Illumina: A Growth Leader In The Genomic Revolution

The genomics revolution will offer extraordinary opportunities for growth in the years ahead, and Illumina (ILMN) is in a position of strength to benefit from those opportunities. The company is at the same time a major driving force and one of the main beneficiaries of the genomics boom.

Illumina has a profitable business model and solid competitive strengths. Volatility can be expected due to the impact of the recession and rising competitive pressure in the near term, but chances are that the stock will deliver solid returns for investors over the next 3 to 5 years.

A High-Quality Business

Illumina is a market leader in life science tools for analyzing genetic material. Nearly 90% of the world's sequencing data is generated with Illumina's technologies nowadays. This technology has enormous potential in areas such as oncology and reproductive health in the near term, and massive opportunities in new applications over the years and decades ahead.

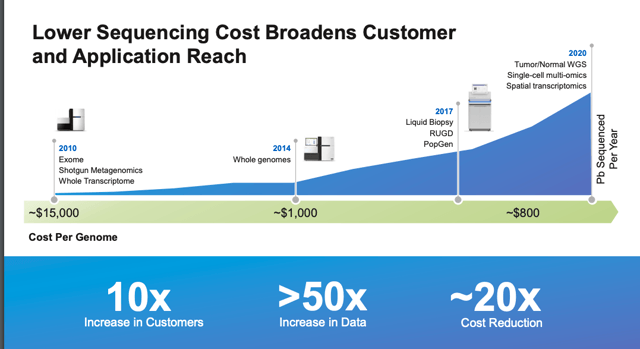

Declining costs are a major driver for the industry, and this can be expected to produce exponential increases in demand. In 2003, the year when the Human Genome Project has completed, the cost of sequencing one genome was prohibitively expensive for most healthcare applications. This cost declined to a much more reasonable $1000 by 2014, and now it is declining to nearly $800. Illumina plans to reduce the cost of sequencing one genome to $100 in the coming years, which could open the doors to truly revolutionary opportunities for the company.

(Click on image to enlarge)

Source: Illumina

Success attracts competition, especially when a company has ample room for further growth. Illumina will most certainly face rising competitive pressure in the years ahead, and investors in the company need to keep a close eye on the competitive landscape. That being acknowledged, the company has the strength to protect its revenue and cash flow from the competition.

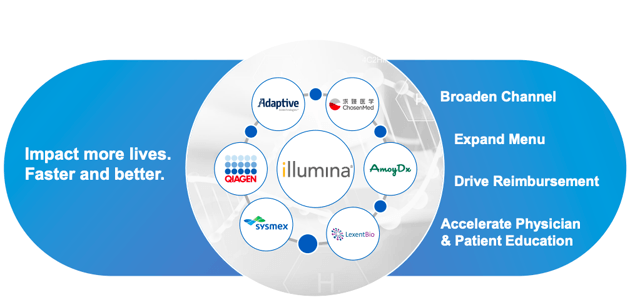

Market leadership provides competitive advantages for the company due to its superior scale and intellectual properties. Illumina invested $545 million in research and development to consolidate and expand its technological advantages last year, and a wide net of strategic alliances differentiates the company from smaller players trying to gain some ground in the sector.

(Click on image to enlarge)

Source: Illumina

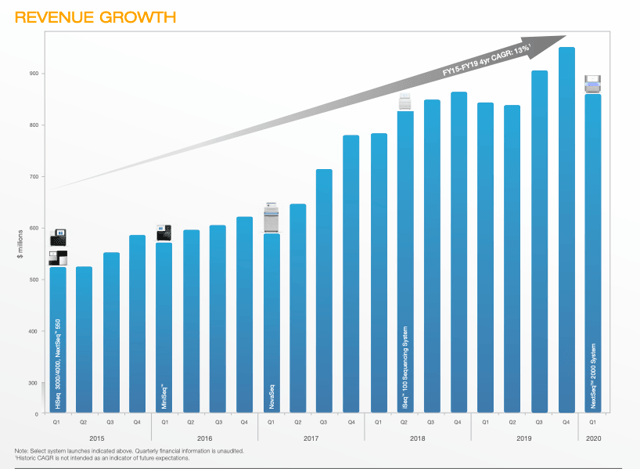

Revenue growth can fluctuate year over year due to product cycles and other considerations. The next 2 or 3 quarters will be particularly uncertain for the company due to the COVID-19 crisis and the recession that is having huge repercussions across the board.

