“It’s Five O’Clock Somewhere” Stock Market (And Sentiment Results)…

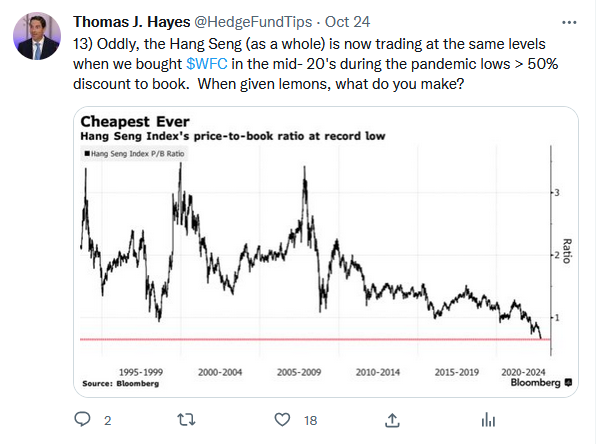

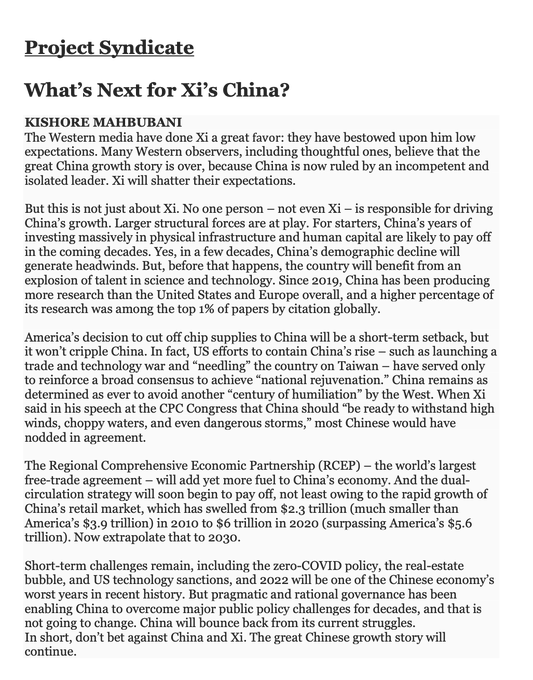

On Monday morning, we woke up to an abrupt market response to Xi Jinping’s new top leadership appointments. Global participants had hoped for some balance in the Standing Committee appointments and when it was not forthcoming, the Hang Seng index plummeted to the lowest levels since the Great Financial Crisis in 2008.

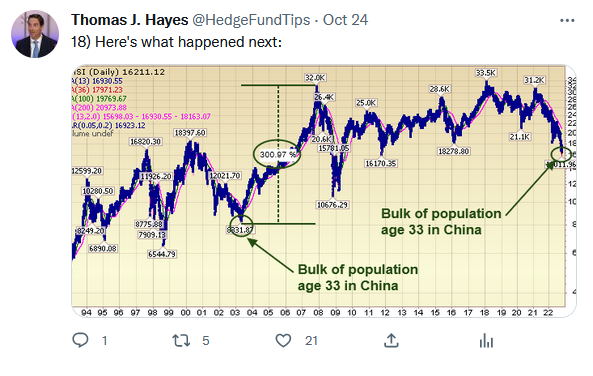

As Alibaba is one of our top 3 positions, rather than joining the Chinese traders at the bar we immediately jumped into action before the bell and posted these 18 points – with our take on the development – first to clients on Sunday then to Twitter on Monday morning.

While the Hang Seng plummeted, U.S. equities rallied and we wound up +1.5% on the day. How the hell that happened, I’ll never understand, but it’s far different from the outcome I expected coming into the open – that’s for sure! We used the strength in the US to trade out some pawns for a queen. Meaning “never let a crisis go to waste.” We looked through the portfolio to find companies we thought would appreciate only 100% (pawns) and trimmed the positions to add 2% equity capital (10% position increase) to Alibaba equity at $60.99 (which we believe could be ~5x+ from those levels over time).

We were prepared to add as much as 1% more equity capital if we dropped into the mid-50s, but the opportunity has not yet presented itself.

So why were we positioned to ACT constructively when many others were destroying themselves in real-time? I saw this tweet (below) on Monday. I’ve erased the name to protect the writer from embarrassment, but this is what happens to people who haven’t lived through cycles or done the work themselves to know what they own. Pure panic and capitulation:

We were burdened by the facts and know what we own. Here are the facts that we were prepared with from Sunday evening and posted on Monday before the opening:

China’s public cloud market to triple by 2025 as industrial sector drives a new wave of expansion: McKinsey report (SCMP)

All the President’s Men Who Will Secure Xi’s Rule (Bloomberg)

Even JESUS was skeptical:

There was 1 guy with a sense of humor in the midst of the chaos:

He was referring to the repeated reports that former Chinese President Hu Jintao was forcibly removed from the CNC. In reality here’s the full video of what actually happened. The Chinese Government said he was not feeling well.

China GDP beats with a bounce in the third quarter, delayed data shows (CNBC)

