Indices Develop Into New Ranges

Today's losses for lead indices may have scared some traders, but in reality, this is just a pause in the advance since March. In the case of the S&P and Nasdaq, there may be some risk of a double top, but there is plenty of support to work with

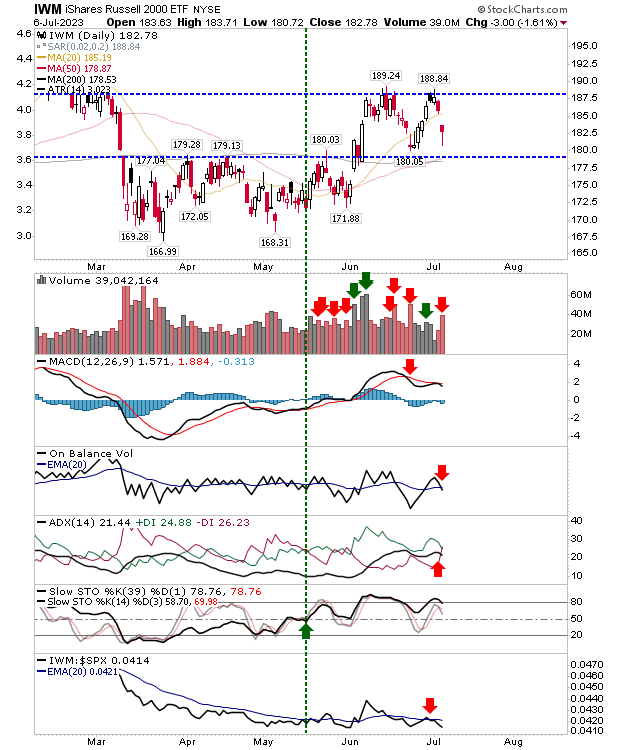

The Russell 2000 (IWM) has been the slowest to get going, having only just emerged from a base that ran from March through May. What today's loss reflects is perhaps action within a new base running between $188 and $179, with added support (and a likely new Golden Cross) at converged 50-day and 200-day MAs.

The S&P peaked at around 12% above its 200-day MA, which is a good time to consider a covered call trade. If we do see a double top here (an undercut of the neckline), or a break below the 20-day MA, then this might be the confirmation needed to pull the trigger on the trade. Technicals have seen new 'sell' triggers in the MACD and OBV, along with two distribution days over the last couple of days. The index is also ticking higher in its relative outperformance against Small Caps.

The Nasdaq is down at its 20-day MA, and like the S&P, peak at 19% above its 200-day MA; this puts it in the 90% percentile of overboughtness relative to the 200-day MA. With the potential double top in play there is an opportunity for a covered call trade to bank some of the gain from the March rally. As with the S&P, there is a new 'sell' trigger in On-Balance-Volume, joining the earlier 'sell' in the MACD. Today's and yesterday's action registered as distribution too.

The summer holidays will likely curtail any big move, so I would be looking for sideways action to continue to evolve from here.

More By This Author:

Markets Push Gains With The Russell 2000 Slowly Working Through Its Base

S&P And Nasdaq Rally In Their Bases

Russell 2000, S&P And Nasdaq All Kick On

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more