Macro Briefing - Wednesday, Sep. 24

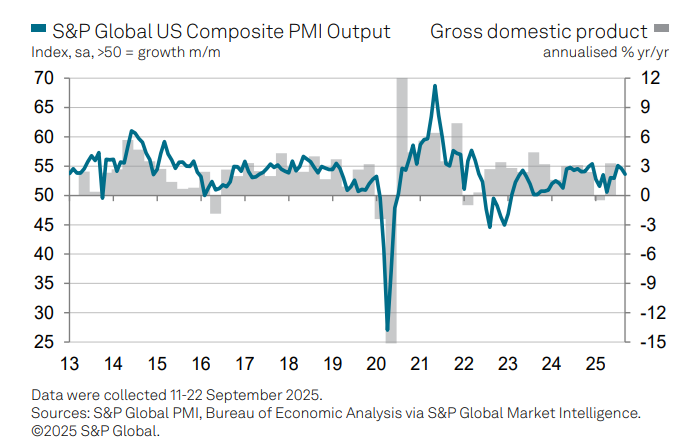

US economic growth cools in September, according to the Composite PMI Output Index, a survey-based GDP proxy. Although the pace downshifted for a second month, “Further robust growth of output in September rounds off the best quarter so far this year for US businesses,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

Gridlock in Congress threatens a government shutdown starting October 1. TMC Research outlined a primer on what to expect, based on history, if the a stopgap spending bill isn’t passed by the Sep. 30 expiration date for the current legislation.

President Trump cancelled a planned meeting with Democratic congressional leaders. The President’s announcement follows a report on Monday that Trump would meet with Senate Minority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries as government shutdown approaches.

Gold hit another record high after Fed Chair Powell spoke at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon on Tuesday. “Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation,” he said. “Two-sided risks mean that there is no risk-free path.”

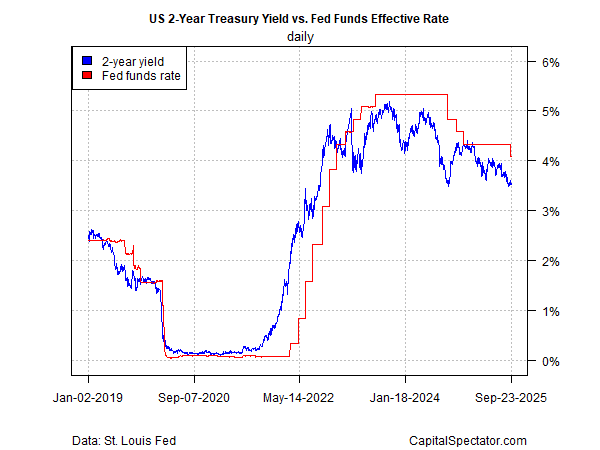

Newly appointed Fed Governor Stephen Miran’s calls for rate cuts “don’t add up,” argues Wall Street Journalist columnist James Mackintosh. “After voting for a supersize rate cut last week, Stephen Miran has now provided the intellectual cover for President Trump’s calls for drastically lower interest rates. If Miran is right, everyone else is wrong—not just the Federal Reserve, but investors and independent economists too. Miran “wants rates almost 2 percentage points lower, at 2.5% — against the 4% to 4.25% range following last week’s reduction.”

More By This Author:

US Q3 GDP Nowcasts Indicate Solid Growth After Fed Rate Cut

Macro Briefing - Tuesday, Sep. 23

US Recession Risk Is Still Low – Will It Last?

Disclosure: None.