American Cannabis MSO Stocks Portfolio Was Up Dramatically In August - Here's Why

Introduction

The 6 largest American cannabis multi-state operator (MSO) stocks in our American Cannabis MSO Stocks Portfolio were UP an unbelievable 96.4% in August. That's correct - 96.4% - ranging from "just" 47% to 198%!

Below are the catalysts behind this amazing surge, a table of the portfolio's performance returns over various time periods, and that of each constituent, and a chart snapshot of the portfolio's performance since the beginning of 2025.

Key Catalysts Behind the Rally

- DEA Rescheduling Speculation:

- Donald Trump said on August 11th that his administration was “looking at” moving cannabis from Schedule I to Schedule III and would “make a determination over the next few weeks”. If that should happen it would dramatically reduce tax burdens under Section 280E by allowing MSOs to deduct normal business expense which would make them more profitable and drive up their stock prices.

- SAFE Banking Momentum:

- Trump's comments have made investors more hopeful that SAFE Banking legislation - which would allow cannabis firms access to traditional banking - might pass under the current administration enabling MSOs to lower financing costs, improve transparency and improve investor confidence in the category.

- Cautious Institutional Interest:

- While cannabis stocks remain off-limits to many institutional investors due to federal illegality, signs of stabilization and profitability are drawing cautious interest

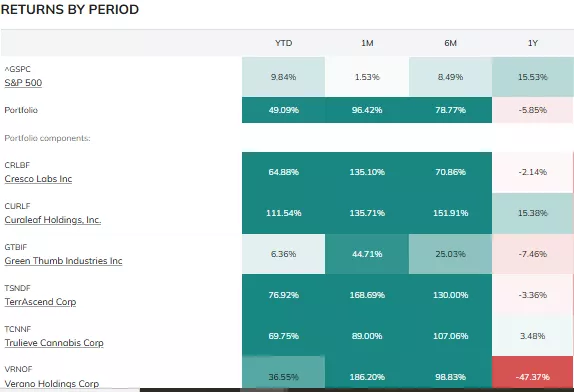

Table of Constituent Returns

The table below of the returns of the stocks in the Portfolio over specific time periods has been generated by PortfoliosLab.com

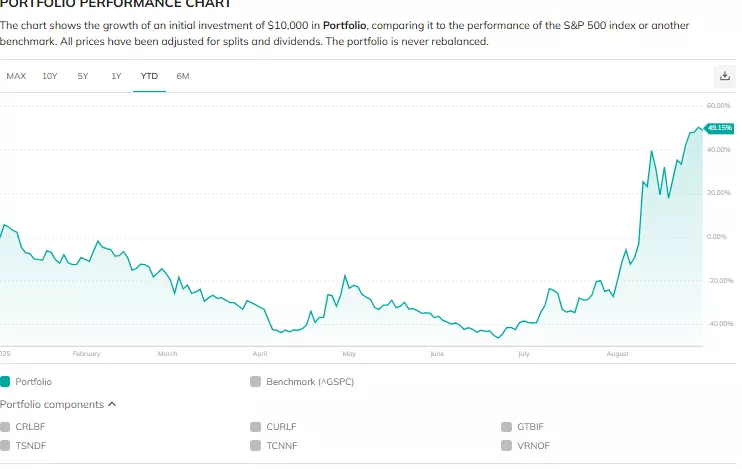

Chart of Portfolio's Returns

To my knowledge PortfoliosLab.com is the only site that enables an investor the ability to create a chart of the performance of a portfolio and below is a chart I created of the returns of our American Cannabis MSO Stocks Portfolio.

(Click on image to enlarge)

If you want to create your own portfolio chart go more