Last Minute Thoughts Ahead Of The FOMC Meeting

Unless you’ve been completely devoid of financial news over the past few weeks, you should be well aware that there is an FOMC announcement scheduled for 2 PM EDT today with a press conference to follow a half-hour later. Expectations are for no rate hike. Fed Funds futures are pricing in only a 6% chance for a 25-basis point rise, which is down from over 25% prior to yesterday’s CPI report. Equity markets remain sanguine, with the S&P 500 (SPX) and NASDAQ 100 (NDX) rising about ½% this morning and VIX around 14.5. Nothing to see here, right?

Um…, no. For starters, we will hopefully learn whether a lack of movement represents a skip, pause or peak. It seems reasonable to think that the FOMC statement will continue to offer rhetoric about being resolute about fighting inflation. We will also see whether the “dot plot” will continue to show expectations for higher and or stable rates. Futures are anticipating a 65-75% chance for one more hike in either July or September before cuts begin by December. Fed speakers have been almost unanimous about saying that no cuts will be coming before the end of the year or beyond. We will see if that is still the consensus and whether the market needs to readjust its view about future rate policy.

A key will of course be the tone that the Chair takes in his presser. His nature tends to be conciliatory. He doesn’t like to anger the questioners or the market, which is why we’ve repeatedly called him “Goldilocks in a suit.”Yet he does recognize the need to remind the market that monetary policy can be harsh. He first did so at last year’s Jackson Hole conference and occasionally since. While I would never profess to know what is in Mr. Powell’s head, it seems hard to imagine that he hasn’t noticed the rekindling of animal spirits evident in a rising stock market. My gut says that each leg higher in NDX raised the likelihood that he would once again go to lengths to remind us that inflation-fighting can be painful and that quantitative tightening remains in place.

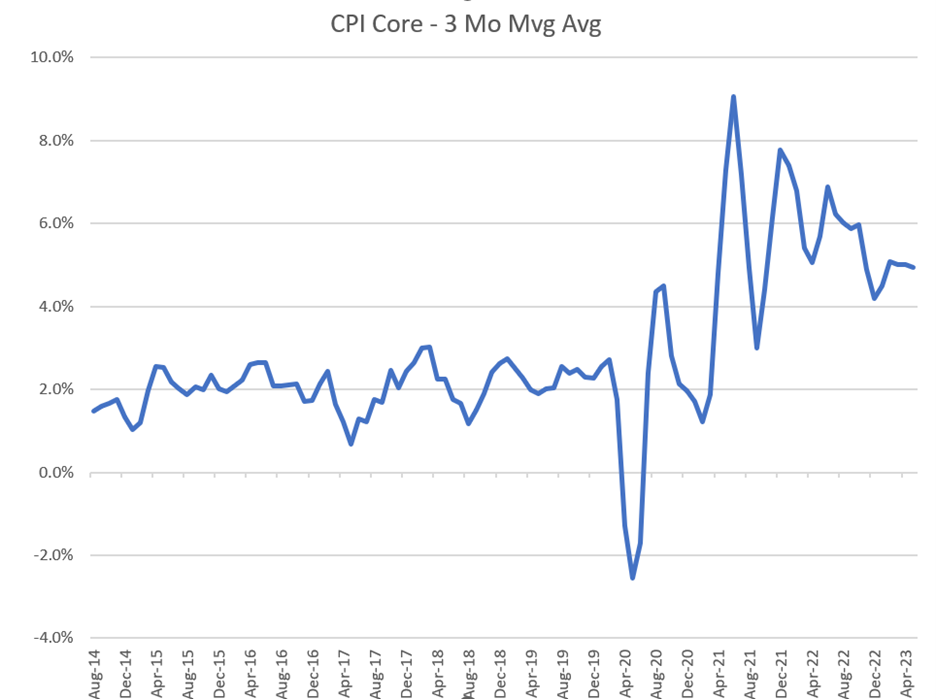

One other reason for the Chair’s resolve could be that although headline CPI showed a notable drop, the core reading has not. We noted yesterday that many economists prefer to use a 3-month moving average of core inflation. On that basis, we are still a long way from the 2% target, with 4% providing a visible floor:

Source: Interactive Brokers

On the basis of the chart above and similar readings in the PCE Core Deflator, it seems hard to believe that the FOMC will declare “mission accomplished.”

