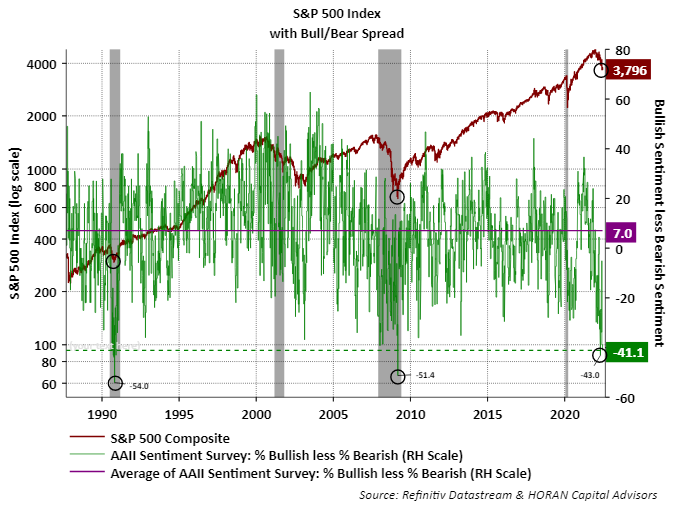

Investor Sentiment Remains Decidedly Bearish

Both individual and institutional investor sentiment are expressing bearishness on future equity returns. The American Association of Individual Investors sentiment survey reading Thursday shows individual investors remain decidedly bearish on their view of equity market returns over the next six months. The bull/bear spread is reported at -41.1 percentage points and is the seventh-lowest weekly spread reading since the survey's inception in 1987. As the below chart shows, historically, this has been associated with equity market turning points.

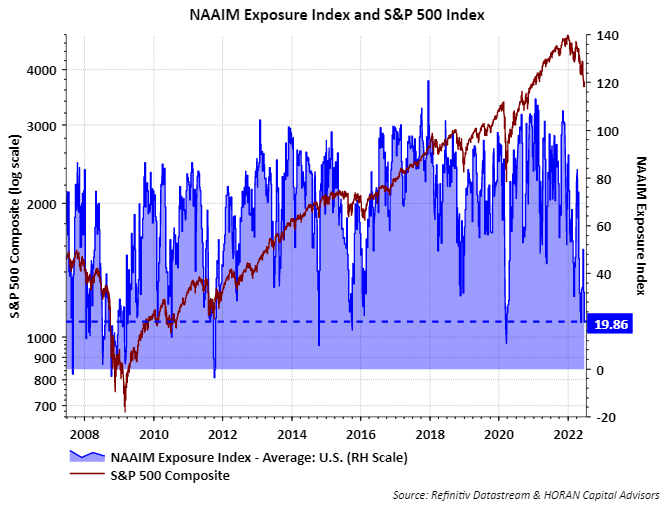

One can gauge institutional sentiment by reviewing the weekly NAAIM Exposure Index. This index consists of a weekly survey of NAAIM member firms who are active money managers and they provide a number that represents their overall equity exposure at the market close on a specific day of the week, currently Wednesday. Responses are tallied and averaged to provide the average long (or short) position of all NAAIM managers as a group. The current NAAIM Exposure Index reading is a low 19.86% as seen in the below chart.

The sentiment measures are contrarian ones, that is, the bearish sentiment being expressed by those participating in the surveys would be a bullish sign for equities. On the other hand, the current environment is a unique one given all the cross-currents impacting the global economy. Further, if the Fed's higher interest rate policy pushes the economy into a recession, corporate earnings likely get reduced for companies, especially economically sensitive ones. It does seem though that a number of variables are coming together that are indicative of an oversold equity market and I highlighted some of these other variables in an article earlier this week.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more