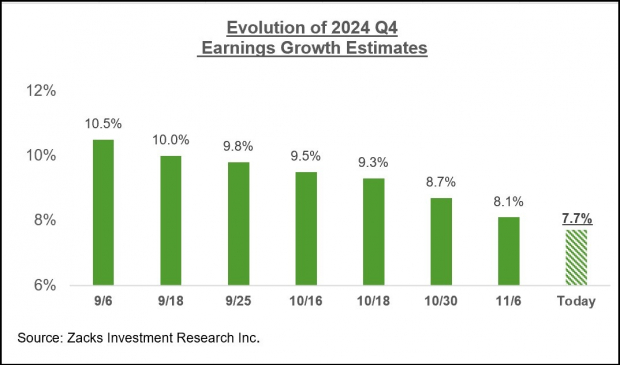

For the current period (2024 Q4), total S&P 500 earnings are expected to be up +7.7% on +4.9% higher revenues. Q4 earnings would be up +9.7% had it not been for the Energy sector drag.

Estimates for the period have started coming down since the quarter got underway. Still, the pace and magnitude of negative revisions are less than we had seen in the comparable period of Q3. You can see this in the chart below that shows how Q4 estimates have evolved in recent weeks.

Image Source: Zacks Investment Research

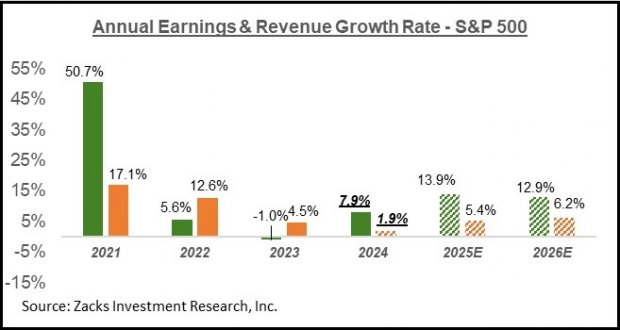

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see, the expectation is for double-digit earnings growth in each of the next two years, with the number of sectors enjoying strong growth notably expanding from the narrow base we have been seeing lately.

Tech sector earnings are expected to be up +16.8% in 2025, which would follow the sector’s +19.2% earnings growth in 2024. But even excluding the Tech earnings, S&P 500 earnings would be up +12.5% in 2025, with eight of the 16 Zacks sectors expected to enjoy double-digit earnings growth.

More By This Author:

Retail Earnings Loom: A Closer Look

Breaking Down The Q3 Earnings Season Scorecard

Breaking Down Magnificent 7 Earnings Results