U.S. Markets: Is The Correction Over?

Last week, we noted that a short-term stock rally was likely after the 5.5% selloff from the recent peak. To wit:

“While it took longer than expected, that correction process arrived last week and continued earnestly, with the market falling to the 100-DMA. With the market short-term oversold, a reflexive rally in the next week is likely, with the 50-DMA being notable resistance. Investors should use any market rally toward 5100 to rebalance risk and hedge portfolios.“

On Friday, following blowout earnings from Google and Microsoft, the market did just by challenging the intersection of the 20- and 50-DMA. With the market not overbought yet and the MACD “buy signal” approaching, the bullish case is building. However, the initial resistance of the 50-DMA could prove challenging.

(Click on image to enlarge)

So, is this a “suckers rally” where the market fails and leads to a more significant decline or just a correction that eventually resolves itself to continue the bullish trend that began in November.

That is the topic we will delve into today.

Need Help With Your Investing Strategy?

Are you looking for complete financial, insurance, and estate planning? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

Sucker Rally Or Return Of The Bulls

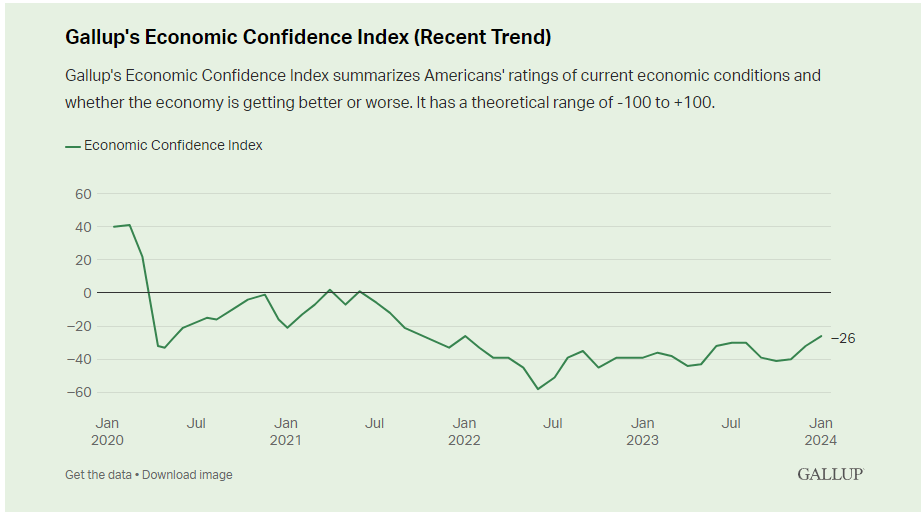

As noted above, the 5.5% decline from the recent market peak brought the bears back from hibernation this past week. From the start of “World War 3,” concerns about inflation and Fed policy had investors running for cover. A recent Gallup poll showed the problem:

“The latest index score, from a Jan. 2-22 poll, is up by six points from last month and 14 points since November to -26, the highest since January 2022. The index has been in mostly negative territory since the beginning of the pandemic in 2020. It fell to -58 in June 2022, marking the worst reading since the Great Recession, as inflation reached its highest point in more than 40 years and gas prices set new records. Since then, it has fluctuated, showing modest signs of improvement last summer before worsening again.”

(Click on image to enlarge)

Interestingly, despite the rather gloomy outlook on the economy, they have been exceedingly bullish about the stock market since November. The remaining question was how long before the two views merged.

