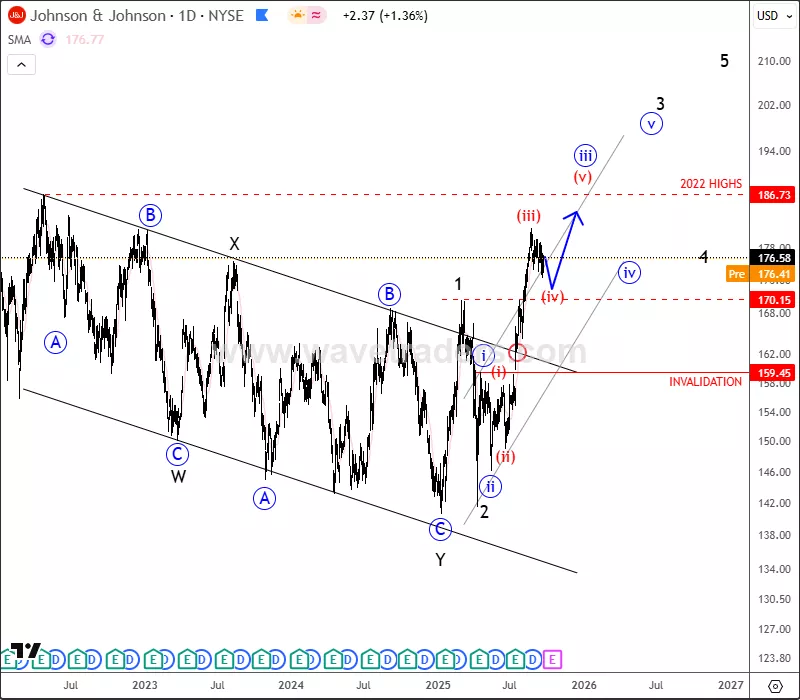

Johnson & Johnson Is Attacking 2022 Highs

Image Source: Unsplash

Johnson & Johnson’s (JNJ) stock is trading higher thanks to stronger-than-expected earnings, raised full-year guidance, and continued growth in its MedTech and pharmaceutical divisions. Recent acquisitions and drug pipeline successes (like its promising psoriasis treatment) add to investor optimism, while its consistent dividend increases and defensive healthcare profile make it attractive in a volatile market.

Johnson & Johnson (JNJ) made a strong and aggressive breakout of the corrective channel back in July, so from Elliott wave perspective, we see this as a new bullish trend that could take us back to the 2022 highs, until it fully completes a five-wave bullish cycle of different degrees. After the current retracement, there is nice potential support for wave four around the 170 zone, while the invalidation level remains at 159. Watch for a fifth-wave recovery setup with a target closer to 186.

Highlights:

Trend: Bullish continuation (after wave four)

Support: 170

Invalidation: 159

Target: 186

JNJ Daily Chart

For more analysis like this, you can also watch our latest recording of a live webinar streamead on September 22: DIRECT LINK

More By This Author:

ETHUSD Longs/Shorts Ratio Is At 3-Year Low

Alphabet Extends Higher Within A Bullish Impulse

Crypto Market Is Nicely Recovering, But Into Some Key Levels Ahead Of Fed

**New** Stock Elliott Wave Report – Beta Access Now Open- Free Access

6th report is already available. To stay on track with our US single stock updates and actionable Elliott Wave ...

more