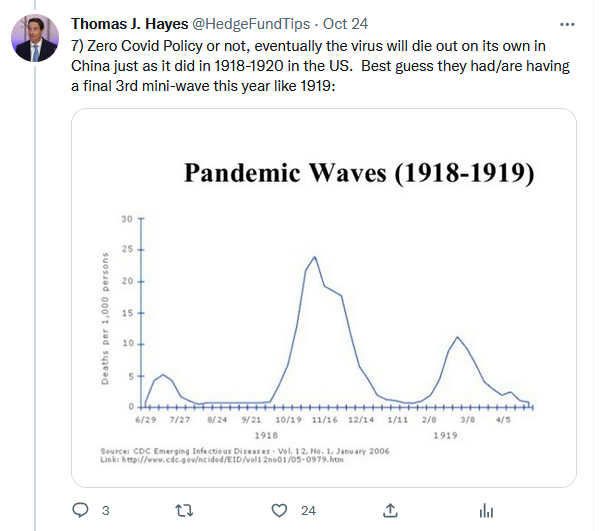

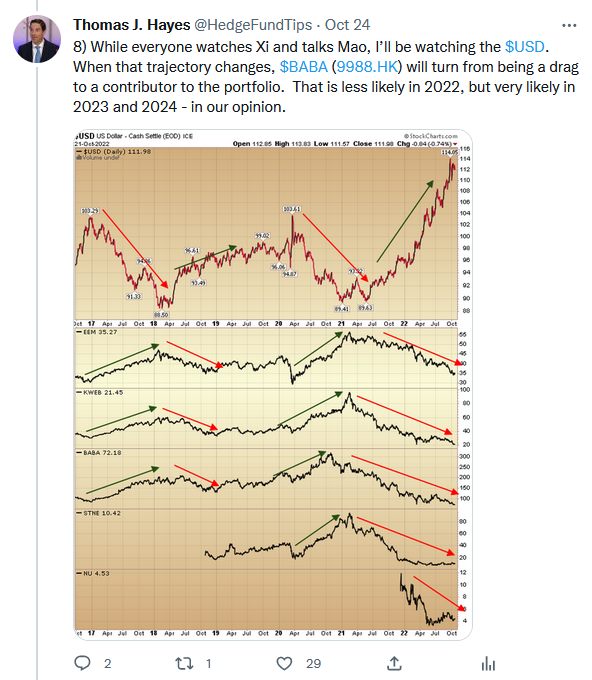

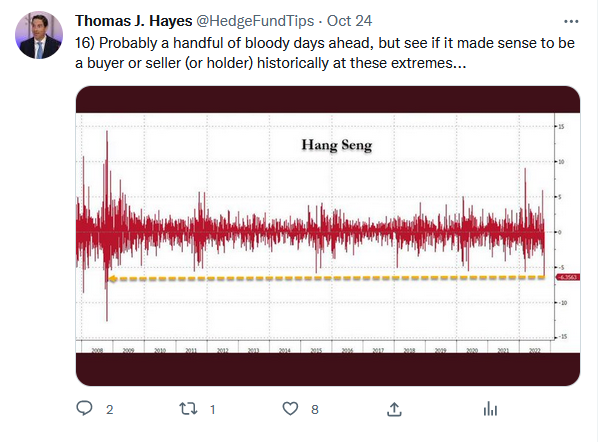

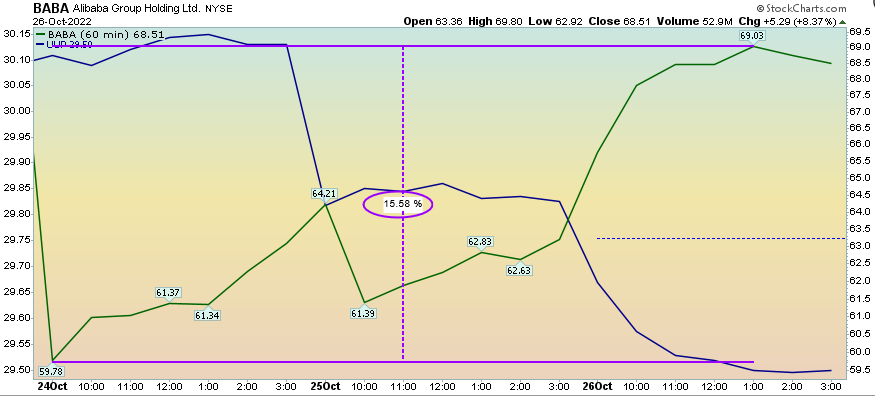

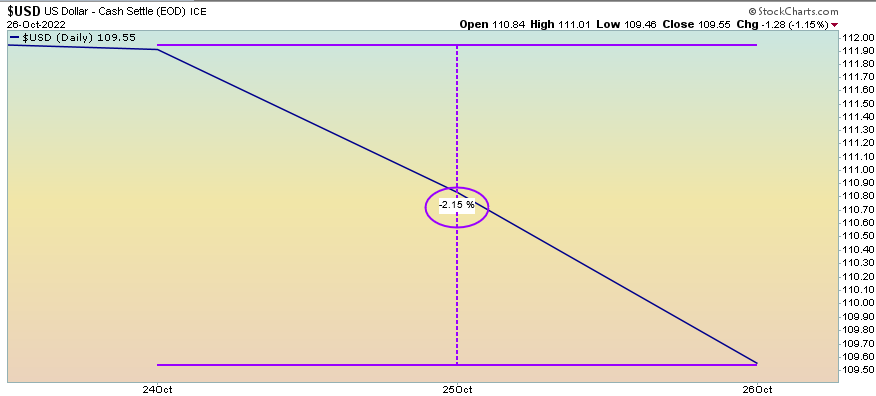

In my view, points 4-5 and 10-11 are the most important “discoveries” I made over the weekend. While valuation will matter for “relative outperformance” when the dollar weakens, the greatest valuation/business won’t get credit UNTIL the dollar weakens. For the investment’s performance moving forward, I would assign 70% weight to what the Dollar does, 25% weight to the fundamentals of the business (which are strong and undervalued), and 5% to Xi’s policies.

This week was “case in point” as the dollar (represented in the blue line) weakened –2.15%, and Alibaba (green line) recovered +15.58% in 2 days:

Where we will get the benefit of “sum of the parts” and fundamentals is once the dollar has weakened, we believe Alibaba will be one of the (if not the) best performers among the highest quality Chinese stocks in the coming years. The intrinsic value of the business can and will continue to grow. When we realize the benefits (IN PRICE) will be determined by when (and how much) the dollar weakens in coming days, weeks, months and years. In effect, it’s a leveraged currency trade with the stability of a durable moated business as its collateral.

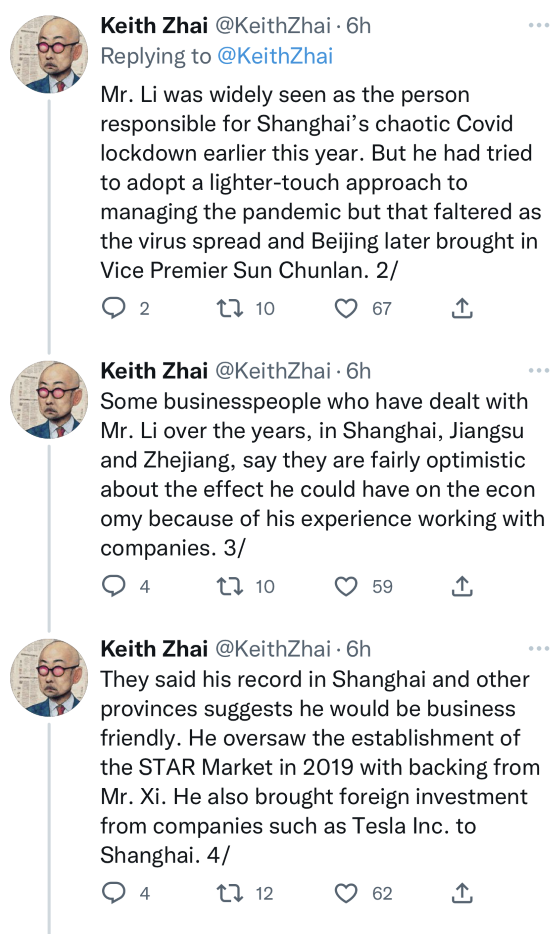

As for people concerned with the appointments, Keith Zhai (WSJ Senior Correspondent) posted this analysis on Sunday:

China’s New Slate of Top Leaders Stirs Concern Over Economy (WSJ)

Michael Burry posted this on Tuesday after the rebound started. You may know the name from the book/movie “The Big Short.” He made a fortune identifying another “once in a lifetime opportunity” shorting housing during the GFC. Translation: Opportunities like this don’t come around often:

The key points you should take away from everything I have written this week are the following:

I’m a big believer in Occam’s razor.

