S&P Breakout Adds To The Earlier Breakout In Nasdaq

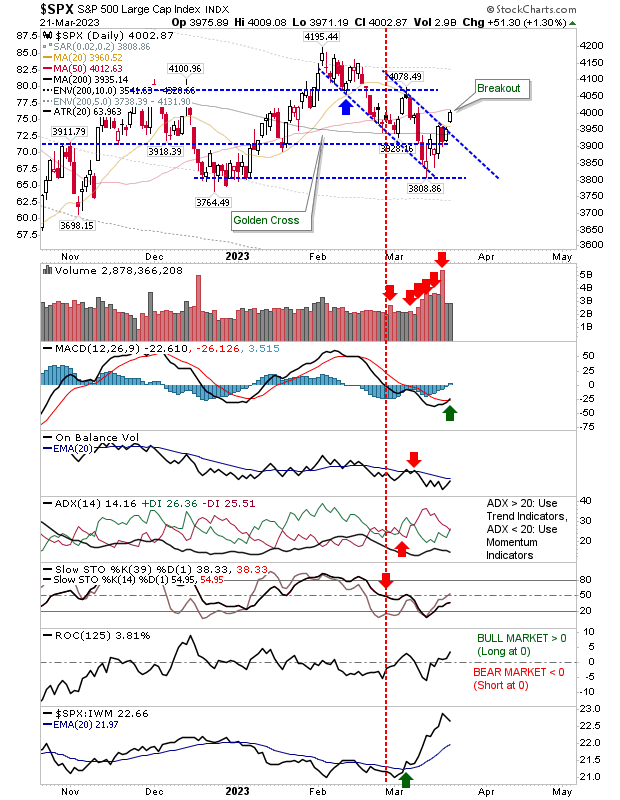

Friday was a sticky finish for markets, Monday managed to make back some of this lost ground, and today delivered a breakout in the S&P.

I had talked over the weekend about the risk of a crash, particularly in the Russell 2000, but today's action in the S&P goes some way to averting this scenario. The Russell 2000 is still in trouble, but there is reason for optimism in the S&P. The gap move above resistance came with a new 'buy' trigger in the MACD, although other technicals remain bearish.

The Nasdaq had already delivered a breakout, that it managed to hang on too despite Friday's selling. Today's action saw a small gap higher that knocked out last week's swing high. Volume was a little disappointing for a follow through so Friday's distribution remains threatening. Technicals remain net bullish, having resisted Friday's selling.

The Russell 2000 had a quiet day.If there is an index vulnerable to a crash it's this. Today's buying came on an indecisive doji on modest volume - not a whole lot to get excited about. The technical picture also remains on the bearish side, including a continued sharp underperformance relative to the Nasdaq.

For this week, we will want to see both the S&P and Nasdaq build on their breakouts to distract from what is worrying weakness in the Russell 2000. Last summer's low should be viewed as a significant market bottom, so even if there is an undercut it should only be temporary.

More By This Author:

Banking Panic Cracks Support In The Indices

Hold The Horses - Buyers Are Back

Weekly Chart Review

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more