However, Illumina has been able to produce attractive revenue growth rates over the long term, and it has a lot of room for further growth if the company keeps executing well.

(Click on image to enlarge)

Source: Illumina

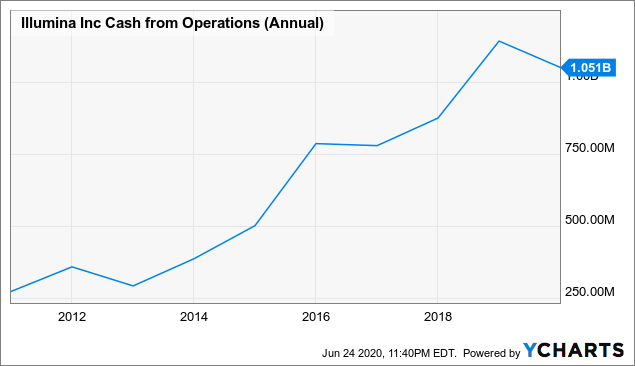

Illumina sells its machines for low margins, and then it makes most of the profitability on the consumables. This business model has proven to be quite profitable across different industries, and Illumina has produced consistent cash flows growth over the past several years.

(Click on image to enlarge)

Data by YCharts

Valuation And Timing

Valuation is an art as much as a science. The true value of the business will depend on the cash flows that such as business is going to generate over the long term, meaning multiple decades. It is obviously impossible to predict these cash flows with any precision, so we need to fully acknowledge that valuation carries a large margin of error, especially when it comes to a company such as Illunimna, which benefits from abundant opportunities for growth over the years.

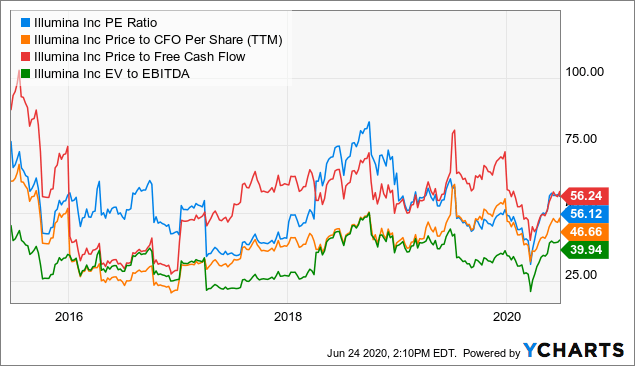

Looking at valuation ratios from a historical perspective, we can see that indicators such as price to earnings, price to operating cash flow, price to free cash flow, and enterprise value to EBITDA are roughly in line with historical standards for Illumina.

(Click on image to enlarge)

Data by YCharts

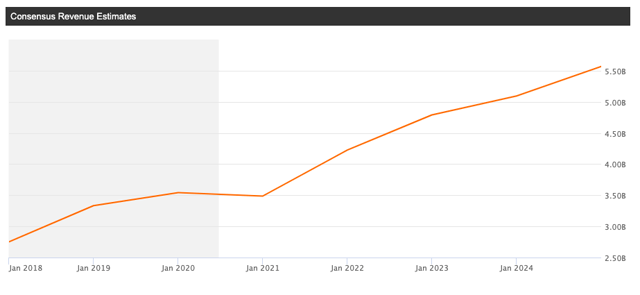

Since earnings are particularly affected by fluctuating spending and margins, revenue can be a more useful and stable metric to value growth stocks. The chart below shows expected revenue growth rates for Illumina in the coming years. The market is clearly expecting a deceleration due to the COVID-19 crisis this year and further acceleration in 2021.

(Click on image to enlarge)

Source: Seeking Alpha

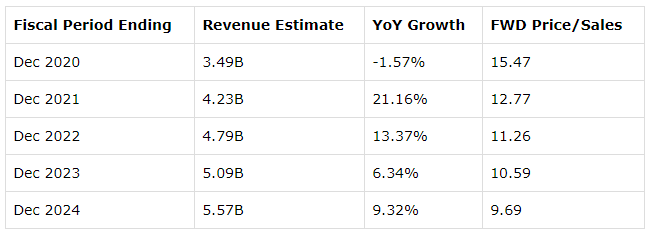

The table provides the Wall Street revenue estimates and the implied forward price to sales ratios based on those estimates. A forward price to sales ratio below 13 for 2021 is not particularly cheap, but it is not excessive either for such a high-quality business.

