Investors Factor In The Fed's Expected Actions In Setting The S&P 500's Level

The S&P 500 (Index: SPX) closed at 3,961.63 on Friday, 22 July 2022, rising over 2.5% from the previous week.

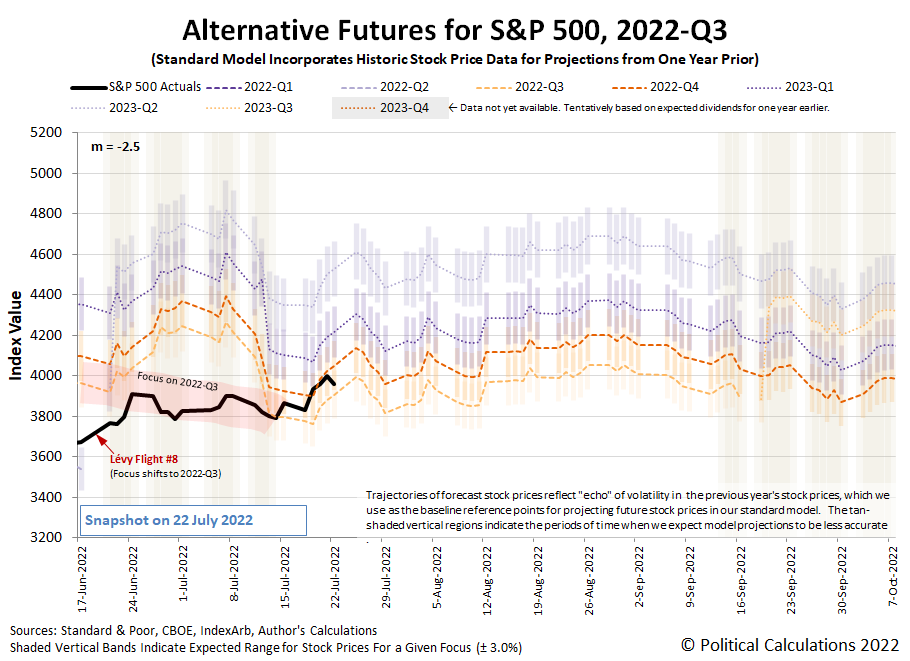

It could have risen higher. For much of the week, the trajectory of the S&P 500 tracked with the dividend futures-based model's projection of where the index would go if investors focused their forward-looking attention on 2022-Q4. But on Friday, they shifted their attention back toward 2022-Q3 and the index stayed below the 4,000 thresholds we identified in last week's edition. Here's the latest update to the spaghetti forecast chart showing that action.

Looking forward, having the index bounce around that 4,000ish threshold would still indicate investors are paying close attention to how the Fed will set short-term interest rates during the current quarter of 2022-Q3. Should stock prices rise significantly above that level would indicate investors have shifted their investment horizon to a more distant future quarter.

With so much attention on the actions, the Fed will take following its upcoming meetings, what change in expectations could prompt investors to re-focus their attention so much further out in time? We'll get to that shortly, but first, here are the market-moving headlines of the week we've identified to help provide the needed context:

Monday, 18 July 2022

- Signs and portents for the U.S. economy:

- ECB minions getting excited about hiking rates after thinking about it for so long!

- Wall Street closes down on slide in Apple shares, bank stocks

Tuesday, 19 July 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan:

- Expectation grow ECB minions will deliver bigger interest rate hike:

- Wall Street closes sharply higher on strong corporate earnings

Wednesday, 20 July 2022

- Signs and portents for the U.S. economy:

- Fed minions expected to deliver another three-quarter point rate hike:

- Bigger trouble developing in Eurozone, China, Canada:

- BOE minions gearing up for big rate hike:

- Wall Street closes higher boosted by tech stocks gains on upbeat earnings

Thursday, 21 July 2022

- Signs and portents for the U.S. economy:

- Bigger stimulus developing in China, S. Korea:

- Despite higher inflation, BOJ minions won't stop, can't stop never-ending stimulus:

- ECB minions finally act to combat Eurozone inflation:

- ECB goes big with 50 basis-point hike, ending negative rates era

- ECB raises rates for first time in decade with safety net for debtors

- Analysis: Debt-laden Italy looks no less vulnerable as rates shoot higher

- Analysis-ECB's new tool fails to impress as Italy confronts political paralysis

- Analysis-R.I.P. forward guidance: Inflation forces central banks to ditch messaging tool

- ECB goes big with 50 basis-point hike, ending negative rates era

- Wall Street closes higher boosted by strong Tesla earnings

Friday, 22 July 2022

- Signs and portents for the U.S. economy:

- Bigger trouble developing in Japan, S. Korea, Eurozone:

- ECB minions pledge to keep up rate hikes until inflation (or Eurozone economy) breaks:

- Bigger stimulus developing in China:

- Wall Street ends lower as ad tech, social media stocks drop

Now, here's where we'll get to why investors would have a strong reason to shift their attention to the more distant future: how investors expect the Fed will change interest rates at different points of time in the future. The CME Group's FedWatch Tool still projects a three-quarter point rate hike for July (2022-Q3), followed by half-point rate hikes in September (2022-Q3) and November (2022-Q4), with the Federal Funds Rate topping out between 3.25 and 3.50%. In 2023, the tool anticipates the Fed will be forced to begin cutting rates in May 2023 as the U.S. central bank responds to more fully developed recessionary conditions.

Speaking of which, turning our attention back to the recent past, the Atlanta Fed's GDPNow tool's latest projection for real GDP suggests the U.S. economy will have shrunk by 1.6% in the recently ended second quarter of 2022. That's down from last week's projection of -1.5% growth, which we had incorrectly identified as the GDPNow tool's final estimate for 2022-Q2 in the previous edition of our S&P 500 chaos series. Looking forward, the BEA will provide its first official estimate of 2022-Q2's GDP later this week, after which, the Atlanta Fed's GDPNow tool will start giving its estimates of real GDP for the current quarter of 2022-Q3.

More By This Author:

The Teen Canaries In The Coal MineBreadflation

The S&P 500 Reacts To U.S. Inflation Surprise

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more