Tuesday, July 2, 2024 7:50 AM EST

Intel’s share prices have been losing out to red hot gains in Nvidia. According to Bloomberg Intel’s sales are projected to end 2024 with $20 billion less revenue than it had in 2021. This is in stark contrast to Nvidia’s sales which are set to double and AMD sales are projected to grow more than 10%. Intel has been the market leader in the computer industry for many years, but now it is losing out to rivals.

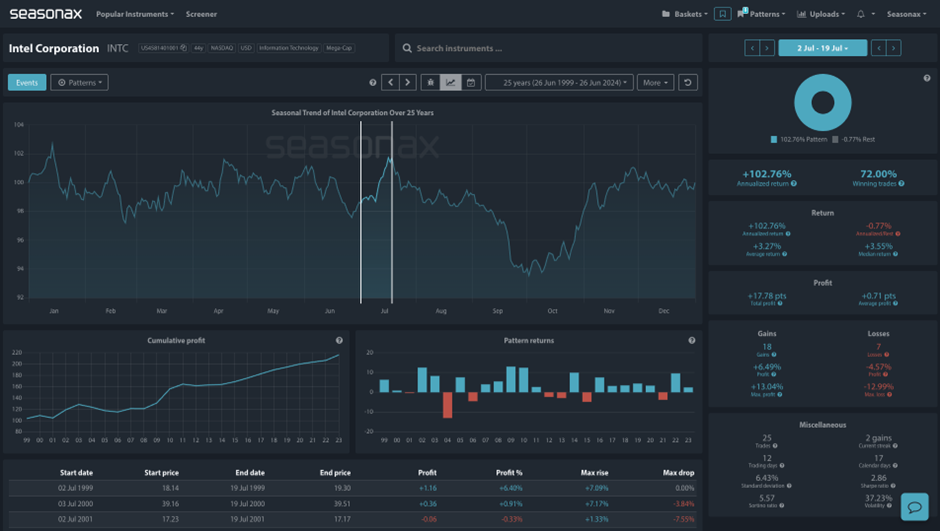

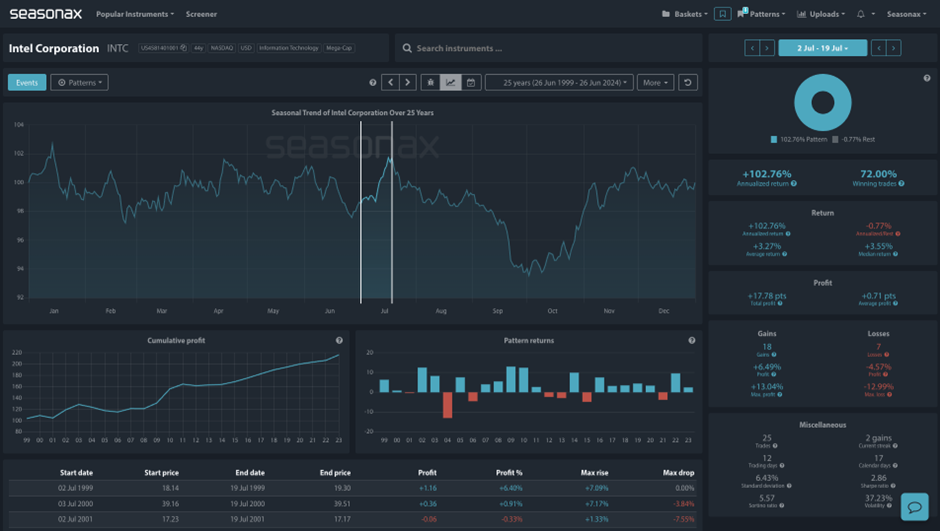

On top of this we can see Intel’s price action is consolidating into a narrow, sideways range. Do the seasonal’s provide any opportunities here? Well, over the last 25 years, between July 02 and July 19, Intel share prices have risen 72% of the time with an average return of 3.27%. So, a summer break out of the recent range could be a possibility.