Even more important, estimated growth rates for 2023 and 2024 are actually quite modest. This is good to see, because a low bar is relatively easy to beat, and undemanding expectations for Illumina make it easier for the company to outperform those expectations.

(Click on image to enlarge)

Source: Seeking Alpha

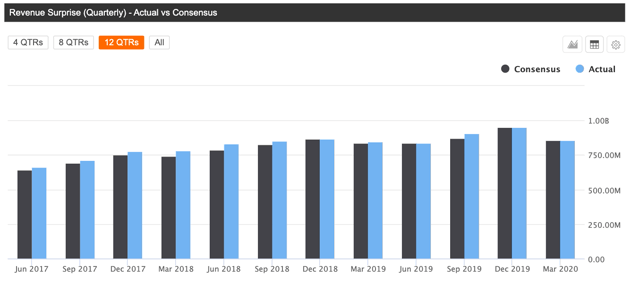

It is worth noting that Ilumina has delivered revenue numbers above Wall Street expectations in each of the past 12 quarters. The company's track-record does not guarantee that it will continue delivering above expectations going forward. However, winners tend to keep on winning over time, and a consistent track record of outperformance is nice to see from a probabilistic standpoint.

(Click on image to enlarge)

Source: Seeking Alpha

Valuation levels should not be interpreted in a vacuum. A company that generates strong profitability and consistently beats expectations deserves a higher price to sales ratio than a business with below-average profitability and underperforming expectations.

In order to incorporate multiple factors in a single multi-variate metric, we can take a look at the PowerFactors ranking system. This is a quantitative algorithm that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

Illumina has a PowerFactors ranking above 90 as of the time of this writing. This means that the stock is in the top 10% of companies in the U.S. stock markets based on financial quality, valuation, fundamental momentum, and relative strength together.

It is important to keep in mind that an algorithm such as PowerFactors is based on current data and current expectations about future data. This provides an assessment based on hard data as opposed to opinions, but it also has some limitations.

In essence, forward-looking returns will depend on the cash flows that the business can produce in the future. The algorithm is saying that Illumina is attractively priced based on current expectations and past history, but the most important factor to consider is whether the company can meet or ideally exceed those expectations in the future.

Backtested data for quantitative algorithms should always be taken with a grain of salt. The backtest shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the long term, but this does not tell us much about how a specific company such as Ilumina will perform in a particular year such as 2020.

In this particular case, however, it seems to me like growth expectations are more than achievable, and the data shows that the stock is offering attractive upside potential from a valuation standpoint if the business delivers.

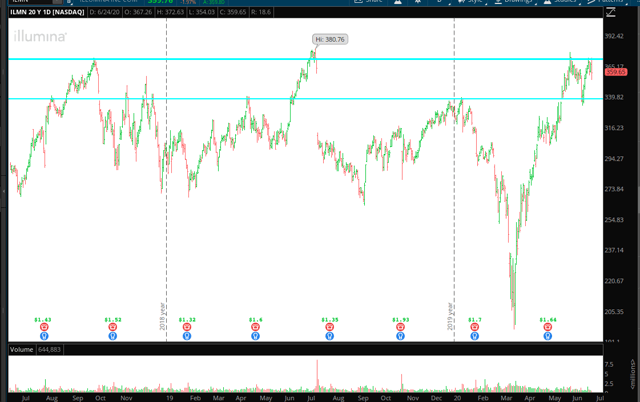

In terms of price action, Ilumina stock has faced resistance in the $370-$380 level since September of 2018. A breakout above this level could open the door to further gains in the middle term. In the short term, the area around $340 could be an important support level to watch.

(Click on image to enlarge)

Source: TOS

The Bottom Line

It is hard to quantify the impact of the recession on Illumina's financial statements over the short term, but it makes sense to assume that such an impact will be material, even if temporary. Over the middle term, Illumina needs to stay on top of its game to retain its industry leadership because competitive pressure will most probably increase.

In spite of those risk factors, Illumina is a market leader in an industry with enormous potential, and the company has the strength to keep the competition at bay if management plays its cards well. All in all, the risk and reward trade-off for investors in Illumina looks quite convenient over the long term.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ILMN over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more

The estimates don't justify the current price, therefore it is probable that they must beat the estimates consistently to keep the current price. This is why I suspect the price has hit a wall. As people who watch the stock market, it is hard to beat expectations that well exceed estimates on a regular basis. I think the company's performance needs time to catch up with the stock price, but it has been a nice bounce off a scary downturn in stock price.

You make some good points. I've reconsidered buying $ILMN.