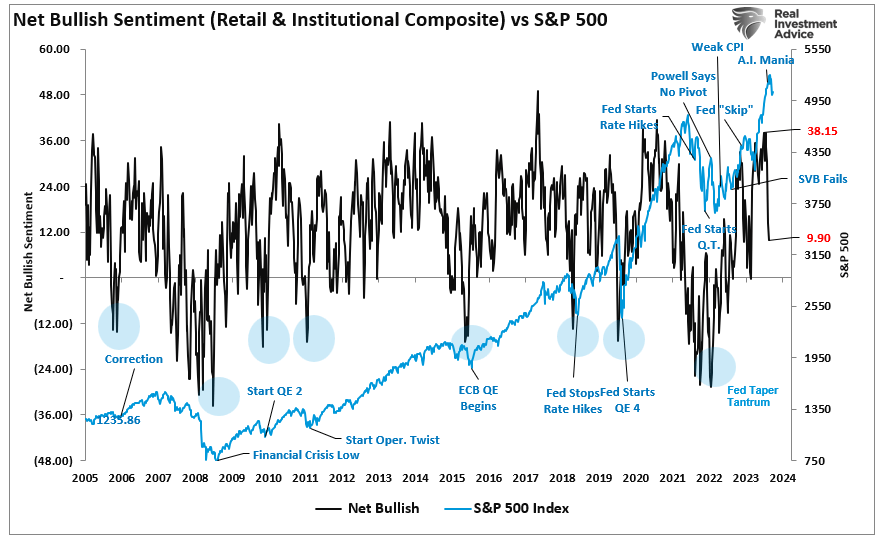

Unsurprisingly, investors quickly reversed their bullish sentiment as stock prices ebbed. The chart below, from last week, combines retail and professional net bullish sentiment. The net difference between bulls and bears dropped from 38.15 to 9.9 in two weeks. The previous drop between July and October last year was similar and marked the bottom of the correction.

(Click on image to enlarge)

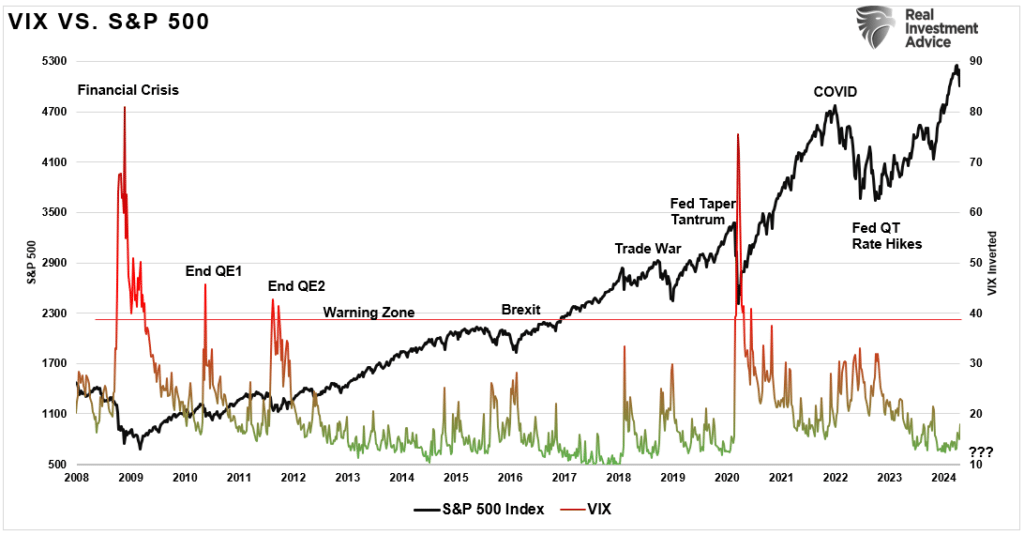

However, as sellers emerged, the market decline remained quite orderly. While the volatility index did increase, it did so modestly, suggesting there was no “panic selling” in the market.

(Click on image to enlarge)

As the market decline broke through the 50-DMA, the bears emerged from hibernation with messages of doom. It was rough, as markets declined for six consecutive days, taking the market darlings down. It seemed as if the bears had regained control of the narrative.

However, with the markets oversold in the short term, we suggested that investors not panic and sell as a “reflexive rally” was likely from these levels. As noted in “Just A Correction:”

“Given the significant reversal in sentiment and short-term oversold conditions, we highly suspect the markets will provide a reflexive rally soon. However, with the number of bullish investors who got “trapped” in the selloff, any rallies will likely be met with further selling.”

