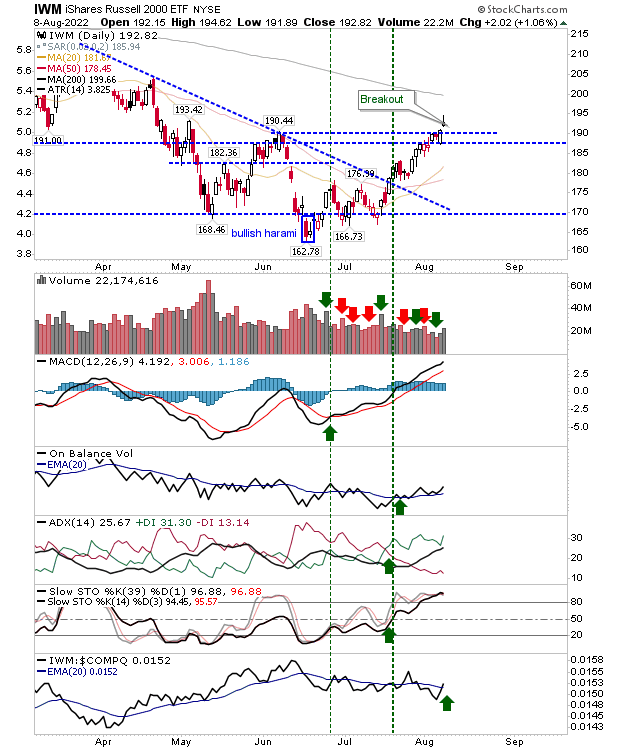

"Inverse Hammer" On Russell 2000 Breakout

It was a mixed day for indices with the first indication of a top for the current advance with reversal candlesticks coming into play off opening gaps in markets.

The Russell 2000 is looking the most vulnerable as it finally manages to break past the June swing high. With the 'inverse hammer' we have the risk of a possible gap down Tuesday, which would result in an 'evening star' and a likely "bull trap" - feeding into the likelihood of a larger sell-off.

The Nasdaq had already achieved its breakout of the May/June high but wasn't able to build on the move before today's bearish 'gravestone doji'.There is no immediate risk of a "bull trap", but a feedback loop could develop if there is one in the Russell 2000.

The S&P had a more low key day than other indices as it hasn't yet breached the June swing high. On the plus side, there isn't a risk of a "bull trap", but it's the only index which has triggered a 'sell trigger' in On-Balance-Volume.

Tomorrow's open will be key. A gap down will set the cat amongst the pigeons, but if markets can rally to challenge today's highs it would go a long way in negating the bearish implications of the reversal candlesticks.

More By This Author:

200-Day MAs Come Into Play For Indices

Rallies Continue As Volume Buying Starts To Improve

Higher Lows Developing Across Indices

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more