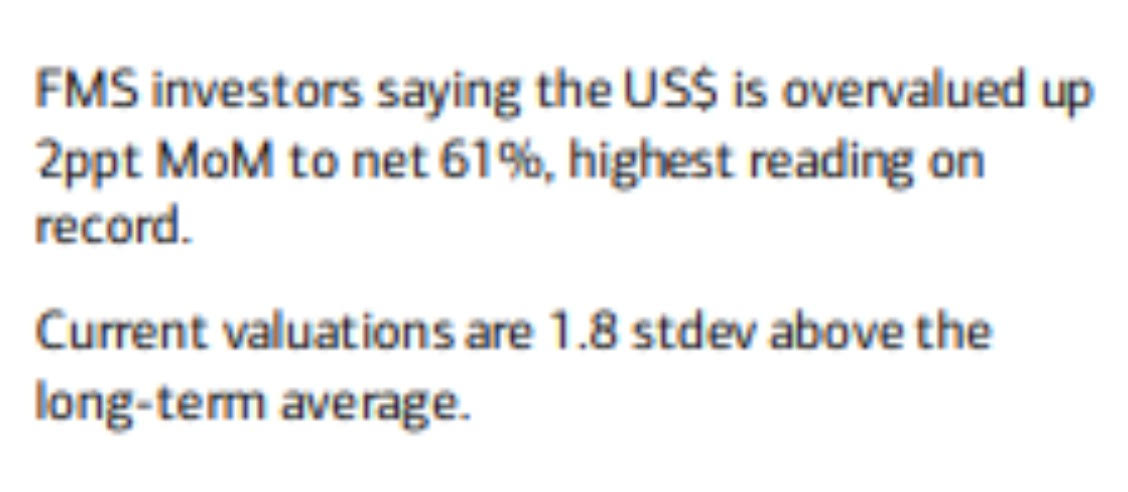

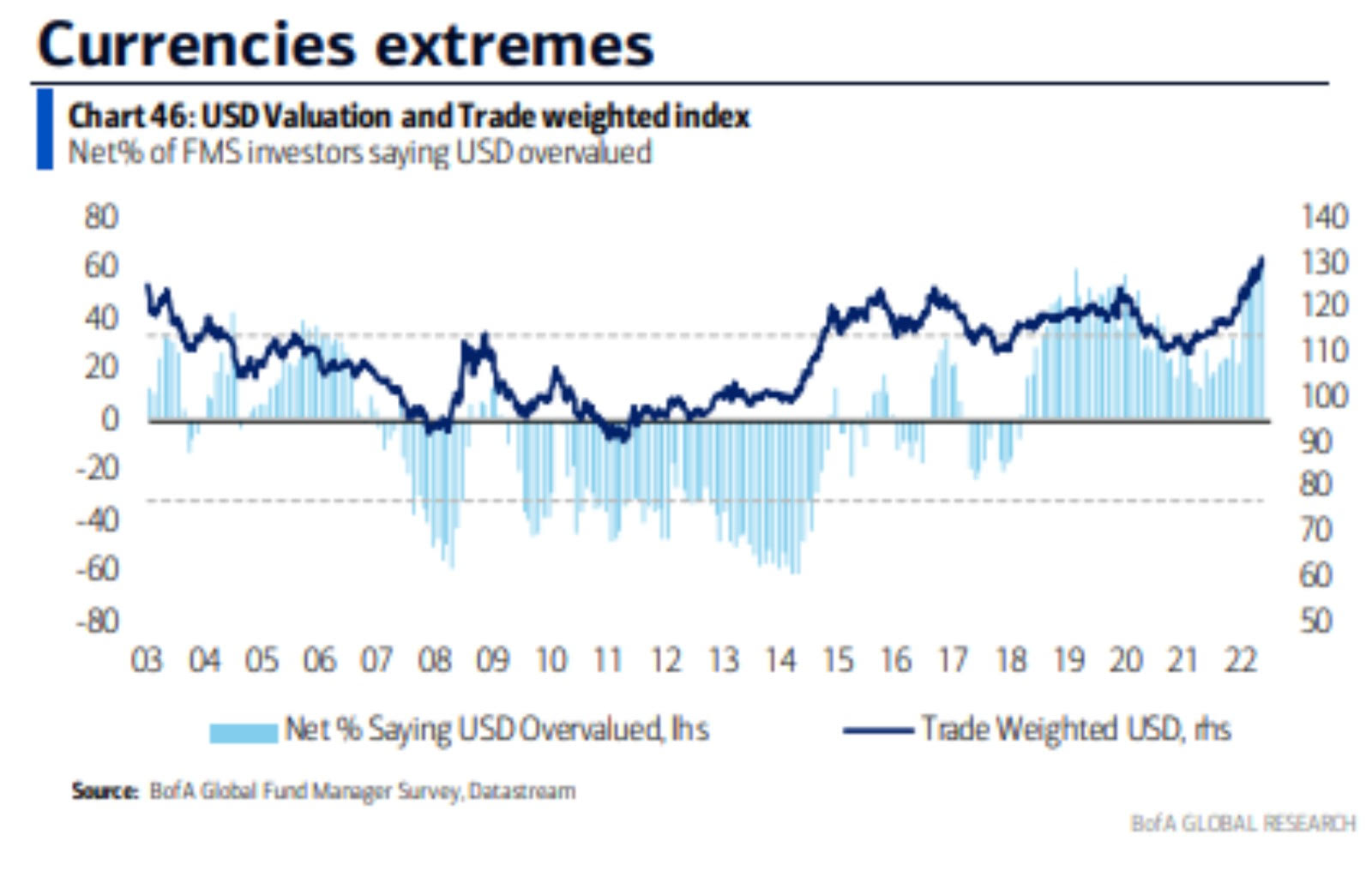

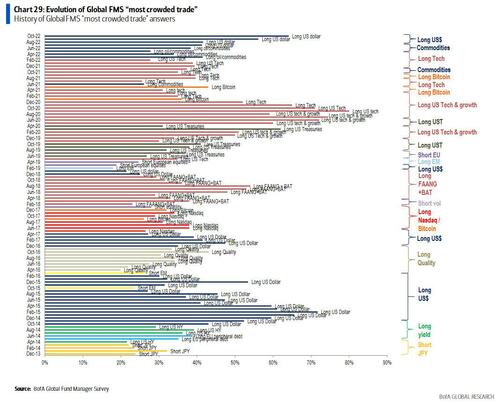

While I’ve spent a lot of ink and talk on Xi’s policy and the amazing underlying fundamentals of Alibaba, at the end of the day it comes down to 1 key factor (as to when the money finally starts rolling in on this investment): The US Dollar.

If it was only Xi’s crackdown/de-listing/earnings/etc, then why did the Emerging Markets index and major companies in Brazil (and throughout all emerging markets) crash along with BABA? Xi and his policies have little bearing on what happens to consumers in Brazil – or the rest of the countries in Emerging Markets.

The chart I put together below shows that both China Equities (BABA, KWEB) trade in direct correlation to Buffett Backed Brazil Equities (STNE, NU) and Emerging Markets (EEM) as a whole. It’s 100% a function of the Dollar. We are in a timely leveraged currency trade (that has embedded operating and valuation leverage).

When the dollar declines, BABA will soar – regardless of Xi.

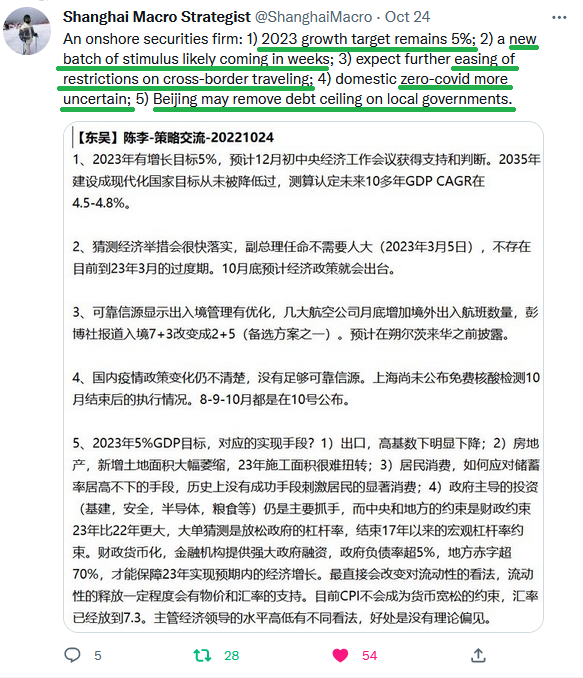

While nothing material will happen until the dollar sustains some weakness (sniffs out Fed hiking coming to an end in coming months), there may be some further good fundamental news on the horizon:

The above was posted on Monday. #3 was announced already today. #2 and #4 would be very welcome:

China Signals Easing of Covid-19 Restrictions for Foreign Businesses (WSJ)

China Plans to Increase International Flights From This Weekend (bloomberg)

JPMorgan’s Kolanovic Calls China Stocks Selloff a Buying Moment (bloomberg)

China equity selloff not on fundamentals creates opportunity – JPM (reuters)

Auto Supplier

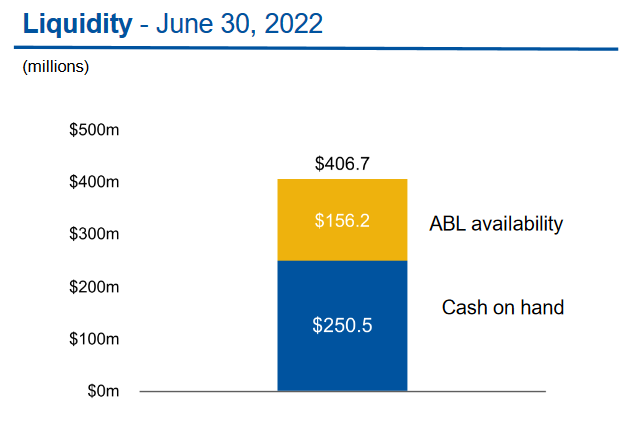

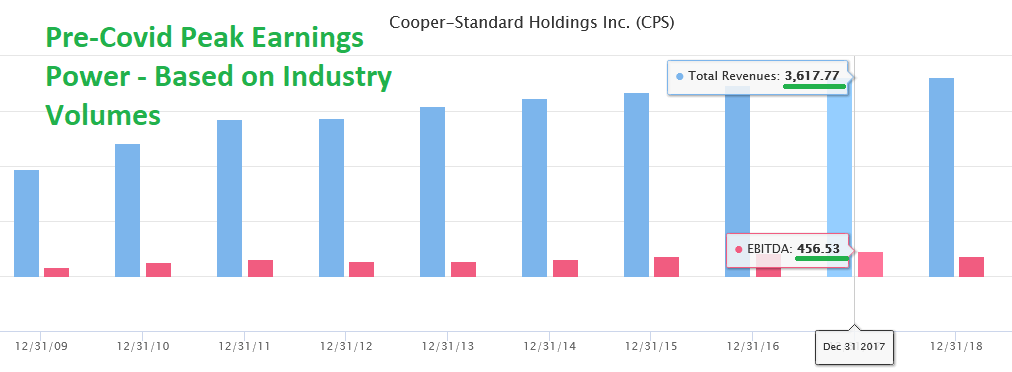

Another of our top three positions is an auto-supplier named Cooper Standard. We made our case for the stock several months ago (originally on Fox Business – “The Claman Countdown” June 7, 2022 with Liz Claman) and executed across accounts at ~$5.50 (it is now up ~52% as of yesterday’s close).

