Insiders Are Buying These 3 Large Cap Stocks

Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

An insider is an officer, director, 10% stockholder, or anyone who possesses internal information because of their relationship with the company. It’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

Several large-cap companies – FedEx (FDX), Casey’s General Stores (CASY), and Centene (CNC) – have seen recent insider activity. Let’s take a closer look at the transactions for those interested in trading like the insiders.

FedEx

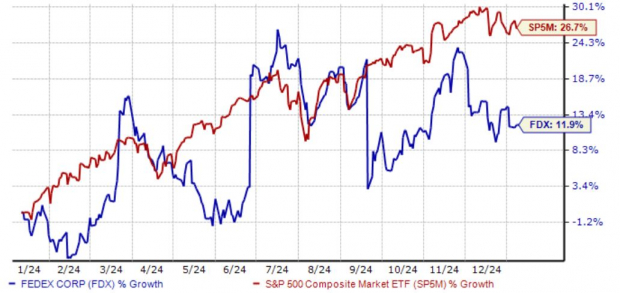

FDX shares have been somewhat disappointing over the last year, gaining roughly 12% and underperforming relative to the S&P 500. Quarterly results have regularly brought big post-earnings moves, though that’s unsurprising given its economically-sensitive nature.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Just a few days back, FDX’s CFO swooped in for a purchase, acquiring 1k shares at an overall transaction cost of just under $275K. It was a pretty sizable purchase for the insider, increasing its total shares owned by more than 10%.

Casey’s General Stores

CASY shares have been strong over the past year, gaining nearly 40% and outperforming relative to the S&P 500. Though off its high, the strong performance here is certainly notable given its retail-heavy footprint.

(Click on image to enlarge)

Image Source: Zacks Investment Research

A director recently purchased 500 shares at a total cost of just under $200k, increasing the total stake by more than 20%.

Centene

CNC shares have fared the worst out of the bunch over the last year, losing nearly 20% and widely underperforming relative to the S&P 500. Several insiders swooped in for purchases just before the Christmas holiday, with the combined transaction totaling roughly $1.6 million.

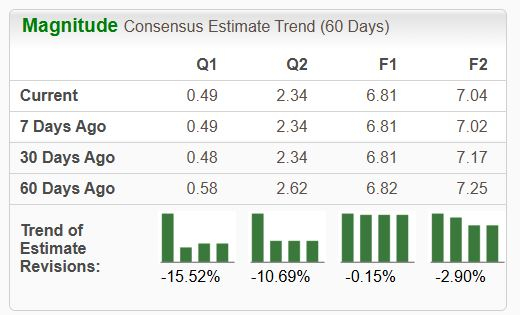

Though the recent insider purchases may ring positivity, the near-term outlook for CNC shares here remains bearish, with analysts downwardly revising their expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, looking to receive insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – FedEx, Casey’s General Stores, and Centene – have seen recent insider activity.

More By This Author:

3 Simple Tips To Managing A Successful Portfolio

3 Stocks Tailored For Growth Focused Investors

Ride The Quantum Computing Wave With These 2 Stocks: RGTI, QBTS

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more