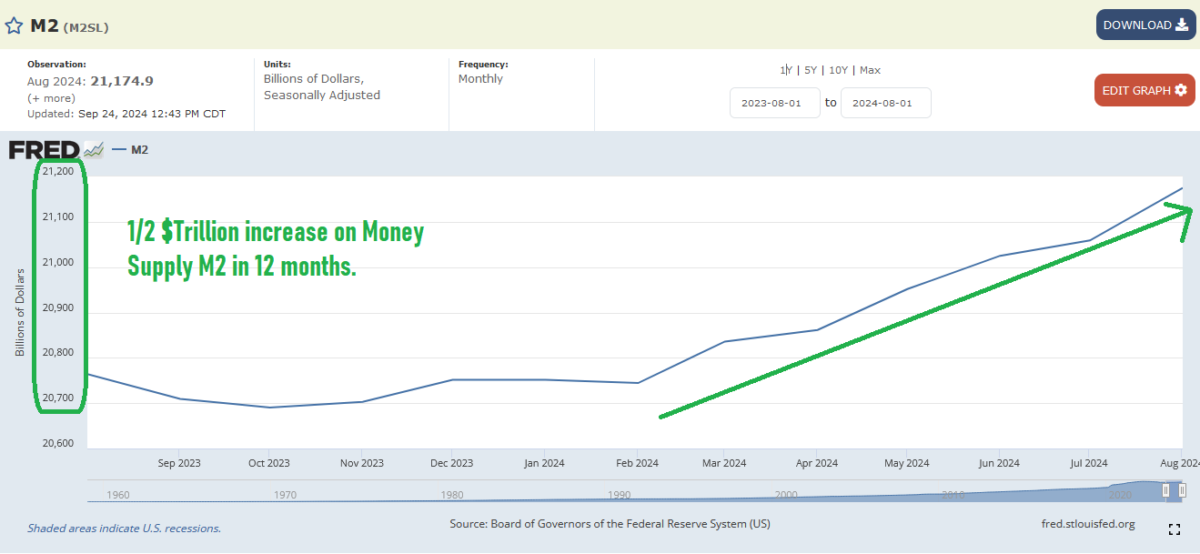

Liquidity + Complacency Stock Market (And Sentiment Results)…

(Click on image to enlarge)

On Tuesday, I joined the great Neil Cavuto on Fox Business to discuss Stock Market, Earnings, Fed, Liquidity + Complacency, Outlook and more. Thanks to Neil and Jenna DeThomasis for having me on. Link here.

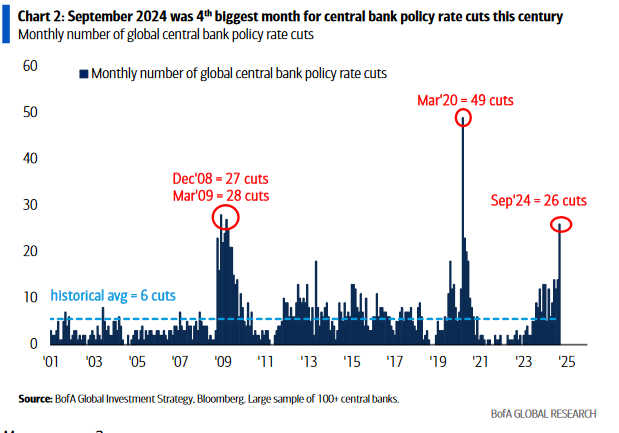

Cuts I referenced in interview:

