Largest Cannabis MSOs Have Crashed; Down +12% This Week

Image Source: Unsplash

An Introduction

It has been more than a month since Trump said on August 11th that his administration was “looking at” moving cannabis from Schedule I to Schedule III and would “make a determination over the next few weeks”. That caused the largest cannabis MSOs to rocket higher by 96% in August (see here). Unfortunately, however, the rocket has run out of the fuel that propelled it upwards - DEA re-scheduling and SAFE Banking legislation optimism - and crash landed going down by xx% this week as a result of no action by the administration. In addition, traders who have seen a number of such cycles of hope, hype, and harsh reality in the past related to cannabis, began locking in profits.

American Cannabis MSO Stocks Portfolio

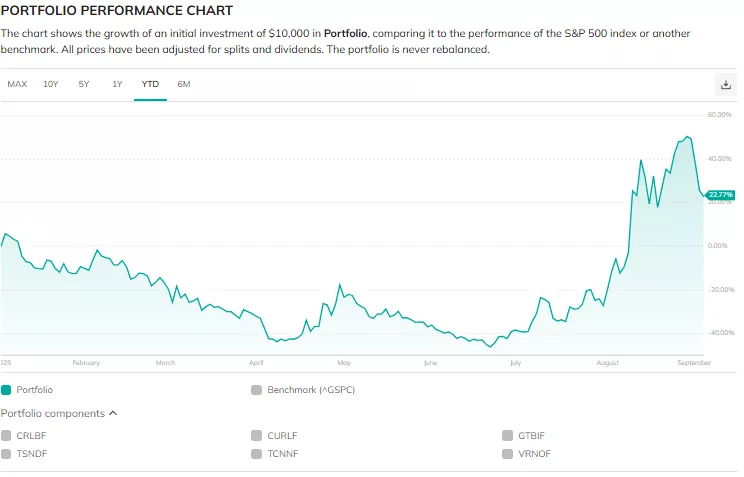

Below are how the 6 constituents in our American Cannabis MSO Stocks Portfolio performed this week in ascending order, and an interactive chart showing how the Portfolio has performed over various time periods:

- TerrAscend (TSNDF): DOWN 24.3% w/e September 5th

- Verano (VRNOF): DOWN 20.6%

- Cresco (CRLBF): DOWN 19.9%

- Trulieve (TCNNF): DOWN 14.1%

- Curaleaf (CURLF): DOWN 13.6%

- Green Thumb (GTBIF): DOWN 5.9%

Summary

The above stocks were DOWN 12.4%, on average, this week.

Interactive Portfolio Performance Chart

Below is an interactive chart snapshot of the portfolio's performance since the beginning of 2025.

Conclusion

The cannabis sector has been in a prolonged bear market, and even sharp rallies like we saw in August are now met with skepticism.

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.