Retail Earnings Loom: A Closer Look

Image Source: Unsplash

Home Depot (HD - Free Report) is on track to kick off the Q3 earnings season for the conventional brick-and-mortar retailers this week, with the company on deck to report results before the market’s open on Tuesday, November 12th. Lowe’s (LOW - Free Report) comes out a week later on Tuesday, November 19th.

Lowe’s shares have outperformed Home Depot this year (+21.6% vs. +16.8%), though both have lagged the Zacks Construction sector (+26.4%) as well as the S&P 500 index (+25.7%), as the chart below shows.

Image Source: Zacks Investment Research

The operating environment for Home Depot and Lowe’s remains difficult, as the interest rate backdrop continues to be unfavorable despite the U.S. Fed’s easing policy. The strength in treasury yields in recent weeks likely reflected the bond market’s early read on the U.S. elections and the incoming administration’s pro-growth policy posture.

With the Fed on track to continue easing, as reconfirmed by the Fed Chair’s press conference, investors would expect treasury yields to eventually come down. That said, the yield curve is unlikely to shift down in parallel, with the shorter end of the curve reflecting the central bank’s easing policy and the longer end proving to be somewhat ‘sticky’ to reflect expectations of a more robust growth environment.

The read-through for Home Depot and Lowe’s of this interest rate discussion is that mortgage rates may not come down as much or as fast as would typically be expected in a Fed easing cycle. What this means is that trends in the existing home sales space are unlikely to meaningfully improve over the near term, though one would expect the medium- to long-term outlook on the existing home sales front to be positive on economic and demographic grounds.

We don’t expect any major surprises in Home Depot’s Q3 results, though the numbers may have benefited on the margin from the active storm activity in the U.S. Southeast. The expectation is for Home Depot’s Q3 earnings to be down -5% from the year-earlier level on +4.1% higher revenues. Estimates for the period are down from three months back, reflecting management’s guidance following the August 13th quarterly report, but they have modestly ticked up in recent days.

With respect to the Retail sector’s 2024 Q3 earnings season scorecard, we now have results from 23 of the 34 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.

The Zacks Retail sector includes not only Home Depot, Lowe’s, and other traditional retailers, but also online vendors like Amazon (AMZN - Free Report) and restaurant players. The 23 Zacks Retail companies in the S&P 500 index that have reported Q3 results already belong to the e-commerce and restaurant industries.

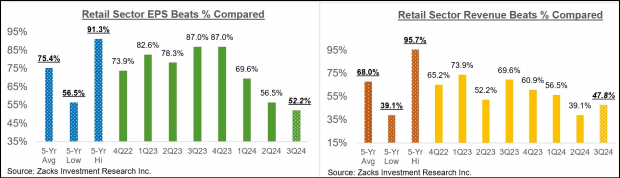

Total Q3 earnings for these 23 retailers that have reported are up +17.3% from the same period last year on +6.3% higher revenues, with 52.2% beating EPS estimates and 47.8% beating revenue estimates.

The comparison charts below put the Q3 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

As you can see above, the online players and restaurant operators have struggled to beat EPS and revenue estimates in Q3. In fact, the Q3 EPS beats percentage for these players represents a new low over the preceding 20 quarters (5 years), while the revenue beats percentage is only modestly above the 20-quarter low and significantly below the 20-quarter average.

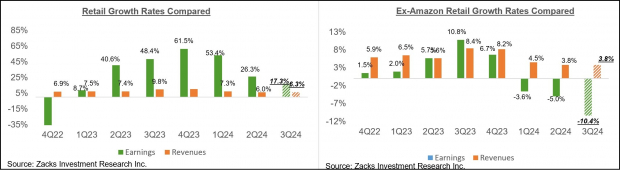

Concerning the elevated earnings rate at this stage, we like to show the group’s performance with and without Amazon, whose results are among the 23 companies that have reported already. As we know, Amazon’s Q3 earnings were up +71.6% on +11% higher revenues, beating EPS and revenue expectations.

As we all know, the digital and brick-and-mortar retail spaces have been converging for some time now, with Amazon now a decent-sized brick-and-mortar operator after Whole Foods and Walmart remaining a growing online vendor. As we will see in the days ahead, as Walmart releases quarterly results, the retailer is steadily becoming a big advertising player, thanks to its growing digital business. This long-standing trend got a huge boost from the Covid lockdowns.

The two comparison charts below show the Q3 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart)

Image Source: Zacks Investment Research

As you can see above, all of the earnings growth at this stage for the Retail sector is coming from Amazon, with Q3 earnings for the rest of the group that have reported down -10.4% on +3.8% higher revenues. You can see that the top-line growth effectively reflects headline inflationary trends in the economy.

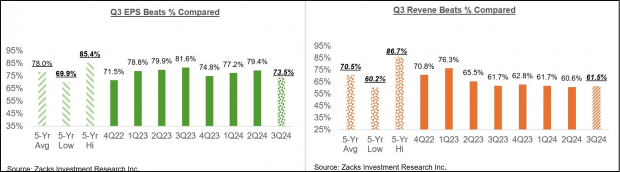

Q3 Earnings Season Scorecard

Through Friday, November 8th, we have seen Q3 results from 452 S&P 500 members, or 90.4% of the index’s total membership. We have another 9 S&P 500 members on deck to report results this week, including Disney, Applied Materials, Shopify, Home Depot, and others.