(Click on image to enlarge)

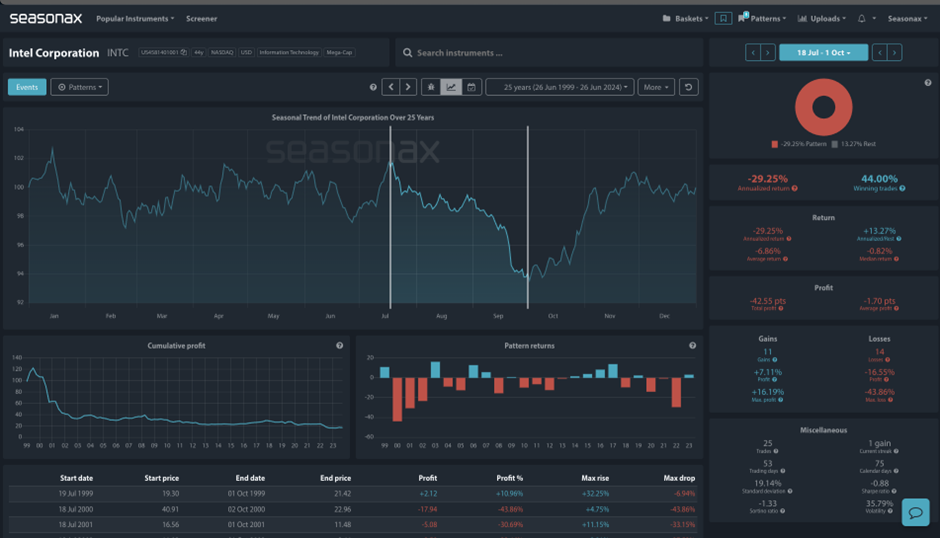

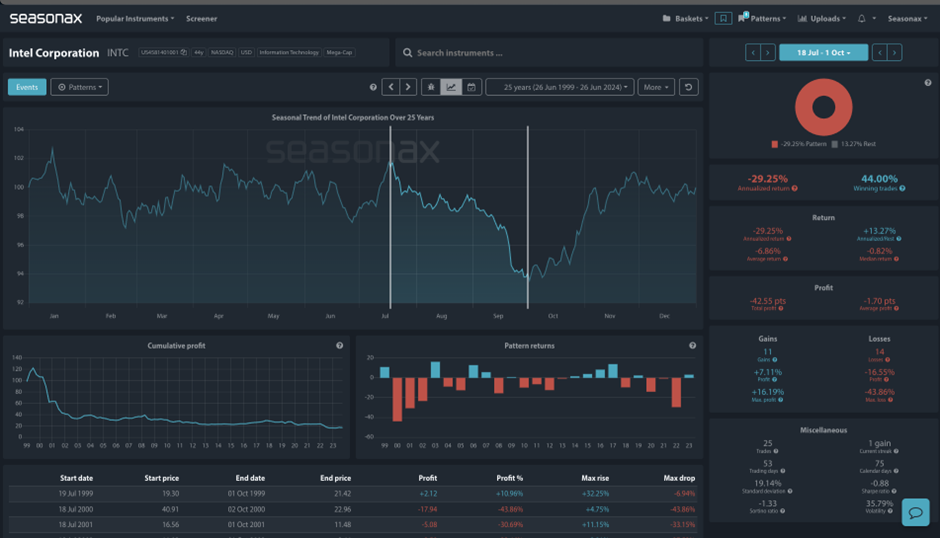

However, there is also a weaker period immediately after this seasonal period of strength.

(Click on image to enlarge)

Technically, we can see that Intel is stuck in a narrow daily range after sharp falls in April as it’s rivals snap up gains.

(Click on image to enlarge)

The major trade risk here is that previous price patterns do not necessarily repeat themselves each time.

More By This Author:

Hot Stocks For The Hot Summer What Seasonal Clues Do We See Ahead Of The US CPI Print?Will The Nasdaq Rise Into The Fed Meeting On Wednesday?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

less

How did you like this article? Let us know so we can better customize your reading experience.