Breadflation

Bloomberg finds another familiar consumer good whose price is rapidly rising and hitting Americans where it hurts in their wallets: bread.

People really begin noticing inflation when it shows up in things that they regularly buy. That’s why gasoline and milk get so much attention. Add bread to a growing list of basics that are rising in price and crushing consumer sentiment.

Amid the highest US inflation in four decades, bread prices have soared this year, pushing more premium options to an unheard-of $10 a loaf and beyond.

“It’s kind of like a punch in the nose,” said Mark Cohen, director of retail studies at Columbia Business School. These are prices “nobody has seen before” and have the same impact as gasoline hitting $5 a gallon, he said.

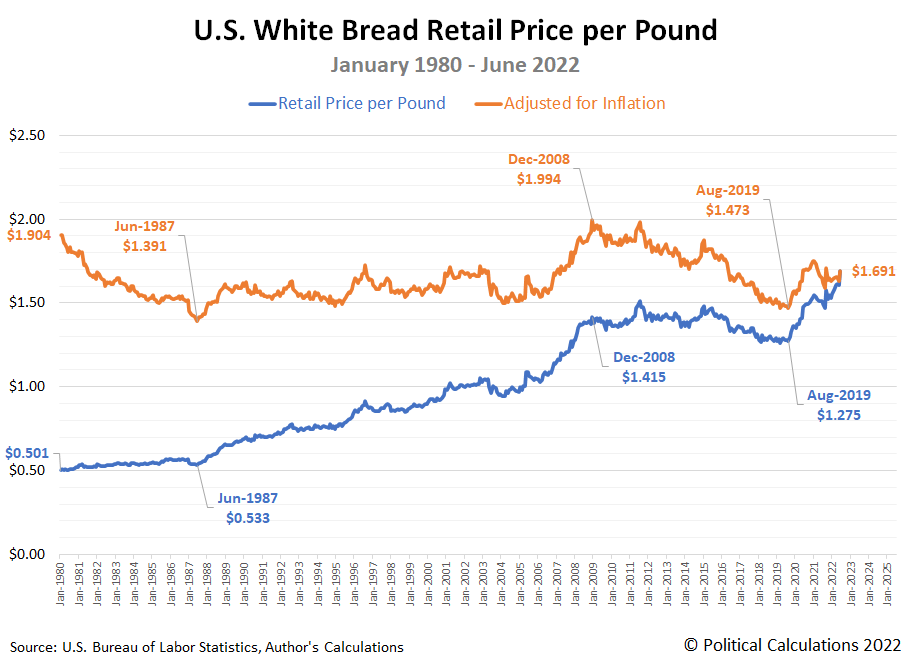

The Bloomberg article features a chart showing the retail price of a pound of white bread over the past 10 years. But since we're talking about the highest inflation in the last 40 years, we wondered how the price of bread has changed since January 1980. In the following chart, we visualize all the Bureau of Labor Statistics' available data at this writing, showing in both nominal (the prices people actually pay) and in terms of constant June 2022 inflation-adjusted dollars.

In nominal terms, we can see the price of a pound of white bread in the U.S. has never been higher. It is nearly 3.4 times what it cost in January 1980.

But we find something different when we account for inflation. Here, we find the average cost of a pound of white bread has ranged from a low of $1.391 in June 1987 to a high of $1.994 in December 2008. At June 2022's average price of $1.691 per pound, the relative cost of bread is in the middle of the range Americans have paid over the last 42+ years. One might reasonably wonder why Bloomberg's writers are choosing to make the big deal out of it that they are.

If you dig deeper into the Bloomberg article, you'll find its three authors are strangely focused on a "premium" bread price of $10 per pound as some kind of talismanic threshold in which they find meaning. As you'll see in the following excerpt, that price applies for a "luxury" two-pound loaf being aimed at consumers with a lot of discretionary income:

In Chicago’s Logan Square neighborhood, husband-and-wife team Taylor and Brian Bruns are trying to stay profitable at their mountain-themed restaurant, Flat & Point. This spring, they ramped up their baking to begin selling loaves of sourdough and whole wheat at farmers markets across the city.

The couple priced their 2-pound loaves at $10, hoping to offset higher flour costs, but also because of surging prices for eggs and butter. While the price tag has turned off some shoppers at the farmers market, it’s fair because they use pricier organic ingredients, according to Taylor Bruns.

“We’ve definitely gotten pushback,” she said.

Comparing apples to apples, the Bruns are asking farmers market customers to pay $5.00 per pound for their gourmet bread product, which is 2.96 times what those same consumers would pay for plain white bread. That's deeper analysis than the three authors have done, so lets consider what it really means by asking some questions.

With money getting tighter because of President Biden's not-so-transitory inflation, which kind of bread do you think these consumers will be more likely to buy when they go shopping six months from now? If you're an investor, would you invest money in the opportunity to expand production of a high-end barbeque restaurant's gourmet bread product in today's economic climate?

Ultimately, it's the answers to the questions we've asked that will determine what the future will be for all those involved. The first question asks you to put yourself into the shoes of a typical consumer. But the second question is the deeper one, because our hypothetical investor might be the small business owner using their own money to expand their business, or perhaps a loan underwriter at a bank, who has to decide if investing in that scheme is worth the risk. Whether it is hinges on how the consumer will answer their question.

They're all being affected by what we'll call "breadflation", even though its a lot more about the "flation" than it is about the "bread". In today's economic climate, all Americans are facing similar questions because of it.

More By This Author:

The S&P 500 Reacts To U.S. Inflation SurpriseAverage Earned Personal Income In The 21st Century And In The Biden Era

Campbell's Soup To See Third Wave Of Price Increases

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more