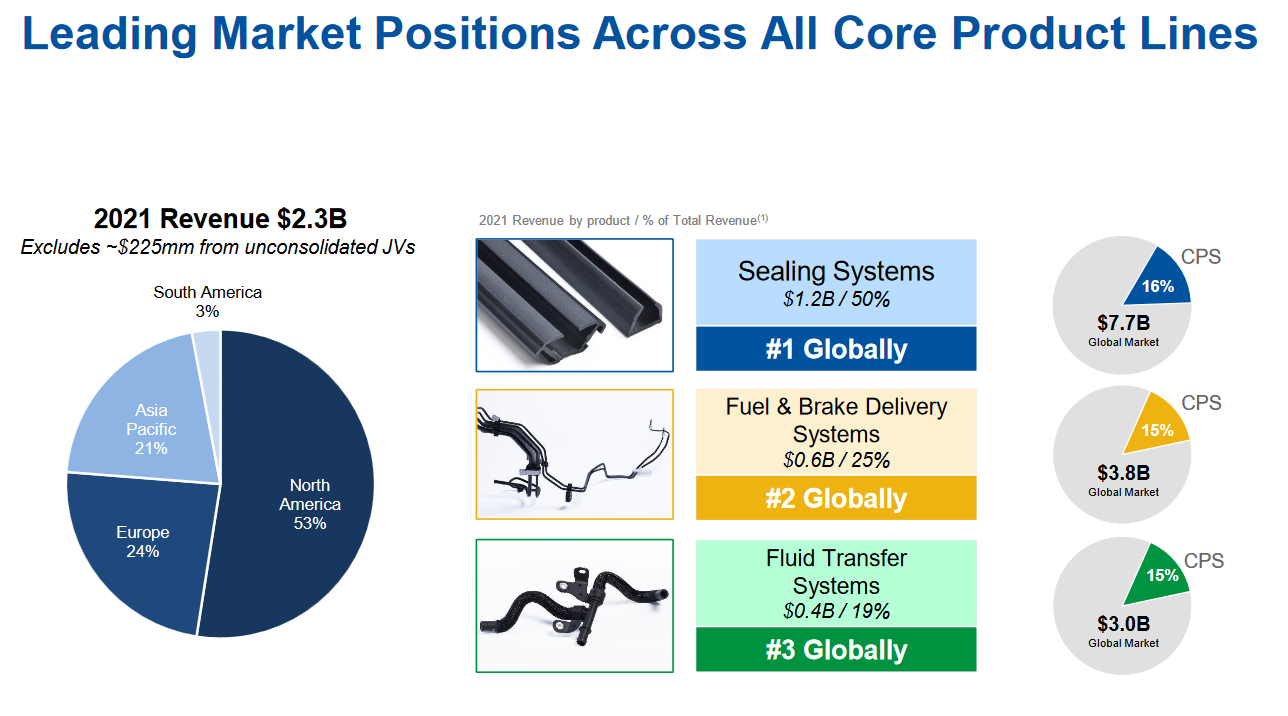

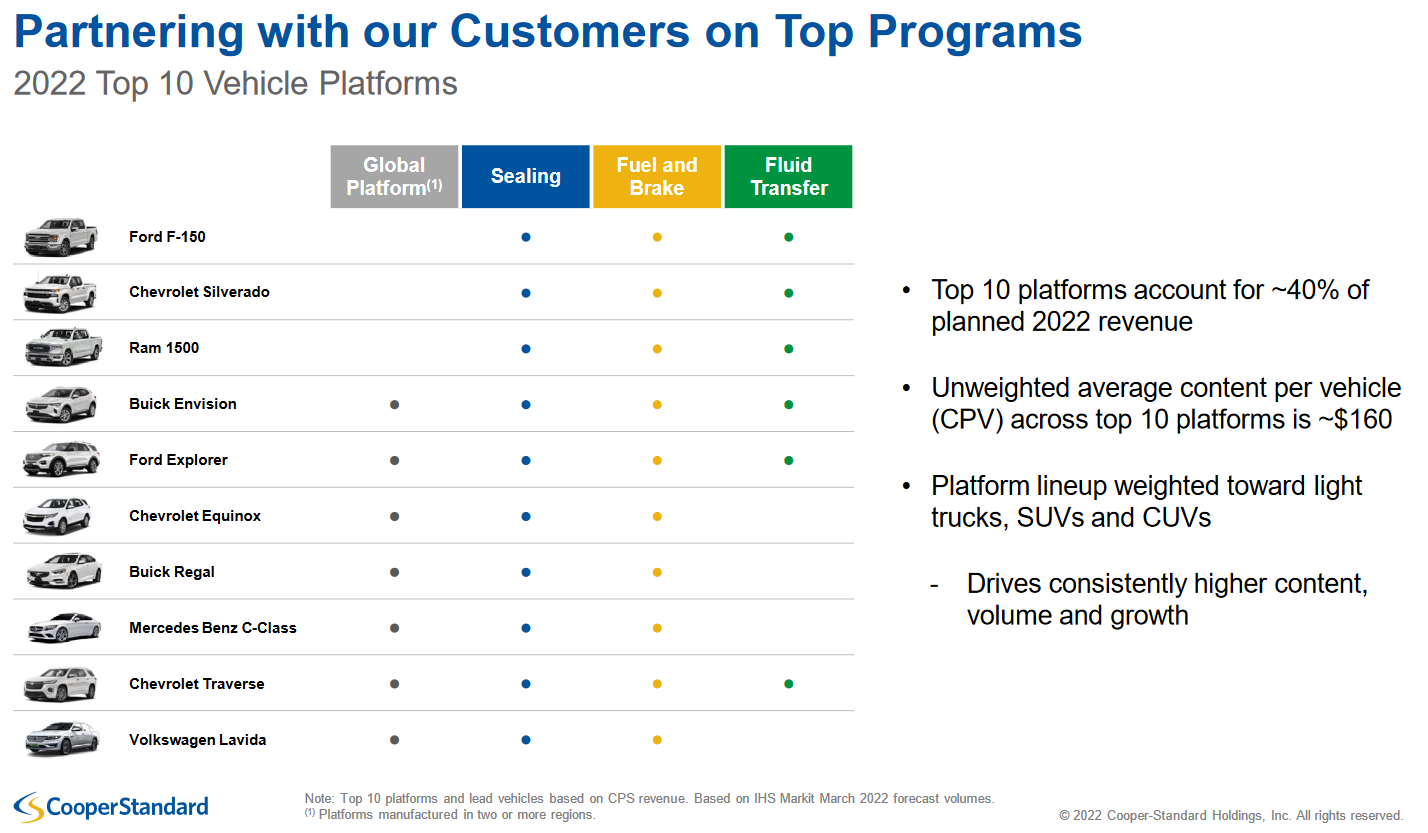

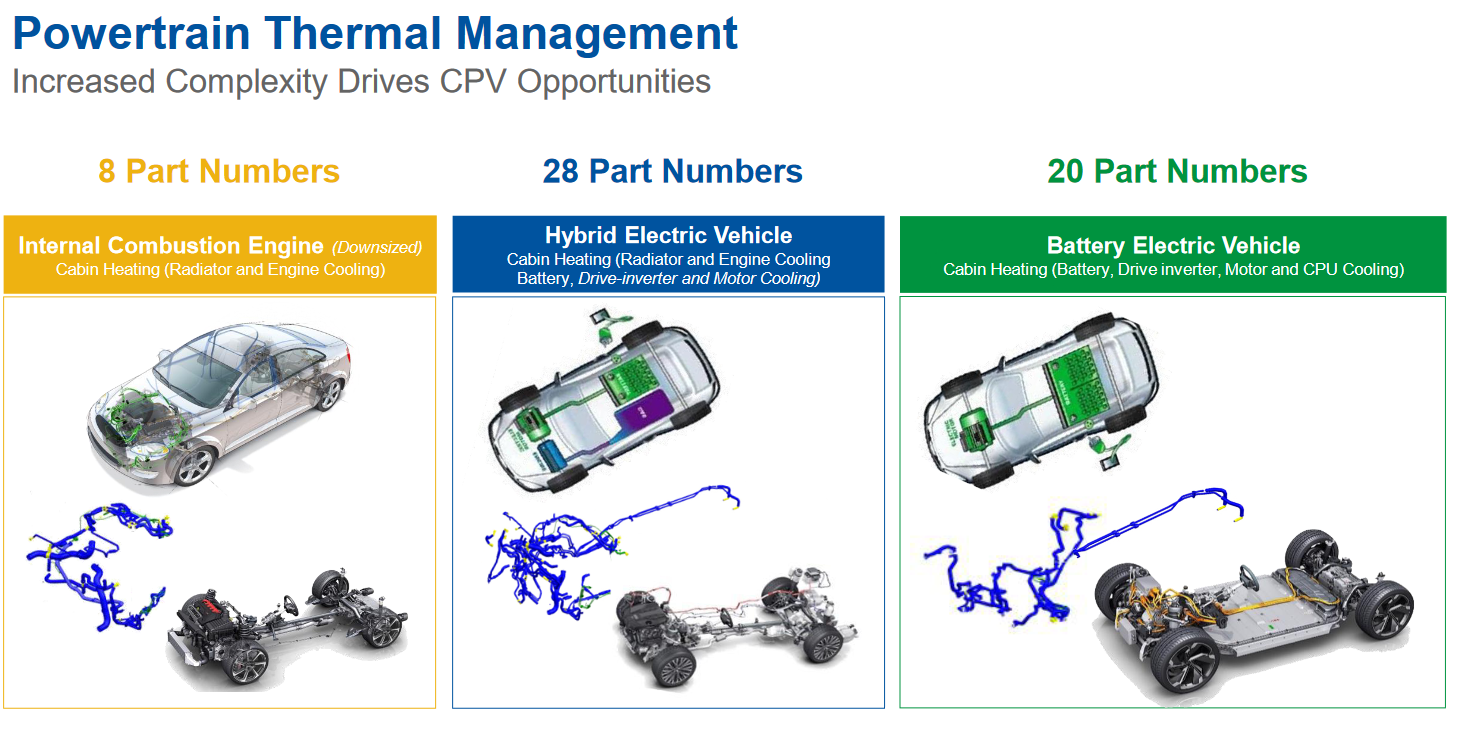