But therein lies the risk. Is rally early this week that reflexive rally that leads to a better entry point for investors, or is it a “sucker rally” leading to a more profound decline.

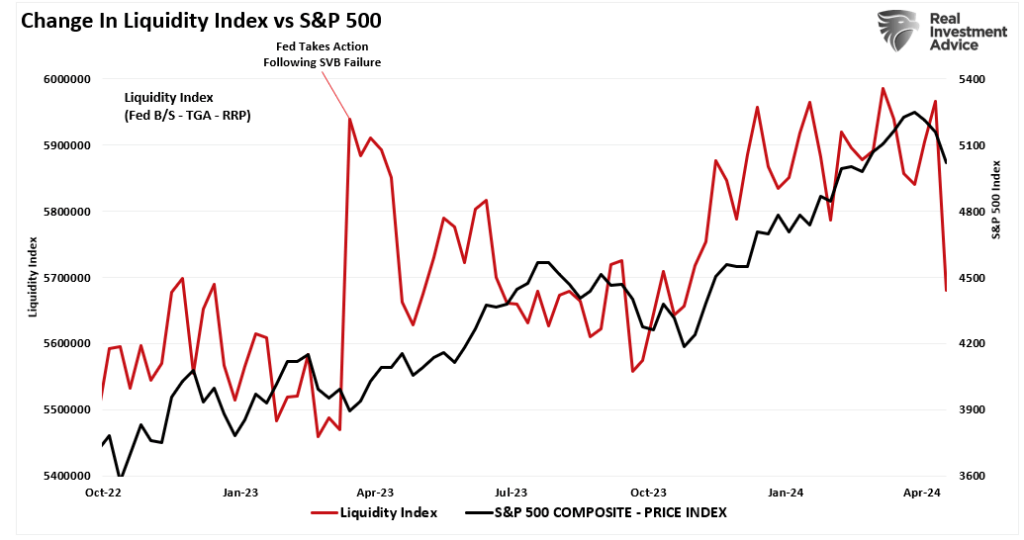

A Liquidity Boost Coming?

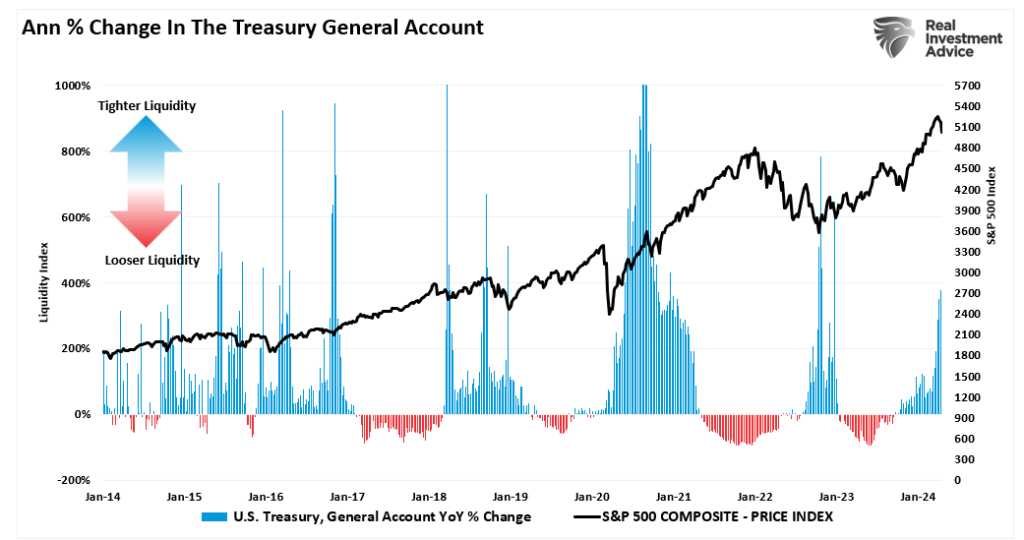

One of the factors contributing to the recent selloff, besides just the reversal of ebullient investor sentiment, was a sharp contraction in liquidity. As shown in the Liquidity Index chart below, while liquidity tends to ebb and flow from one week to the next, the trend has supported recent market gains. However, last week, there was a sharp contraction in liquidity coinciding with the contraction in asset prices.

