“Jackets And Packets” Stock Market (And Sentiment Results)

Each week we like to cover one or two companies we have discussed in our weekly podcast|videocast(s).

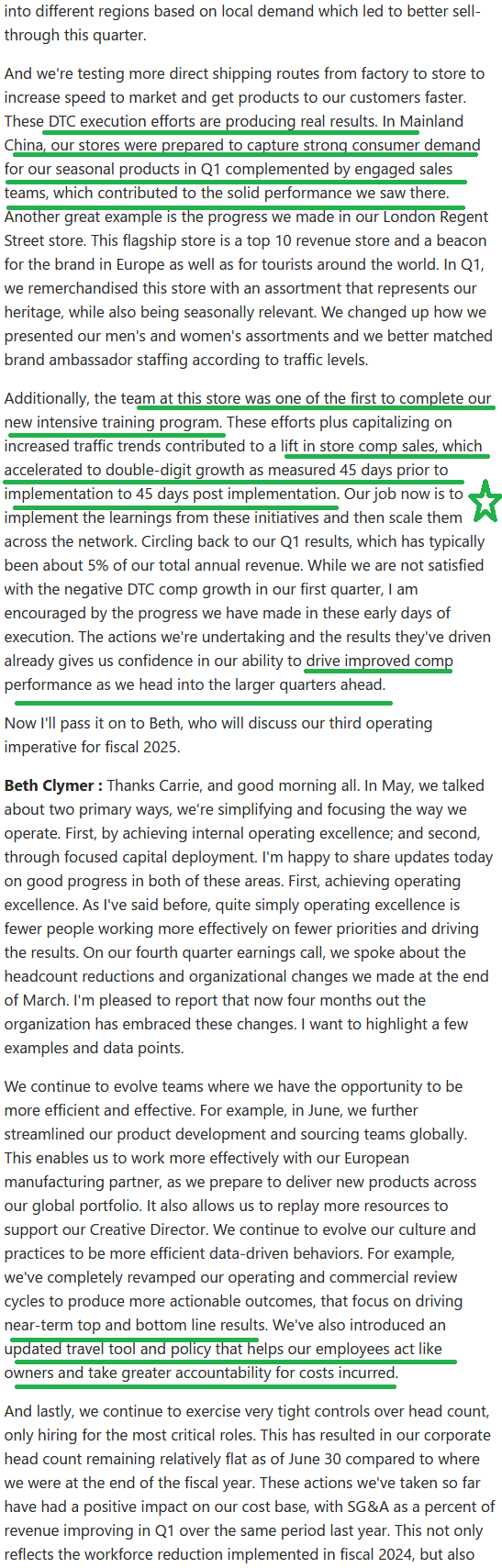

Canada Goose

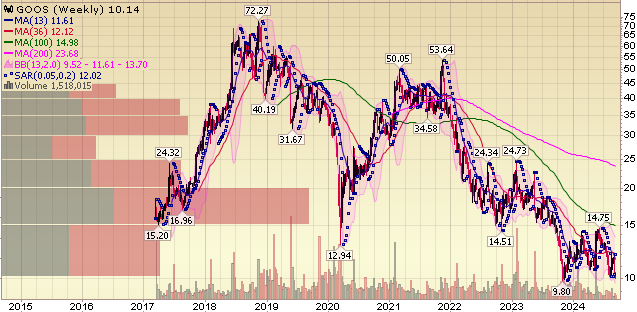