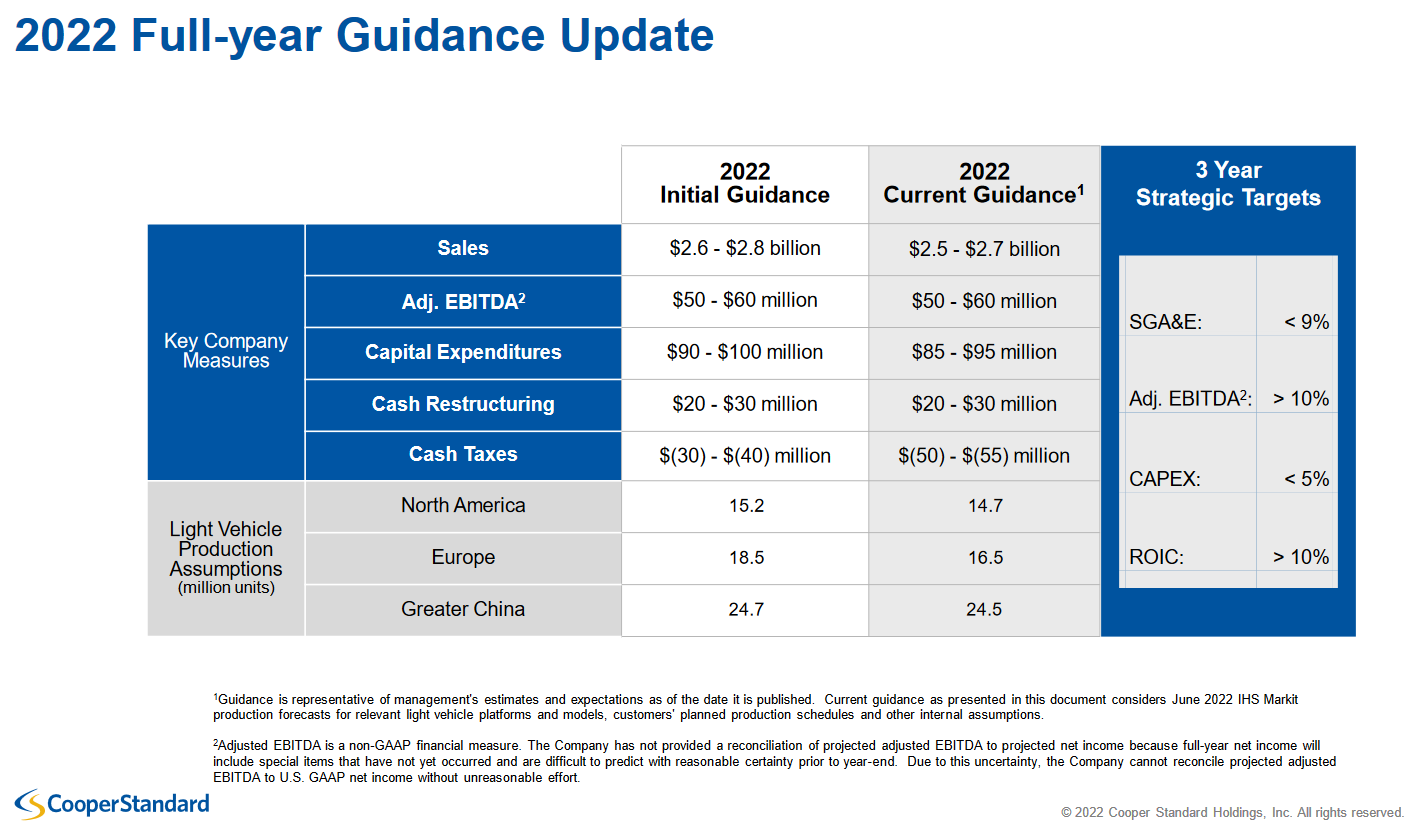

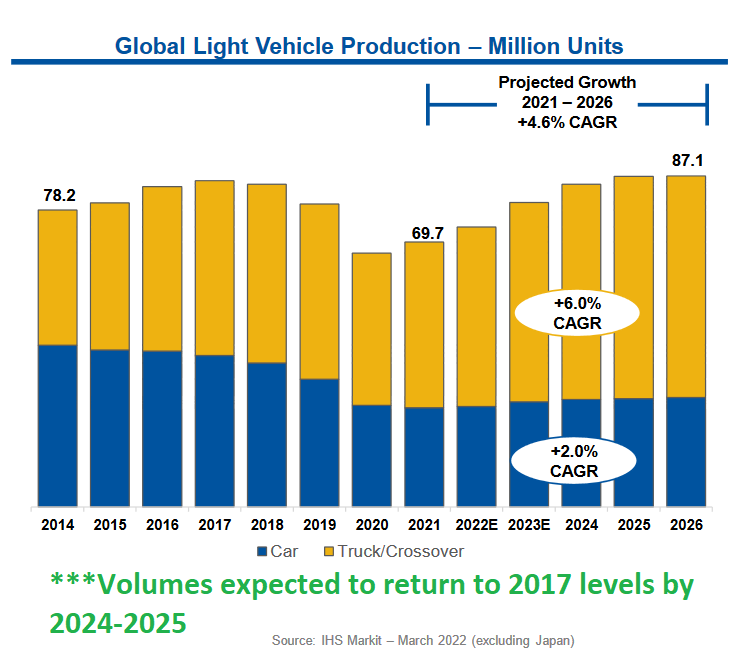

Here’s a little company background on Cooper Standard for newer readers:

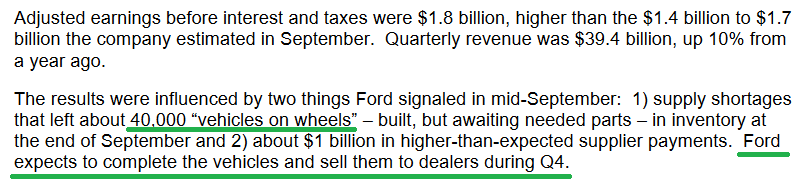

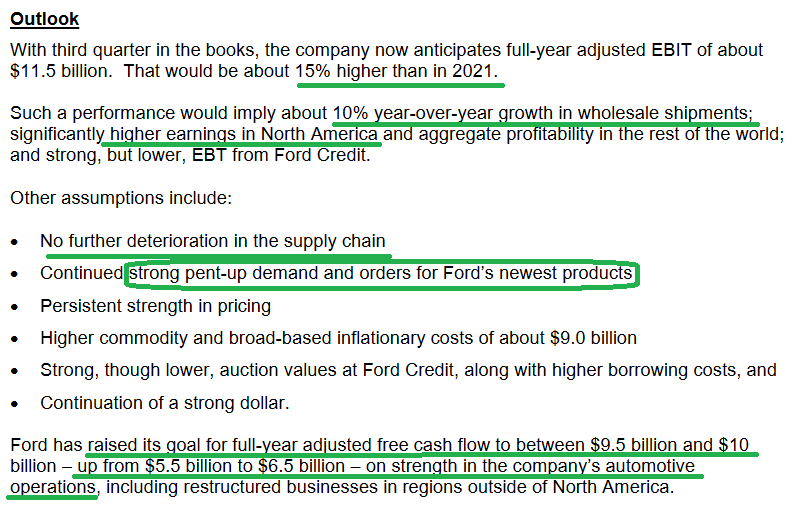

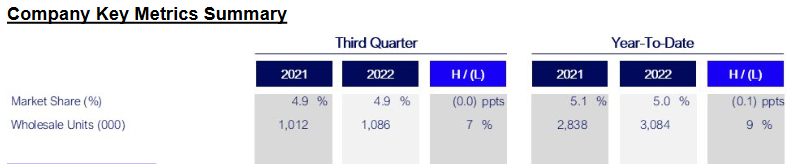

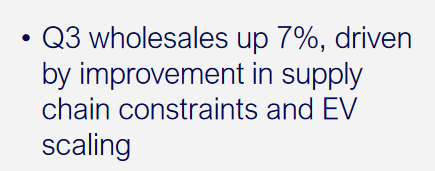

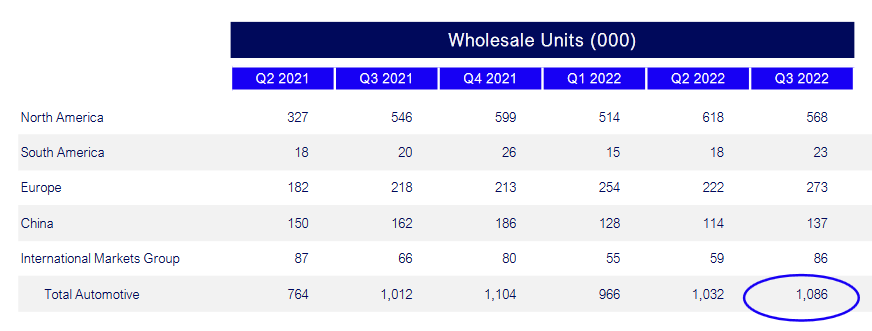

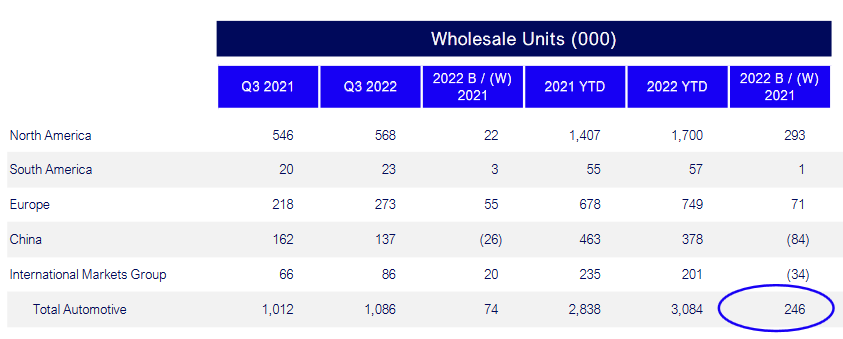

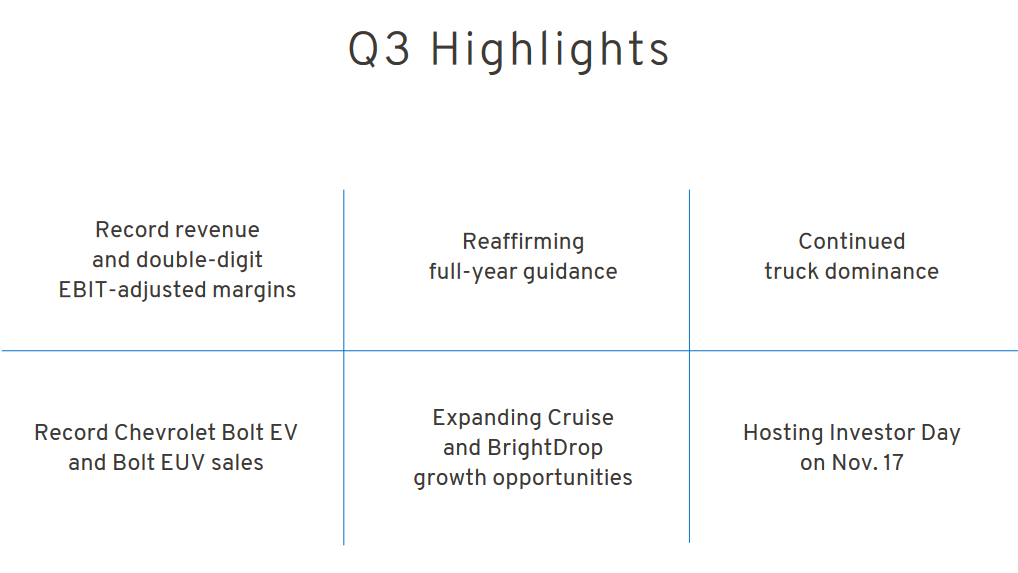

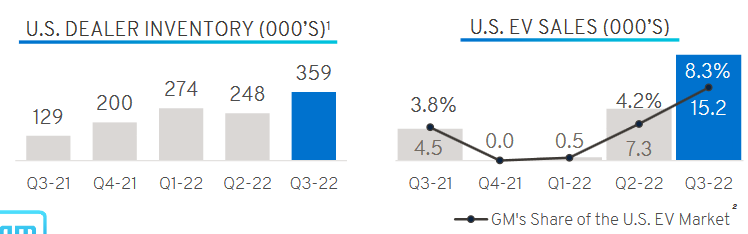

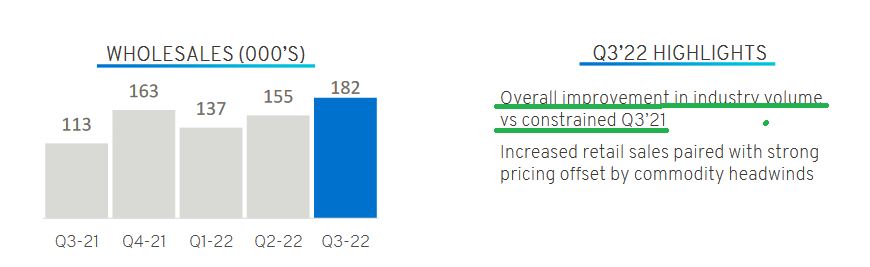

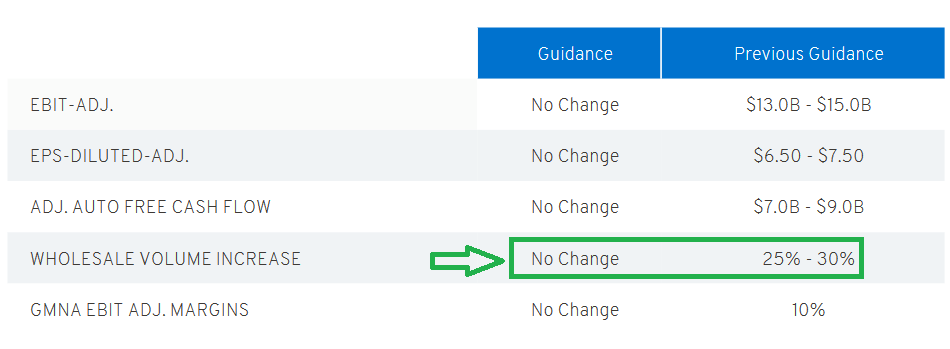

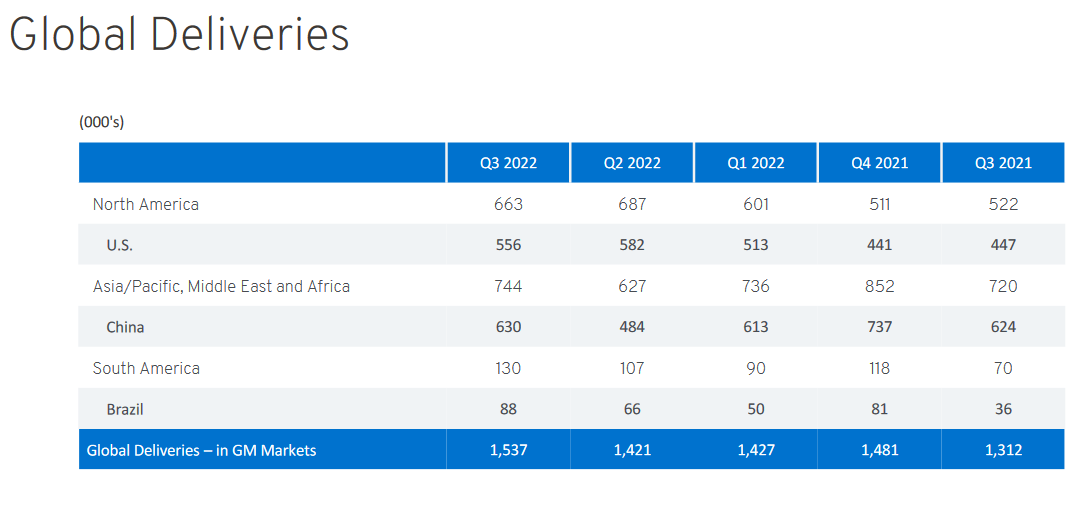

While the real catalysts will be refinancing and a continuation of their cashflow positive turn last quarter (now that auto-chips are flowing into the OEMs), we did receive good