Large Cap Biopharmaceuticals: Provide Growth, Value And Yield

Image Source: Unsplash

Large Cap Biopharmaceuticals: Provide Growth, Yield, and Value

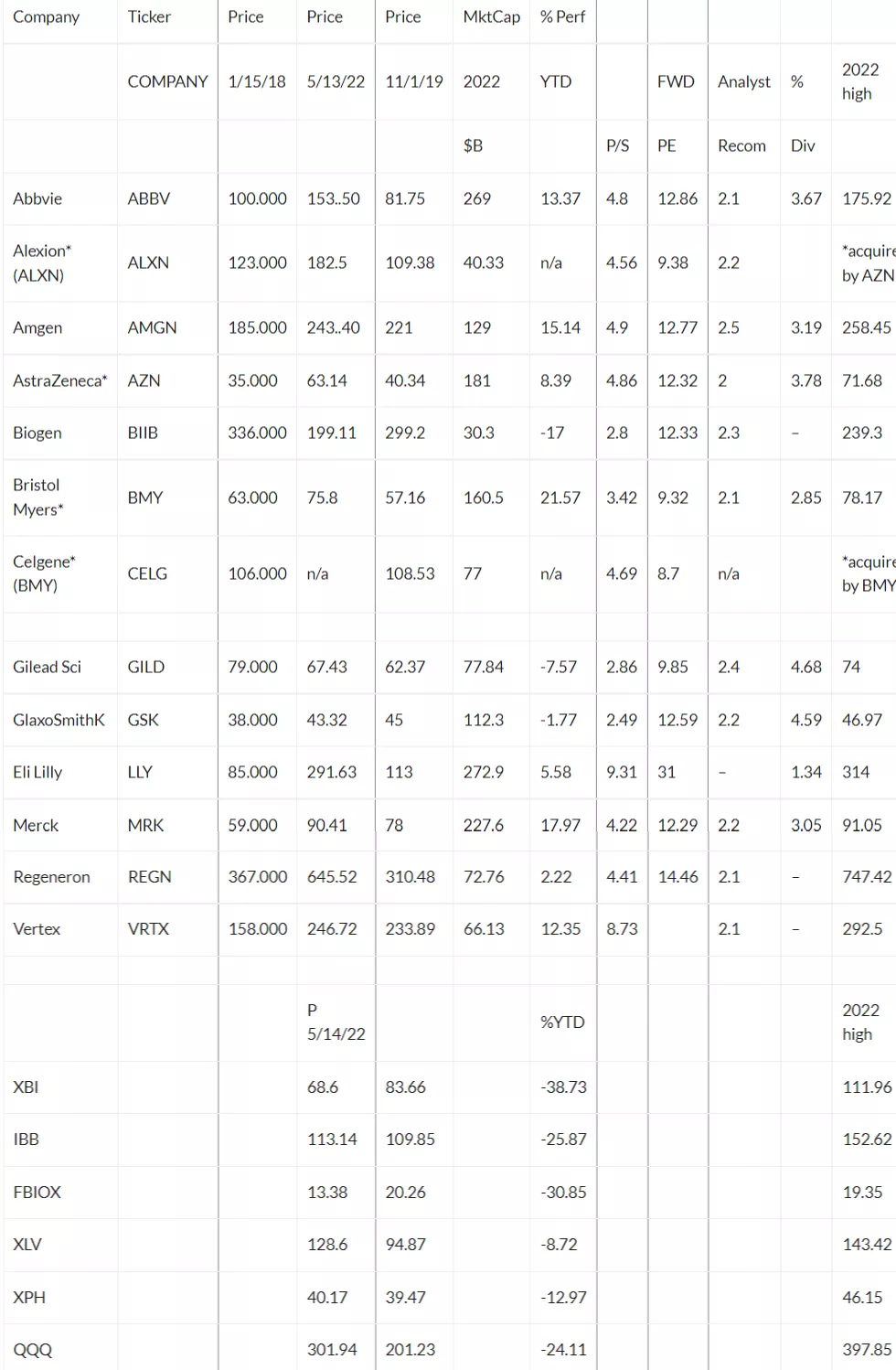

- All of our top picks beat the market: BMY, MRK, ABBV, VRTX, REGN and are off their 2022 highs.

- Laggards GILD and GSK provide good value and dividends.

- The most volatile stocks in the group are Regeneron and Vertex but neither provide dividends.

Now that all major biopharmaceutical earnings are in, we can review the financial metrics and see if our portfolio needs re-balancing. It was a tumultuous week as we posted but there was good relief for riskier small cap biotech stocks on Friday and we added a little XBI, which was up 5.68% Friday to $68.60.We did not trade off the tops of REGN and VRTX because we were busy in other volatile sectors. Last week’s trading was very unusual with most sectors hit very hard in what has become a grueling bear market. Commodities remain very strong with wheat, gasoline, and soybeans among the winners.

Two new positions to consider for longer-term trades are AstraZeneca (AZN) at $63.14 and Pfizer (PFE) at $49.92. Both trade at the low end of their range and offer good dividends. AZN stock has been weak because of guidance on vaccine sales but has $39B of revenues from the acquisition of Alexion. We will update both stocks on any news and as you know Pfizer distributes the mRNA vaccine of BioNtech (BNTX).

in the mid-cap biopharma sector, we own Seagen (SGEN) now at 135 with good potential from good news from ASCO.

Disclosure: Long ABBV, BMY, MRK, REGN, VRTX, XBI.