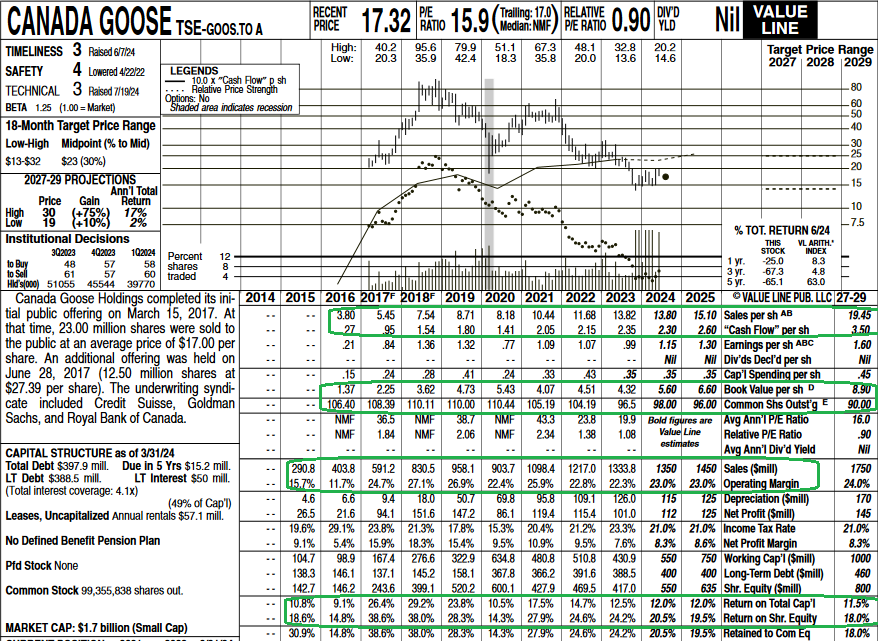

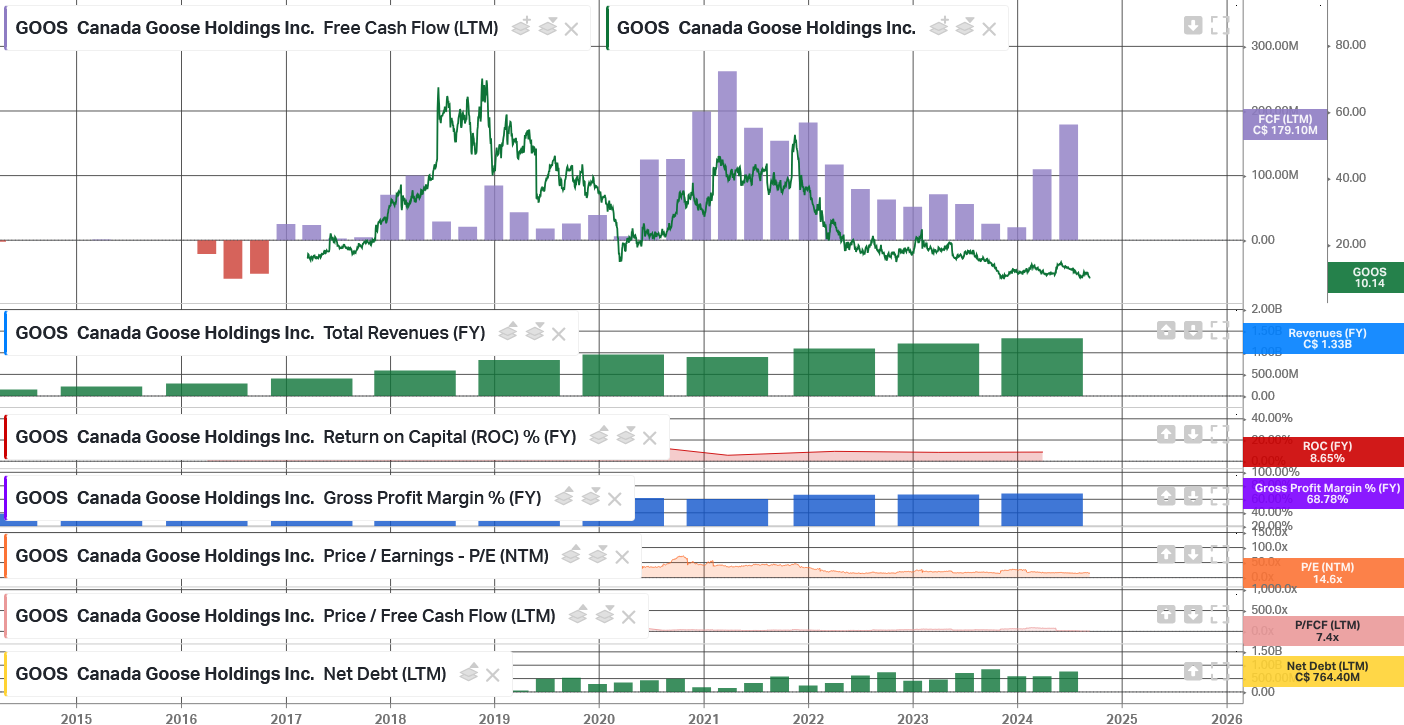

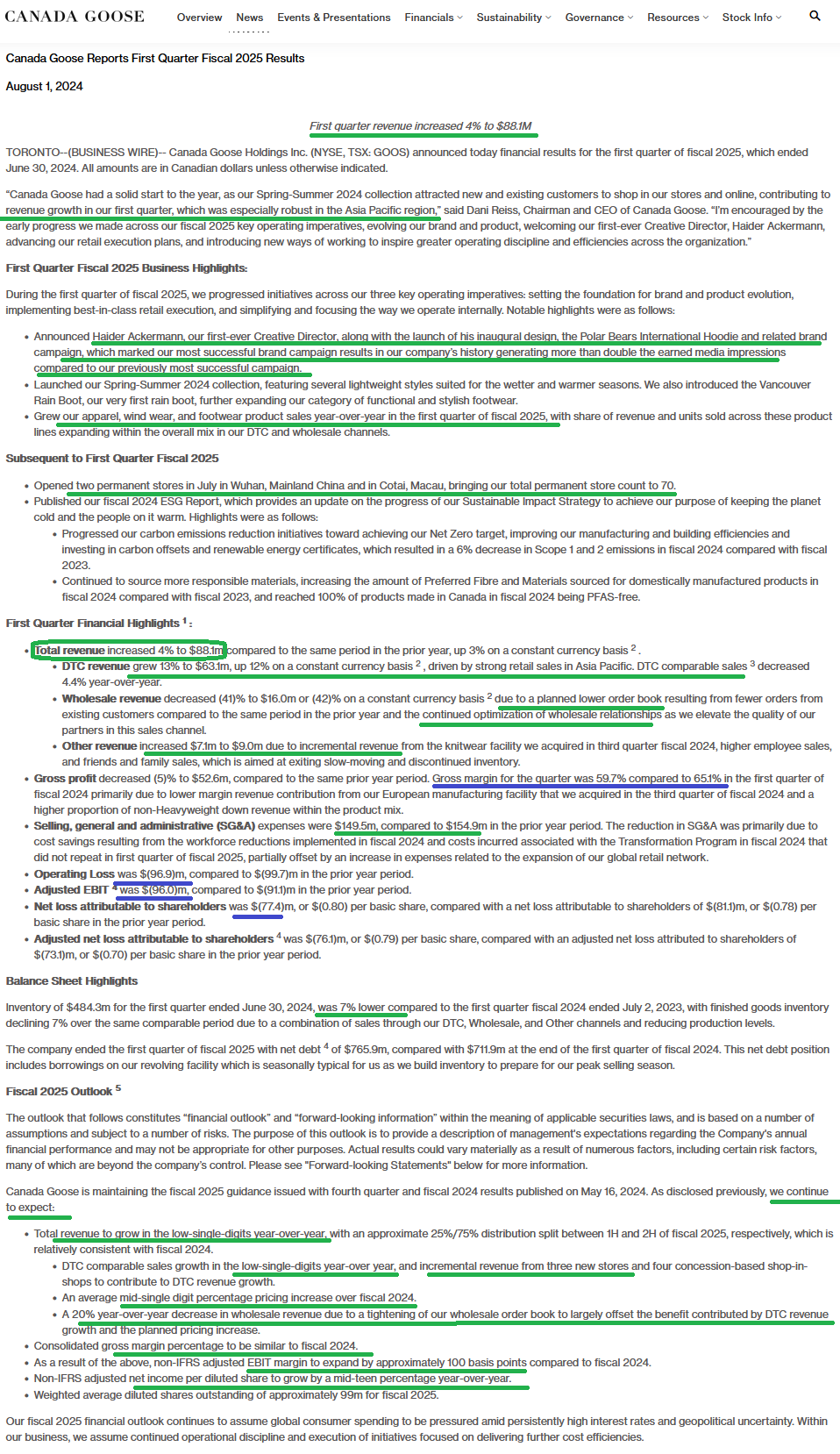

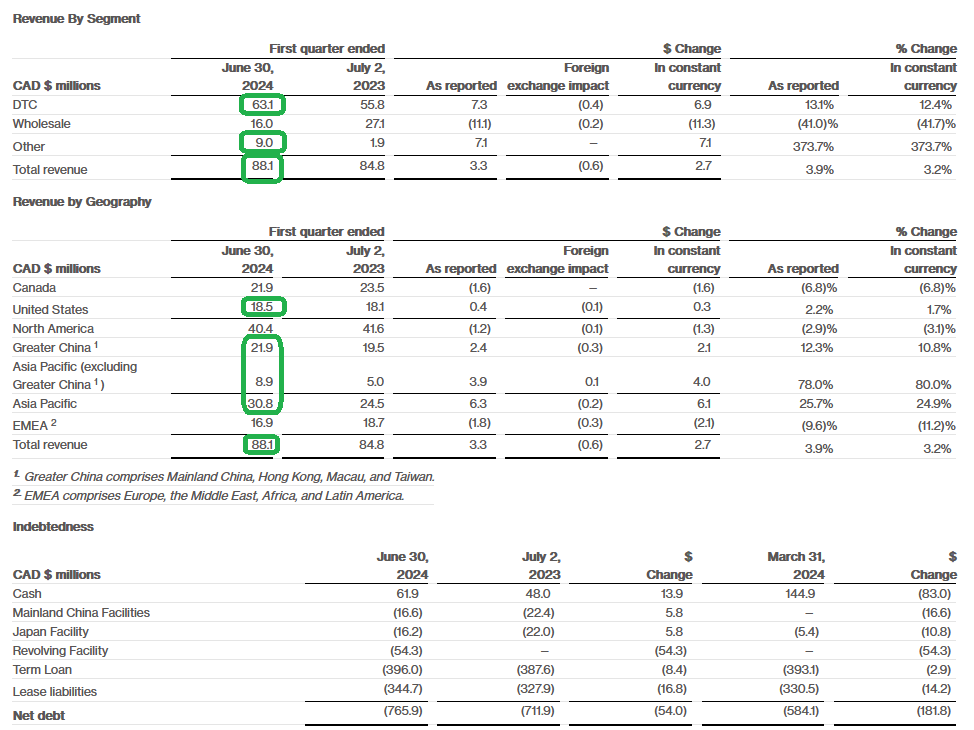

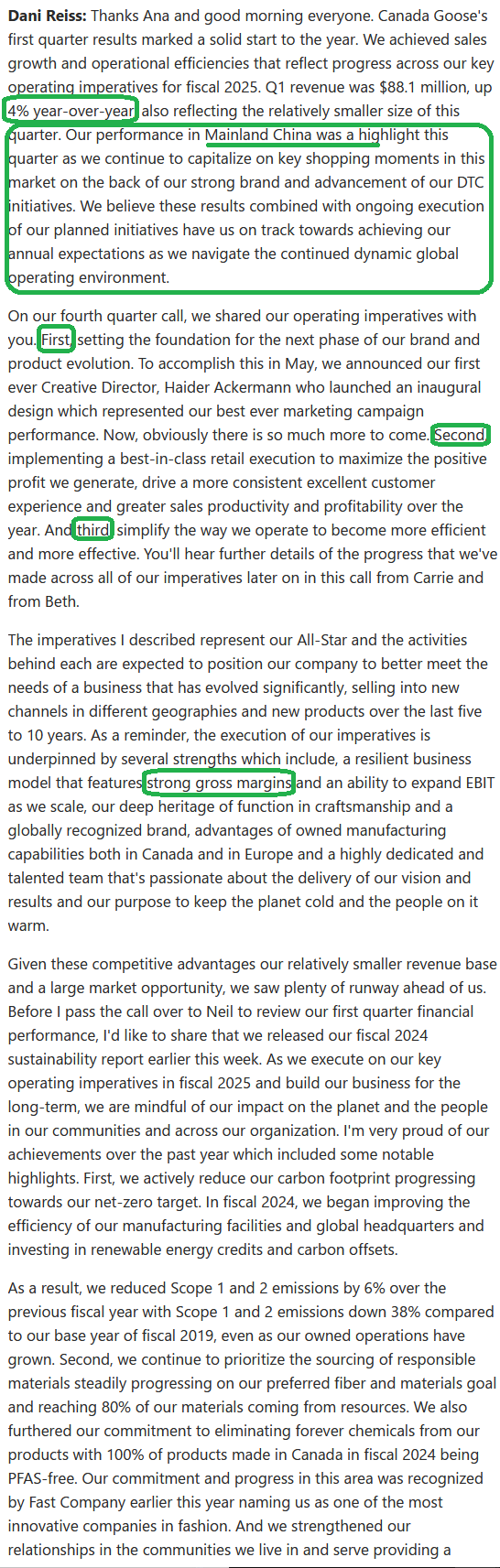

1. Revenues continue to grow, Free Cash Flow recovering, Margins high, Stock Price subdued.

