In My Opinion, The Value Of The Fail To Redeem Clause Is Greatly Overstated

Granted that I hold a contrarian view concerning the FTR clause, during my time as a well-respected Seeking Alpha contributor, I proved my point repeatedly: The FTR clause is not only overvalued, often it lowers the profitability of a particular preferred investment. Ironically, TNP preferred shares brought the FTR clause to my attention when several of my followers commented that I had been mistaken about my choice of the best TNP preferred to purchase because I hadn't taken the FTR clause into account, arguing that it reduced my risk and, therefore, negatively affected what I considered would be the best TNP preferred to buy at that particular time.

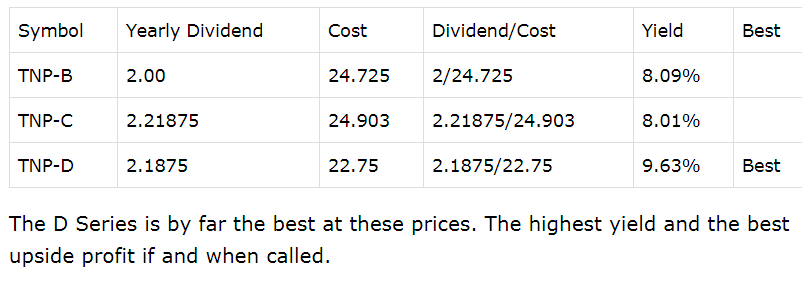

The following is a screenshot from that particular article published May 16, 2016, which is included in my book, The Art & Science of Preferred Dividend Investing:

(Click on image to enlarge)

TNP's B & C Series preferred shares contained the draconian "fail-to-redeem" clause that would place a great burden upon TNP if those shares were not redeemed in a timely fashion. (B shares would breach the conditions of the clause if uncalled by 7/30/19, and C shares would do likewise after 10/30/20.) Consequently, investors valued both the B & C shares approximately $2/share more than the D, which has no such clause.

Although a contrarian view, one which I still hold today; should the B be called in a timely fashion, I contend that my D shares would be considered more valuable because TNP displayed the fiscal strength to be able to redeem the shares as required. And should it redeem the C Series in a timely fashion, I expect my Ds would benefit even more. I'm aware that Tsakos might have to issue additional commons and/or preferred shares to pay for this call, which might or might not prove advantageous were this to occur. Time will tell. What I am certain of is that if the shares are redeemed in a timely fashion, I will continue to receive dividend payments at the effective higher yield I've had since the day I bought them, as displayed above. Conversely, should TNP fail to redeem as required and incur the costly penalties, I believe all the preferred shares - series B, C, and D - will suffer accordingly, but I will have been invested at approximately $2 less per share, or more succinctly, I would be at risk for $2 less per share.

