I Don’t Want To Spoil The CPI Party

Yesterday we discussed whether momentum trading should really be considered inertia trading because a market in motion tends to stay in motion unless acted upon by a force. We had a potential market-moving force this morning in the form of CPI, but the in-line report was clearly not enough to disrupt the positive motion of US equities.

The month-over-month reports were as expected: +0.1% for headline CPI, +0.4% for core. The year-over-year numbers were also close enough: +4.0% for headline (vs. +4.1% expected), and +5.3% for core (vs. 5.2% expected). Interestingly, the actual CPI index was slightly higher than expected at 304.127 (vs. 304.075), so I’m not sure how the year-over-year headline number was less than expected (unless there was a minor inconsistency in the estimates), but the slight beat was good enough to amplify the ongoing good feelings.

Throw in some better-than-expected results from Oracle (ORCL), which is up over 2% this morning, though a bit lower than its 6.5% jump on the open. The stock was up nearly 6% yesterday in anticipation, but liberal use of the term AI in their conference call was enough to allow the price to ramp even further.

Tomorrow brings perhaps the most significant potential market-moving force. We’re keeping an eye on the PPI report, but of course, the FOMC meeting and subsequent press conference are the key factors. Thanks to today’s CPI report, Fed Funds futures are now pricing in only a 10% chance for a hike tomorrow, down from 25% yesterday. This Fed has shown little interest in surprising the market, so it is more than reasonable to think that a skip or a pause (choose your preferred terminology) is in the cards.

It will then come down to whether Chair Powell offers cheery or gloomy rhetoric at his post-meeting press conference. It is sobering to think that the fate of the markets rest upon whether “Goldilocks in a Suit” or “Jackson Hole” Powell makes an appearance. Much depends upon whether the FOMC believes that the investor enthusiasm is helping or hurting the Fed’s fight against inflation.

One other thing to keep in mind is that the Fed is far more focused on core inflation than the headline number. A 0.1% monthly print on headline inflation is clearly in synch with declining inflationary pressures and a 2% target. A 0.4% monthly print on the core is not. Furthermore, many economists annualize the 2- or 3-month change in Core CPI as a better proxy for current inflationary trends. For better or worse, those measures are close to 5%. If we look at the PCE Core Deflator on that basis, those measures are a little over 4%.On that basis, a hike may not be in the cards for tomorrow, but it would be quite surprising if the messaging is such that it takes a future hike off the table.

We have also noted how VIX is mired in the mid to low teens. When we’re in a steady uptrend with little volatility or perceived need for protection, that is to be expected. We noted that recency bias is a key factor in the expectations that are inherent in the VIX calculation. Quite frankly, if there’s a drought, who needs umbrellas?

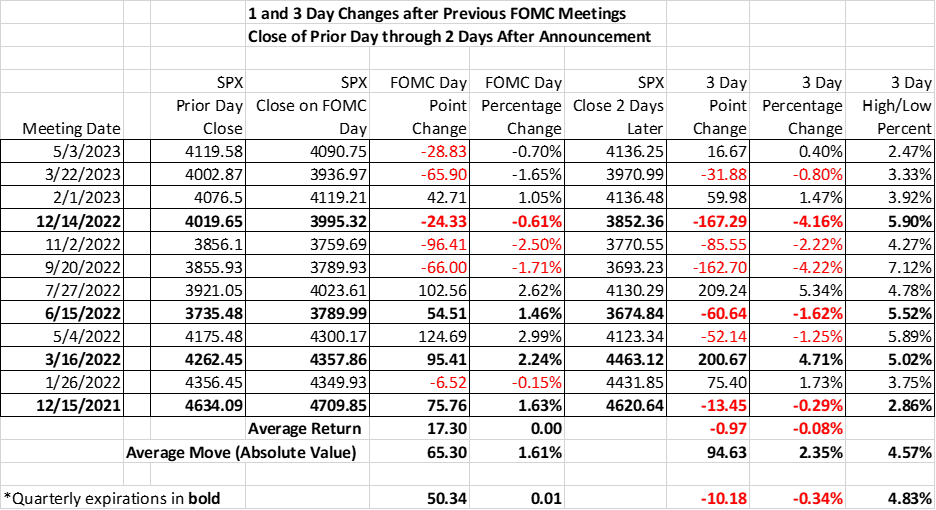

Yet if we are using the past as prologue, investors might need to express a bit more concern. The chart below shows the moves in SPX around the FOMC meetings that have occurred since we have entered a rate-hiking cycle:

(Click on image to enlarge)

Source: Interactive Brokers

If recent history is a guide, it is reasonable to expect that markets to have a relatively substantial percentage move over the coming days. Bear in mind that Friday is a quarterly expiration, and we have seen even more volatility during expiration weeks than in typical FOMC weeks.

Ahead of the last FOMC meeting, we noted how the then-low 15.5 VIX seemed unreasonably sanguine ahead of the upcoming event. Just three days later, VIX was six points higher. The reason was that Powell was relatively dour. And that week had the smallest post-FOMC high-low range we’ve seen in over two years.

We’ve noted how VIX has an asymmetric response to events. There is nothing to guarantee that VIX will pop once again in the aftermath of the upcoming FOMC meeting. If markets are happy with the Chair, then VIX could be expected to drift further down. But if Powell reaffirms the message that core inflation, while improved, is nowhere close to the Fed’s 2% target, the response from VIX could be sharp. In my mind, that’s a one-tailed bet.

More By This Author:

The Asymmetries Of Fear, Greed And Monetary Policy

Will Chair Powell Repeat Jackson Hole’s Penalty?

VIX Doing The Limbo Dance – How Low Can We Go?

Disclosure: OPTIONS TRADING

Options involve risk and are not suitable for all investors. For more information read the “ more