GDXJ: Is The Gold Miners Junior ETF Set To Soar Impulsively?

Image Source: Pixabay

The VanEck Vectors Junior Gold Miners ETF (GDXJ) is an exchange-traded fund designed to provide investors with exposure to small- and mid-cap companies in the gold and silver mining industry, often referred to as “junior” miners. Launched on November 10, 2009, and managed by VanEck, GDXJ seeks to replicate the performance of the MVIS Global Junior Gold Miners Index. It tracks firms primarily engaged in the exploration and production of precious metals. These companies often have higher growth potential but also elevated risk compared to larger, established mining companies.

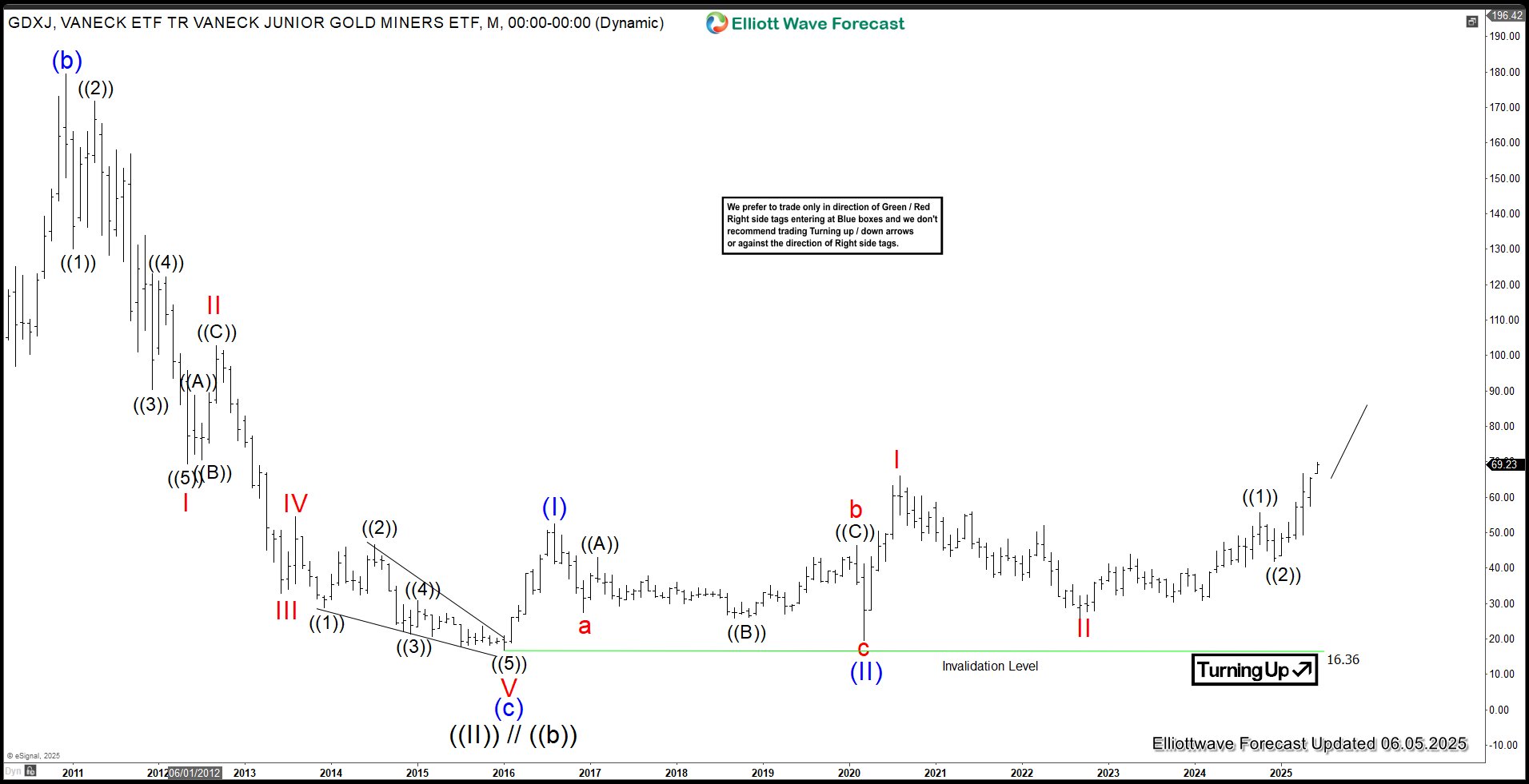

GDXJ Monthly Elliott Wave View

The monthly Elliott Wave chart for the GDXJ (Junior Gold Miners ETF) reveals a significant turning point. The ETF reached a major Grand Super Cycle bottom at $16.36 in January 2016. Since then, it has trended upward in a nested impulsive structure. From the January 2016 low, wave (I) peaked at $52.50, followed by a pullback in wave (II) that bottomed at $19.52. The ETF then resumed its upward trajectory in wave (III), forming another impulsive structure. Within this wave, wave I reached $65.95, and the subsequent wave II pullback concluded at $25.80. The ETF has since nested higher again, with wave ((1)) peaking at $55.58 and the pullback in wave ((2)) ending at $41.85. As long as the ETF remains above the $16.36 level, expect it to continue extending higher.

GDXJ Daily Elliott Wave View

The daily Elliott Wave chart for the GDXJ (Junior Gold Miners ETF) indicates a potential quadruple nest structure emerging from the September 26, 2022 low. This structure is characterized by the sequence ((1))-((2))-(1)-(2)-1-2-((i))-((ii)), as illustrated in the chart. Such a formation suggests the possibility of a highly powerful upward move in the ETF in the coming weeks and months. Maintain a firmly bullish outlook on the ETF as long as the pivot low at $30.46 remains intact.

GDXJ Elliott Wave Video

Video Length: 00:07:40

More By This Author:

XAUUSD: Trade Setup For A Move higher

Elliott Wave Outlook: FTSE To Signal Market Direction Soon

Solana Long-Term Elliott Wave View Looking For $383 – 561 Area

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more