Information Technology Has Evolved To Become A Consistent Presence In The S&P 500 Low Volatility Index

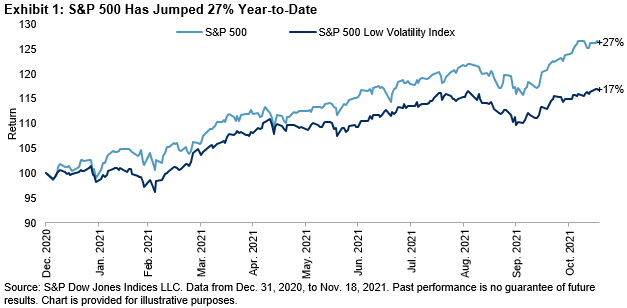

Equities in 2021 had a slow start, but as December approaches it looks to be another stellar year. Through Nov. 18, 2021, the S&P 500® was up 27%. For a strategy that is explicitly designed to mitigate risk, the S&P 500 Low Volatility Index’s year-to-date gain of “only” 17% is well within the range of reasonable expectations.

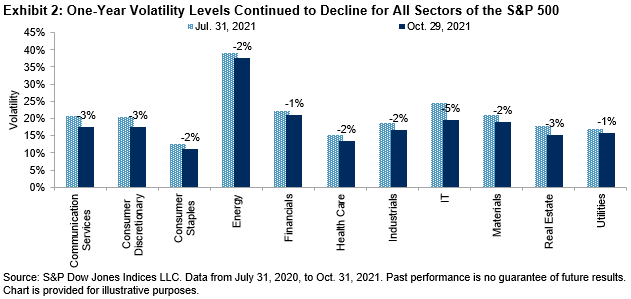

One-year volatility declined across all sectors of the S&P 500, with Information Technology experiencing the largest reduction.

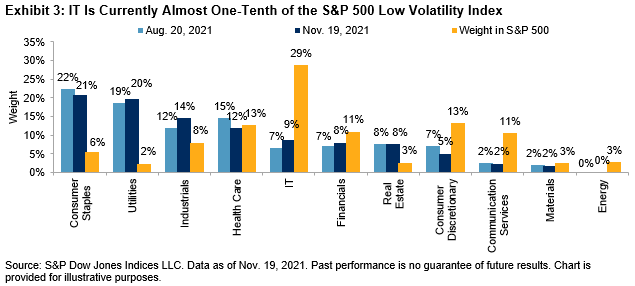

Changes in the latest rebalance for the S&P 500 Low Volatility Index, effective after the market close on Nov. 19, 2021, were small. Notably, IT still holds a significant weight (9%) in the context of the history of the low volatility index. Since 2017, it has maintained a weight of 5% or more in the low volatility index, the lengthiest run in index history back to 1991.

Health Care pared its weight to 12% of the index. Consumer Staples, Utilities, and Industrials together accounted for more than half of the index. Energy’s weight remained at 0%.

For the broader S&P 500, IT’s underweight is still the largest difference between the S&P 500 Low Volatility Index and the S&P 500. The overweights in Utilities and Consumers Staples pick up the slack on the other end of the spectrum.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more