2. Growing double digits in China. Asia Pacific up 25%.

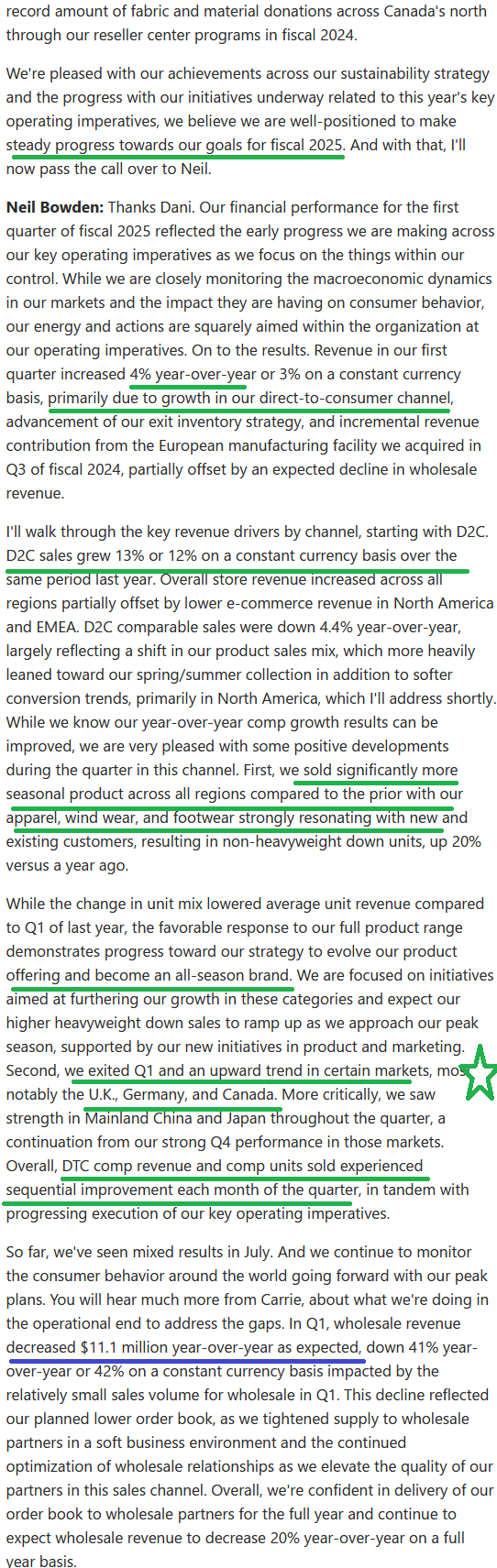

3. In line with their long term growth plan they are growing DTC and shrinking wholesale business to improve margins and the customer experience.

4. Non-jackets (windwear, apparel, footwear) up 20% yoy. Becoming an “all-season” brand globally.

5. New sales training in key London store led to double digit yoy growth comp within 45 days. Now rolling out across all 70 stores.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

