LEU: A Nuclear Power Play In A Market Set To Prosper From Fed Cuts

Image Source: Unsplash

The Federal Reserve voted to lower interest rates by half a percentage point, the first cut since 2020 and more than many expected. The overwhelming Fed board vote suggests more rate reductions are likely this year. Meanwhile, I continue to like the nuclear power play Centrus Energy Corp. (LEU)

This Fed move was clearly somewhat baked into markets. But this action will help support the market and boost interest rate-sensitive stocks such as real estate and utilities.

Now we need to see how labor markets, and especially corporate profit numbers, develop. More important than Fed rate cuts to stock markets and the economy is whether the next Congress keeps driving up deficits and the national debt. If so, it is inevitable that rates will have to go up over time.

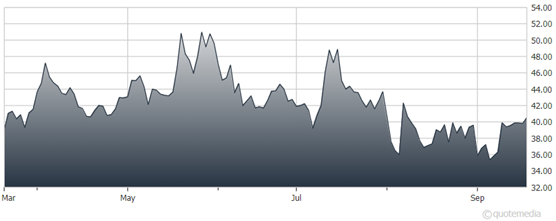

Centrus Energy Corp. (LEU)

Meanwhile, we are looking for new nuclear power ideas since nuclear plants generate electricity 24/7/365 – more than twice as much as solar and wind resources. The generating assets require fewer maintenance outages than coal or gas, making electricity even more reliable.

Nuclear energy is the only carbon-free emissions baseload energy source available today, offering efficient operations around the clock. One example, Georgia Power’s Plant Vogtle in Waynesboro, Georgia, is delivering carbon-free nuclear energy to more than 1 million homes.

As for LEU, its shares were steady this week as demand for processed uranium increases. Russia reportedly supplies around 14% of global uranium concentrates, 27% of conversion, and 39% of enrichment, while Kazakhstan produces 43% of the world’s uranium.

Four hundred and forty nuclear reactors across 32 countries provide about 10% of the world’s electricity. There are roughly 65 new nuclear reactors under construction around the world, with an additional 110 planned. Centrus is at the middle of this growth as a diversified supplier of nuclear fuel and services for nuclear power plants in the US and globally.

Recommended Action: Buy LEU.

More By This Author:

KVYO: A Promising E-Commerce Tech Play Whose Shares Are On The MoveSilver: What Elliott Wave Analysis Says About the Next Big Move

Equinix Inc.: A Data Center REIT With Healthy Return Potential

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more

Good article. I bought into TEU a week ago and was rewarded with a 20% gain. Hope it does that every week!

Nice! I was going to and held off. Big mistake. Not too late to get in on this?

I think TEU has a big future. Had I not bought in last week I would do so now