Is This Actually A New Bull Market? The Statistics Say Yes

(Click on image to enlarge)

Despite Friday's swoon, the S&P 500 is now up 26% from its October low. That's a new bull market... at least by most traders' standards. Underscoring the argument is the fact that the S&P 500 has also punched through the falling resistance line that steered it lower all of last year.

On the other hand, last year was a pretty rough rout. It's arguable the sheer scope and speed of the selloff set up this year's bounce without actually kick-starting a new bull market. That is to say, we may see even-lower lows ahead (and the Fed's threat of a couple more rate hikes to be imposed later this year only ups the likelihood of such weakness).

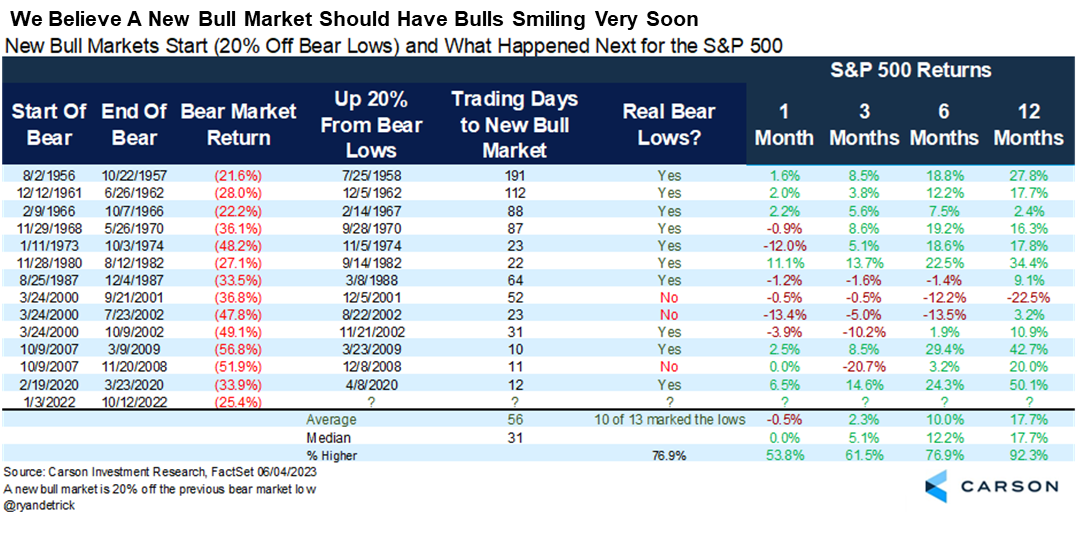

That's still the less likely outcome though, at least according to data dug up by Carson Group's chief strategist Ryan Detrick. He analyzed the last 13 times the S&P 500 logged a 20% gain up and off of a bar market low. Ten of those times, the market was even-higher still six months later. Twelve of those times, the S&P 500 was up some more a year after reaching the first 20% advance.

And these aren't small advances. The average six-month, post-20%-rally gain is 10.0%. The average twelve-month gain once the S&P 500 gains 20% from a bear market is 17.7%.

(Click on image to enlarge)

In other words, despite the naysayers, we probably really are in a new bull market.

That's not a reason to close your eyes to the potential risks here. Those three failures? Two of them took shape in the wake of the dot-com meltdown in 2000... a brutal bear market that (obviously) dished out a couple of bullish headfakes. The third one surfaced in 2007, when the subprime mortgage meltdown was in full swing.

And that's a bit of a red flag in and of itself.

See, volatile bounces during bear markets seem to be common now. Indeed, with the exception of the exceptional circumstances of the pandemic-prompted setback in early 2020, at least one bear-market-headfake seems to be expected. It may also indicate that traders' mindsets themselves are different now than they were then. Everything was slower then, and less volatile because the world didn't have access to 24/7 information at their fingertips.

Underscoring this worry is that the circumstances now are largely the same as they were during the past two true, cyclical and economically-driven bear markets. That is, inflation was and is uncomfortably high, but the Federal Reserve doesn't seem comfortable in raising rates any further for fear of pushing the economy back into a recession.

So what does a trader do here? Two things.

First, like it or not, until you clearly have a reason not to, following the market's long-term tendencies. In other words, play the odds. That means presume the recent 20% advance really does portend more gains ahead, marking the beginning of a new bull market.

Second (and in the same vein), assume the current momentum will remain in place until it's also clear it isn't.

It just so happens that in this instance, those two things lead you to the same conclusion-based decision.

With all of that being said, there's a third, almost-as-important action -- or maybe non-action for the time being -- to take at this time. That is, at least prepare for the possibility that we're due for a correction even if it doesn't fully reignite the bear market. Like we noted in this week's Weekly Market Outlook, any and all of all the indices' moving averages can and should serve as a floor here.

A brief blip may even be in the bulls' best interest at this time. The rally since the end of last year has traveled too far, too fast, with the S&P 500 soaring 12% in just the past five weeks. That's a lot, and it's arguably keeping a lot of would-be buyers on the sidelines. Just don't panic if we start to see such a pullback.

More By This Author:

Weekly Market Outlook - Last Week's Action Seals The Deal (Probably)Weekly Market Outlook - Running Out Of Steam

Weekly Market Outlook - Stocks Pull Off A Huge Last-Minute Win