Is A Highly Valued Stock Market A Warning Or The New Normal?

Image Source: Unsplash

The legendary investor Sir John Templeton famously warned: “The four most dangerous words in investing are: ‘This time it’s different.'” The caveat is once again topical as the stock market continues to rise despite high valuations. The rationale: artificial intelligence has changed the game.

The reasoning outlined in some corners is that AI will generate a hefty increase in economic productivity, forging new markets and ushering a golden age of opportunity and profits. On that basis, the case for a higher market valuation is warranted.

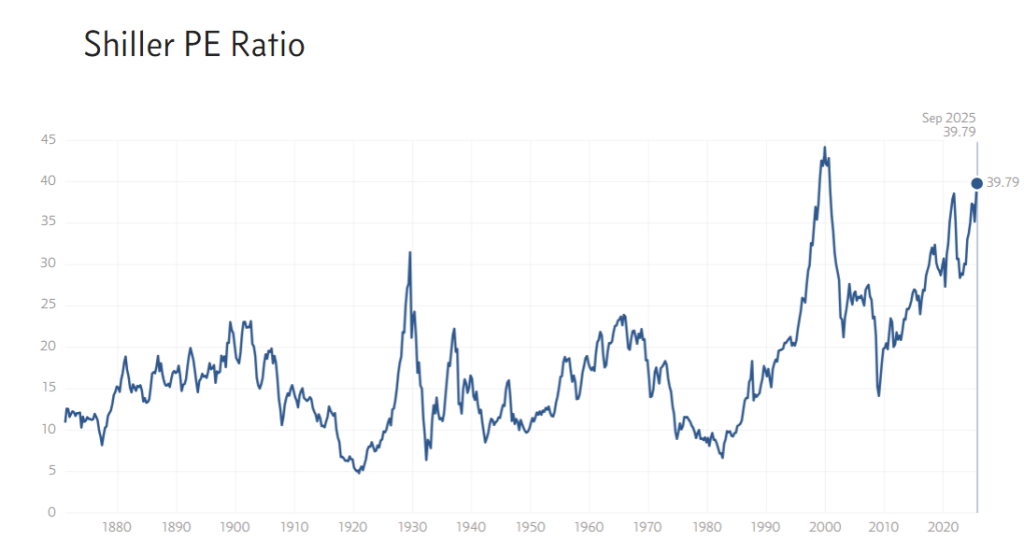

Equity valuation is certainly lofty. The Shiller CAPE Ratio, for example, is approaching a record high, which is no trivial affair for data that reaches back to 1871.

Federal Reserve Chairman Powell weighed in this week, noting: “Equity prices are fairly highly valued.” Lest anyone thought he was issuing a macro warning, he added that “it’s not a time of elevated financial stability risk.”

We’ve been here before, of course, and it usually ended in tears for stocks. Reversion to the mean doesn’t operate like clockwork, but trees don’t grow to the sky either, or so history reminds. One of the more notable instances of incorrectly arguing that regime change favored the bulls: Yale economist Irving Fisher’s ill-timed 1929 pronouncement that stocks had reached a “permanently high plateau.” A few days later, Wall Street suffered a devastating stock market crash.

Let’s be clear: 2025 is not 1929, for many reasons, and so comparisons between now and then are thin, if not totally irrelevant. This time could be different, but it could also turn out to be another bubble. Nobody knows. That’s worth repeating: Nobody, which includes you and me, knows what will happen. And so the question of whether the high valuation in stocks is defensible, or not, is surely germane.

Bank of America analysts, led by Savita Subramanian, argue that equities deserve a higher premium. In a research note sent to clients yesterday they write: “The index has changed significantly from the 80s, 90s and 2000s. Perhaps we should anchor to today’s multiples as the new normal rather than expecting mean reversion to a bygone era.”

Unsurprisingly, such thinking is far from the consensus view. Ron Albahary, chief investment officer at LNW in Philadelphia, is among the skeptics, telling Reuters yesterday:

“With the S&P pricing in 23-24 times expected earnings and expectations priced into that multiple of about 15% annualized earnings growth over the next five years, that sounds pretty rich to me. So not that we’re market timers at all, but the idea that people might be using this, using the Fed’s comments, Powell’s comments as just a reason to trim back a little bit makes sense to me.”

How should investors navigate between the 21st century financial version of Scylla and Charybdis? In the ancient Greek myth, Odysseus must sail through narrow, dangerous waters and avoid the monsters lurking below. The key takeaway: Sometimes there are few, if any, good options, and so the best course of action is to opt for a lesser evil.

All of which suggests that the standard advice applies with regards to the stock market. The future, after all, is still uncertain, which suggests it’s timely to refocus on what you can control and manage. If your US equity allocation is well above target weight, for instance, the case for rebalancing back to or near the target is compelling. Holding other asset classes and perhaps owning a tactical strategy or two that can react to changes in market conditions is also prudent.

Ultimately, designing and managing a portfolio that’s customized for your particular set of expectations, risk tolerance, time horizon, etc., are essential facets of money management. One size never fits all, even if we’re entering a new, golden age of AI.

Sure, you’ve heard this before, and there’s a reason: Good advice transcends the trend du jour. Or as I like to think of the standard portfolio advice: It’s the worst guidance available… except when compared with everything else.

More By This Author:

Macro Briefing - Wednesday, Sep. 24

US Q3 GDP Nowcasts Indicate Solid Growth After Fed Rate Cut

Macro Briefing - Tuesday, Sep. 23

Disclosure: None.