(Click on image to enlarge)

The critical factor in that liquidity change was a sharp increase in the Treasury General Account (TGA). While the Fed’s balance sheet declined from $7.43 trillion to $7.40 trillion, the TGA surged from $675 billion to $930 billion last week. Such was due to the relatively large auctions by the Treasury to fund current expenditures.

(Click on image to enlarge)

As Alfonso Peccatiello recent noted:

“Over the next 6 months, we might experience (another) huge liquidity injection in markets and the economy! How. By having Yellen drain the Treasury General Account (TGA).

You can think of the Treasury General Account (TGA) as the checking account the US Government holds at its bank – which is the Federal Reserve. Every time the US government has accumulated excess money through taxes or bond issuance that it doesn’t intend to immediately channel into spending, they will park it at the TGA account at the Fed.

As you can see from the chart above, the TGA generally sits around 250-350 USD billions and it occasionally increases towards USD 1 trillion only to be subsequently drained back to its standard size. After the ongoing tax season, Yellen will soon have around USD 1 trillion in the TGA – that’s quite high, and hence we should expect a drainage to follow.

On top of it, the US debt ceiling suspension only lasts until the end of 2024 and at some point the US will ”run out of room” to issue new bonds which means the only way to facilitate spending will be through using the money sitting in the TGA – great political cover to move ahead with a TGA drainage.

But why does draining the TGA matter that much for markets and the US economy?

That’s because draining the TGA is akin to throwing fresh money at the economy (similar to deficit spending) and also adding new liquidity to the interbank system (similar to QE).”

Of course, as that money finds its way into the economy, it also supports company earnings growth, leading to higher asset prices.

As such, the potential liquidity boost will likely contain the recent correction, keeping it from becoming a “sucker’s rally” to a more considerable decline. At least for the next few months, anyway.

The Return Of Buybacks

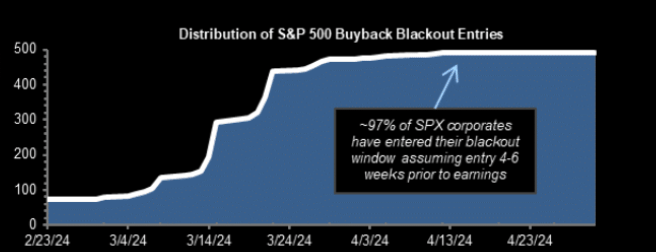

The second reason why this is likely not a “sucker’s rally” is that the blackout window for corporate share buybacks is close to ending.

Before the current correction, we wrote:

“As we have discussed for the last month, the market is exceptionally bullish, extended, and deviated from long-term means. With the beginning of the “buyback blackout,” removing an essential buyer of equities is a risk worth watching.” – Buyback Blackout – March 19th

As shown, we are nearing the end of the blackout period, which will begin to reopen in May.

(Click on image to enlarge)