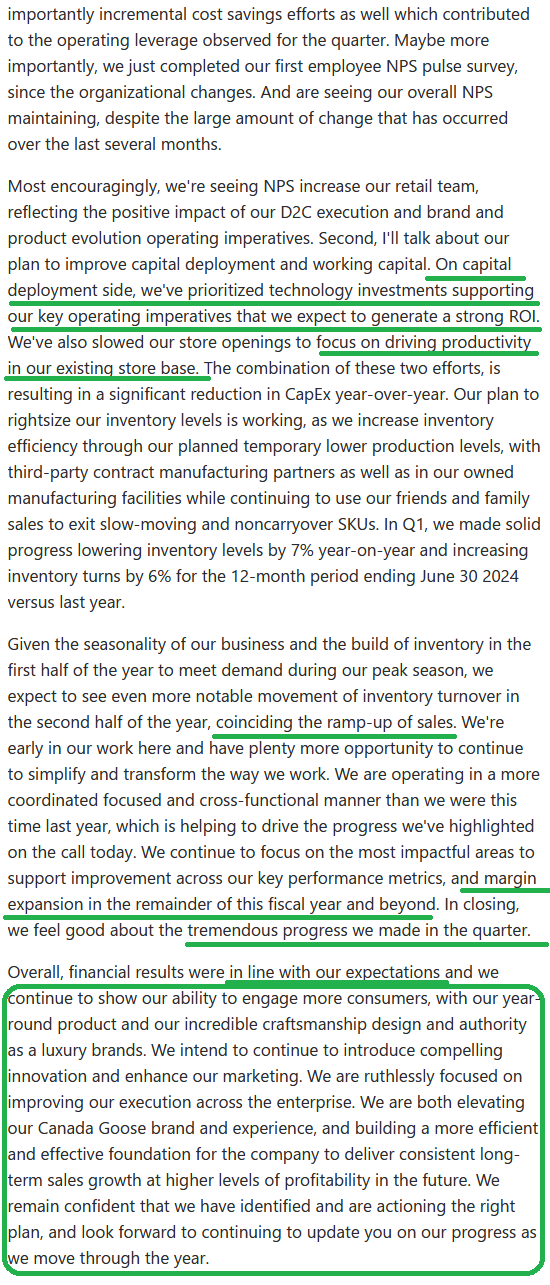

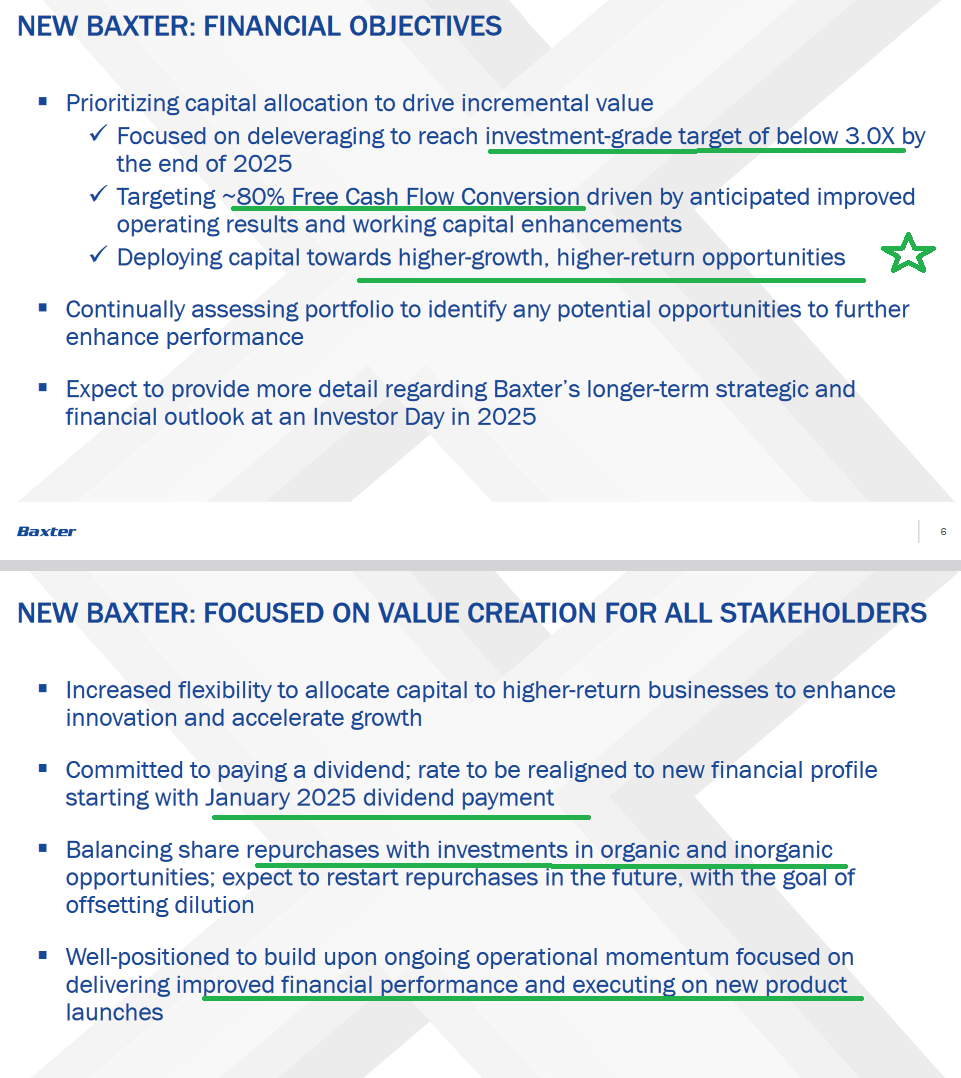

Baxter International

(Click on image to enlarge)

(Click on image to enlarge)