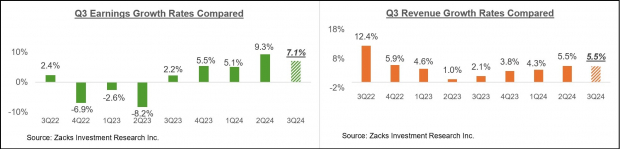

Total earnings for these 452 companies that have reported are up +7.1% from the same period last year on +5.5% higher revenues, with 73.5% of the companies beating EPS estimates and 61.5% beating revenue estimates.

The proportion of these 452 index members beating both EPS and revenue estimates is 50.7%.

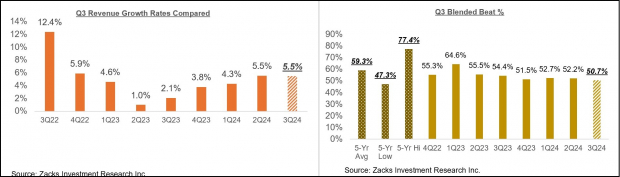

The comparison charts below put the Q3 earnings and revenue growth rates and the EPS and revenue beats percentages in a historical context. The first set of comparison charts show the earnings and revenue growth rates.

Image Source: Zacks Investment Research

The second set of comparison charts compare the Q3 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The comparison charts below spotlight the revenue performance and the blended beats percentage for this group of 452 index members.

Image Source: Zacks Investment Research

As you can see above, the growth trend appears to be stable-to-positive, though fewer companies are able to beat consensus estimates relative to other recent periods. In fact, both the EPS and revenue beats percentages are tracking below the 20-quarter averages for this group of companies.

The Earnings Big Picture

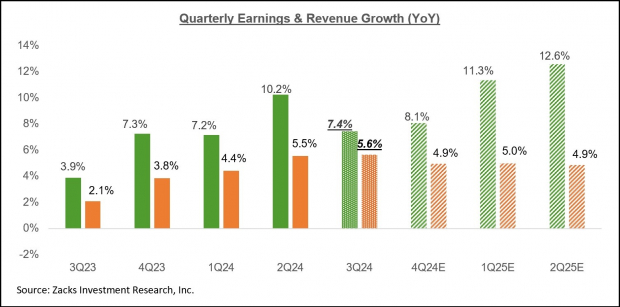

Looking at Q3 as a whole, combining the results that have come out with estimates for the still-to-come companies, total earnings for the S&P 500 index are expected to be up +7.4% from the same period last year on +5.6% higher revenues.

The chart below shows the Q3 earnings and revenue growth pace in the context of where growth has been in the preceding four quarters and what is expected in the coming three quarters.

Image Source: Zacks Investment Research

The Energy and Tech sectors are having the opposite effects on the Q3 earnings growth pace, with the Energy sector dragging it down and the Tech sector pushing it higher.

Had it not been for the Energy sector drag, Q3 earnings for the S&P 500 index would be up +9.9% instead of +7.4%. Excluding the Tech sector’s substantial contribution, Q3 earnings growth for the rest of the index would be up only +2.6% instead of +7.4%.

Excluding the contribution from the Mag 7 group, Q3 earnings for the rest of the 493 S&P 500 members would be up only +2.1% instead of +7.4%.

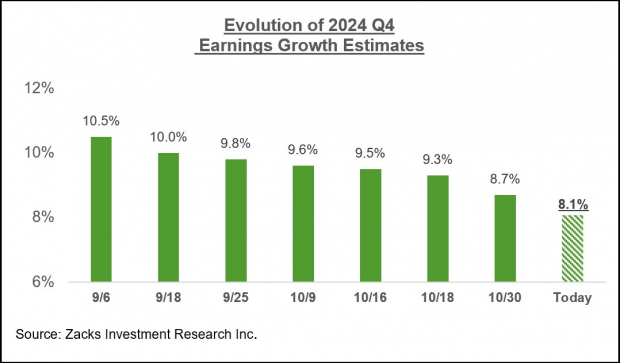

For the last quarter of the year (2024 Q4), total S&P 500 earnings are expected to be up +8.1% from the same period last year on +4.9% higher revenues.

Unlike the unusually high magnitude of estimate cuts that we had seen ahead of the start of the Q3 earnings season, estimates for Q4 are holding up a lot better, as the chart below shows.

Image Source: Zacks Investment Research

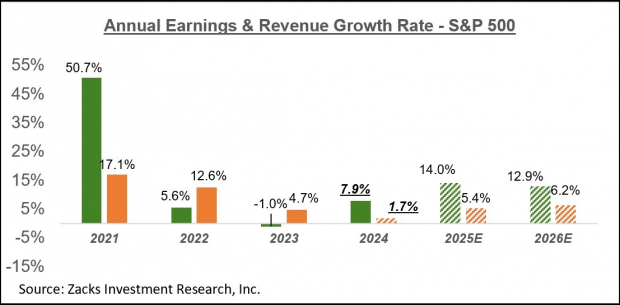

The chart below shows the overall earnings picture on a calendar-year basis, with the +7.9% earnings growth this year followed by double-digit gains in 2025 and 2026.

Image Source: Zacks Investment Research

Please note that this year’s +7.9% earnings growth improves to +9.8% on an ex-Energy basis.

More By This Author:

Breaking Down The Q3 Earnings Season Scorecard

Breaking Down Magnificent 7 Earnings Results

Tech Flexes Earnings Power: A Closer Look