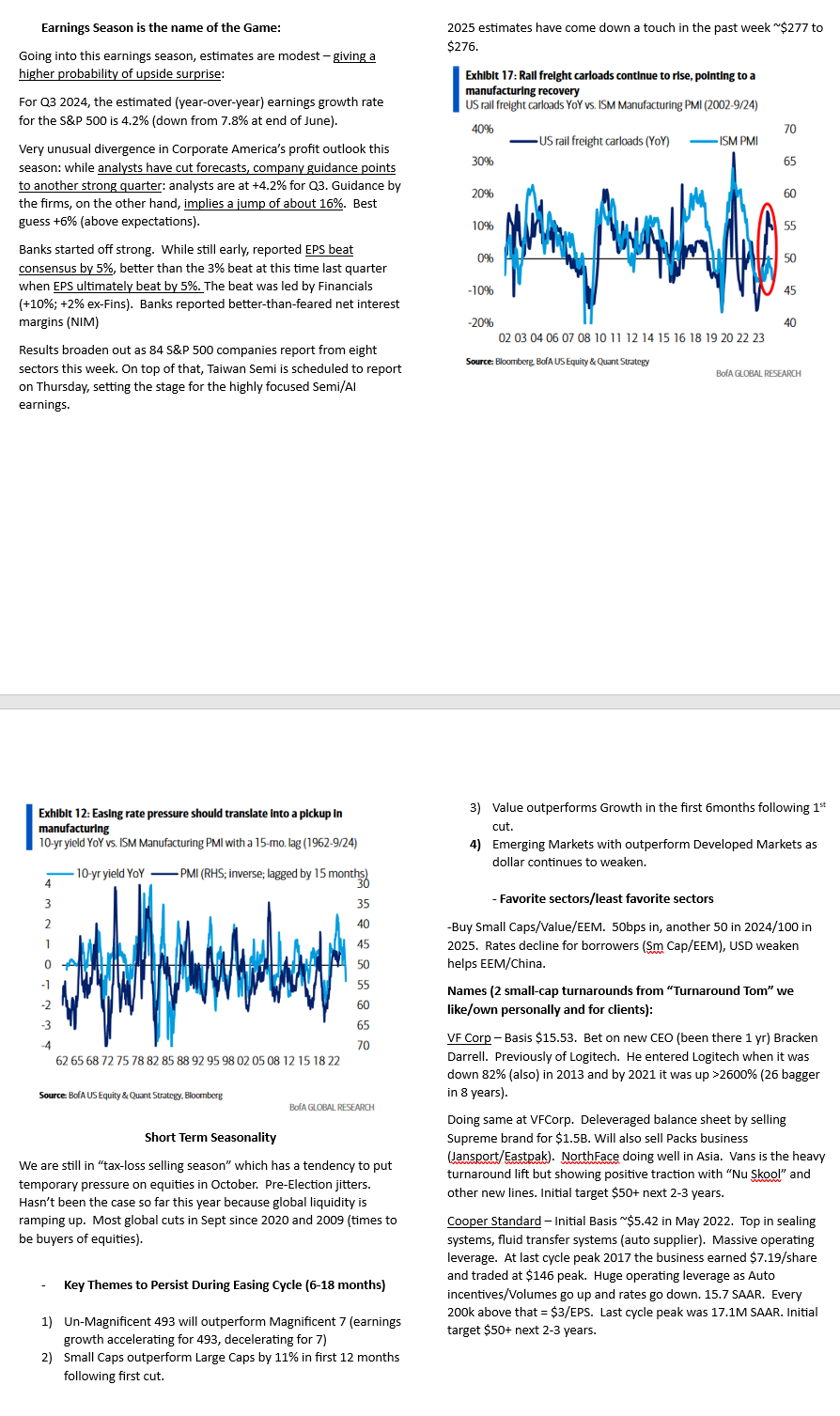

Here were my show notes ahead of the segment:

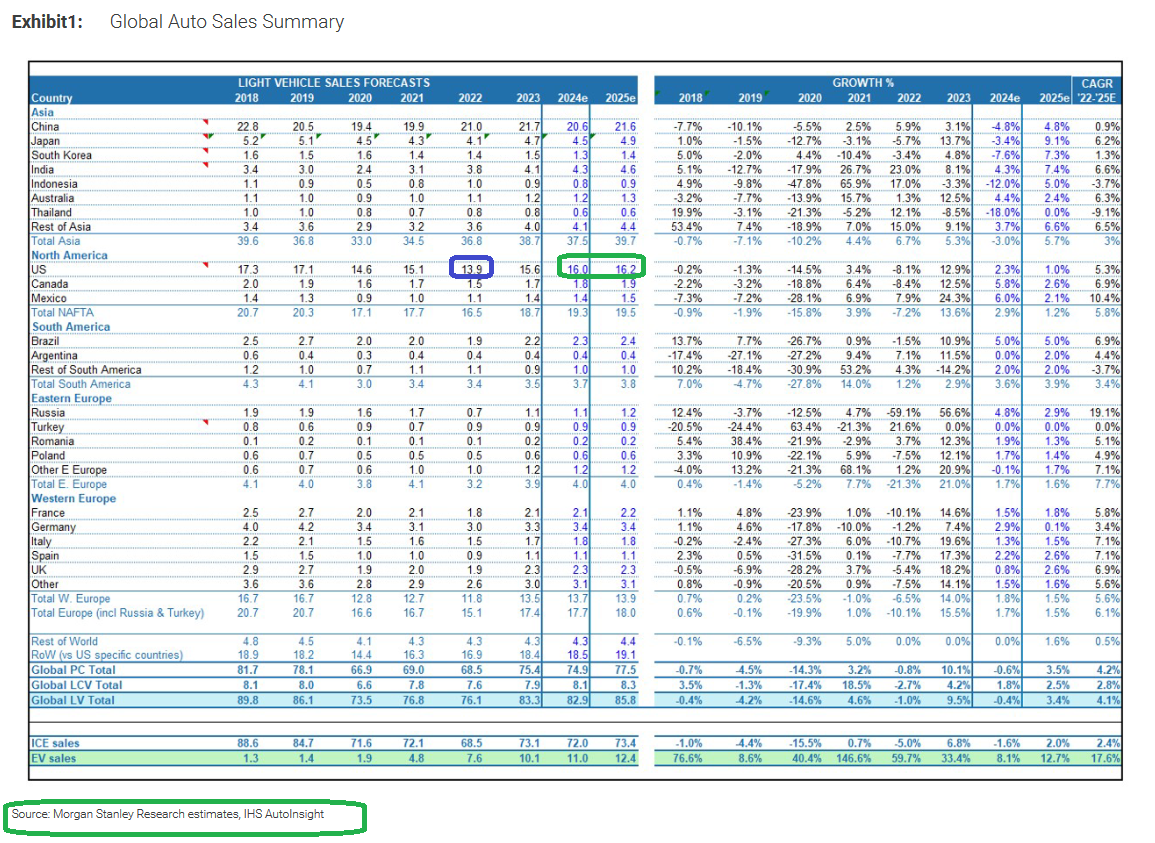

Cooper Standard: Quick Update

(Click on image to enlarge)

As of October 11, 2024, Morgan Stanley is now estimating 16M SAAR for North America. That would be 200,000 units higher than is baked into CPS guidance for 2024. The operating leverage inflection we have discussed in past podcast|videocast(s) kicks in on every extra car above 15.8M SAAR. If Morgan Stanley is correct, this has huge implications for CPS over the next 12 months. Time will tell…

See recent CPS update here – also link to ”Volumes are the Name of the Game” update prior

BABA: Quick Update

If you forgot what David Tepper said 3 weeks ago – that he was above his position limit for China and if we got a pullback in the coming weeks he would exceed the limit again by adding more – here’s what he said:

Here’s what wasn’t in the picture when he made this assertion:

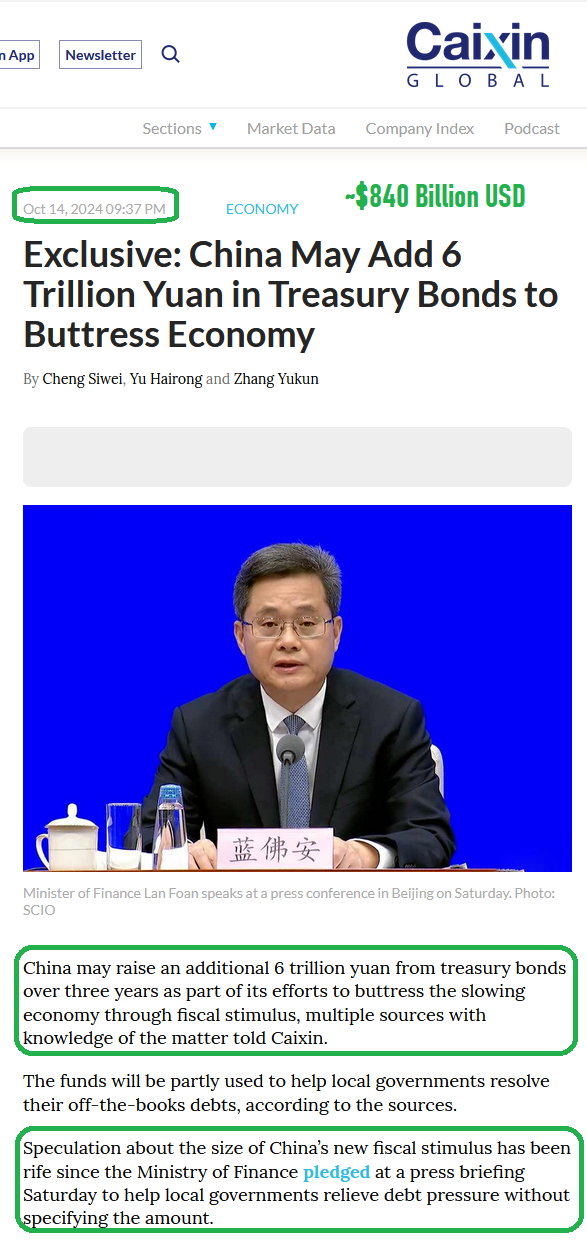

ANOTHER ~$840B of stimulus is potentially on the table now:

h/t Marcel Munch

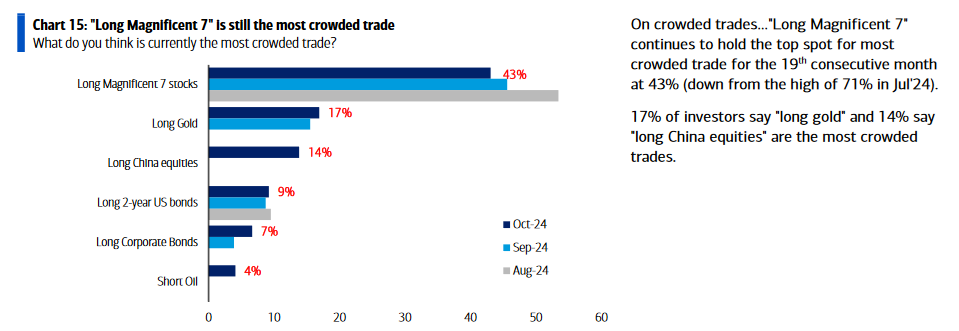

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed institutional managers with ~$503B AUM:

Here were the key points:

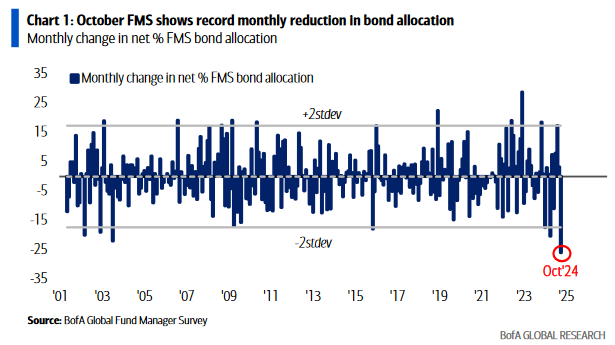

1. The last time we saw this abrupt of a move (2SD) out of bonds in one month was 2001-2003 – which preceded some of the biggest moves in history for U.S. Small Caps, Emerging Markets and China equities:

2. Managers are still at levels of global growth pessimism reminiscent of past lows in equities:

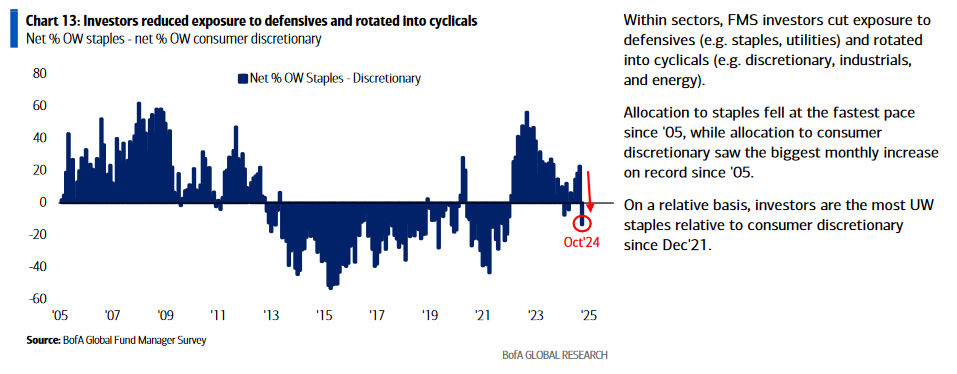

3. Managers have just begun the shift out of Defensives and into Cyclicals:

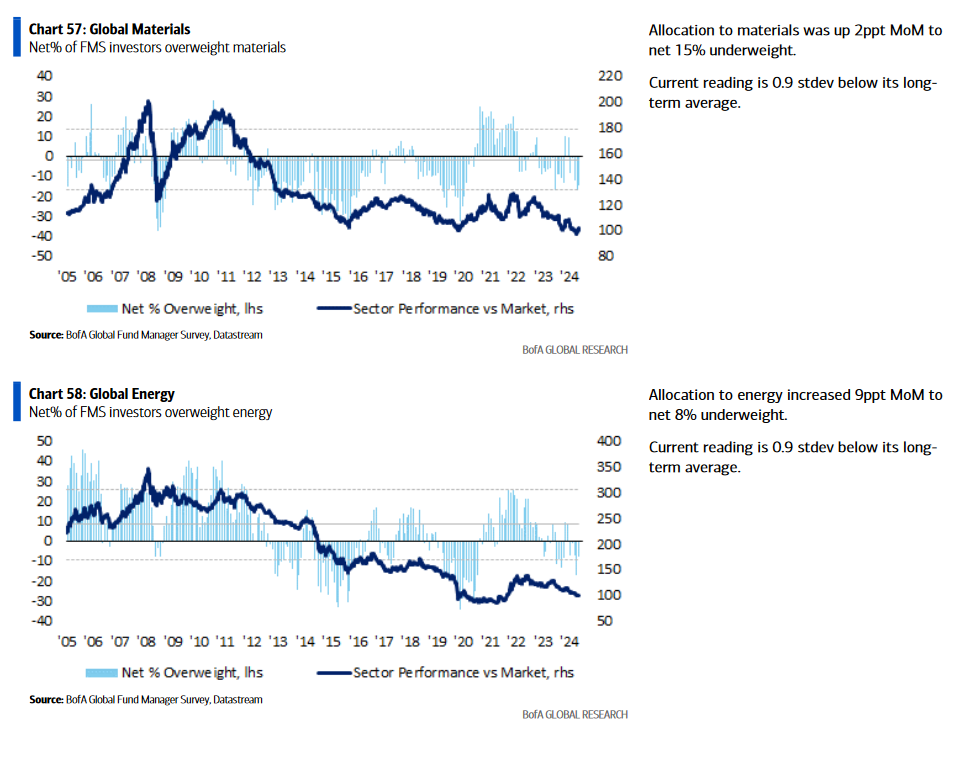

4. Managers are underweight Materials and Energy (relative to historical positioning):

5. Short China Equities is still the 3rd most crowded trade even after the reaming they took in September. More reaming to come:

Now onto the shorter term view for the General Market:

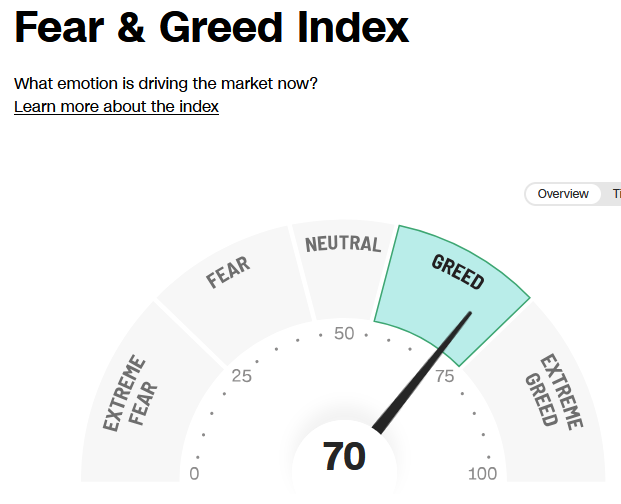

The CNN “Fear and Greed” ticked down from 72 last week to 70 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 90.26% this week from 86.93% equity exposure last week.

Our podcast|videocast will be out tonight or tomorrow. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

More By This Author:

Fake Out Or Breakout? Stock Market (And Sentiment Results)

“Sell Rosh Hashanah, Buy Yom Kippur?” Stock Market (and Sentiment Results)…

“Cowboys Owner Full Of Gas” Stock Market And Sentiment Results…

Long all mentioned tickers

Congratulations to all of the new clients that came in during our early Q2 and Q3 raises. We re-opened to smaller accounts $1M+ again starting early this month ...

more