Might An Equity Market Bottom Be Near?

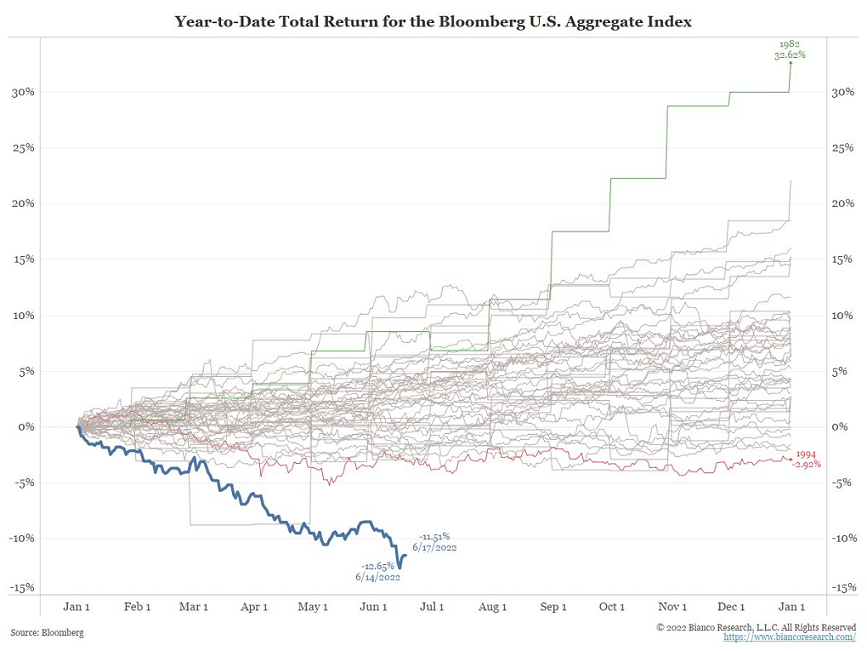

It has been nothing short of a difficult start to the market for the first half of this year. Inflation now seems far from transitory and the Fed is moving short term interest rates higher in an effort to counteract inflation pressure. Oil prices are in the triple digits and gas prices at the pump are near record levels too. On top of this investors and the market are contending with the fallout from the Russia/Ukraine conflict. For investors there seems to be no place to seek shelter as the U.S. equity market has delivered one of its a worst starts to a year. Bonds have not served as a safe haven given the high level of inflation and the Fed's move to push interest rates higher in an effort to lessen the likelihood of inflation becoming ingrained in the economy. Bond prices move inversely to interest rates and higher rates have led to lower prices on bonds.

(Click on image to enlarge)

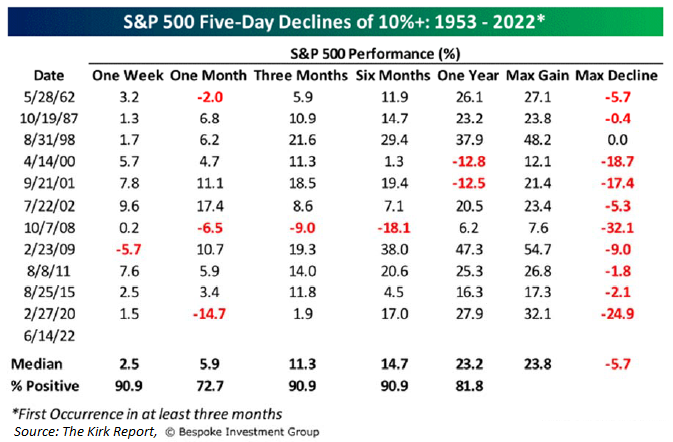

The equity market pullback has been significant and seemed to accelerate last week. The five days ending June 14 saw the S&P 500 Index down -10.6%. Since 1953 this has occurred only eleven other times and 9 times out of 10, the market was higher three and six months later. The last column in the below chart does show that investors faced additional downside market volatility, but overall returns, even out to a year, were mostly favorable.

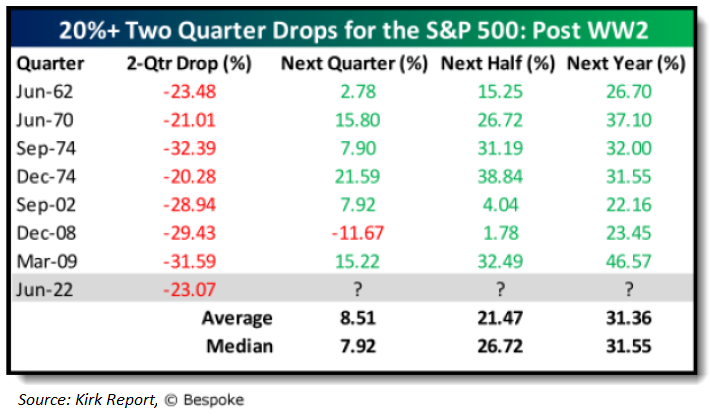

With the end of June fast approaching, two quarters will have passed and if returns for the second quarter are similar to those through June 17, the S&P 500 Index return will be one of the eight worst two-quarter stretches for the market. The subsequent two-quarter return and the next four quarters saw the market generate positive returns for each time period in all seven instances as seen below.

