Indecisive Gains, If There Is Such A Thing...

Buyers were able to drive gaps higher at the open, but couldn't build on the initial gains.

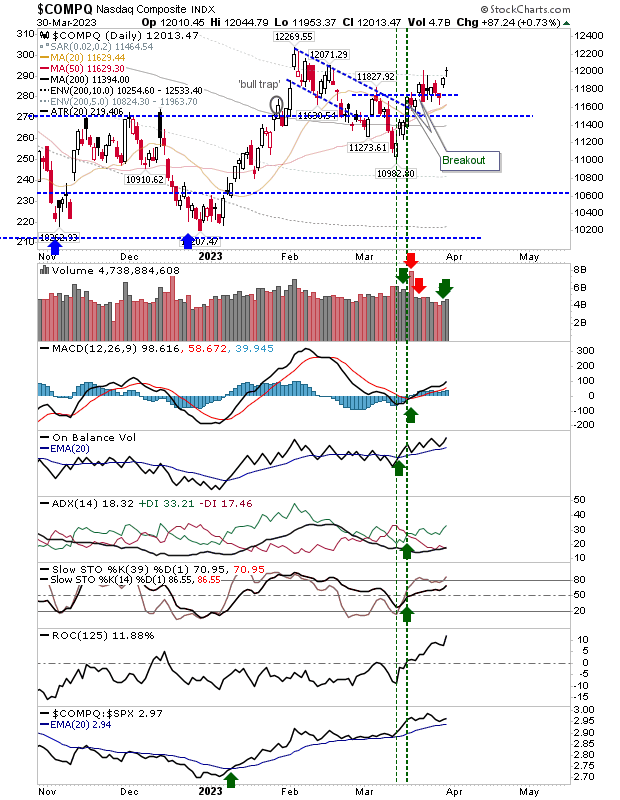

The Nasdaq managed to make a new swing high for the March rally, but it could take a while before the February highs are challenged. Technicals are net bullish, and more importantly, the index is outperforming the S&P.It looks like risk can be measured against the 50-day MA.

The S&P is in the process of challenging the March swing high and is holding on to its 50-day MA. Technicals, like the Nasdaq, are net bullish. Since early March, the S&P has accelerated sharply against the growth stock index, the Russell 2000. Having attracted buyers it now has the opportunity to build on that, take out the March high, and challenge the February high. If you are looking for a support area to measure risk against (for a long position), the 200-day MA looks like a good place to start.

The Russell 2000 (IWM) remains the index of concern. While other indices are challenging highs, the Russell 2000 is still trying to work off its lows. The MACD is on a weak 'buy' signal (the signal occurred well below the zero mid-line), and other technicals are net bearish. To add insult to injury, today's candlestick ranked as a bearish engulfing pattern, coming off 20-day MA resistance.

Whatever happens in the days and weeks ahead, we have indices that are working at shaping bases. And base shaping is better than selling. If you are an investor, you should be in accumulate mode.

More By This Author:

Markets Giveth, Then Taketh Away

S&P Breakout Adds To The Earlier Breakout In Nasdaq

Banking Panic Cracks Support In The Indices

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more