3 Stocks Tailored For Growth Focused Investors

Image Source: Pexels

Growth investing is a widespread strategy deployed, with investors targeting companies expected to grow their earnings and revenues at an above-average level. It’s a development that commonly follows through to share outperformance.

These companies typically reinvest back into the business for expansion, commonly at the forefront of innovation. And for those seeking a group of strong growth stocks, Nvidia (NVDA - Free Report), Broadcom (AVGO - Free Report), and Palantir (PLTR - Free Report) could all be considerations.

Let’s take a closer look at each.

Broadcom Rides AI Wave

Broadcom has quickly risen to the top concerning AI players, with its latest set of quarterly results fully confirming robust demand. Its FY24 has just ended, with annual revenue of $51.6 billion reflecting a new record and growing 44% year-over-year on the back of strong demand for its solutions.

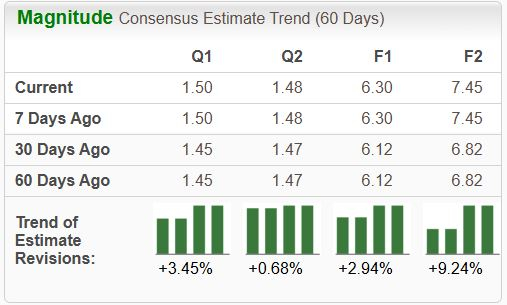

Broadcom’s earnings outlook shifted positively across the board following the results, landing the stock into a favorable Zacks Rank #2 (Buy). Its next quarterly results are scheduled for March, with early consensus expectations alluding to 36% EPS growth on 22% higher sales.

Image Source: Zacks Investment Research

Palantir Sees Big Demand

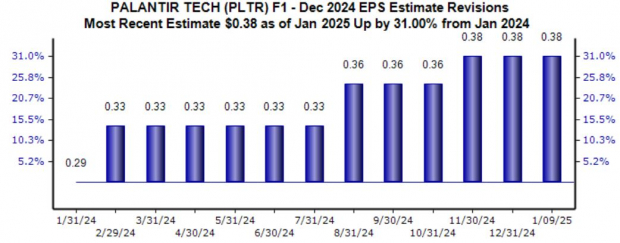

Palantir’s robust share performance has also been fueled by the AI frenzy, with the company’s latest set of quarterly results pleasing investors in a big way. The strong results and favorable commentary have caused analysts to raise their earnings expectations, with the stock sporting a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company’s sales have snowballed thanks to strong AI demand, with sales of $726 million throughout its latest period growing 30% year-over-year and 7% sequentially.

Nvidia Data Center Remains Robust

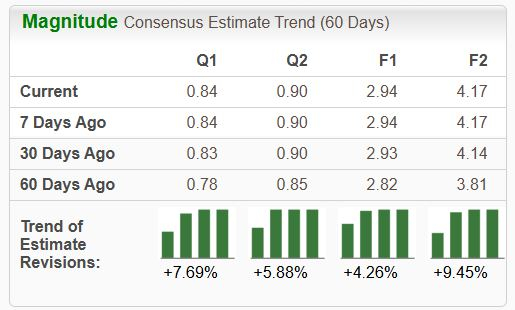

Investor-favorite and Zacks Rank #2 (Buy) Nvidia continues to fire on all cylinders, with its Data Center results regularly blowing away expectations and posting big year-over-year growth. Like those above, its earnings outlook has brightened nicely over recent months, with positive revisions regularly hitting the tape following quarterly prints.

Image Source: Zacks Investment Research

Jensen Huang, CEO, wrapped up the latest set of quarterly results with a bullish statement: “The age of AI is in full steam, propelling a global shift to NVIDIA computing. Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.”

Bottom Line

Above-average sales and earnings growth commonly lead to share outperformance, undoubtedly a welcomed development among investors.

And for those seeking companies with bright outlooks, all three above – Broadcom, Nvidia, and Palantir – fit the strategy nicely.

In addition to rock-solid growth, all three sport a favorable Zacks Rank, with positive earnings estimate revisions providing bullish fuel.

More By This Author:

Ride The Quantum Computing Wave With These 2 Stocks: RGTI, QBTSBear Of The Day - Boeing

These 2 Mag 7 Members Just Broke All Time Highs

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more