Inflation Cools Down, As S&P 500 Earnings Season Ends & More

Inflation Update: A Cool Wind Blows

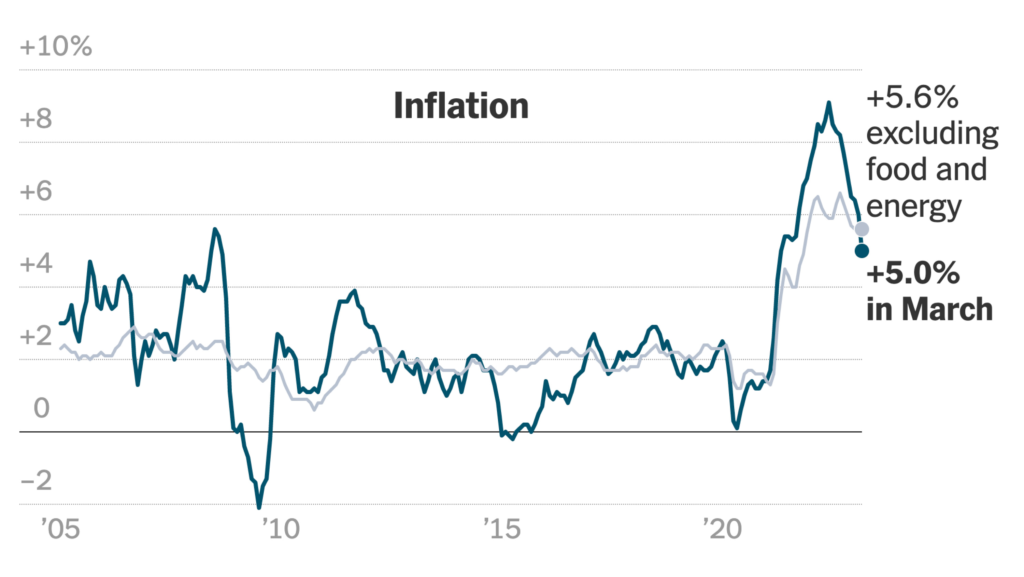

Headline CPI came in at a cooler 4.9% versus expectations of 5.0%, and a high of 9.1% less than one year ago. This, along with slowing rents and core service prices, suggests a cooling inflation trend, leading to potentially higher Treasury yields and inflation expectations.

Introduction: Softbank’s Troubled Waters

The financial world experienced a seismic shift as Softbank, the posterchild of ZIRP (zero-interest-rate policy), recorded a staggering $32 billion loss at its Vision Fund tech investment arm. The Japanese giant’s fiscal year ended in the red despite gains from high-profile exits such as Uber. Losses were mainly driven by reduced share prices in portfolio companies like the Chinese artificial intelligence firm SenseTime and Indonesian ride-hailing and e-commerce company GoTo.

The Earnings Update: A Mixed Bag

Despite Softbank’s setback, the broader earnings picture is somewhat encouraging. Approximately 85% of SPX companies reported EPS growth at -2.2% YoY, better than the -6.7% initially expected. Revenue growth is +3.9% YoY, and FY23 is expected to deliver +2.4% revenue growth and +1.2% EPS growth. However, economic growth must be maintained to meet these targets.

Robinhood’s Surprising Windfall: Accidental Bankers

In other market news, Robinhood, the online brokerage, saw a boost in interest income due to the Federal Reserve’s rapid rate hikes. Net interest revenue nearly quadrupled, making the platform seem more like a bank than a simple trading app.

AI Advances: Google Claps Back

Google has made significant strides in AI technology with the announcement of its new AI model, PaLM 2, trained on academic papers and over 100 languages. This innovation is set to revolutionize search, providing AI-generated answers at the top of the page for certain queries.

The Lithium Game-Changer: A $10.6B Mega Merger

Amidst this whirlwind of financial news, one major development stands out: the merger between Australian lithium miner Allkem Ltd. and US rival Livent Corp. This all-stock deal, worth an impressive $10.6 billion, will create a lithium producer contributing to 7% of the global supply in 2023. Given the skyrocketing demand for batteries in electric vehicles, this deal represents a significant consolidation in the sector and a potential game-changer for the lithium market.

In conclusion, the current financial landscape is incredibly dynamic, filled with both challenges and opportunities.

As Softbank’s losses underline the risks in tech investments, the Allkem-Livent merger highlights the potential in the lithium market, signaling a significant opportunity for savvy investors.

Meanwhile, developments in AI and the online brokerage sector continue to reshape the business environment, keeping all players on their toes.

More By This Author:

Macro Factors Impacting Currencies & Equities This WeekWatch Closely At US Jobs Data To Better Predict Fed’s Next Moves

Goldman On The Future Of AI And Jobs, Plus Key Player To Bet On

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more