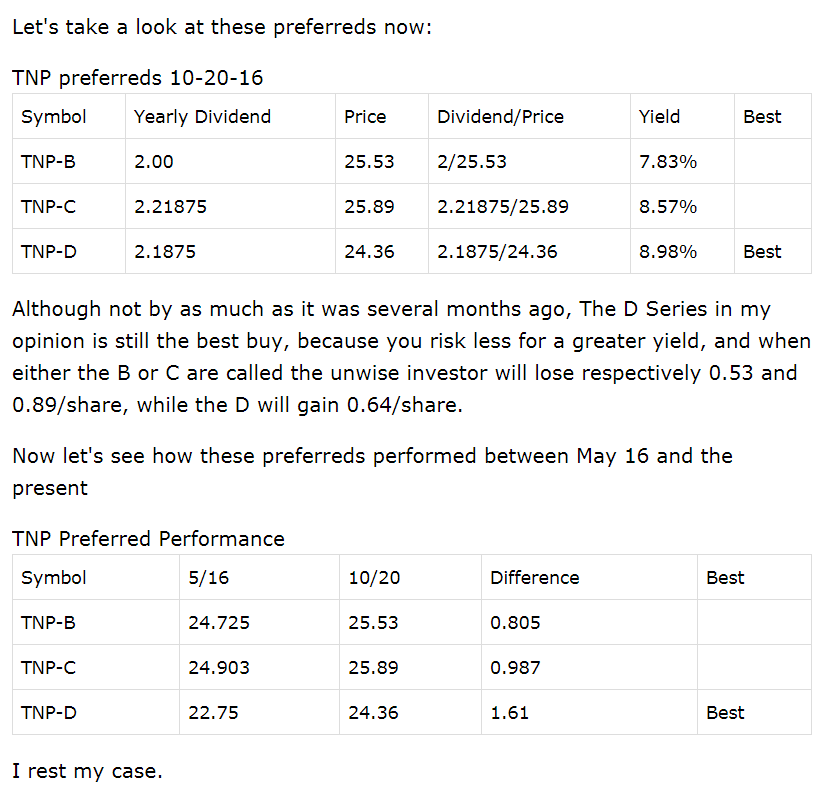

I'll begin making my case by offering my initial TNP article as Exhibit #1, which I now enter into evidence. In this article, published May 16, 2016, I presented my case concerning which preferred offered was the best buy. At the time, admittedly, the FTR clause was not even on my radar, an omission for which I was excoriated. The following screenshot was taken from an article I contributed on October 20, 2016:

(Click on image to enlarge)

Let's flash forward to the present and see how these TNP preferred shares performed in relation to each other. Note that since 2016, TNP issued an E and F series of preferred shares, which are worthy of discussion, but not here because this article concerns the FTR clause and the continuation of the long-time horizon of the three preferred shares I have been tracking.

| Symbol | Investment Date | Cost | Yearly Dividend | Total Dividends collected | Current Price | Price Differential | Dividends +/- Price differential | Profit | Best |

| TNP-B* | 5/16/16 | 24.725 | 2.00 | 24.00 | 25.00* | .275 | 24+.275 | 24.275 | |

| TNP-C** | 5/16/16 | 24.903 | 2.21875 | 31.0625 | 25.60 | .697 | 31.0625 + .697 | 31.7595 | |

| TNP-D | 5/16/16 | 22.75 | 2.1875 | 30.625 | 24.73 | 1.98 | 30.625 + 1.98 | 32.605 | Best |

*B was called 7/30/19 @ $25.00

** According to the FTR clause, all shares of TNP-C must be redeemed prior to 10/30/20.

As I predicted in 2016, D was the best TNP preferred investment as of this moment. Furthermore, in my estimation, it was probably the least risky because its cost was at least $2/share less than either of the B or C preferred shares. Additionally, had the B not been redeemed in a timely fashion, all the TNP preferred shares would have suffered because of the weakness the company had demonstrated by not being able to redeem the B shares, thereby suffering the penalties as dictated in the Series B IPO prospectus. And, the moment the B shares were redeemed the investor no longer earned the dividends the shares paid. Finally, although the C earns a higher yearly dividend, because of the reduce cost of the D during the time of the initial investment, its dividend yield % earned was and is higher per dollar invested as reflected in the initial chart above.

When I buy a company's preferred, I expect that company to remain a viable entity. I won't rely on the FTR clause to protect my investment; no I prefer to rely on my research into the economics and past price performance of the company's common shares, which can't be spun with happy talk and manipulated financial statements as presented in quarterly conference calls and press releases.

When, to my chagrin, I discovered that I was not smart or diligent enough to wade through complicated financial statements, at least enough to determine the price rise or fall of a prospective investment, I turned to cumulative preferred investing whereby all I really had to determine was the eventual viability of a company whose preferreds I was considering an investment in. Bottom line: short of bankruptcy, or me being forced to sell a position as a result of a margin call or some personal financial calamity, my preferred investments will usually be safe, usually, in the event when the preferred dividend is suspended for a period of time, especially during some transient market weakness. Had you done your due diligence prior to investing in particular companies, which I have thoroughly covered in "The Art & Science of Preferred Dividend Investing," the majority of your cumulative preferred investments should be a reliable source of income until they are called by the company.

This is my opening article as a TalkMarkets contributor. I'm simply an average market investor with one claim to fame: I know more about preferred investing than most, and the majority of my ...

more