IPO Activity Expected To Pick Up Before The Election - We Have Our Eyes On The Trading Desk

The lackluster market for initial public offerings (NYSEARCA:IPO) may face an outpouring of new IPOs. Companies ranging from finance to healthcare plan to go public, and the quantity of issuances is expected to parallel what would normally be expected, given high stock prices and exceptionally low volatility. Since the process to complete SEC filings and other documents for an IPO takes approximately four to five months, we know that a number of companies are in the in the pipeline. At the end of August, there was 101 companies in public registration for an IPO.

However, this comeback in the IPO market may be short-lived. The opportunity for IPOs will most likely disappear about six weeks later as the U.S. heads into the heat of the election season. After mid-October, the window of opportunity will likely shut until December, due to the short time between election and Thanksgiving.

2016 IPO Market

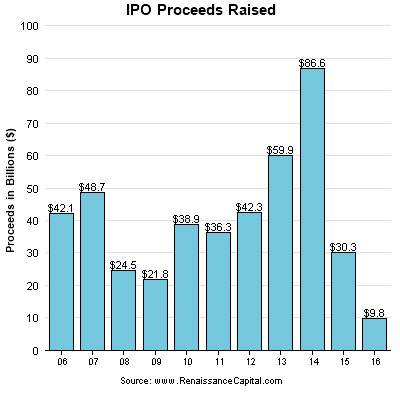

This expected flood of IPOs will be a welcome change for investors who are facing a particularly dismal IPO market this year. To date, 2016 is on track to be the worst year for IPOs since the 2008 financial crisis, with only 63 companies going public, raising a mere $9.8 billion. This is a 56.3% decline from the proceeds raised at the same time the previous year. The first quarter of 2016 marked the slowest quarter for IPOs in seven years with only eight companies debuting, all in the health care field. Activity has picked up in the second quarter, but was still well below normal levels.

Market Conditions Keeping IPO activity at Bay

Several global and financial concerns have contributed to the thin IPO market. The decision by the UK to leave the EU and concerns of an interest rate hike in the US has led companies to delay new issues or cancel them outright. However, with the post-Brexit volatility now behind us, the market's steady performance, and historically low volatility, companies are being lured back to the IPO pipeline.

Another contributor to the slow IPO market is that companies are staying private longer despite having strong history of growth and high valuations. One example of this is Uber, which has a $62.5 billion, larger than the majority of companies trading on the S&P 500, but has remained private. Private companies are more likely to consider other exit opportunities like a merger, acquisition or buyout as opposed to only considering an IPO. In addition, new sources of liquidity are available for private companies, and so there is less of a rush to the IPO market.

Leading the Pack

After the slow start to the year, all eyes were on the companies first to test the IPO market. In the last couple of months, Acaci Communications (Pending:ACIA), a provider of low-power, high speed interconnect modules, Twilio (NYSE:TWLO), a cloud software provider, and Line (NASDAQ:LN), Japanese-based messaging application and went IPO with strong results. Acaia paved the way with its May 13th IPO. Its stock price increased 35% on its first trading day. Twilio and Line showed similar results with Twilio increasing nearly 92% on its first trading day and Line increasing 26%. These highly anticipated and closely watch IPOs have helped to encourage other companies to follow suit.

On Our Watchlist

Given this short window of opportunity companies interested in an IPO this year will have to act fast. We are expecting September and early October to be a busy time for the IPO market. One of the largest IPOs expected is Valvoline (Pending:VVV), an engine and automotive-maintenance company that Ashland Inc. is spinning off. The company could raise as much as $750 million. Valvoline has a strong team of underwriters and filed for its IPO at the end of May this year.

In addition, Nutanix (Private:NTNX) is also being watched closely. It filed for its IPO in December 2015 and delayed going public, given weak market conditions. Nutanix is a Silicon Valley software company founded in 2009 with over 1,500 employees. If Nutanix does move forward with its plan, it would be one of the few billion-dollar startups to launch an IPO this year and a strong signal to the rest of the technology sector on how the IPO market is performing.

Two other upcoming IPOs we expect strong results from are: The Trading Desk (Pending: TTD) which provides a real-time bidding platform for ad agencies and Apptio (Pending: APTI) which sells IP department management software. The Trading Desk filed for an $86 million IPO at the end of August and is planning to IPO on September 19. It has shown high growth and profitability and is backed by a strong team of underwriters. Apptio also filed for its IPO in August and plans to raise $75 million in its IPO.

Several smaller companies have also recently filed for an IPO including: Bank of N.T. Butterfield & Son (Pending:NTB), a commercial bank in Bermuda backed by Carlyle Group; the cosmetics company, e.l.f. Beauty (Pending:ELF) and Yeti Holdings (Pending:YETI), a high-end drinkware and cooler business. All of these companies have a strong team of underwriters. In addition, two companies that had postponed their IPOs, Noble Midstream Partners LP and Advanced Disposal Services Inc, may re-enter the pipeline.

Conclusion

Companies which have gone public in 2016 have performed well and we expect this trend to continue. Shares of companies which have gone public this year, are up 25% on average from their IPO price. This increase is due partly to conservative pricing with a mere 5% of IPOs being priced above their initial target range in contrast to 23% in a typical year. This discipline in pricing will likely continue into September.

Recent trading has demonstrated that the appetite for tech IPOs is high and is a strong indicator for companies in the IPO pipeline that these next couple of months is a good time to move. Continued success may encourage other unicorns waiting in the wings, like Uber, Snapchat, or Airbnb to move forward with an IPO if they see success with these deals. We are excited about these upcoming IPOs and expect strong returns to continue as activity increases.

Disclosure:

more

Sadly few talk about how the stock market is shrinking as big companies buyback shares and buy other companies and fewer companies replace the void. It helps the stock market in terms of higher prices but eventually it is horrible for future investors. Sadly the quality of new companies is deteriorating as well as the upside.