IDEX Corporation: Bullish Continuation Expected

Image Source: Unsplash

Bullish Continuation Expected as IDEX Sets Up for the Next Impulsive Rally in Wave (3)

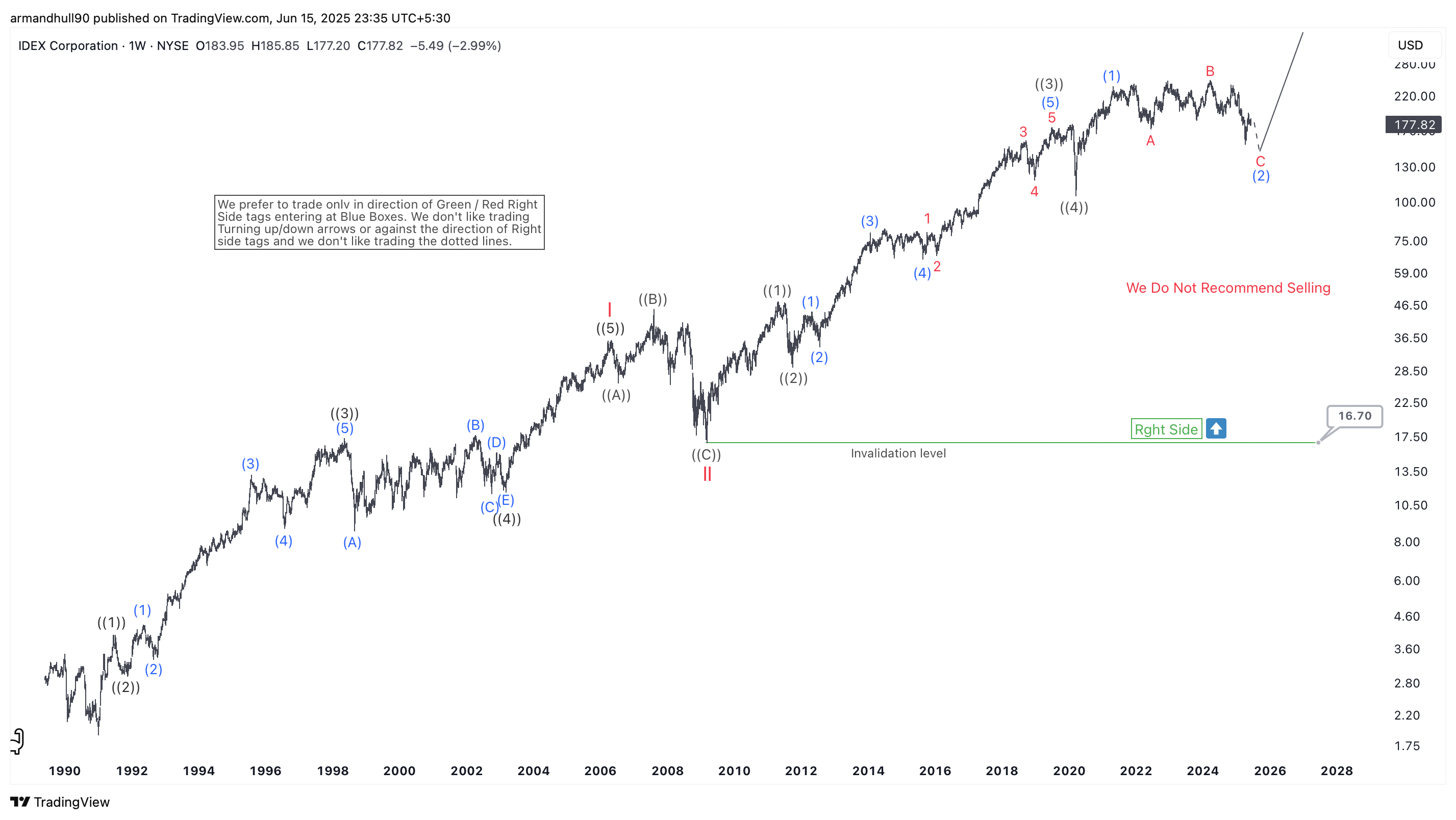

IDEX Corporation (IEX) is showing signs of completing its wave (2) correction within a broader bullish Elliott Wave cycle. The long-term chart highlights a strong impulsive trend that began in the early 1990's. Since then, the stock has advanced through multiple Elliott Wave degrees, forming a sustained upward structure.

After peaking around late 2021, IDEX Corporation entered a corrective phase. This move is labeled as wave (2), and it appears to be forming a classic A-B-C zig-zag correction. Wave A and B are already complete, while wave C is likely in its final stages. This suggests the pullback could soon end, setting the stage for a bullish reversal.

(Click on image to enlarge)

The “Right Side” tag on the chart indicates that the preferred trading direction is higher. This aligns with the larger trend and long-term bullish bias. Additionally, the chart carries a warning — “We Do Not Recommend Selling” — which reinforces the view that the current weakness should be treated as an opportunity rather than a trend reversal.

The invalidation level stands far below at $16.70, offering a solid technical floor. As long as the price remains well above this level, the long-term bullish count remains intact. Once wave (2) completes, IDEX Corporation is expected to resume its uptrend in wave (3), which typically shows strong acceleration and momentum.

Conclusion

In conclusion, IDEX Corporation is likely nearing the end of its wave (2) correction. Long-term investors and trend-followers should watch closely for bullish confirmation and be prepared for the next impulsive rally that could unfold in the coming months. The current pullback may offer a favorable risk-reward setup for positioning into wave (3).

More By This Author:

Elliott Wave Outlook: Microsoft Surges To Record High, Sustaining Bullish Momentum

GDXJ: Is The Gold Miners Junior ETF Set To Soar Impulsively?

XAUUSD: Trade Setup For A Move higher

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more