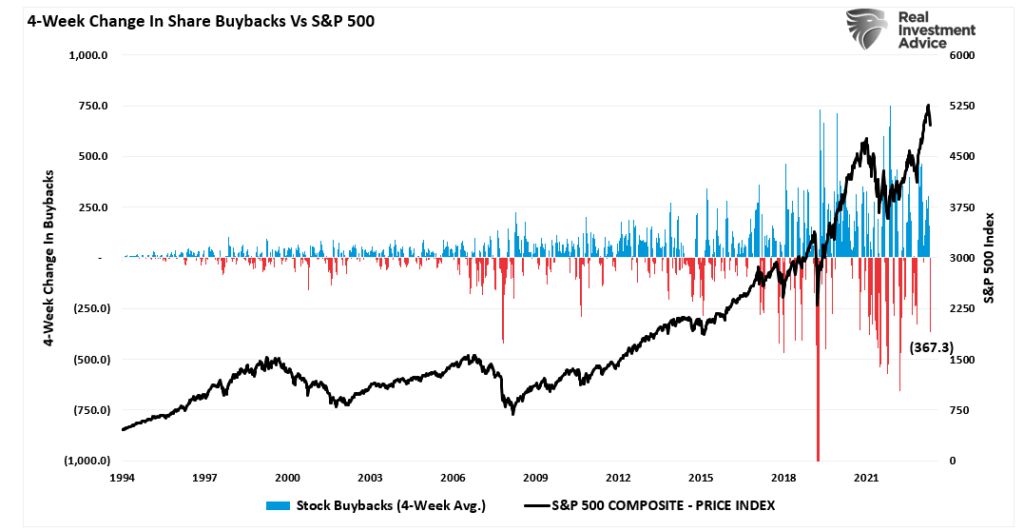

Unsurprisingly, that blackout window coincided with a sharp contraction of more than $367 billion in buybacks over the last 4-weeks.

(Click on image to enlarge)

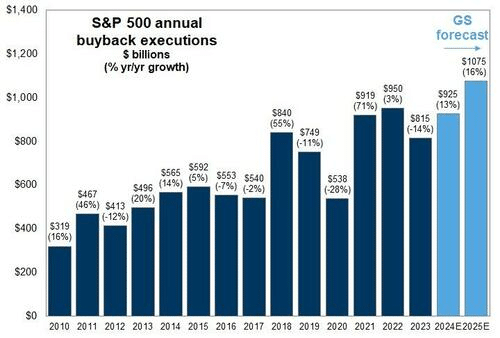

However, corporate share buybacks will resume in the next couple of weeks, and with more than $1 trillion slated for 2024, many buybacks remain to complete. Such is particularly the case with Google adding another $70 billion to that total.

(Click on image to enlarge)

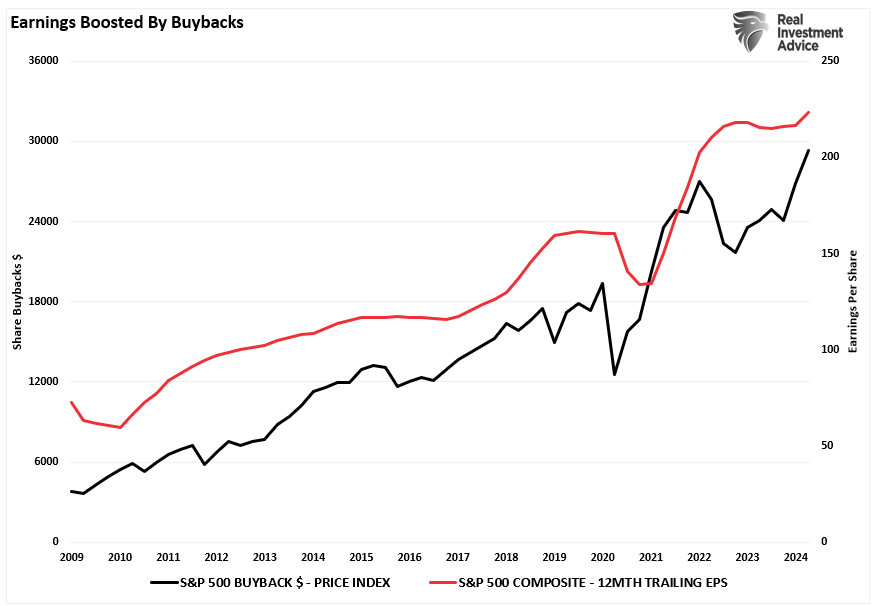

Furthermore, buybacks continue to increase as earnings rise.