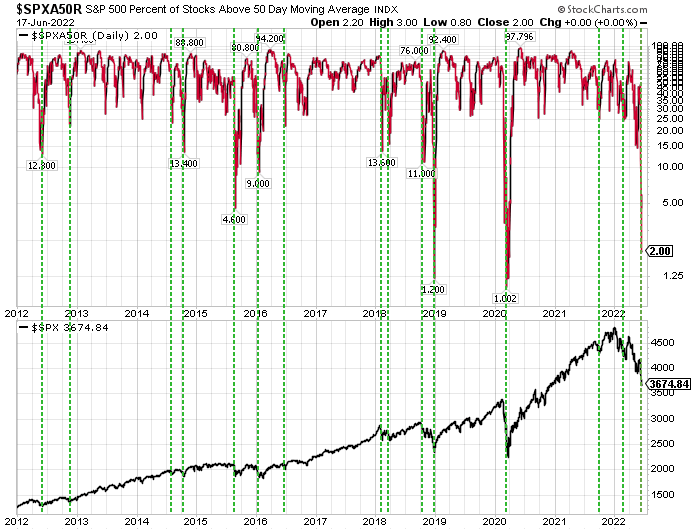

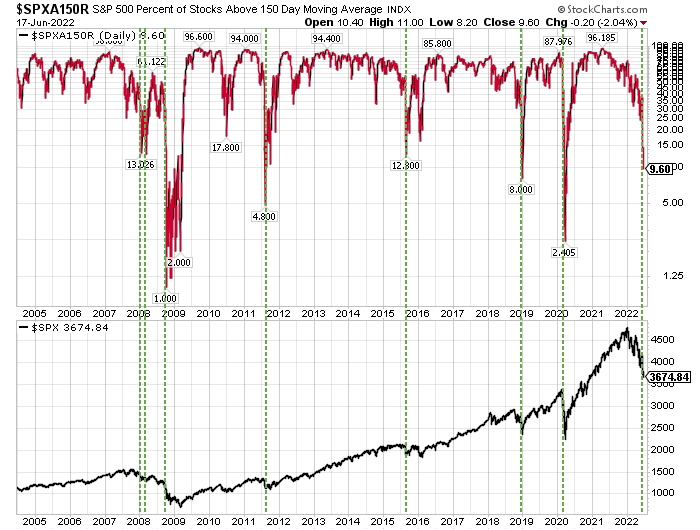

In the three weeks following Memorial Day, the S&P 500 Index is down -12.1% and this includes the previously noted -10+% five-day decline. This quick pace of the decline has resulted in the market reaching oversold levels from a technical perspective. The only equity market sector that has generated a positive return this year is the energy sector; however, For the week ending June 17, 2022, the energy sector is down -17.2% and is now up just 32.4% year to date after being up over 65% near the beginning of June. When the best performing sector is caught up in the selling pressure this can be a sign of some equity market capitulation. The below chart shows that only 2% of S&P 500 stocks now trade above their 50-day moving average, an oversold indication.

Just 9% of S&P 500 stocks trade above their 150-day moving average as of June 17, 2022.

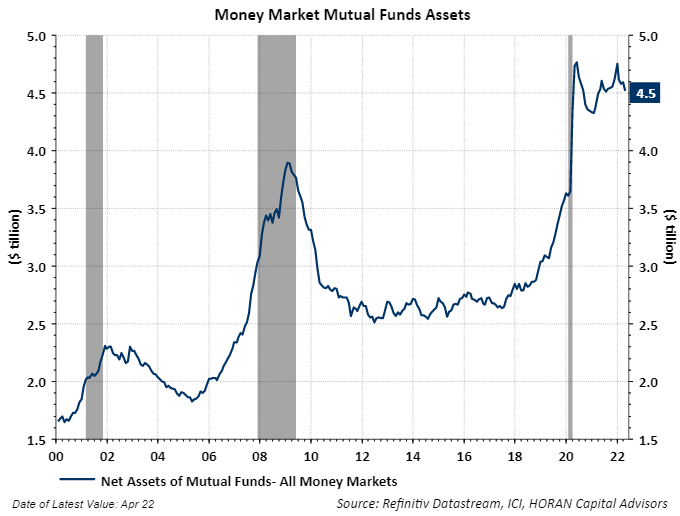

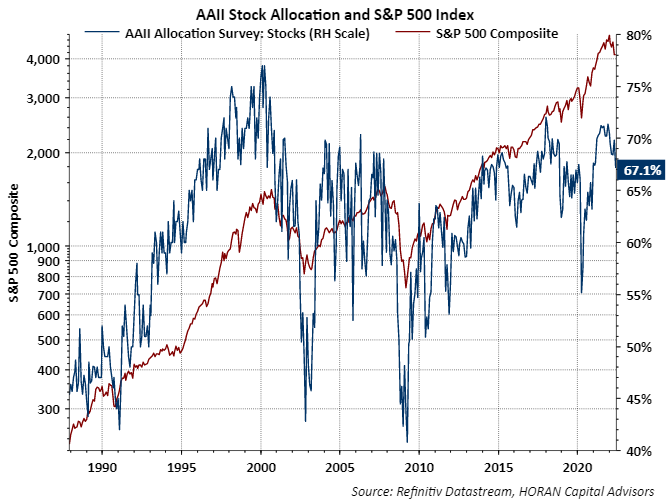

Although cash levels held in money market accounts remains high at $4.5 trillion (first chart below), investor surveys, like the American Association of Individual Investors asset allocation survey (second chart below) indicates individual investors continue to maintain a high allocation to stocks.

Individual investor sentiment surveys indicate investors are bearish on future equity market returns. And as noted in a number of earlier blog posts, investor surveys are contrarian indicators. On the other hand, if investors' responses about their equity allocation are correct (see above chart), then individual investor "actions" differ marketably from sentiment surveys like the weekly AAII Sentiment Survey. The current market environment is certainly one of the most difficult ones navigated by investors in recent years. Incorporating some of the technical indictors noted above, and given the magnitude of the pullback so far this year, a near term equity bounce would not be an unreasonable occurrence.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more