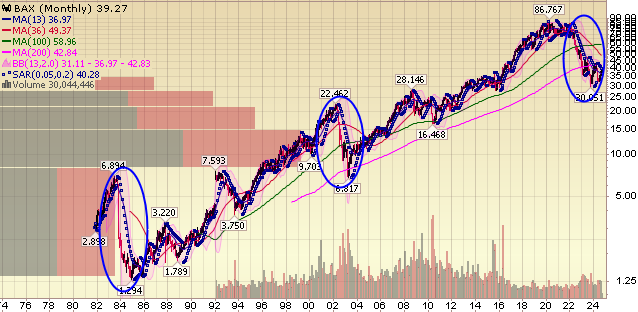

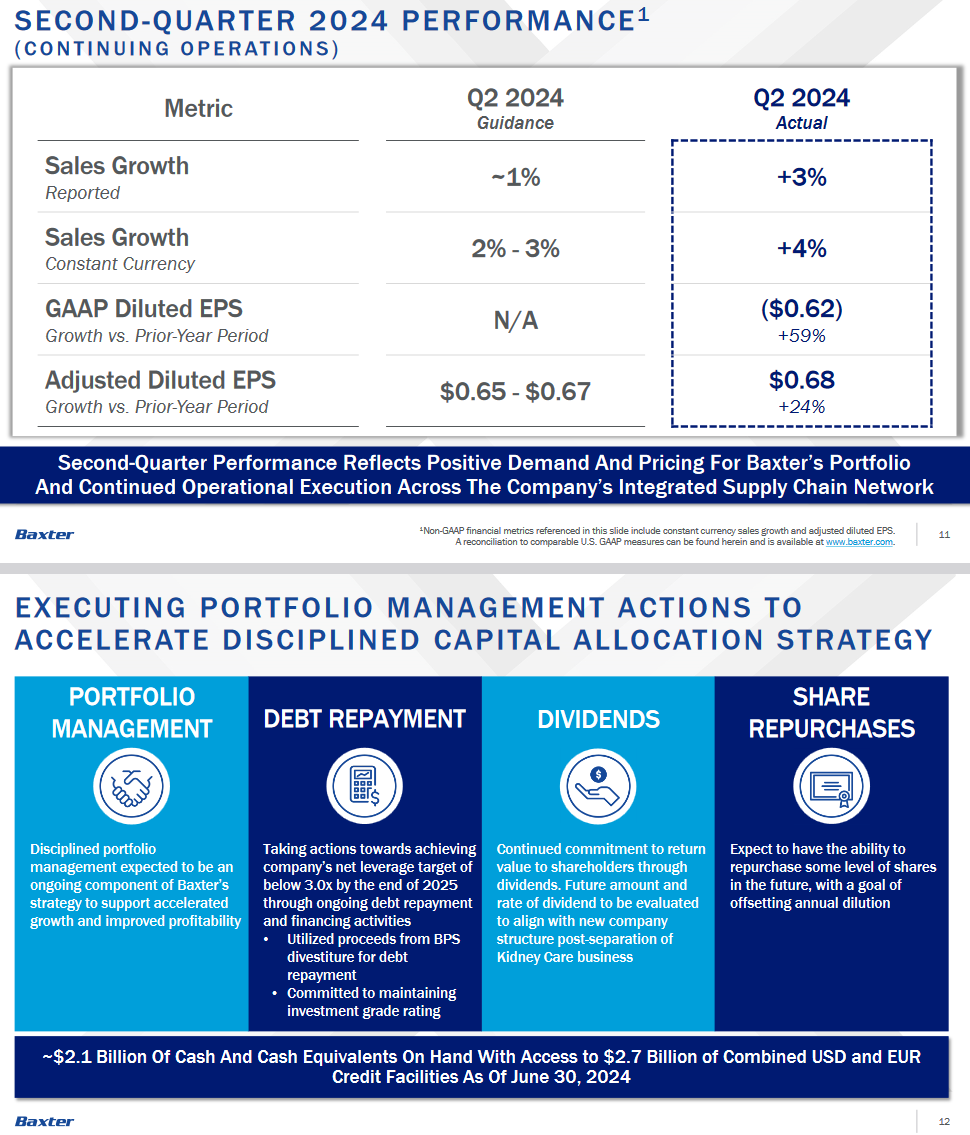

Here are 10 key points from Baxter International’s Q2 2024 earnings call on August 6, 2024:

- Strong performance: Baxter exceeded its previously issued guidance on both the top and bottom lines for Q2 2024.

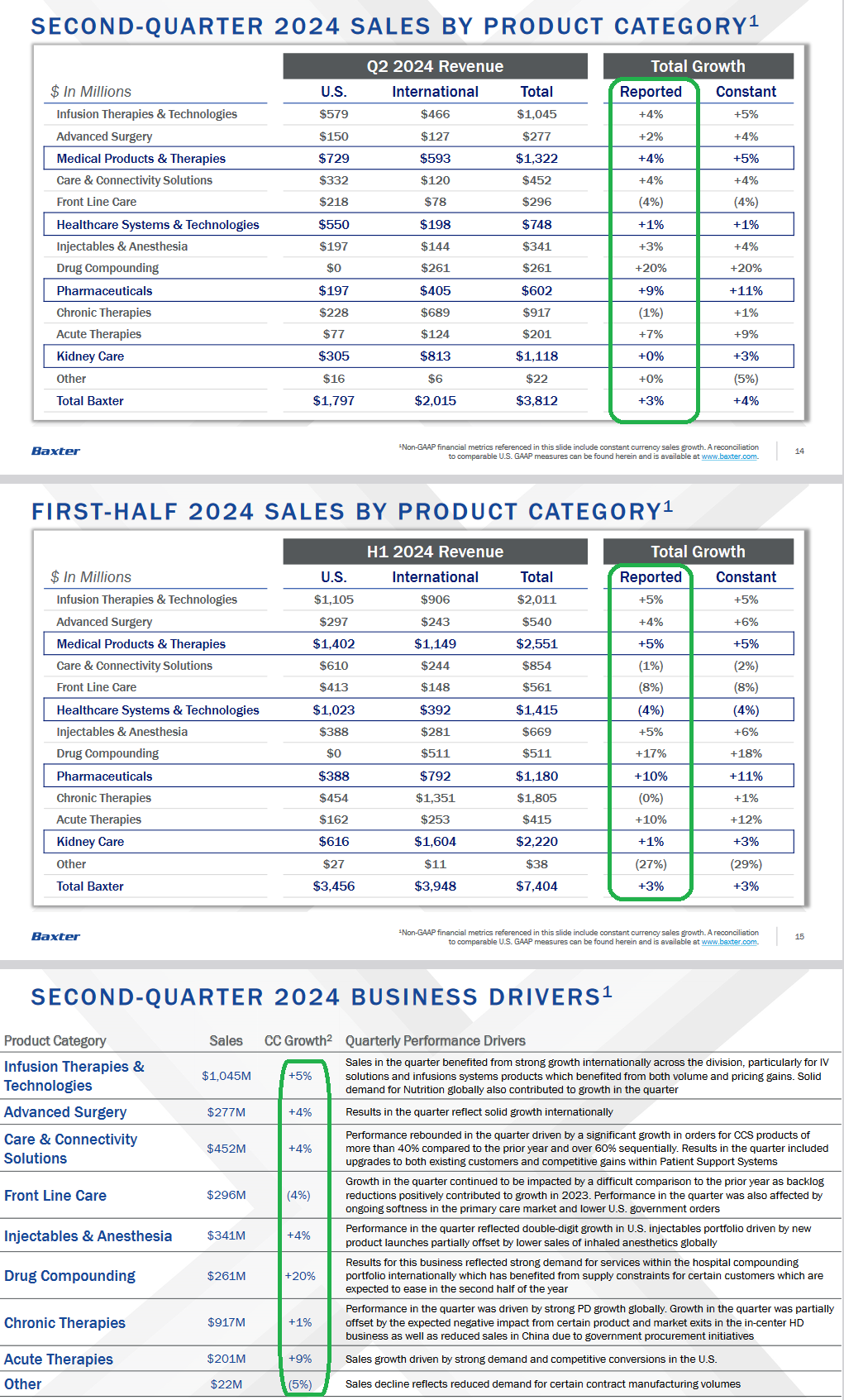

- Sales growth: Second quarter sales from continuing operations grew 3% on a reported basis and 4% at constant currency rates.