(Click on image to enlarge)

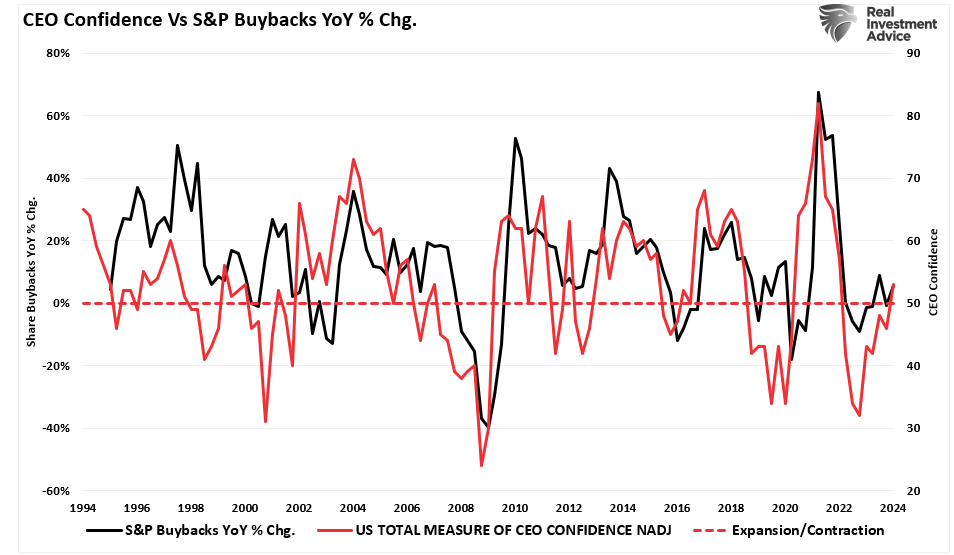

With robust economic activity supporting earnings growth, that improvement boosts CEO confidence. As CEOs are more confident about their business, they accelerate share buybacks to increase executive compensation.

(Click on image to enlarge)

The boost of liquidity from buybacks will likely provide a floor below the market, further limiting the risk of a “sucker’s rally.” Such doesn’t mean the current correction doesn’t have more work to do. However, it is unlikely that it will resolve into something more significant.

At least for now.

But as is always the case, there are possibilities and probabilities. Preparing for an unlikely but always possible event is always a good idea.

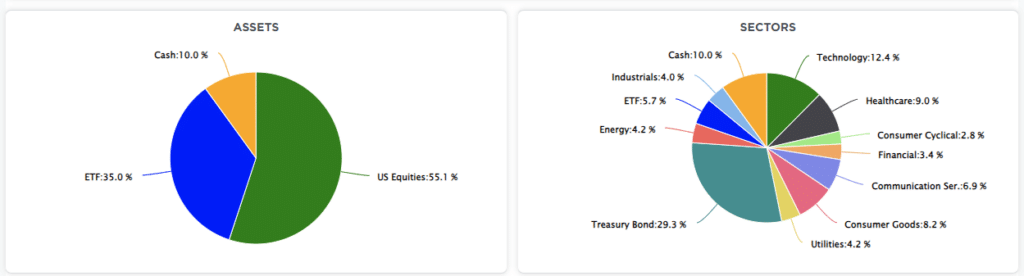

How We Are Trading It

This past week, we got a lot of data from GDP to PCE, which provided very different messages to the market. Furthermore, Meta showed little tolerance for disappointment in earnings on Wednesday.

As we stated last week, this remains a normal and healthy correction process and will unlikely devolve into something more egregious. Therefore, it is critical to continue making minor portfolio adjustments and looking for oversold opportunities to add exposures as needed.

A more significant correction will eventually occur, but given the underlying bullish sentiment, it is unlikely now. Things can certainly change; if they do, we will evolve accordingly.

(Click on image to enlarge)

More By This Author:

Meta And Tesla Show Technical Trump Narratives

Retail Sales Data Suggests A Strong Consumer Or Does It

Treasury Cash Soars Providing A Liquidity Reprieve

Disclaimer: Click here to read the full disclaimer.