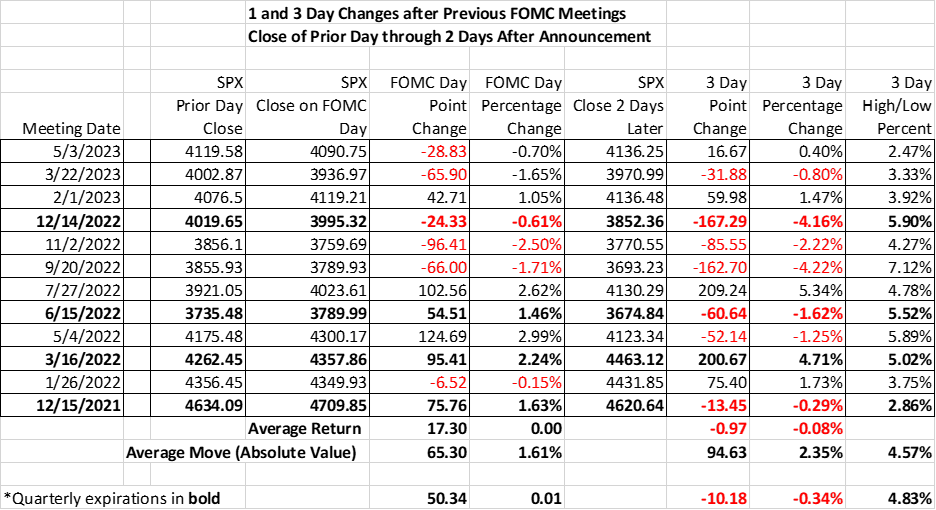

For some historical perspective, here is the 1- and 3-day performance of SPX around the FOMC meetings that have occurred during the recent hiking cycle. Bear in mind that this a quarterly expiration week, which tends to add to the high-low volatility somewhat:

(Click on image to enlarge)

Source: Interactive Brokers

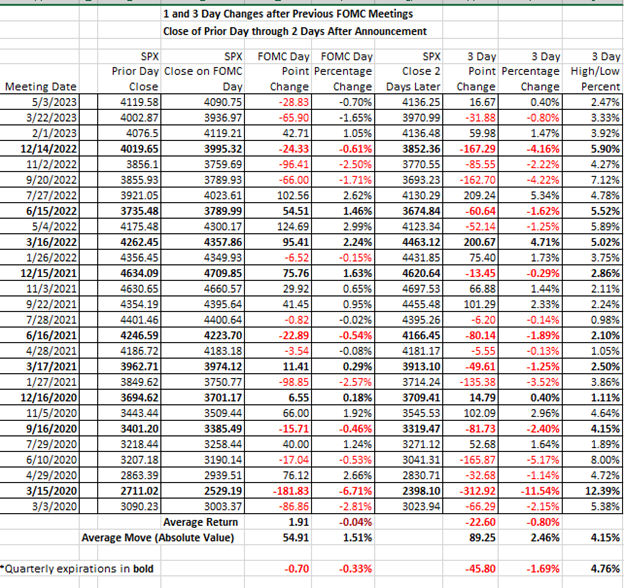

Notice that the period around the last meeting was the least volatile in some time. The last period with a similar high-low 3-day move was December 2021, which proved to be just ahead of the US markets’ all-time highs.For further reference, here is the same table going back to the Covid-era “shock and awe”:

Source: Interactive Brokers

Even with VIX poised just above multi-year lows, options traders are not completely blind to the potential for movement over the next few days. At-money implied volatilities for SPX options expiring today are about 40%, implying a roughly 2.5% move. Those decline to 21% tomorrow, 17.5% Friday, and 12.5% for next week. Those convert approximately to average daily volatilities for the respective relevant periods of 1.3%, 1.1%, and 0.78% respectively. In other words, we might be volatile today, but it will pass quickly.

We concluded yesterday’s piece with the assertion that VIX and hence SPX implied volatility offered a one-tailed bet.If they decline further, it would likely be a slow grind. If they rise, it could easily be a very rapid jump. Which side would you rather be on?

More By This Author:

I Don’t Want To Spoil The CPI Party

The Asymmetries Of Fear, Greed And Monetary Policy

Will Chair Powell Repeat Jackson Hole’s Penalty?

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more