- Adjusted EPS: Adjusted earnings per share from continuing operations were $0.68, exceeding expectations.

- Broad-based growth: All four Baxter segments delivered growth above expectations, reflecting positive demand and improved pricing.

- Medical Products and Therapies (MPT) performance: MPT delivered second quarter sales growth of 4% at reported rates and 5% at constant currency rates.

- Novum IQ launch: The quarter included first US sales of Baxter’s new Novum IQ large volume infusion pump.

- Operational efficiency: Strong operational performance offset negative impacts from foreign exchange and a higher-than-expected tax rate.

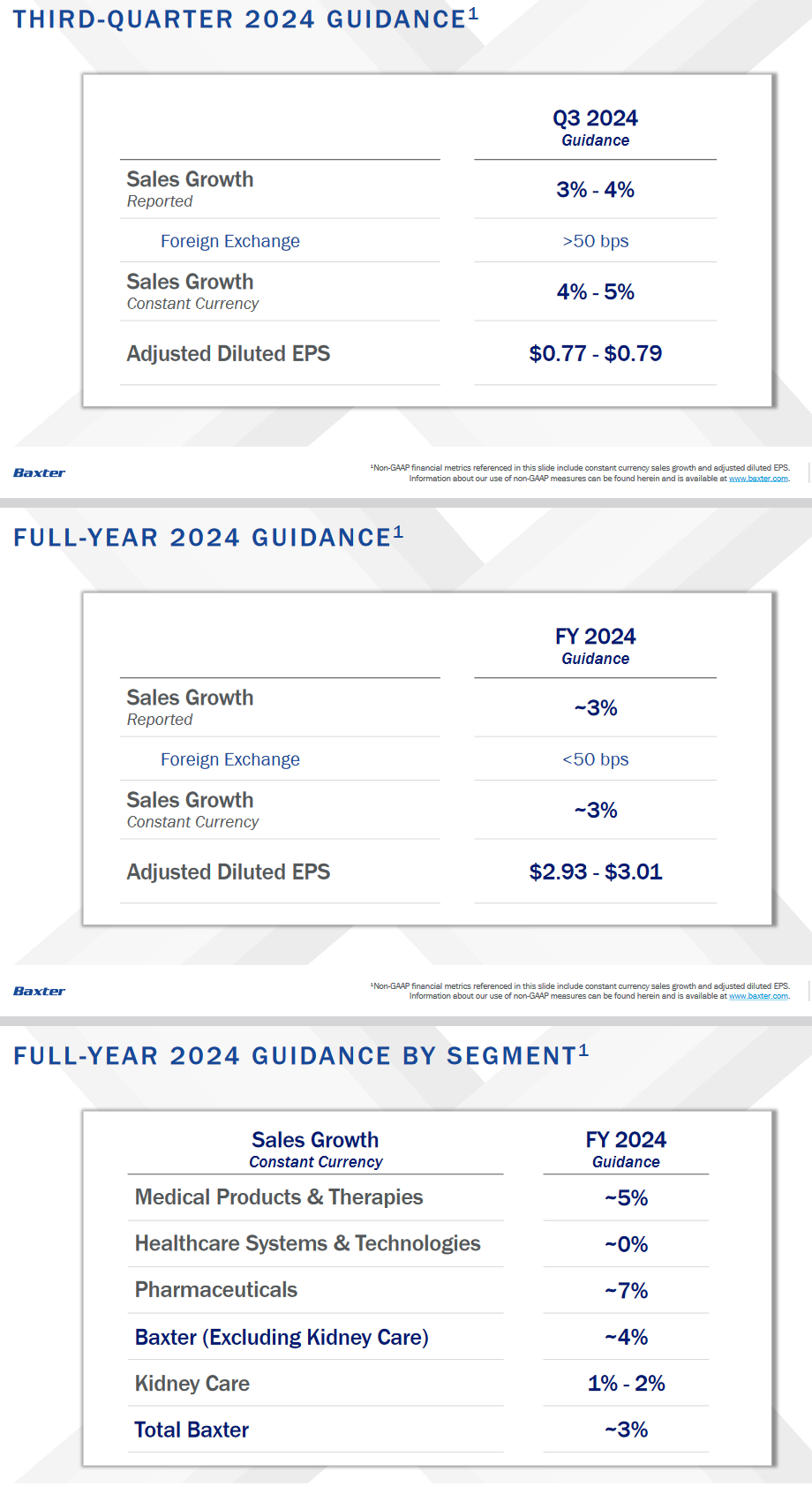

- Revised guidance: Baxter increased its full year sales outlook and adjusted EPS guidance due to strong performance.

