Watch Closely At US Jobs Data To Better Predict Fed’s Next Moves

The US jobs report, set to be released today, is a significant event for economists as it provides insight into future interest rate movements.

A robust job market is generally a sign of a healthy economy, but wage growth can exacerbate inflation, which poses a challenge for the Federal Reserve. The report is expected to show a gain of almost 250,000 jobs added last month, which economists will scrutinize for clues about the Fed’s next move.

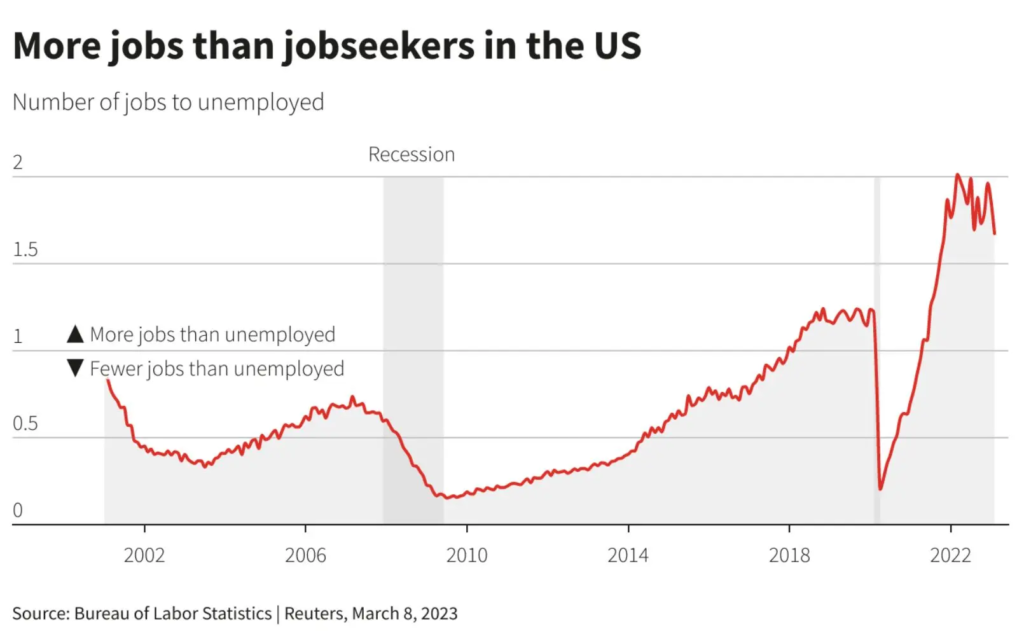

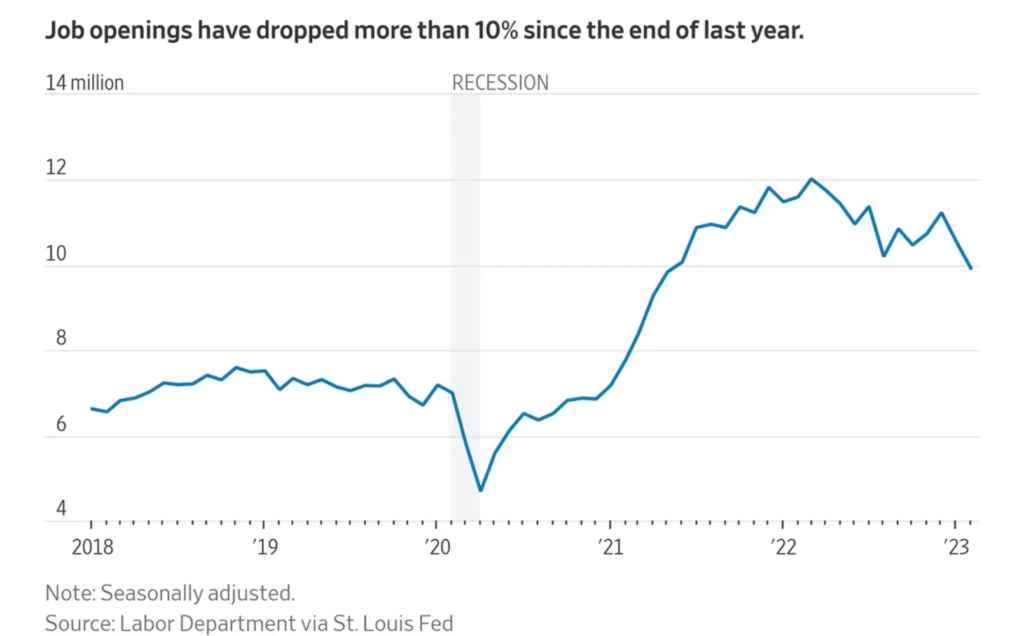

There are indications that the labor market is cooling off, as evidenced by data released this week, which revealed the fewest job vacancies in February since 2021. Given that companies tend to freeze hiring before layoffs, this could indicate a shift in the broader job market.

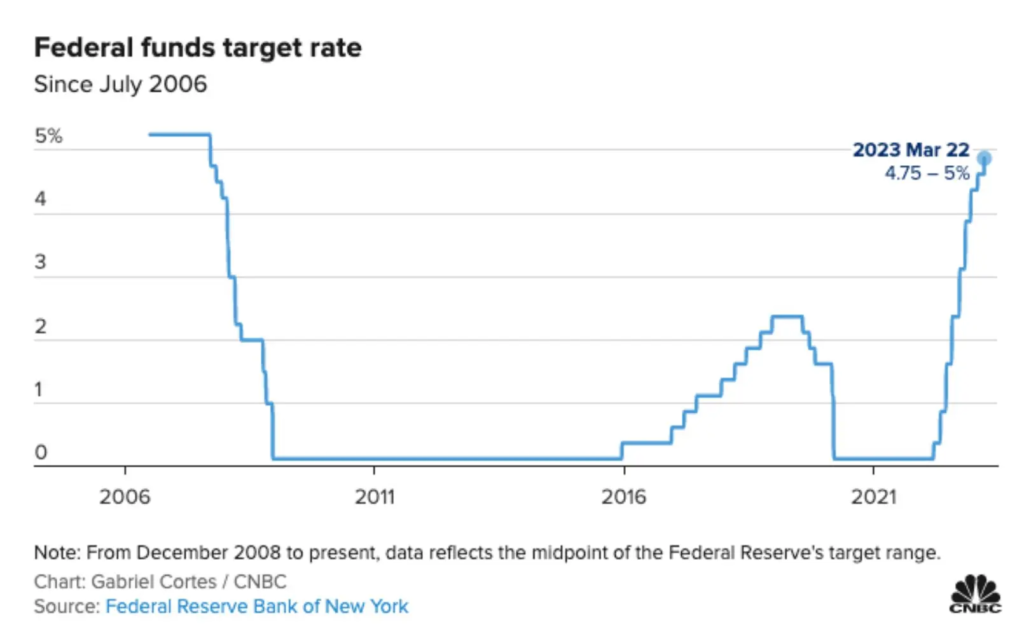

If the numbers released on Friday miss expectations, the Fed may hold off on raising rates to avoid the possibility of causing a recession. Since the release of the job openings data, the markets have been betting that the Fed will not increase rates next month.

If job growth exceeds expectations again, another 0.25-percentage-point hike may be on the horizon. The Fed has already hinted that it will raise rates just one more time this year, given the recent banking turmoil.

Anything more significant seems unlikely unless the job numbers exceed expectations by a significant margin.

The real risk could be the Fed keeping rates high for longer than investors anticipate, which could harm corporate profits and stocks in the long run.

More By This Author:

Goldman On The Future Of AI And Jobs, Plus Key Player To Bet On

NVIDIA: There’s Room For Further Growth

Trading Forex Order Blocks

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more