news from their two largest clients (GM and FORD this week) – and the stock showed come correlated buoyancy:

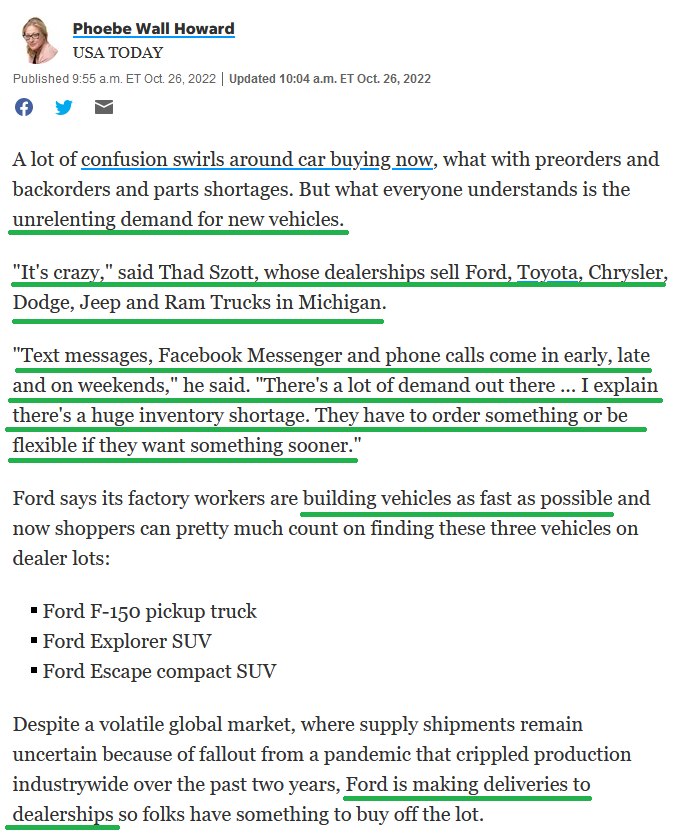

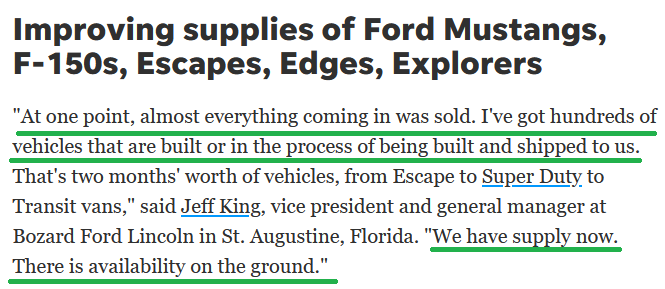

Ford:

GM:

Demand:

Full Article Here (usatoday)

Cooper Standard reports Q3 earnings on November 1.

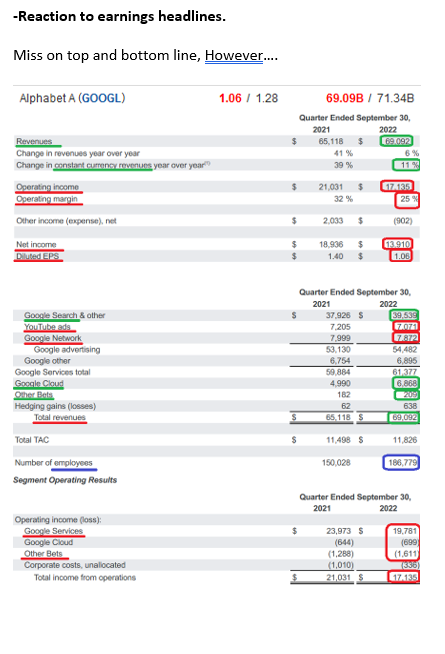

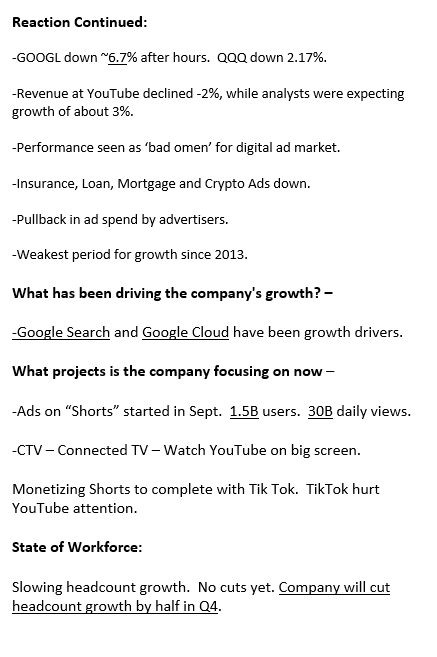

Google (Tech Earnings)

While everyone is glum about digital advertising, sometimes it makes sense to take a step back and look at the facts. I discussed just that with Phil Yin on CGTN America on Tuesday evening. Thanks to Phil and Ai Xing for having me on.