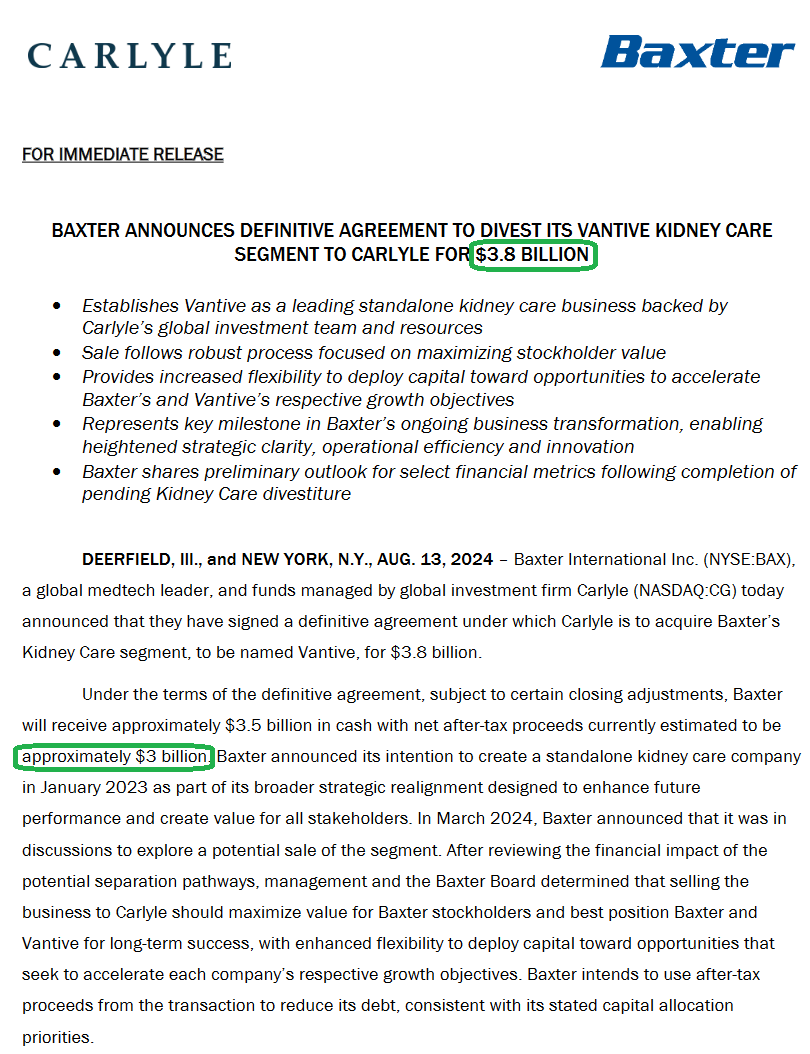

- Kidney Care separation: Preparations continue for the proposed separation of the Kidney Care segment, with the company exploring a potential sale in lieu of a spinoff. This was announced later in August ($3.8B sale to Apollo).

- 2024 outlook: For full-year 2024, Baxter now expects sales growth of approximately 3% on both a reported and constant currency basis, with adjusted earnings of $2.93 to $3.01 per diluted share.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Now onto the shorter term view for the General Market:

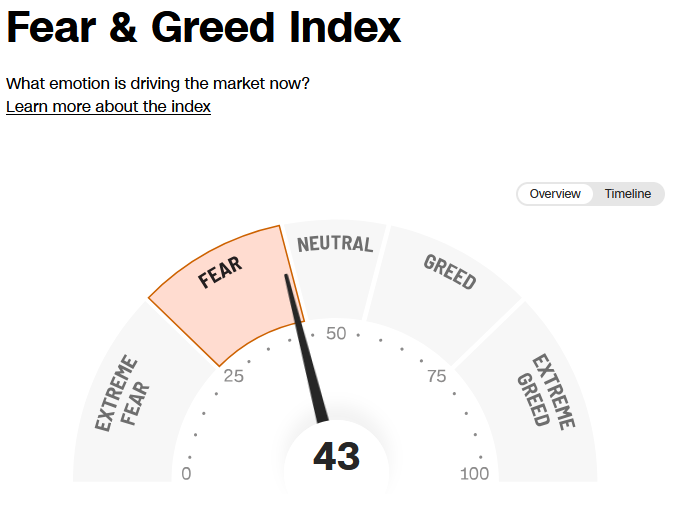

The CNN “Fear and Greed” dropped from 53 last week to 43 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

(Click on image to enlarge)

(Click on image to enlarge)

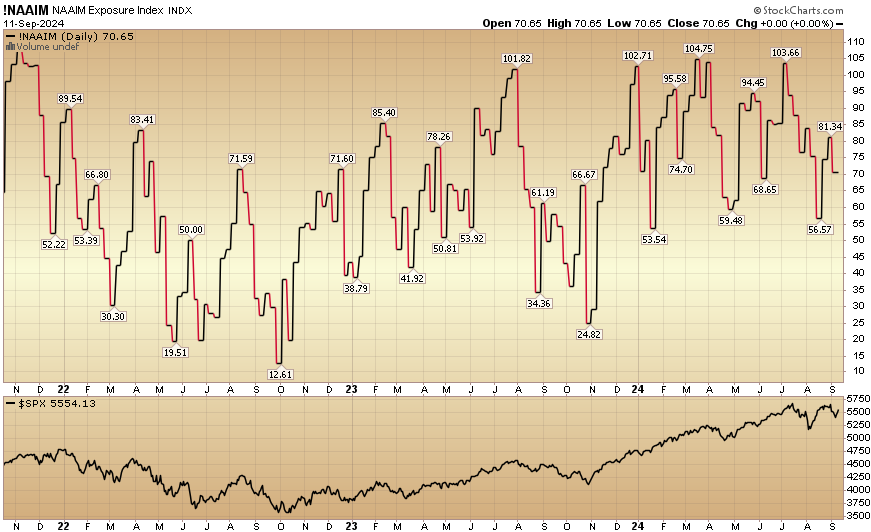

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 70.65% this week from 81.34% equity exposure last week.

(Click on image to enlarge)

Our podcast|videocast will be out tonight or tomorrow. We’ll have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

More By This Author:

“World’s Smallest Violin” Stock Market (And Sentiment Results)

“Oil Cans And Vans” Stock Market (And Sentiment Results)

Babalicious Stock Market (And Sentiment Results)

Long all mentioned tickers

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.