Notes ahead of the segment:

Now onto the shorter-term view of General Market:

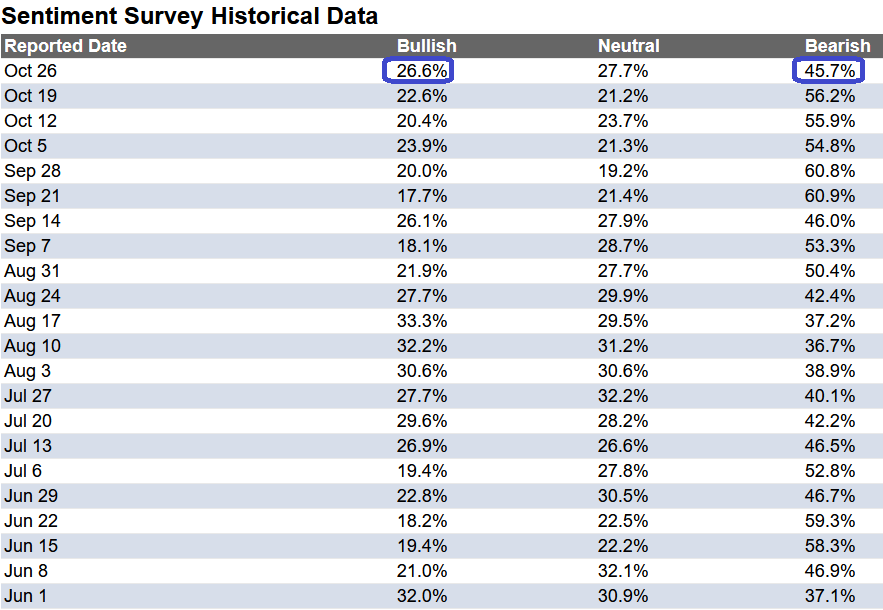

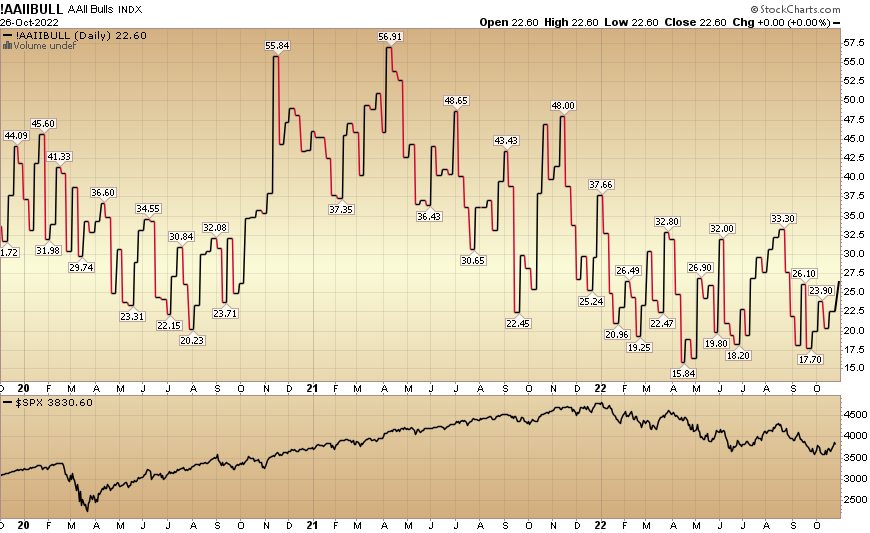

In this last week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 26.6% from 22.6% the previous week. The bearish Percent ticked down to 45.7% from 56.2%. Retail Sentiment is improving.

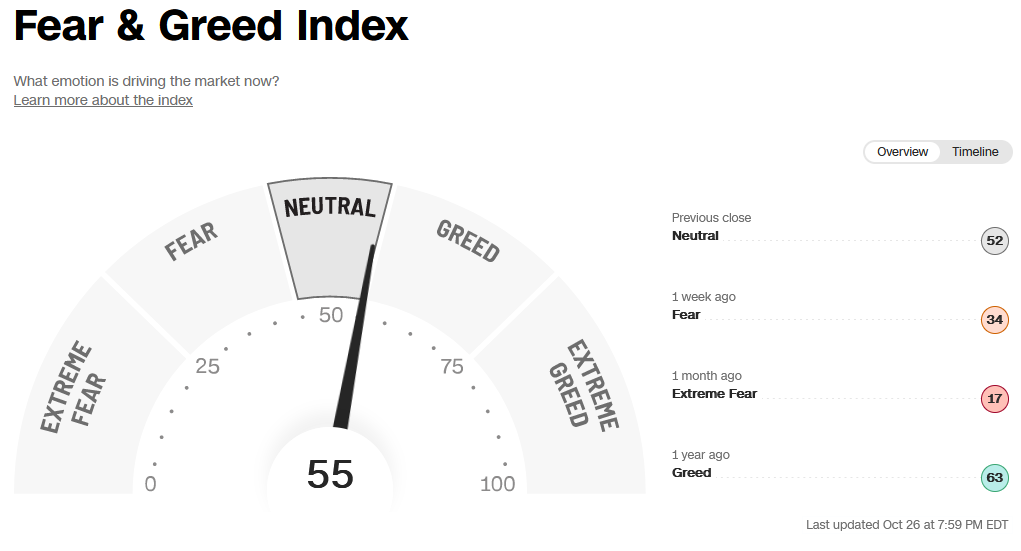

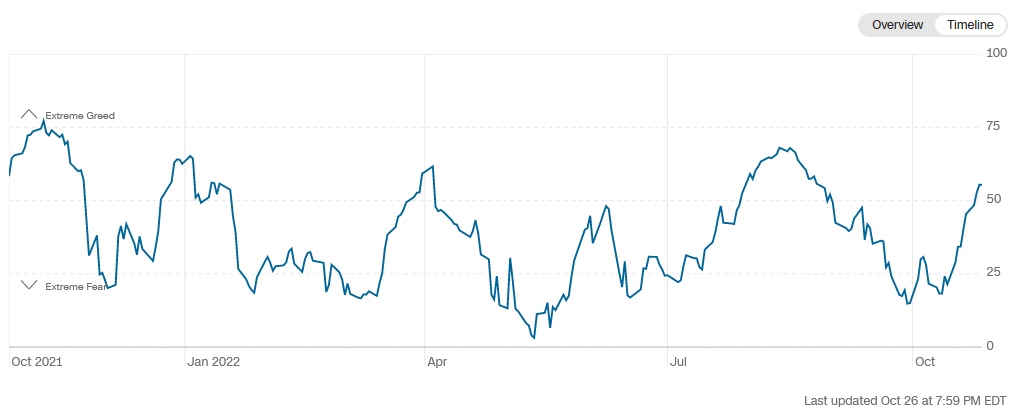

The CNN “Fear and Greed” rose from 34 last week to 55 this week. The sentiment is thawing. You can learn how this indicator is calculated and how it works here: (Video Explanation)

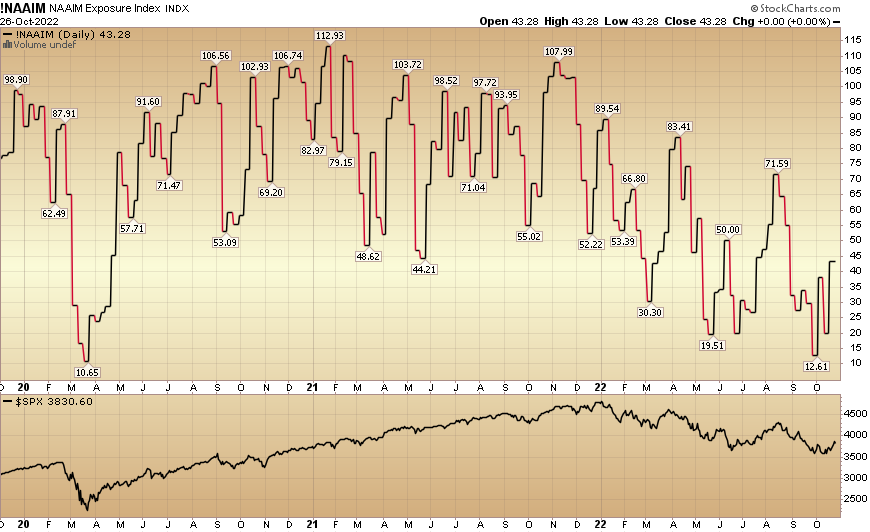

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 43.28% this week from 19.84% equity exposure last week.

Our podcast|videocast will be out on Thursday or Friday this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

More By This Author:

“What To Watch Now” Stock Market (And Sentiment Results)…

The “Fed Talk” Stock Market (And Sentiment Results)

Give Up On China? Stock Market (and Sentiment Results)…

Disclosure: Not investment advice. Visit Terms at HedgeFundTips.com